Contents

- Introduction

- Preface

- Overview

- Relief Valve

- LECTURE 1: Why We Are In The Dark About Money

-

LECTURE 2: The Con

- The Banker Explained - The Wizard of Oz

- Why Do We Need Banks?

- What Bank Supervision?

- Banks Too Big To Fail

- Banks Cheat

- Banks and Money Laundering

- Banks Sell Drugs

- Money is NOT the same as Currency

- Currency Markets Are Rigged

- HFT High Finance Trading Predators

- Libor

- London Gold Fix Proof of Bank Manipulation

- QE Quantitative Easing

- A Trust Deficit Caused by Predator Bankers' Secrets

- HSBC The Pirate Bank

- HSBC The Dirtiest Bank

- Propaganda

- Banks Role in Terrorism

- The Octopus

- The First Banks in America

- History of Banking – Index (by date)

- Wealth Distribution and Why do the Rich Get Richer?

- Learn How Lobbyists Buy Politicians

- Commerce Without Conscience

- The Shattered American Dream

- United States Treasury Department

- About Gold and Fort Knox

- Paying Taxes in April

- Lecture 2 Objectives and Discussion Questions

- LECTURE 3: The Vatican-Central to the Origins of Money & Power

- LECTURE 4: London The Corporation Origins of Opium Drug Smuggling

- LECTURE 5: U.S. Pirates, Boston Brahmins Opium Drug Smugglers

- LECTURE 6: The Shady Origins Of The Federal Reserve

- LECTURE 7: How The Rich Protect Their Money

- LECTURE 8: How To Protect Your Money From The 1% Predators

- LECTURE 9: Final Thoughts

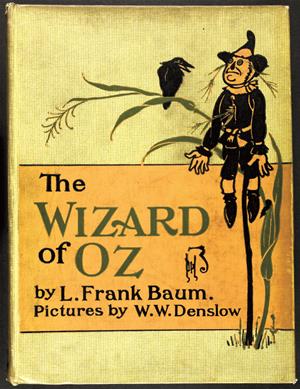

The Wizard of Oz by Baum, L. Frank

The Wizard of Oz allegory is about money

OZ = Gold and explains the Banks.

"Baum was a true educator, and those who read his Oz books are often made what they were not—imaginative, tolerant, alert to wonders, life."

"The great Oz has spoken! Pay no attention to that man behind the curtain!

I am the great and powerful Wizard of Oz!"

1906 Like the Wizard of Oz, Wall Street banks pretend to be too big, important, and complex to understand.

1906 Like the Wizard of Oz, Wall Street banks pretend to be too big, important, and complex to understand.

However, Dorothy, representing the 99%, makes it to Oz to discover that it's all a big hoax: that she had the power she needed within herself (and her slippers) all along.

Unprecedented Power

Houston Founders Jesse H. Jones - Mr. Jones’s business acumen and civic leadership were called upon during the depths of the Great Depression when President Herbert Hoover asked him in 1932 to serve on the board of the newly created Reconstruction Finance Corporation (RFC). After his inauguration, President Franklin Roosevelt expanded the RFC’s powers and made Mr. Jones its chairman. Under his leadership, the RFC disbursed more than $10 billion (about $120 billion in today’s dollars) to reopen banks, save homes, farms and businesses, rescue the railroads and bring electricity to rural areas. Fannie Mae and the Export-Import Bank are only two of the many enduring agencies created by Mr. Jones and the RFC. Remarkably, the funds allocated for the massive RFC recovery efforts were returned to the United States Treasury, along with a $500 million profit. Vice President John Nance Garner once said about Mr. Jones, “He has allocated and loaned more money to various institutions and enterprises than any other man in the history of the world.” As World War II loomed, Mr. Jones shifted the RFC’s focus from domestic economics to global defense and used the corporation’s enormous clout to build and equip more than 2,000 plants that manufactured everything from airplanes and battleships to penicillin and synthetic rubber, an industry the RFC developed from the lab. In 1940, after Congress passed a special resolution allowing Mr. Jones to become secretary of commerce while maintaining his RFC position, the ‘Saturday Evening Post’ reported, “Next to the President, no man in the government and probably in the United States wields greater powers.” Today scholars give Jesse Jones a tremendous amount of credit for the role he played in saving capitalism during the Great Depression and mobilizing industry in time to fight and win World War II.

The Wizard of Oz Story Allegory

The World Stage -

"A billion here and a billion there, and pretty soon you're talking real money." - Everett Dirksen

KNOW YOUR MUHFGGAZ!

KNOW YOUR MUHFGGAZ!

12/15/14 Is Homo Economicus A Psychopath?

In what academics call neoclassical economics, human beings are largely rational, self-interested decision-makers. This stereotypical human, often referred to as Homo economicus, is a creature of coldly calculated selfishness, dispassionately maximizing its best interests even if that comes at the expense of others.

A study in Japan shows that Homo economicus makes up only a minority of the population, but a minority with a wide range of unusual personality traits, including a touch of psychopathy.

To identify people who qualify as Homo economicus (from now on, HE), the researchers asked people to play a series of games. In the dictator game, people were given money and told that their partner (an anonymous person they would never meet) had received none. They were asked how much of that money they would give their partner. Those acting like HE consistently gave their partners no money. Zilch. Their self-interest was maximized by keeping all the money, so that’s what they did.

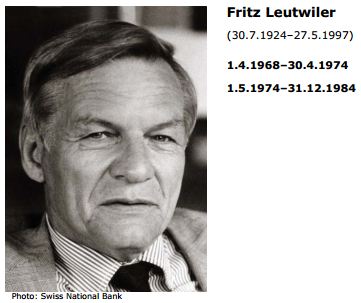

BIS

BANK FOR INTERNATIONAL SETTLEMENTS

"I have no use for politicians," says Fritz Leutwiler,

Head of the Bank for International Settlements.

"They lack the judgment of central bankers." [ pdf ]

The Bank for International Settlements (BIS) is an intergovernmental organization of central banks which "fosters international monetary and financial cooperation and serves as a bank for central banks. It is not accountable to any national government.

The BIS carries out its work through subcommittees, the secretariats it hosts, and through its annual General Meeting of all members. It also provides banking services, but only to central banks, or to international organizations like itself. Based in Basel, Switzerland, the BIS was established by the Hague agreements of 1930. The name of the BIS in German: Bank für Internationalen Zahlungsausgleich (BIZ), in French: Banque des Règlements Internationaux (BRI), in Italian: Banca dei Regolamenti Internazionali (BRI). It has representative offices in Hong Kong and Mexico City.

Bank for International Settlements (BIS)

David Rockefeller, a key player in international finance, echoed this thinking in 1994, when he said at a UN dinner,“We are on the verge of a global transformation. All we need is the right major crisis and the nations will accept the New World Order.”

BAIL IN

PREPARE YOURSELF WITH CASH

The Global Bankers’ Coup: Bail-In and the Shadowy Financial Stability Board CAPITALISM,

The Global Bankers’ Coup: Bail-In and the Shadowy Financial Stability Board CAPITALISM,

12/15/14 by Ellen Brown, Web of Debt SEE PDF

On December 11, 2014, the US House passed a bill repealing the Dodd-Frank requirement that risky derivatives be pushed into big-bank subsidiaries, leaving our deposits and pensions exposed to massive derivatives losses. The bill was vigorously challenged by Senator Elizabeth Warren; but the tide turned when Jamie Dimon, CEO of JPMorganChase, stepped into the ring. Perhaps what prompted his intervention was the unanticipated $40 drop in the price of oil. As financial blogger Michael Snyder points out, that drop could trigger a derivatives payout that could bankrupt the biggest banks. And if the G20’s new “bail-in” rules are formalized, depositors and pensioners could be on the hook.

The new bail-in rules were discussed. They are edicts of the Financial Stability Board (FSB), an unelected body of central bankers and finance ministers headquartered in the Bank for International Settlements in Basel, Switzerland. Where did the FSB get these sweeping powers, and is its mandate legally enforceable?

WHO RUNS THE REGULATOR?

The Shadowy FSB Financial Stability Board

Buried on page 83 of an 89-page Report on Financial Regulatory Reform issued by the US Obama administration was a recommendation that the FSB strengthen and institutionalize its mandate to promote global financial stability. It sounded like a worthy goal, but there was a disturbing lack of detail. What was the FSB’s mandate, what were its expanded powers, and who was in charge? An article in The London Guardian addressed those issues in question and answer format:

Who runs the regulator?

The Financial Stability Forum is chaired by Mario Draghi, governor of the Bank of Italy. The secretariat is based at the BIS Bank for International Settlements’ headquarters in Basel, Switzerland.

Draghi was director general of the Italian treasury from 1991 to 2001, where he was responsible for widespread privatization (sell-off of government holdings to private investors). From 2002 to 2006, he was a partner at Goldman Sachs on Wall Street. He was succeeded in 2011 by Mark Carney, who also got his start at Goldman Sachs, working there for 13 years before going on to become Governor of the Bank of Canada in 2008 and Governor of the Bank of England in 2012. In 2011 and 2012, Carney attended the annual meetings of the controversial Bilderberg Group.</READ THE WHOLD ARTICLE>

6/22/09 BIG BROTHER IN BASEL: HOW BIS FINANCIAL STABILITY BOARD UNDERMINES NATIONAL SOVEREIGNTY by Ellen Brown

REMEMBER IT ISN'T A CONSPIRACY "THEORY" WHEN YOU CAN SHOW PROOF OF STRATEGY

After Empowering the 1% and Impoverishing Millions, IMF Admits Neoliberalism Is a Failure

"Instead of delivering growth," the report explains that neoliberal policies of austerity and lowered regulation for capital movement have in fact "increased inequality."

International Monetary Fund ADMITS NEOLIBERALISM IS WRONG!

International Monetary Fund ADMITS NEOLIBERALISM IS WRONG!

2016 The world’s largest evangelist of neoliberalism, the International Monetary Fund, admitted NEOLIBERALISM IS WRONG. Neoliberalism refers to capitalism in its purest form. It is an economic philosophy espoused by libertarians — and repeated endlessly by many mainstream economists — one that insists that privatization, deregulation, the opening up of domestic markets to foreign competition, the cutting of government spending, the shrinking of the state and the “freeing of the market” are the keys to a healthy and flourishing economy.

NOW top researchers at the International Monetary Fund, or IMF, the economic institution that has proselytized — and often forcefully imposed — neoliberal policies for decades, have conceded that the “benefits of some policies that are an important part of the neoliberal agenda appear to have been somewhat overplayed.” These statements represent an enormous reversal for the IMF. It is somewhat like the Pope declaring that there is no God; it is a volte-face on almost everything that the IMF has ever stood for.

7/3/15 Europeans tried to block IMF debt report on Greece - FT: plan is for "a “haircut” of at least 30 per cent on deposits above €8,000

A Greek bail-in could resemble the rescue plan agreed by Cyprus in 2013, when customers’ funds were seized to shore up the banks, with a haircut imposed on uninsured deposits over €100,000. It would be implemented as part of a recapitalisation of Greek banks that would be agreed with the country’s creditors — the European Commission, International Monetary Fund and European Central Bank.

http://www.ft.com/intl/cms/s/0/9963b74c-219c-11e5-aa5a-398b2169cf79.html

http://uk.reuters.com/article/2015/07/03/us-eurozone-greece-imf-idUKKCN0PD20120150703

How Europe Played Greece -- Do these things, they said, for all our sakes and you will return to prosperity with our help. They lied.

https://www.byline.com/column/11/article/135

WORLD BANK

Sir James Wolfensohn: 9TH President of the World Bank / World Bank Group 1995–2005 graduate of Harvard Business School.

1/11/10 [19:01] For Stanford graduate students: A tectonic shift in wealth from the west to the east

It is his institution, the world bank, that is directing these changes.

The World Bank was created at the 1944 Bretton Woods Conference, along with three other institutions, including the International Monetary Fund (IMF). The World Bank and the IMF are both based in Washington DC, and work closely with each other. Although many countries were represented at the Bretton Woods Conference, the United States and United Kingdom were the most powerful in attendance and dominated the negotiations.[7]:52-54 Traditionally, the World Bank has been headed by a citizen of the United States, while the IMF has been led by a European citizen.

also see youtube.com tcNJnGmGUmg

BAIL IN VS BAIL OUT

10/2/13 Maria Bartiromo SAYING 'LEGAL PROBLEMS ASIDE', speaks volumes on the moral compass--or lack thereof--that exists in Wall Street and our corporate controlled media.

6/22/15 When "Too Big to Fail" Fails: The Scheme to Seize Depositors' Money ~ By Mike Krauss, Occupy.com | Op-Ed

Where's the outrage? Congress changes savings accounts and retirement funds, and America sleeps

G 20 RULERS OF THE WORLD WITH NO LEGAL STANDING IN THE WORLD

THEY RULLE OVER THE THE FINANCIAL STABILITY BOARD WHO DECIDES CHANGES THE RULES OF BANKING

BAIL IN - THE BANKS CAN TAKE YOUR MONEY - CAN TAKE THE SAVINGS OF THEIR CLIENTS.

Nothing is permanent in this wicked world except banks getting whatever they want, whenever they want, regardless of the risk to their own customers. Two major provisions in the US budget bill spell doom for US savers and retirees Savings accounts are at risk as long as JP Morgan CEO gets his way $1.1trn budget deal imperiled by taxpayer revolt Wall Street and Washington want you to believe the stock market isn’t rigged. Guess what? It is!

Ben Bernanke, the former chairman of the US Federal Reserve, tells former Bank of England governor, Lord King, were buddies way before the 2008 global financial crisis. Mervyn King: 'we knew the financial position was unsustainable.' To end his guest edit former governor http://www.bbc.co.uk/programmes/p02g1zmb

12/14 America’s Big Five Are Plunging the World Into Another Banking Crisis

Peter Koenig, former World Bank economist

I think there is what we would call an impending banking crisis. A new banking crisis is looming on the horizon, I believe. And then, of course, there are many layers to this banking crisis and many elements to it. And if I may, I would like to, perhaps, address three of them, which give clear signals that something is not correct and will not be sustainable over time.

The points that I would like to make are not necessarily listed in order of priority, because they are related, and make no mistake – the coming crisis, like the one in 2008, which is still lingering, is planned. And it is planned by the international banking and financial elite, which is led by Wall Street with the support of the Fed and of the European Central Bank. And, of course, the purpose of that is to make the rich financial elite richer and actually rob the common people of their savings and of their social system. That has been the case before and it is certainly happening again. And that’s what is looming.

NO ETHICS REQUIRED IN BANKING

World Bank Listing of Ineligible Firms & Individuals

FRAUD & CORRUPTION: Canada has the dubious honour of being home to the largest number of firms on a World Bank blacklist of corrupt companies. But virtually all of that can be attributed to one Canadian company -- SNC Lavalin, the construction and engineering giant whose name is becoming a paragon of Canadian corruption. Of the more than 600 companies now listed as barred from doing business with the World Bank over corruption, 117 are Canadian, the most of any one country. And of those, 115 represent SNC-Lavalin and its subsidiaries, the Financial Post reports.

Evelyn De Rothschild Warning Masses - Too Late (Holding Bonds, Oil, Gold) 2008

UBS is the biggest bank in Switzerland [MORE BELOW]

Operating in more than 50 countries with about 63,500 employees globally as of 2012. It is considered the world's largest manager of private wealth assets; with over CHF2.2 trillion in invested assets, a leading provider of retail banking and commercial banking services in Switzerland. According to the Scorpio Partnership Global Private Banking Benchmark 2013, UBS had assets under management (AuM) of US$1,705.0 billion, representing a 9.7% increase in AuM versus 2012. The battle between the US government and first UBS, then Swiss banking regulators, is over Swiss bank secrecy. The US engaged in a series of prosecutions that led one UBS unit that catered to wealthy individuals to be shuttered as part of a deal in which UBS also turned over the names of several thousand US customers that the US suspected of engaging in tax evasion. This case effectively ended Swiss bank secrecy; the efforts of the Swiss to avoid divulging the names of its customers was front page news in the Financial Times. http://en.wikipedia.org/wiki/UBS

Matt Taibbi gives his play by play commentary of CNBC's demented interview with Alex Pareene and why anybody could do Jamie Dimon's job...

BANKS ARE A MASSIVE INTERNATIONAL SYNDICATE: A PRIVATE CARTEL

$11 billion settlement with government officials to settle federal and state mortgage probes. Sources said the discussions have been with the Securities and Exchange Commission, the U.S. Department of Housing and Urban Development and the New York State Attorney General in addition to the DOJ.

DOJ finalizes $13 billion settlement with JPMorgan for toxic mortgages resolving federal and state claims arising from the bank's risky mortgage practices which helped lead to the 2008 financial crisis. It is the largest settlement paid by a single company in American history. Included in the settlement is a [text, PDF], in which JPMorgan admitted that bank employees for JPMorgan, Bear Sterns and Washington Mutual knew that the loans did not comply with guidelines, but they allowed the loans to be securitized, and those securities to be sold, without disclosing this information to investors. "Without a doubt, the conduct in this investigation helped sow the seeds of the mortgage meltdown Attorney General Eric Holder [official website] stated.

7 BILLION IS TAX DEDUCTABLE !!!!!!!!!!!!!!!

JPMorgan was not the only financial institution during this period to knowingly bundle toxic loans and sell them to unsuspecting investors, but that is not an excuse for the firm's behavior. The size and scope of this resolution should send a clear signal that the Justice Department's financial fraud investigations are far from over. No firm, no matter how profitable, is above the law, and the passage of time is no shield from accountability.

The Greatest Fine in the History of the Wall Street Regulation

2013 JP MORGAN CHASE in the last 3 years has paid 16 billion dollars in fees associated with litigation and regulatory requirements which is 1/3 of its net over that time. So even before this settlement, 1 out of ever 3 dollars that they made went for their legal expenses. It's too big, too complicated and too corrupt for anyone to run.

THE CON IN ECONOMICS

Anti-consumerist magazine Adbusters, gestated the original idea behind the Occupy Wall Street movement. Carmen Reinhart, an economist at Harvard and her colleague Kenneth Rogoff had become famous for observing a connection between high debt in a country and low GDP growth. Their paper was then the center of a controversy in 2013 when economists at the University of Massachusetts, Amherst pointed out an error in an Excel spreadsheet.

Plutonomy

Plutonomy: noun. An economy that is driven by or that disproportionately benefits wealthy people, or one where the creation of wealth is the principal goal. [Blend of pluto- (wealth) and economy.]

Moyers quoted from this Report for the super-rich (a Top 1 Percent, investment guide). Citibank Plutonomy Memo Scandal

Little of this note should tally with conventional thinking. Indeed, traditional thinking is likely to have issues with most of it. We will posit that:

1) the world is dividing into two blocs - the plutonomies, where economic growth is powered by and largely consumed by the wealthy few, and the rest.

Plutonomies have occurred before in sixteenth century Spain, in seventeenth century Holland, the Gilded Age and the Roaring Twenties in the U.S. What are the common drivers of Plutonomy?

Disruptive technology-driven productivity gains, creative financial innovation, capitalist- friendly cooperative governments, an international dimension of immigrants and overseas conquests invigorating wealth creation, the rule of law, and patenting inventions. Often these wealth waves involve great complexity, exploited best by the rich and educated of the time.

2) We project that the plutonomies (the U.S., UK, and Canada) will likely see even more income inequality, disproportionately feeding off a further rise in the profit share in their economies, capitalist-friendly governments, more technology-driven productivity, and globalization.

4) In a plutonomy there is no such animal as “the U.S. consumer” or “the UK consumer”, or indeed the “Russian consumer”. There are rich consumers, few in

number, but disproportionate in the gigantic slice of income and consumption they take.

There are the rest, the “non-rich”, the multitudinous many, but only accounting for surprisingly small bites of the national pie. Consensus analyses that do not tease out the profound impact of the plutonomy on spending power, debt loads, savings rates (and hence current account deficits), oil price impacts etc, i.e., focus on the “average”consumer are flawed from the start. It is easy to drown in a lake with an average depth of 4 feet, if one steps into its deeper extremes. Since consumption accounts for 65% of the world economy, and consumer staples and discretionary sectors for 19.8% of the MSCI AC World Index, understanding how the plutonomy impacts consumption is key for equity market participants.

OF THE 1% BY THE 1% FOR THE 1%

THE BASTARD JAMIE DIMON

THE BASTARD JAMIE DIMON

JP Morgan Chase has a long rap sheet of illegal conduct and, although overlooked, it includes enabling Bernie Madoff's $64.8 billion Ponzi scheme, the largest in history, which caused net losses of more than $17 billion and untold human wreckage.

On December 11, 2008, federal agents arrested Madoff, the ringleader of the Ponzi scheme -- as a coda to an age of regulator and prosecutorial incompetence and neglect, Madoff was not caught; he was arrested after turning himself in. This happened in the middle of the largest financial crash since 1929, when the country's economy was collapsing and when a second Great Depression was a very real possibility. Although not responsible for the crash and collapse, Madoff in handcuffs was in some ways the face of Wall Street greed and criminality.

JP Morgan Chase, Bernie Madoff's $64.8 Billion Ponzi Scheme and Crime on Wall Street Dennis M. Kelleher 12/19/2014 However, that is a false and misleading picture of crime on Wall Street. After all, how could this one guy possibly pull off such a crime and at that scale and for so long? He couldn't have and didn't. Like most substantial illegal and criminal financial activities, Madoff had a very close relationship with a big Wall Street bank: JP Morgan Chase, the country's largest bank. Given the focus on the crash and economic calamity in 2008 and JP Morgan Chase's years-long efforts to prevent any information from being publicly disclosed, JP Morgan's role in enabling this massive crime wasn't publicly known for years. That veil of secrecy ended when a compliant was filed by a court appointed trustee to recover funds for the thousands of injured investors, as summarized in this article: "Trustee: JP Morgan Abetted Madoff." In the complaint, the trustees alleged that JP Morgan Chase "was at the very center of the fraud, and thoroughly complicit in it." JP Morgan Chase, the complaint stated, "turned a blind eye to" Madoff's fraud." JP Morgan made hundreds of millions of dollars from "servicing" Madoff's accounts and saved itself another $276 million invested with Madoff by remarkably well-timed withdrawals, conveniently just before the scheme was revealed. All of this is documented in the complaint.

Moreover, there is clear information that JP Morgan Chase, including senior officials in compliance and elsewhere, knew about the Ponzi scheme long before Madoff decided to turn himself in. In fact, it appears that JP Morgan Chase "ignored red flags for about 15 years" that Madoff used JP Morgan Chase accounts to run his fraudulent scheme. Just one egregious example: the complaint quotes (p. 31+) from a June 15, 2007 email from John Hogan, Chief Risk Officer, Investment Bank, JP Morgan Chase to Matt Zames, a senior executive and head of several business lines, stating: "For whatever its worth, I am sitting at lunch with Matt Zames who just told me that there is a well-known cloud over the head of Madoff and that his returns are speculated to be part of a [P]onzi scheme...."

And, then, in October of 2008, JP Morgan Chase said in a report that Madoff's "'investments appear too good to be true -- meaning that it probably is.'" What did it do? Other than surreptitiously withdrawing its own $276 million investment, effectively nothing: it filed a report with a banking regulator in the UK. Did it tell anyone in the US? No. Did it tell the SEC? No. Did it tell the FBI? No. Did it bring the report it filed in the UK to anyone's attention? No. (As is too often the case when it comes to Wall Street, the media downplayed JP Morgan's role in enabling Madoff's crimes, one even referring to the years long indefensible conduct as mere "lapses.")

Six years later, after $17 BILLION -- net -- were lost and thousands of investors' lives have been ruined, turned upside down or otherwise damaged, Madoff is sitting in a prison cell, sentenced to 150 years, as are a number of his former workers and co-conspirators. (Although, unfortunately, all the sentences but Madoff's "fall far below federal guidelines.")

But no such punishment for JP Morgan Chase. Earlier this year, it got to use today's shareholder money to pay a fine to make it all go away. Instead of pursuing criminal charges, prosecutors opted to settle with JP Morgan for "$2.6 billion, ending all charges." The US Attorney stated that JP Morgan Chase "failed miserably" as a financial institution and "connected the dots when it came to its own profits, but not when it came to its own legal obligations."

Strong words and a big fine, but the settlement still followed the standard playbook of prosecutors and regulators and the indefensible practice of dealing with the rich, powerful and well connected on Wall Street: not one person at the bank was held accountable; not one person at the bank was made to answer for its role in the largest Ponzi scheme in history.

Most indefensible, despite a deep, close and extremely lucrative relationship that lasted decades, JP Morgan Chase wasn't even required to publicly disclose the information that detailed its complicity in Madoff's scheme, including how much money it made and how; who got the bonuses from the money of thousands who were ripped off; where those employees and officers are now; and how it and they could have ignored so many clear warnings over so many years that cost so many other people a great deal -- if not all -- of their savings.

JP Morgan Fixing Bonuses

Some 15 executives responsible for hiring bankers said that bonuses weren’t all that important for their own motivation — but that bonuses were very important to those they employ. David De Cremer thinks this is more than a discrepancy; it reveals a self-created myth that is destructive — and addressable. One of the most-cited examples of the unlimited pursuit of self-interest in the financial world is the delivery of excessive bonuses. Instead of being offered as a reward for a job well done, they now appear to be handed out simply because the job was done. Intrinsic motivation has been replaced by ‘extrinsic motivation’: the bonus is no longer the reward and, instead, has become the motivation.

3/21/11 FIX THE TOO BIG TO FAIL FINANCIAL INSTITUTIONS AND THE IMF

Professor Stiglitz, winner of the Nobel Prize in eCONomics.

The Money Changer and His Wife ~ Mariuns van Reymerswaele.

"The issue which has swept down the centuries

and which will have to be fought sooner or later

is The People versus The Banks."

~ Lord Acton. Historian. Politician. Writer. 1834-1902.

The nexus between Congress and Wall Street - insider trading and political intelligence.

Members of Congress received special opportunities to get in on the ground floor of stock offerings, and were actively trading in shares of companies “whose prosperity they influence and whose conduct they help to regulate." ~ 1968 exposé "The Case Against Congress" by the muckrakers Drew Pearson and Jack Anderson.

These men laid out dubious financial maneuvers by lawmakers seeking to enrich themselves using their powerful positions and inside knowledge. Finger-pointing over shady stock dealing in the hallways of the House and Senate is almost as old as Congress itself — the infamous Crédit Mobilier scandal of the 1870s was partially about members of Congress cashing in on discounted railroad stock. And nothing has changed. Video

The six -- JPMorgan, Bank of America, Citigroup Inc. (C), Wells Fargo & Co. (WFC), Goldman Sachs Group Inc. (GS) and Morgan Stanley -- accounted for 63% of the average daily debt to the Fed by all publicly traded U.S. banks, money managers and investment services firms, the data show. By comparison, they had about half of the industry’s assets before the bailout, which lasted from August 2007 through April 2010. The daily debt figure excludes cash that banks passed along to money-market funds.

2015 Lawsuit accuses 22 banks of manipulating U.S. Treasury auctions

Twenty-two financial companies that have served as primary dealers of U.S. Treasury securities were sued in federal court on Thursday, in what was described as the first nationwide class action alleging a conspiracy to manipulate Treasury auctions that harmed both investors and borrowers. The State-Boston Retirement System, the pension fund for Boston public employees, accused Bank of America Corp's (BAC.N) Merrill Lynch unit, Citigroup Inc (C.N), Credit Suisse Group AG CGSN.VX, Deutsche Bank (DBKGn.DE), Goldman Sachs Group Inc (GS.N), HSBC Holdings Plc (HSBA.L), JPMorgan Chase & Co (JPM.N), UBS Group AG (UBSN.S) and 14 other defendants of illegally trying to profit on the sale of Treasury bills, notes and bonds at investors' expense. According to the pension fund's complaint, filed in U.S. District Court in New York, the banks used chat rooms, instant messages and other means to swap confidential customer information and coordinate trading strategies in the roughly $12.5 trillion Treasury market. This enabled the banks to inflate prices on Treasuries they sold to investors in the pre-auction "when issued" market, and deflate prices when they bought Treasuries to cover their pre-auction sales, violating antitrust laws, according to the complaint.

INSIDER TRADING AND THE SHADOW CIA

The problematic connections between the intelligence firm (called by Barron's "The shadow CIA") and investment banking interests - connections most agree reek with a combined stink of unchecked intelligence gathering and insider trading.

In early 2012, Anonymous turned a huge database of Stratfor emails over to Wikileaks. This included the revelation of Stratfor's plans to set up an investment fund with a former Goldman Sachs director to trade on intelligence information collected by Stratfor. Among the Wikileaks/Stratfor emails was apparent client-contact between Stratfor and the target of Monday's #OpLastResort hack, George K. Baum and Company's Vice President Joshua Magden. Also Anonymous (AnonOpsIRC) announced a second #OpLastResort hack and the release of some State.gov email database credentials.

THE TOP SIX FINANCIAL INSTITUTIONS

in America owns assets equal to more than 60% of our gross domestic product and possess enormous economic and political power. One of the great questions of our time is whether the American people, through Congress, will control the greed, recklessness and illegal behavior on Wall Street, or whether Wall Street will continue to wreak havoc on our economy and the lives of working families. FORECLOSURE DEAL: $26 Billion Settlement 2/9/12 - video

HSBC Holdings Plc. and HSBC Bank USA N.A. Admit to Anti-Money Laundering and Sanctions Violations, Forfeit $1.256 Billion in Deferred Prosecution Agreement

When you decide not to prosecute bankers for billion-dollar crimes connected to drug-dealing and terrorism (some of HSBC's Saudi and Bangladeshi clients had terrorist ties, according to a Senate investigation), it doesn't protect the banking system, it does exactly the opposite.

Homeland Security & Governmental Affairs: The Permanent Subcommittee On Investigations Majority and Minority Staff Report July 17, 2012

http://www.hsgac.senate.gov/subcommittees/investigations/hearings/us-vulnerabilities-to-money-laundering-drugs-and-terrorist-financing-hsbc-case-history

http://antifascist-calling.blogspot.ca/2012/12/hsbc-impunity-of-oligarchs.html

(PDF Document) http://www.hsgac.senate.gov/download/?id=2a76c00f-7c3a-44c8-902e-3d9b5dbd0083PRIVATE BANKS

Indeed, HSBC's private banking arm, HSBC Private Bank is the principal private banking business of the HSBC Group. A holding company wholly owned by HSBC Bank Plc, its subsidiaries include HSBC Private Bank (Suisse) SA, HSBC Private Bank (UK) Limited, HSBC Private Bank (CI) Limited, HSBC Private Bank (Luxembourg) SA, HSBC Private Bank (Monaco) SA and HSBC Financial Services (Cayman) Limited. All of these entities featured prominently in money laundering and tax evasion schemes uncovered by the Senate Permanent Subcommittee in their report. Combined client assets have been estimated by regulators to top $352 billion (£217.68).

According to Senate investigators, HSBC Financial Services (Cayman) was the principle conduit through which drug money laundered through HSBC Mexico (HBMX) flowed. "This branch," Senate staff averred, "is a shell operation with no physical presence in the Caymans, and is managed by HBMX personnel in Mexico City who allow Cayman accounts to be opened by any HBMX branch across Mexico." [ARCHIVE]

INSURANCE POLICY OF POWER

The National Association of Insurance Commissioners (NAIC) [ BAIL OUT CENTRAL ]

is the organization of insurance regulators from the 50 states, the District of Columbia and U.S. territories.

Dodd-Frank Financial Services Regulatory Reform: NAIC Initiatives

State Regulatory Initiatives - WHAT A JOKE!

MUST READ

FINANCIAL LITERACY 101 - PREDATORS

ARE MEMBERS OF THE HOUSE WORKING FOR THE BANKERS

WHO'VE SOLD US OUT AGAIN

The U.S. House just passed a bill called H.R. 992 — the Swaps Regulatory Improvement Act — that was literally written by mega-bank lobbyists. It repeals the laws passed in 2010 to prevent another meltdown like the one that crashed our economy in 2008. The repeal was co-sponsored by a former Goldman Sachs executive and passed with bipartisan support from some of the House’s largest recipients of Wall Street cash. It’s so appalling… so unbelievable… so blatantly corrupt… that you’ve got to see it to believe it:In 2010, Congress passed the “Dodd-Frank” law to clamp down on risky “derivatives trading” that led to the financial collapse of 2008. Dodd-Frank was weakened by banking lobbyists from the start and has been under attack by those lobbyists ever since. Now a new law written by Citigroup lobbyists (we couldn’t make this stuff up if we tried) exempts derivatives trading from regulation, and was passed this week by the House of Representatives with broad bipartisan support.

It sounds bad… but don’t worry, it gets much, much worse. The New York Times reports that 70 of the 85 lines in the new House bill were literally written by Citigroup lobbyists (Citigroup was one of the mega-banks that brought our economy to its knees in 2008 and received billions in taxpayer money.)

11.18.13 The nation's largest lobbying industry group is ditching its lobbyist-centric name. The American League of Lobbyists — known as such since its founding in 1979 — will now call itself the Association of Government Relations Professionals, organization officials confirm to the Center for Public Integrity.

These Central Banks Have Agreed to Lower the Pricing (see LIBOR)

on the existing temporary U.S. dollar liquidity swap arrangements by 50 basis points so that the new rate will be the U.S. dollar overnight index swap (OIS) rate plus 50 basis points. This pricing will be applied to all operations conducted from December 5, 2011. The authorization of these swap arrangements has been extended to February 1, 2013. In addition, the Bank of England, the Bank of Japan, the European Central Bank, and the Swiss National Bank will continue to offer three-month tenders until further notice.

As a contingency measure, these central banks have also agreed to establish temporary bilateral liquidity swap arrangements so that liquidity can be provided in each jurisdiction in any of their currencies should market conditions so warrant. At present, there is no need to offer liquidity in non-domestic currencies other than the U.S. dollar, but the central banks judge it prudent to make the necessary arrangements so that liquidity support operations could be put into place quickly should the need arise. These swap lines are authorized through February 1, 2013.9/24/13 JPMorgan Chase & Co., Barclays Plc, Credit Suisse Group AG and 10 other international lenders were sued by a U.S. credit union regulator alleging they illegally manipulated benchmark Libor interest rates.

THE CON

Piketty, who teaches at the Paris School of Economics, has spent nearly two decades studying inequality. In 1993, at the age of twenty-two, he moved to the United States to teach at M.I.T. A graduate of the élite École Normale Supérieure, he had recently completed his doctorate, a dense mathematical exploration of the theory behind tax policies.

Capitalism simply isn't working and here are the reasons why

eCONomist Thomas Piketty's message is bleak: the gap between rich and poor threatens to destroy us.

[ . . . . Piketty deploys 200 years of data to prove them wrong. Capital, he argues, is blind. Once its returns – investing in anything from buy-to-let property to a new car factory – exceed the real growth of wages and output, as historically they always have done (excepting a few periods such as 1910 to 1950), then inevitably the stock of capital will rise disproportionately faster within the overall pattern of output. Wealth inequality rises exponentially. The process is made worse by inheritance and, in the US and UK, by the rise of extravagantly paid "super managers". High executive pay has nothing to do with real merit, writes Piketty – it is much lower, for example, in mainland Europe and Japan. Rather, it has become an Anglo-Saxon social norm permitted by the ideology of "meritocratic extremism", in essence, self-serving greed to keep up with the other rich. This is an important element in Piketty's thinking: rising inequality of wealth is not immutable. Societies can indulge it or they can challenge it. ... ]

Occupy was right: capitalism has failed the world

One of the slogans of the 2011 Occupy protests was 'capitalism isn't working'. Now, in an epic, groundbreaking new book, French economist Thomas Piketty explains why they're right.

Piketty says that neither of these arguments stand up to the evidence he has accumulated. More to the point, he demonstrates that there is no reason to believe that capitalism can ever solve the problem of inequality, which he insists is getting worse rather than better. From the banking crisis of 2008 to the Occupy movement of 2011, this much has been intuited by ordinary people. The singular significance of his book is that it proves "scientifically" that this intuition is correct.

NO AMERICAN BANKSTERS GO TO JAIL

Chinese Bankers

Get Put To Death

Combining unfettered capitalism with a government that only seeks to further big businesses’ interests, leads to bad outcomes for consumers and citizens alike! Almost! The key difference between how bankers are responding to Beijing’s saber-rattling, and American Bankers according to the WSJ, is the Chinese Bankers are willing to cooperate — very willing. Compare that to Bank of America CEO Brian Moynihan, who nearly got into a verbal tiff with President Obama over the president’s suggestion that his federally-bailed-out bank was being a bit greedy with its customer base by imposing a $5 monthly fee on debit card use, last November. Perhaps it was Beijing’s threat of “severe” punishment that whipped Chinese bankers into shape. While both the U.S. and China put their own citizens to death — one of our cherished similarities! — China does so for a number of less grave crimes than we do here, among them: stealing guns, arson and food-safety violations. A truly oppressive state can coerce businessmen to bend to its will quite easily.

Recoverable fatal error: Object of class stdClass could not be converted to string in DatabaseStatementBase->execute() (line 2173 of /home/guavaberry/public_html/includes/database/database.inc).

Recoverable fatal error: Object of class stdClass could not be converted to string in DatabaseStatementBase->execute() (line 2173 of /home/guavaberry/public_html/includes/database/database.inc).

Recoverable fatal error: Object of class stdClass could not be converted to string in DatabaseStatementBase->execute() (line 2173 of /home/guavaberry/public_html/includes/database/database.inc).

Recoverable fatal error: Object of class stdClass could not be converted to string in DatabaseStatementBase->execute() (line 2173 of /home/guavaberry/public_html/includes/database/database.inc).

Recoverable fatal error: Object of class stdClass could not be converted to string in DatabaseStatementBase->execute() (line 2173 of /home/guavaberry/public_html/includes/database/database.inc).