Contents

- Introduction

- Preface

- Overview

- Relief Valve

- LECTURE 1: Why We Are In The Dark About Money

-

LECTURE 2: The Con

- The Banker Explained - The Wizard of Oz

- Why Do We Need Banks?

- What Bank Supervision?

- Banks Too Big To Fail

- Banks Cheat

- Banks and Money Laundering

- Banks Sell Drugs

- Money is NOT the same as Currency

- Currency Markets Are Rigged

- HFT High Finance Trading Predators

- Libor

- London Gold Fix Proof of Bank Manipulation

- QE Quantitative Easing

- A Trust Deficit Caused by Predator Bankers' Secrets

- HSBC The Pirate Bank

- HSBC The Dirtiest Bank

- Propaganda

- Banks Role in Terrorism

- The Octopus

- The First Banks in America

- History of Banking – Index (by date)

- Wealth Distribution and Why do the Rich Get Richer?

- Learn How Lobbyists Buy Politicians

- Commerce Without Conscience

- The Shattered American Dream

- United States Treasury Department

- About Gold and Fort Knox

- Paying Taxes in April

- Lecture 2 Objectives and Discussion Questions

- LECTURE 3: The Vatican-Central to the Origins of Money & Power

- LECTURE 4: London The Corporation Origins of Opium Drug Smuggling

- LECTURE 5: U.S. Pirates, Boston Brahmins Opium Drug Smugglers

- LECTURE 6: The Shady Origins Of The Federal Reserve

- LECTURE 7: How The Rich Protect Their Money

- LECTURE 8: How To Protect Your Money From The 1% Predators

- LECTURE 9: Final Thoughts

IN THE EARLY DAYS BEFORE AND JUST AFTER THE AMERICAN REVOLUTION:

Americans used English, Spanish, and French money.

- Old Money - GUELPHS - Royalty, Drugs, and Money -

HISTORY

PHILADELPHIA Bank of the United States, on Third Street

The handsome Federal style mansion in the (MG-L) was built in 1789 by William Bingham, a wealthy merchant, banker and legislator. The house was set amid extensive formal gardens and was probably further back from the street than appears in the engraving. A self-supporting wide marble staircase graced the front hall and mirrored parlors decorated with paintings and magnificent imported furnishings were the settings for the most elegant entertaining. Bingham and his beautiful wife, Anne Willing, made their mansion the center of social life in Philadelphia.

Anne's father, Thomas Willing, a prominent merchant, partner of Robert Morris (1754-93) and president of the First Bank of the United States was a near neighbor, as was Samuel Powel, the last mayor of the city under Penn's charter and the first under the Charter of 1789. With the Binghams, Willings and Powels the area was one of the most fashionable in the city. The Powel house (BG-R) is a historic house museum today. In 1806-07, after the deaths of the Binghams (Anne's in 1801, untimely at age 37, and William's in 1804 at age 52), their mansion was turned into a public hotel named Mansion House. It was damaged by fire in 1823, repaired, again burned in 1847 and finally razed about 1850.

Powell Family Papers (Collection 1582), John Hare Powel worked for the firm in the early 1800’s first in the counting house and latter as supercargo on the ship Anthony Mangin bound for Calcutta in 1806 to transport sugar and brandy. Willing and Francis are also known to have commissioned voyages to Batavia and Canton facilitating the trade of seal skin, opium, sandalwood, cotton, tea and other spices.

Willings and Francis Records (Collection1874), The Historical Society of Pennsylvania.

The Historical Society of Pennsylvania

1300 Locust Street, Philadelphia, PA 19107

Phone: (215) 732-6200 FAX: (215) 732-2680

http://www.hsp.org

Thomas Willing also helped to establish the London Coffee House in 1754 located in Philadelphia. He and approximately 200 other merchants contributed 348 Pounds to the establishment run by William Bradford. The Coffee House soon became the center of business and politics in Philadelphia laying the foundation for the Philadelphia Stock Exchange.

PHILADELPHIA

- CHINA TOWN

Smyrna to Canton

Opium tRADE

The Origins of Philadelphia's Self-Depreciation, 1820-1920 see PDF

IN 1820 Stephen Girard, the richest man in the country, was at the peak of his mercantile career. Philadelphians were dominating the Smyrna-to-Canton opium trade.

Philadelphia’s Chinese communities for more than 200 years and the prominent Philadelphia families in initiating, sustaining, and profiting from the opium trade. From the 1780s to the 1840s, Philadelphia was a leading port for the China trade, with Philadelphia merchant and financier Robert Morris a “moving force behind the initiative. ”Members of Philadelphia’s “first” families, including the Girards and Chews, were among those who made fortunes by smuggling opium into China, in direct and blatant violation of Chinese law, and bringing back tea, silk, porcelain, furniture, and other valuable goods (Lee 1984:11–14, 44). Thus Philadelphia city are now named after people who were essentially drug traffickers.

History of Banking – Index (by date)

THE FIGHT FOR CONTROL OF WORLD'S WEALTH IS BETWEEN MERCHANTS AND ROYALTY

THE HISTORY OF WALL STREET BANKERS

1690 Colonial Notes

The Massachusetts Bay Colony issued the first paper money in the colonies which would later form the United States.

1775 Continental Currency

American colonists issued paper currency for the Continental Congress to finance the Revolutionary War. The notes were backed by the "anticipation" of tax revenues. Without solid backing and easily counterfeited, the notes quickly became devalued, giving rise to the phrase "not worth a Continental."

1781 Nation's First Bank

1781 Nation's First Bank

Also to support the Revolutionary War, the continental Congress chartered the Bank of North America in Philadelphia as the nation's first "real" bank.

First Bank of the United States (1797-1811), Stephen Girard’s Bank (May, 1811-1831), subsequent banks, and owned since 1955 by the National Park Service. Location: 116 South 3rd Street, Philadelphia, PA 19106.

The President, Directors and Company, of the Bank of the United States, commonly known as the First Bank of the United States, was a National Bank, chartered for a term of twenty years, by the United States Congress on February 25, 1791. Establishment of the Bank was included in a three-part expansion of federal fiscal and monetary power (along with a federal mint and excise taxes) championed by Alexander Hamilton, first Secretary of the Treasury. Hamilton believed a national bank was necessary to stabilize and improve the nation's credit, and to improve handling of the financial business of the United States government under the newly enacted Constitution.

ROGER BROOKE TANEY Fought against the Bank of the United States. Throughout his tenure in Washington, Taney had been an outspoken leader in the Democrats’ fight against the central bank, the Bank of the United States, which was widely regarded as a tool of Eastern financial interests. Taney believed it had abused its powers, and he strongly advised the President to veto the congressional bill that would renew the bank’s charter and wrote much of the veto message; he also recommended that government funds be withdrawn from the bank and be deposited in a number of state banks. As a result of his role in the fight over the Bank of the United States, Taney had become a national figure, and in 1833 President Jackson appointed him secretary of the treasury. But opposition to Taney and his financial program was so strong that the Senate rejected him in June 1834, marking the first time that Congress had refused to confirm a presidential nominee for a Cabinet post.

The Bank of North America, 1781

Towards the end of the Revolution, the Continental Congress, meeting at Independence Hall in Philadelphia, grew desperate for money. In 1781, they allowed Robert Morris, their Financial Superintendent, to open a privately-owned central bank in the hopes that would help. Incidentally, Morris was a wealthy man who had grown wealthier during the Revolution by trading in war materials. Shortly after he assumed economic power in Congress in the spring of 1781, Morris introduced a bill to create the first commercial bank, as well as the first central bank in the history of the new Republic. This bank, headed by Morris himself, the Bank of North America, was not only the first fractional reserve commercial bank in the U.S. it was to be a privately owned central bank, modeled after the Bank of England. The money system was to be grounded upon specie (commodity), but with a controlled monetary inflation creating an expansion of money and credit based upon that reserve of specie. The Bank of North America, which quickly received a federal charter and opened its doors at the beginning of 1782, received the privilege from the government of its notes being receivable in all duties and taxes to all governments, at par with specie. In addition, no other banks were to be permitted to operate in the country; the first central bank in America rapidly loaned $1.2 million to the Congress.

A private corporation with public duties, the bank handled all fiscal transactions for the US Government, and was accountable to Congress and the US Treasury. Twenty percent of its capital was owned by the federal government, the Bank's single largest stockholder. Four thousand private investors held 80% of the Bank's capital, including one thousand Europeans. The bulk of the stocks were held by a few hundred wealthy Americans.[8] In its time, the institution was the largest monied corporation in the world.

Failing to secure recharter, the Second Bank of the United States became a private corporation in 1836 and underwent liquidation in 1841.

3/4/1861 -- Salmon P. Chase was appointed as the 25th Secretary of the Treasury.

Salmon P. Chase, a Senator from Ohio who opposed Slavery, was made Secretary of the Treasury in Lincoln's administration. He was also later a Supreme Court Justice.

Chase as Secretary of the Treasure introduced our paper money system and created the first market for US Bond sales (government debt) with Jay Cooke and Company, who operated a telegraph based bond marketing system across the USA.

Den of Vipers & Thieves

“I too have been a close observer of the doings of the Bank of the United States. I have had men watching you for a long time, and am convinced that you have used the funds of the bank to speculate in the breadstuffs of the country. When you won, you divided the profits amongst you, and when you lost, you charged it to the Bank…You are a den of vipers and thieves. I have determined to rout you out and, by the Eternal, I will rout you out.” - Andrew Jackson

"I see in the near future a crisis approaching. It unnerves me and causes me to tremble for the safety of my country. The money power preys upon the nation in times of peace and conspires against it in times of adversity. It is more despotic than a monarchy, more insolent than autocracy, more selfish than bureaucracy. It denounces, as public enemies, all who question its methods or throw light upon its crimes. "I have two great enemies, the Southern Army in front of me and the financial institutions at the rear; the latter is my greatest foe. Corporations have been enthroned and an era of corruption in high places will follow, and the money power of the country will endeavor to prolong its reign by working upon the prejudices of the people until the wealth is aggregated in the hands of a few, and the Republic is destroyed." President Abraham Lincoln, 21 November, 1864

The Brown Pattern:

An Octopus is Born Chapter Two

The branches of the family of Alexander Brown stretch like the tentacles of an octopus into every conceivable type of money-making enterprise growing out of the Anglo-American establishment that existed in 1800, a generation after America's revolution against the the colonial regime. In order to understand how the original network has grown, we must return to the Liverpool of that day and meet the members of the linen-trading network who became so prosperous. We will study the Browns living in the Baltimore region, the investments made with the textile profits, and the aristocratic Southern lifestyle they established in Maryland and Virginia.

Newest Technology for Wealthiest Investors Chapter Four

Banking Clients in the Second Generation

The Brown family bank was able to recover from that recession by receiving a loan from the Bank of England, negotiated by Joseph Shipley, their partner in W & J Brown & Co. and Brown Shipley & Co. Alex. Brown & Sons security its payment of this loan by pledging as collateral the "protested bills of exchange" notes to the Bank of England at a very discounted rate, according to Joseph Shipley's letter. Had the loan not been repaid, the Bank would have had recourse against the promissory notes, if they could be collected. As long as the Bank of the United States was operating, all government funds were on deposit in it, a fact which made the government less nervous about speculation and inflationary lending. However, when Jackson withdrew the deposits from that bank and spread money into the frontier banks, it stimulated "reckless extension of credit and wild speculation" in loans made to build infrastructure projects that had no cash flow tied to the loan's repayment -- many times the amount of deposits held in reserve. Consequently, when notes went into default, the holders lost whatever had been paid for them unless the U.S. Government was willing to pay them off in specie.

1791 The First Bank of the United States

Alexander Hamilton, the 1st Secretary of the Treasury, proposed this bank and convinced a hesitant President Washington to agree. John Adams and Thomas Jefferson were against the concept. It favored the moneyed classes of the North versus the agrarian South.

The bank was given a 20 year charter and President James Madison let it expire in 1811. He understood the true nature of the banking interests:

“History records that the money changers have used every form of abuse, intrigue, deceit, and violent means possible to maintain their control over governments by controlling money and its issuance”.

Madison had to renew the charter in 1816 as the War of 1812 resulted in large government debts. Politicians always turn to bankers when funding wars and programs to get them re-elected. As usual, once unshackled, the bankers immediately caused a boom through their loose monetary policies. The Bank created a fake boom by 1818 through its reckless lending, which encouraged speculation in land. This lending allowed almost anyone to borrow money and speculate in land, sometimes doubling or even tripling the prices of land (remind you of another time in recent history?). In the summer of 1818, the national bank managers realized the bank's massive over-extension, and instituted a policy of contraction and the calling in of loans. This recalling of loans simultaneously curtailed land sales and slowed the U.S. production boom due to the recovery of Europe. The result was the Panic of 1819. There was a wave of bankruptcies, bank failures, and bank runs; prices dropped and wide-scale urban unemployment struck the country. By 1819 many Americans did not have enough money to pay off their property loans. Do you see any difference between 1816 – 1819 and 2005 – 2011? Central banks don't eliminate financial panics, they cause them. Booms and busts have always existed. They have become more common and extreme since the unleashing of greedy corrupt central bankers in the U.S., going back two centuries.

The First Bank of the United States

is a National Historic Landmark located in Philadelphia, Pennsylvania within Independence National Historical Park. The First Bank was a bank chartered by the United States Congress on February 25, 1791. The charter was for 20 years. The Bank was created to handle the financial needs and requirements of the central government of the newly formed United States, which had previously been thirteen individual states with their own banks, currencies, financial institutions, and policies.

Officially proposed by Alexander Hamilton, Secretary of the Treasury, to the first session of the First Congress in 1790, the concept for the Bank had both its support and origin in and among Northern merchants and more than a few New England state governments. It was, however, eyed with great suspicion by the representatives of the Southern States, whose chief industry, agriculture, did not require centrally concentrated banks.However, unlike the Bank of England from where Hamilton drew much of his inspiration, the primary function of the Bank would be commercial and private interests. The business it would be involved in on behalf of the federal government—a depository for collected taxes, making short term loans to the government to cover real or potential temporary income gaps, serving as a holding site for both incoming and outgoing monies—was considered highly important but still secondary in nature.

There were other, nonnegotiable conditions for the establishment of the Bank of the United States. Among these were:

* That the Bank was to be a private company.

* That foreigners, whether overseas or residing in the United States, would be allowed to be Bank of the United States stockholders, but would not be allowed to vote.

The establishment of the bank also raised early questions of constitutionality in the new government. Hamilton, then Secretary of the Treasury, argued that the Bank was an effective means to utilize the authorized powers of the government implied under the law of the Constitution. Secretary of State Thomas Jefferson argued that the Bank violated traditional property laws (corporations are people) and that its relevance to constitutionally authorized powers was weak. Another argument came from James Madison, who believed Congress had not received the power to incorporate a bank; or any other governmental agency; His argument rested on his belief that if the Constitution's writers had wanted Congress to have such power they would have made it explicit in the Constitution. The decision ultimately fell to President George Washington.

Knowing he was setting a precedent by everything he was doing in his capacity as President of the United States, George Washington was hesitant about signing the "bank bill" into law. Washington asked for a written opinion from all his cabinet members—most particularly from Hamilton.

Attorney General Edmund Randolph from Virginia felt that the bill was unconstitutional. Jefferson, also from Virginia, agreed that Hamilton's proposal was against both the spirit and letter of the Constitution. In addition,

"...in a masterpiece of legal obfuscation, well calculated to confuse the president, he [Jefferson] asserted the bank bill violated the laws of mortmain, alienage, forfeiture and escheat, distribution and monopoly. Washington, overwhelmed by the arguments...send Hamilton copies of Randolf's and Jefferson's opinion...inviting Hamilton in effect to defend the bank if he could..."[6] RECORD OF THE DEBATE

Hamilton, who, unlike his fellow cabinet members, hailed from New York, quickly set about laying to rest the arguments of those who claimed incorporation of the bank unconstitutional. While Hamilton's rebuttals were many and varied, chief among them were these two:

-

What the government could do for a person (incorporate), it could not refuse to do for an "artificial person", a business.

And the Bank of the United States, being privately owned and not a government agency, was a business.

"Thus...unquestionably incident to sovereign power to erect corporations to that of the United States, in relation to the objects entrusted to the management of the government."

- Any government by its very nature was sovereign "and includes by force of the term a right to attainment of the ends...which are not precluded by restrictions & exceptions specified in the constitution..

After the charter for the First Bank of the United States expired in 1811, Stephen Girard opened his own bank, later known as Girard Bank. He purchased most of its stock as well as the building and its furnishings on South Third Street in Philadelphia and over its early history the bank was known as “Girard's Bank,”[9] or as “Girard Bank.” [10] or also as “Stephen Girard's Bank” or even the “Bank of Stephen Girard.” [9] Girard was the sole proprietor of his bank, and thus avoided the Pennsylvania state law which prohibited an unincorporated association of persons from establishing a bank, and required a charter from the legislature for a banking corporation.[11]

Girard hired George Simpson, the cashier of the First Bank, as cashier of the new bank, and with seven other employees, opened for business on May 18, 1812. He allowed the Trustees of the First Bank of the United States to use some offices and space in the vaults to continue the process of winding down the affairs of the closed bank at a very nominal rent.[12] The bank's charter expired in 1811.

Stephen Girard's Family Wealth is rooted in the Illegal Opium Drug Smuggler Trade page 290

http://www.scribd.com/doc/30660745/Opium-Traders-and-Their-Worlds-Volume-One

Start reading on page 284

THE SECOND BANK OF THE UNITED STATES

The Second Bank of the United States was chartered in 1816, five years after the First Bank of the United States lost its own charter. The Second Bank of the United States was initially headquartered in Carpenters' Hall, Philadelphia, the same as the First Bank, and had branches throughout the nation. The Second Bank was chartered by many of the same congressmen who in 1811 had refused to renew the charter of the original Bank of the United States. The predominant reason that the Second Bank of the United States was chartered was that in the War of 1812, the U.S. experienced severe inflation and had difficulty in financing military operations. Subsequently, the credit and borrowing status of the United States were at their lowest levels since its founding. Like the First Bank, the Second Bank was also chartered for 20 years, and also failed to have its charter renewed. It existed for 5 more years as an ordinary bank before going bankrupt in 1841.

Andrew “Old Hickory” Jackson became President in 1829 and proceeded to declare war on the Second National Bank. He was the first and only President in U.S. history to pay off the National Debt. He worked tirelessly to rescind the charter of the Second Bank of the United States. His reasons for abolishing the bank were:

- It concentrated the nation's financial strength in a single institution.

- It exposed the government to control by foreign interests.

- It served mainly to make the rich richer.

- It exercised too much control over members of Congress.

- It favored northeastern states over southern and western states.

President Jackson believed that only Congress should be responsible for the issuance and control of the currency. Delegating that duty to powerful New York bankers was distasteful to him:

“If Congress has the right to issue paper money, it was given to them to be used … and not to be delegated to individuals or corporations”

President Jackson vetoed the extension of their bank charter in 1832. He redirected government tax revenue to other state banks. The Second Bank of the United States was left with little money and, in 1836, its charter expired and it turned into an ordinary bank. Five years later, the former Second Bank of the United States went bankrupt. Those who believe that a central bank is essential to economic progress need to examine the “free banking” period from 1837 to 1861. In the last five years of the Second Bank's existence, prices rose by 28%. Over the next 25 years, prices in the U.S. fell by 11%. We experienced the dreaded deflation. Did deflation destroy America? Not quite. GDP grew from $1.5 billion in 1836 to $4.6 billion in 1861. Deflation is only fatal to debtors. Inflation is the friend of lenders and the moneyed classes.

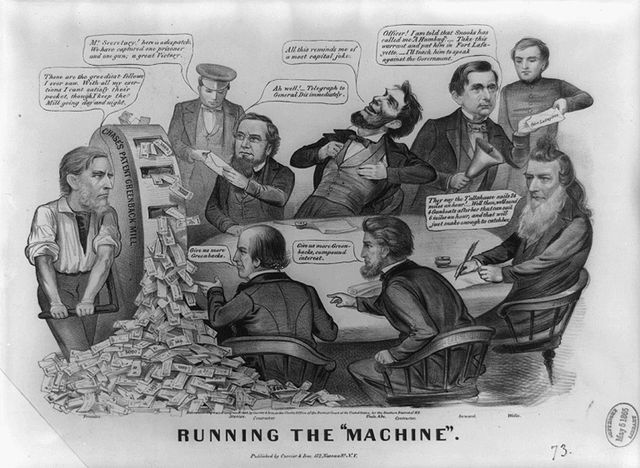

The Celebrated Bank War Period: 1820-1860

Jacksonian Democracy--The Celebrated Bank War Period: 1820-1860

UNITED STATES CIVIL WAR

3RD BANK

OF THE UNITED STATES

BECAME THE

FEDERAL RESERVE

According to the plan put before the first session of the First Congress, Hamilton proposed establishing the initial funding for the Bank of the United States through the sale of $10 million in stock of which the United States government would purchase the first $2 million in shares.

Hamilton, foreseeing the objection that this could not be done since the U.S. government didn't have $2 million, proposed that the government make the stock purchase using money lent to it by the Bank; the loan to be paid back in ten equal annual installments.

The remaining $8 million of stock would be available to the public, both in the United States and overseas. The chief requirement of these non-government purchases was that one-quarter of the purchase price had to be paid in gold or silver; the remaining balance could be paid in bonds, acceptable scrip, etc.

ABRAHAM LINCOLN

“GREENBACKS”

michaeljournal.org/

During the Civil War (1861-1865), President Lincoln needed money to finance the War from the North. The Bankers were going to charge him 24% to 36% interest. Lincoln was horrified and went away greatly distressed, for he was a man of principle and would not think of plunging his beloved country into a debt that the country would find impossible to pay back.

During the Civil War (1861-1865), President Lincoln needed money to finance the War from the North. The Bankers were going to charge him 24% to 36% interest. Lincoln was horrified and went away greatly distressed, for he was a man of principle and would not think of plunging his beloved country into a debt that the country would find impossible to pay back.

Cooke and Company partners were later involved in some serious financial scandals.

The "greenback" as a demand note, got its start in 1871-1872 during Chase' tenure. A demand note is a loan with no set period of payback. Salmon P. Chase's portrait appeared on the now discontinued $10,000 note and he was the man to add the words "IN GOD WE TRUST" to our money. From the founding of our country there had been constant conflict between corrupt bankers trying to control the currency of the nation to further their own enrichment at the expense of the people and a few courageous leaders willing to fight them. The bankers won the century old battle in 1913.

Jay Cooke sold government bonds to be marketed outside of the normal financial circles to ordinary Americans and thus greatly expanded the government's borrowing abilities.

In America's previous wars, the government had sold bonds only to banks and to a few wealthy investors. Now, however, the Treasury employed the services of Jay Cooke, a Philadelphia banker, to persuade ordinary citizens to buy bonds. Through high-pressure propaganda techniques, Cooke disposed of $400 million worth of bonds—the first example of mass financing of a war in American history. In all, the United States borrowed $2.6 billion. The most controversial method of financing (and the least productive of revenue) was the printing of paper currency, or "greenbacks." The new currency paid no interest and was not supported by a specie reserve (gold or silver).

Eventually President Lincoln was advised to get Congress to pass a law authorizing the printing of full legal tender Treasury notes to pay for the War effort. Lincoln recognized the great benefits of this issue. At one point he wrote:

“... (we) gave the people of this Republic the greatest blessing they have ever had – their own paper money to pay their own debts...”

The Treasury notes were printed with green ink on the back, so the people called them "Greenbacks".

Lincoln printed 400 million dollars worth of Greenbacks (the exact amount being $449,338,902), money that he delegated to be created, a debt-free and interest-free money to finance the War. It served as legal tender for all debts, public and private. He printed it, paid it to the soldiers, to the U.S. Civil Service employees, and bought supplies for war.

Shortly after that happened, “The London Times” printed the following: “If that mischievous financial policy, which had its origin in the North American Republic, should become indurated down to a fixture, then that Government will furnish its own money without cost. It will pay off debts and be without a debt. It will have all the money necessary to carry on its commerce. It will become prosperous beyond precedent in the history of the civilized governments of the world. The brains and the wealth of all countries will go to North America. That government must be destroyed, or it will destroy every monarchy on the globe.”

The Bankers obviously understood.

The only thing, I repeat, the only thing that is a threat to their power is sovereign governments printing interest-free and debt-free paper money. They know it would break the power of the international Bankers.

In retaliation: After this was published in "The London Times", the British Government, which was controlled by the London and other European Bankers, moved to support the Confederate South, hoping to defeat Lincoln and the Union, and destroy this government which they said had to be destroyed.

They were stopped by two things. First, Lincoln knew the British people, and he knew that Britain would not support slavery, so he issued the Emancipation Proclamation, which declared that slavery in the United States was abolished. At this point, the London Bankers could not openly support the Confederacy because the British people simply would not stand for their country supporting slavery.

Second, the Czar of Russia sent a portion of the Russian navy to the United States with orders that its admiral would operate under the command of Abraham Lincoln. These ships of the Russian navy then became a threat to the ships of the British navy which had intended to break the blockade and help the South. The North won the War, and the Union was preserved. America remained as one nation. Of course, the Bankers were not going to give in that easy, for they were determined to put an end to Lincoln's interest-free, debt-free Greenbacks. He was assassinated by an agent of the Bankers shortly after the War ended.

Thereafter, Congress revoked the Greenback Law and enacted, in its place, the National Banking Act. The national banks were to be privately owned and the national bank notes they issued were to be interest bearing. The Act also provided that the Greenbacks should be retired from circulation as soon as they came back to the Treasury in payment of taxes.

In 1972, the United States Treasury Department was asked to compute the amount of interest that would have been paid if that 400 million dollars would have been borrowed at interest instead of being issued by Abraham Lincoln. They did some computations, and a few weeks later, the United States Treasury Department said the United States Government saved 4 billion dollars in interest because Lincoln had created his own money.

In Washington, the view is that the banks are to be regulated, and my view is that Washington and the regulators are there to serve the banks."

~ 2011 Rep. Spencer Bachus (R-Ala.), the incoming chairman of the House Financial Services Committee

THE FEDERAL RESERVE ACT

There were changes in the money and banking laws for the next fifty years. Finally, in 1913, the Bankers were able to get their Federal Reserve Act passed through Congress which replaced the National Banking Act that had earlier replaced the Greenback Law. If the Government would have continued the policy of Abraham Lincoln, the warnings given in “The London Times” would have come to pass. America would be a debt-free nation, the most prosperous in the world. And the brains and the wealth of the world would have come to America. But with this Federal Reserve Act being passed, Congress gave up Its power to create its own money that it was given in the United States Constitution, and gave this power over to private Bankers who called themselves the Federal Reserve. The Bankers had achieved their ultimate goal, for now the United States operated under a central bank that was privately owned. They now had the power to run the country by controlling the creation of the money, and were free to charge the interest they so desired.

As Mayer Anselm Rothschild once said: “Permit me to issue and control the money of a nation, and I care not who makes its laws...”

President Kennedy

On June 4th, 1963, President Kennedy signed a presidential document, called Executive Order 11110, which further amended Executive Order 10289 of September 19th, 1951. This gave Kennedy, as President of the United States, legal clearance to create his own money to run the country, money that would belong to the people, an Interest and debt-free money. He had printed United States Notes, completely ignoring the Federal Reserve Notes from the private banks of the Federal Reserve.

Our records show that Kennedy issued $4,292,893,825 of cash money. It was perfectly obvious that Kennedy was out to undermine the Federal Reserve System of the United States.

But it was only a few months later, In November of 1963, that the world received the shocking news of President Kennedy's assassination. It is interesting to note that, only one day after Kennedy's assassination, all the United States notes, which Kennedy had issued, were called out of circulation.

"Despite my views about the value to society of greater publicity for the affairs of corporations, there was an occasion near the close of 1910, when I was as secretive, indeed, as furtive, as any conspirator. . . . Since it would have been fatal to Senator Aldrich's plan to have it known that he was calling on anybody from Wall Street to help him in preparing his bill, precautions were taken that would have delighted the heart of James Stillman (a colorful and secretive banker who was President of the National City Bank during the Spanish-American War, and who was thought to have been involved in getting us into that war) . . . I do not feel it is any exaggeration to speak of our secret expedition to Jekyll Island as the occasion of the actual conception of what eventually became the Federal Reserve System." ~ Frank Vanderlip in the Saturday Evening Post, February 9, 1935, p. 25

"Our secret expedition to Jekyll Island was the occasion of the actual conception of what eventually became the Federal Reserve System. The essential points of the Aldrich Plan were all contained in the Federal Reserve Act as it was passed." ~ Vanderlip in his autobiography, From Farmboy to Financier

The Financial Purpose of the Senate explained in 1906 by David Graham Phillips

The Treason of the Senate: Aldrich, The Head of It All by David Graham Phillips Cosmopolitan March 1906

THE ORIGIN OF THE CENTRAL BANK

ALSO CALLED

THE

FEDERAL RESERVE

STATED Federal Government Official MYTH in the Official K12 Curriculum:

STATED Federal Government Official MYTH in the Official K12 Curriculum:

The Federal Reserve Act was passed illegally under a cloak of secrecy and was started by an elite group of private bankers.

STATED OFFICIAL K12 STORY:

STATED OFFICIAL K12 STORY:

The Federal Reserve System was created by the Federal Reserve Act and signed into law by President Woodrow Wilson on December 23, 1913. Although the Act was passed in the final days of the legislative session, it had been debated for some time in earlier versions. Because the regional Federal Reserve Banks are privately owned,and most of their directors are chosen by their stockholders, it is common to hear that control of the Fed is in the hands of elite bankers. However, individuals do not own stock in Federal Reserve Banks.The stock is held only by banks that are members of the system. Ownership and membership are synonymous.

The actual Fight was for a central bank under public, not banker, control.

American Bankers Association, the presidents of 47 state banking associations and 191 clearinghouse associations raised many objections to the Administration's banking reform. They made it clear that they wanted the Aldrich plan, with one central bank generally controlled by bankers and generally independent of government regulation.

QUESTION: Why is the Fed sometimes called a decentralized central bank that's both public and private?

STATED K12 OFFICIAL BANK ANSWER

The Federal Reserve consists of two main entities—the Board of Governors and the 12 Federal Reserve Banks. The Board of Governors is a public agency.The 12 Federal Reserve Banks and their boards of directors represent the private component of the Fed.

REAL ANSWER:

Contrary to popular belief, the world's finances are controlled by privately-owned “central banks” masquerading as federal government banks in nearly every country in the world.

The U.S. Court of Appeals, Ninth Circuit, ruled that The Federal Reserve (U.S.' central bank) was privately owned in 680 F.2d 1239, LEWIS v. UNITED STATES of America, No. 80-5905. http://land.netonecom.net/tlp/ref/federal_reserve.shtml

The 12 Federal Reserve Banks and their Boards of Directors represent the private "SPECIAL INTERESTS" OF private families who control the Boards of Directors.

It is done this way in England so Who Owns the Bank of England?

CONNECTICUT SECRETS

In 1943, by special act of the Connecticut state legislature, Russell Trust Association trustees were granted an exemption from filing corporate reports with the Secretary of State, which is normally a requirement.

"From 1978 onward, business of the Russell Trust Association was handled by its single trustee, Brown Brothers Harriman & Co. partner John B. Madden. Madden started with Brown Brothers Harriman in 1946, under senior partner Prescott Bush. Father of both Presidents named BUSH

FYI

Watch MGM movie The Mating Game about the family that ignored their income tax.

Starring Tony Randall the IRS agent and Debbie Renolds who manages to go to Washington to fight the tax man to save the family farm from the taxes owed.

In 1965, the Medicare bill was passed by Congress.

"Tucked into the 138 page bill was a clause exempting the Old Order Amish, and any other religious sect who conscientiously objected to insurance, from paying Social Security payments, providing that sect had been in existence since December 31, 1950. After Senate approval in July, the signing of the bill by President Lyndon B. Johnson on August 13, 1965, made it official and canceled tax accounts of some 15,000 Amish people amounting to nearly $250,000."

Amish Country News Amish Series by Brad Igou (1999, 2005)