Contents

- Introduction

- Preface

- Overview

- Relief Valve

- LECTURE 1: Why We Are In The Dark About Money

-

LECTURE 2: The Con

- The Banker Explained - The Wizard of Oz

- Why Do We Need Banks?

- What Bank Supervision?

- Banks Too Big To Fail

- Banks Cheat

- Banks and Money Laundering

- Banks Sell Drugs

- Money is NOT the same as Currency

- Currency Markets Are Rigged

- HFT High Finance Trading Predators

- Libor

- London Gold Fix Proof of Bank Manipulation

- QE Quantitative Easing

- A Trust Deficit Caused by Predator Bankers' Secrets

- HSBC The Pirate Bank

- HSBC The Dirtiest Bank

- Propaganda

- Banks Role in Terrorism

- The Octopus

- The First Banks in America

- History of Banking – Index (by date)

- Wealth Distribution and Why do the Rich Get Richer?

- Learn How Lobbyists Buy Politicians

- Commerce Without Conscience

- The Shattered American Dream

- United States Treasury Department

- About Gold and Fort Knox

- Paying Taxes in April

- Lecture 2 Objectives and Discussion Questions

- LECTURE 3: The Vatican-Central to the Origins of Money & Power

- LECTURE 4: London The Corporation Origins of Opium Drug Smuggling

- LECTURE 5: U.S. Pirates, Boston Brahmins Opium Drug Smugglers

- LECTURE 6: The Shady Origins Of The Federal Reserve

- LECTURE 7: How The Rich Protect Their Money

- LECTURE 8: How To Protect Your Money From The 1% Predators

- LECTURE 9: Final Thoughts

#1 REASON USED TO BE FOR INTERNATIONAL COMMERCE

BUT WE ARE STILL USING A 600 YEAR OLD ACCOUNTING SYSTEM

In the 14th century, the Medici family used the power of its newly invented, double-entry accounting system to build a cross-border banking empire that banks still use today. Now more than 600 years later, cross-border payments total more than $22 trillion. These transactions are essential to conducting international business, and increasingly important as global commerce continues to expand — a 14th century process is simply not good enough. Medici’s system uses “nostro” and “vostro” accounts — in English that translates to “ours” and “yours.”

Using data from the U.S. Census Bureau and the Federal Reserve, ValuePenguin found that the average credit card debt for households that carry a balance is a shocking $16,048 — a figure that has risen by 10% over the past three years. At the average variable credit card interest rate of 16.1%, this translates to nearly $2,600 in credit card interest alone. And many credit cards have interest rates much higher than the average. Even scarier, consider that based on the average interest rate and a minimum payment of 1.5% of the balance, it would take nearly 14 years for the typical indebted household to pay off its existing credit card debt, at a staggering cost of more than $40,200. Keep in mind that this assumes no additional credit card debt is added to the tab along the way.

"...lend widely and in large amounts, and reap large short-term profits from people who have only a marginal capacity to repay." Elizabeth Warren

BITCOIN BLOCKCHAIN

TAKES OVER

21ST CENTURY SOLUTION TO THIS IS BITCOIN AND BLOCKCHAIN TECHNOLOGY

Banks are focused on building private blockchains, apparently to more efficiently conduct interbank settlement (making sure all the day’s payments equal out) or to maintain control over international remittances (sending cash back to one’s home country).

Crypto Currency And a Global, Open, Decentralized Payment Network

The bitcoin ledger, a two-column spreadsheet with who owns what, is simply the 21st-century version: 12 million rows — one for each person who owns bitcoin. The second column shows how many they own and that column totals 14 million bitcoins today. It’s a very clear public record of who owns what — one that does not require paying a third party to keep those accounts. Much like Bitreserve, MonetaGo offers users the ability to 'fix' their bitcoin value to any of its 27 regional currencies. However, whereas the former does not offer the option to cash out 'Bitdollars' into real dollars (only bitcoin), MonetaGo does.

Let’s pull back the curtain on the process.

A typical international cross-border payment for a small-to-medium-sized business whose payments are typically on the order of $1,000 to $10,000 can take several days and cost up to 5 percent of the total transaction.The good news is the fix is under our noses. It’s not a new process for moving money; it’s a whole new approach: bitcoin. As a payment rail, bitcoin has the potential to revolutionize cross-border money flows. With bitcoin, there is way to conduct global and secure commerce efficiently. By design, bitcoin is a global and secure payments network, having arguably greater reach and greater security than the legacy payments system or its myriad players. It is much more difficult to establish a bank branch in a remote foreign country than it is to access the Internet. It is much less secure for payment forms to be filled out by several mistake-prone humans as the payment moves from bank to bank than the digital establishment of a worldwide consensus over what cryptographically secure ledger positions are to be swapped.

There is no need for middlemen in a bitcoin-enabled cross-border payments world — no need for any additional fees or processing times to move a payment but those inherent to using the bitcoin network. Bitcoin transactions are virtually free and virtually instantaneous. Bitcoin does everything the legacy payments middlemen individually do — better, faster, cheaper. Real-time wires for half the price. In the 1700s, the last of the Medici’s dynasty fell.

BANKS EXPLAINED

WITH VIDEOS

HOW BANKS MAKE MONEY EXPLAINED BY Dr. Michael Hudson -

Take America Private by debt by predetor banks!

The current economic system which they describe as one vast Ponzi scheme and class war.

The Bubble and Beyond

BANKING REFORM

REMEMBER WHAT THE OFFICIAL FEDERAL RESERVE CURRICUMLUM FAILS TO INCLUDE

William Jennings Bryan and other progressives fiercely attacked the plan;

they wanted a central bank under public, not banker, control.

Why Not Public Bank 25:44

How does the world look without Banks?

Max Keiser and Stacy Herbert talk to Simon Dixon of BnkToTheFuture.com about banking’s future.

They ask him: why not get rid of banks? Dixon believes a world without the current banking infrastructure - from traditional banks to venture capitalists - is possible thanks to bitcoin and blockchain technology. In the second half, 12:57 they ask Sandeep Jaitly of FeketeResearch.com, why not a public bank? Jaitly’s public bank, however, is very different from anything you’ve ever seen or heard before.

https://www.youtube.com/watch?v=t6x_Y2NYoz0

THE UNIVERSAL BANKING SYSTEM EXPLAINED

We were wrong about universal banking

Hardly a week goes by without headlines blaring another restructuring by a big European bank, or the replacement of its management. Deutsche Bank and Barclays are the latest to announce big changes. They follow UBS, Standard Chartered, Royal Bank of Scotland, Credit Suisse and more.

The cause of all this turmoil is the banks’ quest for a formula that will enable them to return to the pre-2008 financial crisis glory days of global reach and big profits. But there is no such formula. The destination will prove unreachable and the quest unfulfilled. The main reason for this is not that economic growth remains subpar, or that regulation has become more onerous (important though these factors may be). Rather, the trouble stems from a perilous cultural balancing act at the core of European banking: how to manage and profit from their high-risk, high-cost investment banking and trading businesses.

In short, the universal banking model is what is really at stake in the search for the right mix of management and operations at banks in Europe and, indeed, in the US.

In America, the universal bank is a relatively new creation. It is 16 years to the day since the Glass-Steagall Act, a law enacted during the Great Depression that had the effect of banning universal banks, was repealed.

Why was the Glass-Steagall was repealed

Back in 1999, the idea of abolishing the old restrictions had gathered overwhelming momentum. Faith in markets and modern finance was felt not only by the banking industry, but also its customers. They wanted to move beyond straightforward bank borrowing, and tap the capital markets directly — with banks arranging a deal between other market participants, rather than acting as straightforward lenders. There were new instruments and new opportunities being offered by financial firms that were not available to them from traditional banks. To those customers (and to those of us in the banks), markets seemed more efficient than banks. Transactions would be easier and less costly. What is more, markets could deal with risk by accepting lower or higher returns, whereas banks needed capital to support their lending exposures. Capital markets were also a way to access many other financial institutions and, as a result, a broader array of investors and financial products.

The second thing we were wrong about has to do with culture — and this turns out to be very serious

However, we were wrong about some things, and others we failed to anticipate. Two stand out.

One was the belief that combining all types of finance into one institution would drive costs down — and the larger the institution the more efficient it would be.

We now know that there are very few cost efficiencies that come from the merger of functions — indeed, there may be none at all. It is possible that combining so much in a single bank makes services more expensive than if they were instead offered by smaller, specialised players. The second thing we were wrong about has to do with culture — and this turns out to be very serious. Mixing incompatible cultures is a problem all by itself. It makes the entire finance industry more fragile. This is what I mean by an unstable cultural balancing act at the core of universal banking and, the restructurings and management changes we are now seeing in European financial institutions. As is now clear, traditional banking attracts one kind of talent, which is entirely different from the kinds drawn towards investment banking and trading.

Traditional bankers tend to be extroverts, sociable people who are focused on longer term relationships. They are, in many important respects, risk averse. Investment bankers and their traders are more short termist. They are comfortable with, and many even seek out, risk and are more focused on immediate reward. In addition, investment banking organisations tend to organise and focus on products rather than customers. This creates fundamental differences in values. As I have reflected about the years since 1999, I think the lessons of Glass-Steagall and its repeal suggest that the universal banking model is inherently unstable and unworkable. No amount of restructuring, management change or regulation is ever likely to change that. The writer is a former chairman and chief executive of Citigroup, created by the merger of Citicorp with Travelers Group when Glass-Steagall was repealed.

BANKERS ARE PIRATES PAYING OFF THE POLITICIANS TO EVISCERATE THE DODD FRANK ACT

THERE IS NO LAW FOR THE RICH - NOTHING IS GOING TO SEPARATE THEM FROM THEIR MONEY AND PROPERTY.

-- "FINANCIAL LITERACY" WON'T FIX THIS --

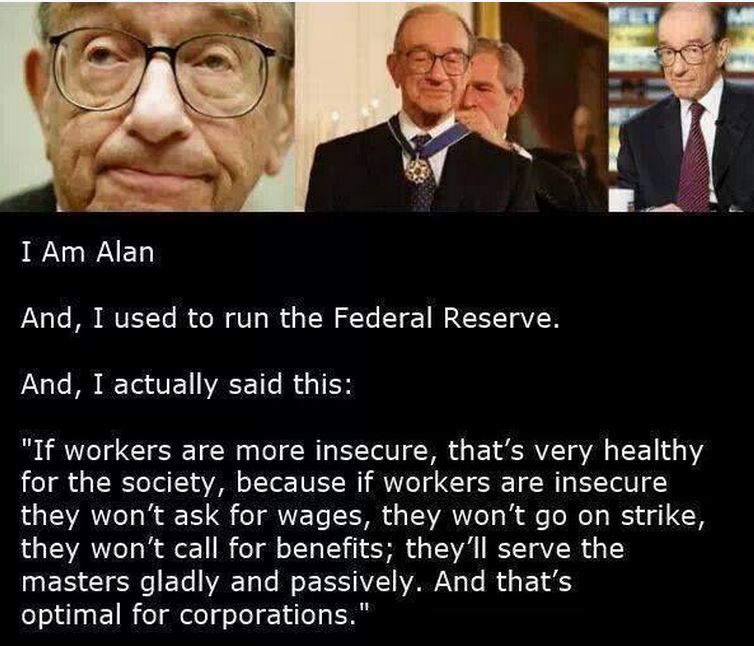

Greenspan Admits Philosophical Error in The Warning

FOR THE RECORD Alan Greenspan's Apology

FRONTLINE "The Warning" Part 1

FRONTLINE "The Warning" Part 2

FRONTLINE | Sneak Peek 1: Breaking the Bank

Sneak Peek 2: Breaking the Bank

How Goldman Sachs makes money - Part 1 of 2

How Goldman Sachs makes money - Part 2 of 2

The Men Who Crashed the World Part 1 | Part 2 | Part 3 | Part 4

The first of a four-part investigation into a world of greed and recklessness that led to financial collapse. In the first episode of Meltdown, we hear about four men who brought down the global economy: a billionaire mortgage-seller who fooled millions; a high-rolling banker with a fatal weakness; a ferocious Wall Street predator; and the power behind the throne. The crash of September 2008 brought the largest bankruptcies in world history, pushing more than 30 million people into unemployment and bringing many countries to the edge of insolvency. Wall Street turned back the clock to 1929. Lack of government regulation; easy lending in the US housing market meant anyone could qualify for a home loan with no government regulations in place. Also, London was competing with New York as the banking capital of the world. Gordon Brown, the British finance minister at the time, introduced 'light touch regulation' - giving bankers a free hand in the marketplace.

All this, and with key players making the wrong financial decisions, saw the world's biggest financial collapse.

PLUTONOMY

THE CITIGROUP'S

2005 MEMOBill Moyers on Plutonomy: noun.

An economy that is driven by or that disproportionately benefits wealthy people, or one where the creation of wealth is the principal goal. [Blend of pluto- (wealth) and economy.]

This explains why they don't go to Jail!

THE CONFIDENTIAL MEMO AT THE HEART OF THE GLOBAL FINANCIAL CRISIS

AMERICA WANTS JUSTICE - THEY WANT OFFICERS FOUND GUILTY AND SENT TO PRISON.

OBAMA WOULDN'T BE PRESIDENT IF NOT FOR BANKERS

VIDEO Bill Moyers: A veteran bank regulator lays bare how Washington and Wall Street are joined in a culture of corruption.

The Best Way to Rob a Bank is to Own One (University of Texas Press 2005), has been called “a classic.”

We can always prosecute bankers but Attorney General Eric Holder never jailed one!

Video+Transcript: 25:24 min

October 3, 2014 VIDEO

Attorney General Eric Holder’s resignation last week reminds us of an infuriating fact: No banking executives have been criminally prosecuted for their role in causing the biggest financial disaster since the Great Depression."I blame Holder. I blame Timothy Geithner," veteran bank regulator William K. Black tells Bill this week. "But they are fulfilling administration policies. The problem definitely comes from the top. And remember, Obama wouldn’t have been president but for the financial contribution of bankers." And the rub? While large banks have been penalized for their role in the housing meltdown, the costs of those fines will be largely borne by shareholders and taxpayers as the banks write off the fines as the cost of doing business. And by and large these top executives got to keep their massive bonuses and compensation, despite the fallout. But the story gets even more infuriating, the more Black lays bare the culture of corruption that led to the meltdown. "The Clinton, Bush and Obama administrations all could have prevented [the financial meltdown]."

Black tells Moyers. And what’s worse, Black — who exposed the so-called Keating Five — believes the next crisis is coming: "We have created the incentive structures that [are] going to produce a much larger disaster."

To rob a country, own a bank https://www.youtube.com/watch?v=sA_MkJB84VA

https://en.wikipedia.org/wiki/William_K._Black | http://online.barrons.com/articles/SB123940701204709985 | http://www.pbs.org/moyers/journal/04032009/profile.html

http://www.peri.umass.edu/fileadmin/pdf/conference_papers/SAFER/Black_September.pdf |

PAYDAY LOAN COMPANY TRAPS YOU IN DEBT THE CIRCLE OF DEBT

CFSA COMMUNITY FINANCIAL SERVICES OF AMERICA

Harvard Law Professor Elizabeth Warren for a discussion of the economic pressures confronting the two income middle class family as it struggles to pay mortgages, health care, and education costs. Professor Warren offers surprising answers to "Who goes bankrupt and why?"

May 9, 2009 Elizabeth Warren, current Chairwoman of the Congressional Oversight Committee, has a great way of reducing complex economic concepts to simple sentences that the average person can actually understand. Here she discusses the stress tests, American economic history and the present sorry state of our national net worth with CNBC's Squawk Box crew and guest host, Arianna Huffington. The normally outspoken panel of Joe Kernen, Becky Quick and Carl Quintanilla - wonder of wonders! - actually allows Ms. Warren to speak at length, despite the fact that what she says is completely at odds with their own long-held beliefs about the role of government and the market. Warren points out that, with the exception of a 50-year stretch after the New Deal, the American economy has been on a roller coaster ride of boom and bust every 15 years.

Maxed Out: Hard Times, Easy Credit and the Era of Predatory Lenders by James D, Scurlock on youtube

Maxed Out takes viewers on a journey deep inside the American style of debt, where things seem fine as long as the minimum monthly payment arrives on time. With coverage that spans from small American towns all the way to the White House, the film shows how the modern financial industry really works, explains the true definition of "preferred customer" and tells us why the poor are getting poorer while the rich keep getting richer. Hilarious, shocking and incisive, Maxed Out paints a picture of a national nightmare which is all too real for most of us. Great for college students.

Elizabeth Warren On Bankruptcy is a life event

The Money Trap BBC Documentary on How Banks Control the World Through Debt youtube

Published on Apr 11, 2013 A senior executive blows the whistle on the banking industry's usurious lending tactics. This documentary reviews some of the profligate and predatory lending practices of the high street banks in the years of the credit boom which preceded the financial crisis. Indeed this documentary is in a sense chilling given what happened during the global financial crisis; i.e. super easy credit, high pressure to make money, huge incentives for banks to lend easy money. The documentary reviews the sales and marketing tactics, how banks benefited from the lending splurge, and some of the fallout e.g. debt related suicides. This documentary should serve as a case study in banking regulation; not just in terms of procedural regulations but also in terms of higher level macroprudential regulation to curtail excessive credit growth, particularly during unsustainable credit booms. See also (the US version): Maxed Out: Hard Times, Easy Credit and the Era of Predatory Lenders The Banking Code Standards Board is to investigate The Royal Bank of Scotland (RBS) after Panorama investigated debt-related suicides.

WATCH Steal This Film II from Robert Scott Curliss - The History of the Control of Information

We need information to survive. Americans believe it is our right to know. Independent Researchers like Anonymous are the only defense we have against the official information. You depend on the ability to pursue knowledge because it may save your life one day.