Contents

- Introduction

- Preface

- Overview

- Relief Valve

-

LECTURE 1: Why We Are In The Dark About Money

- Wealth Objectives

- The Basics - Knowledge is Power

- The Wizard of Oz Story Allegory

- K12 Wealthy Decide

- Richest Two Percent Own Half World

- Cost of Inequality

- K Street Lobbys Write the Law

- Official Federal Reserve K12 Financial Literacy Curriculum by Grade Level

- What's Left Out of the Official U.S. Federal Reserve Curriculum

- EducRats

- Financial Literacy Quotes

- Lecture 1 Objectives and Discussion Questions

- LECTURE 2: The Con

- LECTURE 3: The Vatican-Central to the Origins of Money & Power

- LECTURE 4: London The Corporation Origins of Opium Drug Smuggling

- LECTURE 5: U.S. Pirates, Boston Brahmins Opium Drug Smugglers

- LECTURE 6: The Shady Origins Of The Federal Reserve

- LECTURE 7: How The Rich Protect Their Money

- LECTURE 8: How To Protect Your Money From The 1% Predators

- LECTURE 9: Final Thoughts

THE OFFICIAL FEDERAL RESERVE K12 CURRICULUM FAILS TO INCLUDE

1) Proof that any so called curriculum actually helps anyone make better decisions about money and staying out of debt.

2) No vendor teaches anything about the Compulsive buying disorder (CBD)

which is characterized by excessive shopping cognitions and buying behavior that leads to distress or impairment. Found worldwide, the disorder has a lifetime prevalence of 5.8% in the US general population. Most subjects studied clinically are women (~80%), though this gender difference may be artifactual. Subjects with CBD report a preoccupation with shopping, prepurchase tension or anxiety, and a sense of relief following the purchase. CBD is associated with significant psychiatric comorbidity, particularly mood and anxiety disorders, substance use disorders, eating disorders, and other disorders of impulse control. The majority of persons with CBD appear to meet criteria for an Axis II disorder, although there is no special "shopping" personality. Compulsive shopping tends to run in families, and these families are filled with mood and substance use disorders. There are no standard treatments. Psychopharmacologic treatment studies are being actively pursued, and group cognitive-behavioral models have been developed and are promising. Debtors Anonymous, simplicity circles, bibliotherapy, financial counseling, and marital therapy may also play a role in the management of CBD. Keywords: Compulsive shopping, compulsive buying, impulse control disorders. http://www.ncbi.nlm.nih.gov/pmc/articles/PMC1805733/

3) How Money Changes Us and Not for the Good

4) Economics according to Seinfield

Seinfeld ran for nine seasons on NBC and became famous as a “show about nothing.” Basically, the show allows viewers to follow the antics of Jerry, George, Elaine, and Kramer as they move through their daily lives, often encountering interesting people or dealing with special circumstances. It is the simplicity of Seinfeld that makes it so appropriate for use in economics courses. Using these clips (as well as clips from other television shows or movies) makes economic concepts come alive, making them more real for students. Ultimately, students will start seeing economics everywhere – in other TV shows, in popular music, and most importantly, in their own lives.

2016 The corruption at the heart of our financial system

GANGSTERS AND BANKSTERS WHAT ARE THEY PLANNING

Why should any small clique of fallible, corruptible human beings be entrusted with such corruptive power? Why is the economic well-being (or demise) of the entire world resting in the hands of these bankster elites, who have been shown repeatedly to be enriching themselves and their confederates by plundering the investments and savings of billions of people worldwide? Why are they still allowed to operate in secrecy and to evade the audits that are expected of every business and government agency? Following the 2008-2009 financial crisis, public outrage over the Too Big To Fail banking and corporate bailouts was finally sufficient to take Rep. Ron Paul’s Audit the Fed bill to victory in the House. It was watered down in the Senate, but we did get a partial audit that showed the Fed had funneled trillions of dollars to favored banks.

For the better part of the past century, the controlled major media and the kept academics either have simply ignored the criminal origins of the Fed, or have denied that the Jekyll Island meeting ever occurred. However, in 2013, on the 100th anniversary of the passage of the Federal Reserve Act, the Fed not only acknowledged the secret Jekyll Island meeting, but celebrated it.The principal Rothschild agent at that cabal was Paul Warburg, who became not only the public face of the campaign for a central bank, but subsequently became the president of the Fed’s advisory council. He was a founder of the Council on Foreign Relations (CFR) in 1921, and served as a director on this premier “brain trust” for world government until his death. Many of his Wall Street/Jekyll Island cronies likewise joined in founding the CFR. And CFR members have guided the Fed on a steady globalist course ever since.CFR members listed as attendees1 at the 2016 Jackson Hole conference included:Janet Yellen, Chair of the Fed’s Board of Governors;

Stanley Fischer, Vice Chairman Board of Governors;

William Dudley, President/CEO, Federal Reserve Bank of New York;

Dennis P. Lockhart, President/CEO, Federal Reserve Bank of Atlanta;

Lael Brainard, Governor, Board of Governors of the Federal Reserve System;

Jerome Powell, Governor, Board of Governors of the Federal Reserve System;

Alberto Musalem, Executive Vice President, Integrated Policy Analysis Group Federal Reserve Bank of New York;

Michelle Smith, Assistant to the Board and Division Director Board of Governors of the Federal Reserve System;Providing additional intellectual heft for this year’s event were the usual CFR-member Ivy League professors and think tank gurus:Kristin J. Forbes, Professor, Massachusetts Institute of Technology;

Peter Blair Henry, Dean, Stern School of Business New York University;

R. Glenn Hubbard, Dean, Columbia Business School;

Donald Kohn, Senior Fellow, Brookings Institution;

Adam Posen, President Peterson, Institute for International Economics;

Martin Feldstein, Professor, Harvard University;

Carmen Reinhart, Professor, Harvard University;

Kenneth Rogoff, Professor, Harvard University.Listed on the Fed program as “Media Attendees” at the Wyoming affair were the following individuals from the CFR-dominated thought cartel:Binyamin Appelbaum, Correspondent, The New York Times;

Peter Barnes, Senior Washington Correspondent, Fox Business Network;

Sam Fleming, U.S. Economics Editor, Financial Times;

Kathleen Hays, Host and Economics Correspondent, Bloomberg Radio and Television;

Jon Hilsenrath, Chief Economics Correspondent, The Wall Street Journal;

Steve Liesman, Senior Economics Reporter, CNBC;

Steve Matthews, Reporter, Bloomberg News;

Ylan Mui, Reporter, The Washington Post;

Howard Schneider, Journalist, Reuters News;

Harriet Torry, Reporter, Dow Jones Newswire.As should be expected, after a century of practice, the progeny of the Jekyll Island cabal have become very adept at running these secretive “public show” events.

Optimal collusion with private information

Author: Athey, Susan; Bagwell, Kyle download http://dspace.mit.edu/handle/1721.1/63939

5) Well-kept secret for U.S. taxpayers: the Saver's Credit

It sounds too good to be true: some workers can get a double tax benefit by saving for retirement. But the federal Saver’s Credit does just that by providing a second layer of tax incentives for lower-income households beyond the benefit of tax deferral that everyone receives for contributing to a 401(k) or IRA. The Saver's Credit can be worth up to half of what you contribute to a traditional individual retirement account (IRA), Roth or workplace retirement plan. Yet only 25 percent of workers with annual household incomes below $50,000 know that it exists. The Saver's Credit provides a credit up to $1,000 ($2,000 for joint filers) for contributions to an IRA or workplace plan. For the 2015 tax year, it is available to joint filers with adjusted gross income up to $61,000. Single filers get the credit with income up to $30,500. Even if you did not contribute to a workplace plan last year, you can make a 2015 IRA contribution before April 18 to claim the credit.

The Meaning of 'currency' — money, unlike goods, is 'current.'

If stolen and spent, new owner has the right to keep it.

The Golden Rule: Whoever has the gold makes the rules.

THERE ARE NO RULES FOR THE RICH, THERE ARE ONLY RULES FOR EVERYONE ELSE

"I must admit that given the choice between doing business with violent gangs or with banks I'd choose the gangs." ~ anon

"30+ years have taught me that bankers can't be trusted." ~ anon

HOW IS MONEY CREATED

Money should only be created in the public interest! NOT IN THE BANKS INTEREST!

2015 A parliamentary debate earlier in the year on Money Creation and Society was the first time money creation was debated for almost 200 years.

2017 Blockchain Technology takes off and Cryptocurrencies are now bigger than GE

President Abraham Lincoln, 21 November, 1864 about financial institutions

"I see in the near future a crisis approaching. It unnerves me and causes me to tremble for the safety of my country. The money power preys upon the nation in times of peace and conspires against it in times of adversity. It is more despotic than a monarchy, more insolent than autocracy, more selfish than bureaucracy. It denounces, as public enemies, all who question its methods or throw light upon its crimes.

"I have two great enemies, the Southern Army in front of me and the financial institutions at the rear; the latter is my greatest foe. Corporations have been enthroned and an era of corruption in high places will follow, and the money power of the country will endeavour to prolong its reign by working upon the prejudices of the people until the wealth is aggregated in the hands of a few, and the Republic is destroyed."✔ GOLD FIXING Rothschild biographer Derek Wilson says the family was the official European banker to the US government via the Federal Reserve-precursor Bank of the United States. Family biographer Niall Ferguson notes a “substantial and unexplained gap” in Rothschild correspondence from 1854-1860. He says all copies of outgoing letters written by the London Rothschilds during this Civil War period “were destroyed at the orders of successive partners”.

Do you know who Senator Aldrich is or anything about The Aldrich-Vreeland Act of 1908?

- The Glass-Owen Act was passed in response to the Panic of 1907. Its purpose was to provide for the issue of emergency currency during widespread financial crisis.

- The Aldrich-Vreeland Act of 1908, passed under the leadership of Senator Nelson Aldrich, developed a banker- controlled plan, the basis of the Federal Reserve.

THE OPPOSITION TO THE FEDERAL RESERVE BANK BILL

Carter Glass explaining in 1913 that the Reichsbank & private ownership was model for Fed

When the ALDRICH plan was before the country, the European bank which its sponsors most often cited as a helpful example for the United Stats and the one to which they gave more attention in their report than to all the others combined was the IMPERIAL BANK OF GERMANY. The following brief description of the control of the REICHSBANK is taken from an interview with two of its officers, which was published by the monetary commission:1

[The capital] is ALL PRIVATE OWNERSHIP ... the government owns no shares. [In our organization] we have, so to speak, three boards: first, the Curatorium; second, the Direktorium (president and directors)' third, the Central Ausschuss [or Central Committee]. The Curatorium is composed of five members. The chairman is the Chancellor of the Empire. The Emperor appoints the second member, and it has been the custom to appoint the Prussian Minister of Finance. The Bundesrath [the upper house of the imperial legislature] appoint from among their own number three members, which completes the Board ... In the Chancellor lies supreme poser although he has exercised it but once in the history of the bank. pg 15

✔ The Financial Purpose of the Senate. The Treason of the Senate: Aldrich, The Head of It All by David Graham Phillips - Cosmopolitan

✔ Jekyll Island the Beginnings of the Federal Reserve : "No, The Fed Is Not Populist"

✔ Bank of England - American Federal Reserve Bank A Study of Corporate and Banking Influence Published 1976

AND The Fed fails to explain who the Brown Brothers, Harriman, Rockefeller, Morgan, Schwab, and Prescott Bush were and their parts in the history and creation of a Decentralized Bank.

Jun 24, 2012 CNBC Admits We're All Slaves To The Central Banks

CNBC Admits We're All Slaves To The Central Banks The clip shows how blatantly obvious the system is rigged.

SEE BANKING REFORM

2014 Federal Reserve Janet Yellen describes the severity of financial crisis as it developed in 2008

Fed transcripts from 2008 as the central bank tackled the worst financial crisis in living memory and the US teetered on the edge of another Great Depression. The transcripts of 14 scheduled and emergency policy meetings the Fed held cover only official meetings and not the countless telephone calls and unofficial gatherings of senior policy officials and financiers held during the crisis. What is consistent in the transcripts is that the Fed appeared to be struggling to grasp the magnitude of the crisis that was unfolding.

THE OFFICIAL FINANCIAL LITERACY CURRICULUM SHOULD INCLUDE:

Why it matters who regulates Wall Street

Former Wall Street lawyer Timothy Massad is Obama's CFTC nominee. We'll find out whose side – Wall Street or the public – he's on soon

J.P. Morgan to Pay $1.7 Billion to Victims of Madoff Fraud

Bank Also Expected to Pay Penalties to the Office of the Comptroller of the Currency, Unit of Treasury Department

An Educated Citizenry Must:

✔ REMEMBER THAT THE MOST IMPORTANT LITERACY SKILL IS KNOWING HOW TO READ BETWEEN THE LINES.

✔ KNOW THE MOST IMPORTANT THINKING SKILL IS NOT TO BELIEVE EVERYTHING YOU READ BUT TO RESEARCH AND CHECK THE FACTS FOR YOURSELF.

✔ Know the Point of View: Curriculum must be taught with an Interdisciplinary Point of View

You must be able to learn about something in context in order to see the big picture; otherwise it is only a bunch of fragmented pieces of data.

✔ Know that Data must be turned into information - and if it is not - then it is for keeping knowledge secret.

INTERDISCIPLINARY FACTS

FROM ROYALTY, OPIUM DRUG SMUGGLING PIRATES, AND MONEY WE MEET THE FIRST FAMILIES ALSO KNOWN AS THE BOSTON BRAHMINS WHICH THEN LEADS TO THE UNIVERSITY, SECRET SOCIETIES, FRATERNITIES, TO THE HALLS OF THE SENATE, CONGRESS AND THE PRESIDENCY.

FROM ROYALTY, OPIUM DRUG SMUGGLING PIRATES, AND MONEY WE MEET THE FIRST FAMILIES ALSO KNOWN AS THE BOSTON BRAHMINS WHICH THEN LEADS TO THE UNIVERSITY, SECRET SOCIETIES, FRATERNITIES, TO THE HALLS OF THE SENATE, CONGRESS AND THE PRESIDENCY.

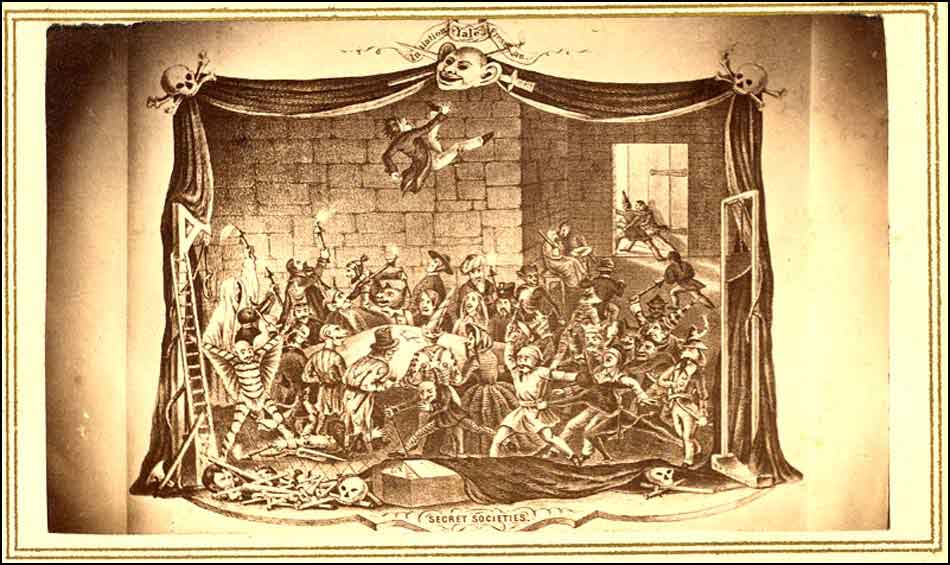

MEET THE SECRET FRATERNITIES, SOCIETIES AND FINANCIAL INSTITUTIONS: harnessed to move money for drug runners.

World Wide Commerce Begins with Merchant Marines who were sailors, the ones who traded cargo - using ships that sailed from country to country starting with Carrack Sail Boats.

OLD MONEY: EARLY ENGLISH AND AMERICAN PIRATE DRUG SMUGGLER NETWORKS

- Colonel Thomas Handasyd Perkins, Samuel Russell - Franklin Delano Roosevelt's Grandfather Warren Delano, John Cleve Green, Abiel Low, Forbes, Taft and Sturgis families

-

George Walbridge Perkins, Sr. is a direct descendant of the opium drug smuggler Perkins family.

The founding families of Skull & Bones included the Russell and Perkins families. Over several generations, however, all these families heavily intemarried and became, in effect, one extended power grouping. They considered themselves to be special among the merchant, banking, and Puritan Pilgrim elite of Yale. They took the Puritan beliefs of the early New England settlers, that they were "elected by God," and pre-ordained to rule North America. - Meet the Forbes Family - Yes! that family.

- Brown Brothers Harriman & Co., Skull and Bones

- Prescott S. Bush (B.A. 1917, S&B 1917) – Partner of Brown Brothers Harriman & Co. (1931-1972)

- When Time magazine announced this merger in its December 22, 1930 issue, they noted that of the company's 16 founding partners, a total of 11 were graduates from Yale University. Eight of the ten initial partners (all except Moreau, Delano, and Thatcher Brown) were members of Skull and Bones.

William Huntington Russell (12 August 1809 – 19 May 1885)

William Huntington Russell (12 August 1809 – 19 May 1885)

SKULL AND BONES (S&B), Yale University secret society Skull and Bones was first established by the Yale University graduating class of 1832, founded by William Harrison Russell and Alphonso Taft, the father of President William Howard Taft.

The Russell Trust Association was first established among the class graduating from Yale in 1833. Its founder was William Huntington Russell of Middletown, Connecticut. The Russell family was the master of incalculable wealth derived from the largest U.S. criminal organization of the nineteenth century: Russell and Company, the great opium syndicate.

It is significant to note that Alphonso Taft was thereafter powerful enough to manipulate his son into both the presidency and the Chief Justices of the U.S. SUPREME COURT.

He was a descendant of several old New England families, including those of Pierpont, Hooker, Willett, Bingham, and Russell. His ancestor Rev. Noadiah Russell was a founder and original trustee of Yale College.

THE POWER ELITE

Origins of Private Banks;Corporation - Company - The Subsidiary, Councils - Groups - Assurance / Insurance, Trusts

Origins of First American Families Wealth, Pirates, Opium, Smugglers, Slavery, Rum, Sugar, Taxes, Trade Routes, Transfer, Tax Shelters

Origins of The University, Secret Societies, Fraternities like Skull and Bones, K12 Feeder Prep Schools

Both George Bush and Barbara Pierce Bush (of Merrill, Lynch, Pierce, Fenner and Smith) are descended from the same Pierce family of England as President Franklin Pierce. Originally known as the enormously powerful Percy family of England, a name change to Pierce was required along with a quick immigration to America, when their involvement in the failed Gun Powder Plot to blow up Parliament became known. One of the Percy castles, where this plot was hatched was known as Sion House.

Both George Bush and Barbara Pierce Bush (of Merrill, Lynch, Pierce, Fenner and Smith) are descended from the same Pierce family of England as President Franklin Pierce. Originally known as the enormously powerful Percy family of England, a name change to Pierce was required along with a quick immigration to America, when their involvement in the failed Gun Powder Plot to blow up Parliament became known. One of the Percy castles, where this plot was hatched was known as Sion House.

Background Story:

Background Story:

The idea of Nation or Religion being the center of people's identity. Some people may define themselves by what they are not, as not following any religion or thinking of themselves as from some country, or nationality.

But at some point in the world's history, The Catholic Religion also became a nation, not just a religion.

When the religion evolved into a nation, it acquired its own infrastructure to govern itself including laws, a treasury, Banks, a military and the "legal" or "official" recognition from other countries that it was a nation able to do business with other countries too.

- PIRATES AND PROFITEERS APPOINTED BY POLITICIANS TO PRIVATIZE K12 EDUCATION

- BUSINESS PARTNERS APPOINTED TO CONTROL K12 POLICY

THE OFFICIAL AMERICAN GOVERNMENT CURRICULA FOR THE K12 STUDENTS OF AMERICA THAT TEACHES THE NATION'S CITIZENS ABOUT BANKS, MONEY AND THEIR ECONOMY.

Financial Literacy Means Having Interdisciplinary Knowledge!

YOU must know the point of view of the media you get your information from.

YOU must know The Who, What, When, Where, Why and HOW IT WORKS!

The "Great Depression" begins October 24, 1929 and lasted until the late 1930s. On October 24, the large brokerages all simultaneously called in their 24 hour "call-loans." The largest drop will occur on October 29, "Black Tuesday". Stock market losses for the month of October will total $16 billion. The stock market crash and banking collapse in the United States sparks a global downturn, including a second downturn in the U.S., the Recession of 1937. During this time the Fed reduced the money supply by 33%.

"It was not accidental. It was a carefully contrived occurrence...

The international bankers sought to bring about a condition of despair here so that they might emerge as rulers of us all." - Rep. Louis T. McFadden (D-PA)

"I think it can hardly be disputed that the statesmen and financiers of Europe are ready to take almost any means to re-acquire rapidly the gold stock which Europe lost to America as the result of World War I." - Rep. Louis T. McFadden (D-PA)

"The Federal Reserve definitely caused the Great depression by contracting the amount of currency in circulation by one-third from 1929 to 1933."- Milton Friedman, Nobel Prize winning economist.

In 2013 For The First Time Ever

-

The Fed Must Reveal Which Big Banks Took Emergency Loans From The Discount Window

http://www.businessinsider.com -

Fed Must Release Bank Loan Data as High Court Rejects Appeal

http://www.bloomberg.com/

Whistleblower Suit Confirms that the New York Fed is in the Goldman Protection Racket

By Yves Smith

Oct 11 2013

On Thursday, a former bank examiner at the Federal Reserve Bank of New York, Carmen Segarra, filed a suit (embedded at the end of this post) against the New York Fed and several of its employees alleging, among other things, improper termination. The complaint is a doozy and some of the additional details supplied by Segarra to ProPublica make an already ugly picture look even worse.

Segarra was an experienced attorney who had spent her entire career working in banking in the corporate counsel’s office of large financial firms, most recently as a senior counsel at Citi. In other words, she is not a naif or a theoretician. She was hired as part of an effort to increase bank examination functions to meet Dodd Frank requirements. But Segarra wound up on a collision course with the old guard at the New York Fed, which is particularly deeply tied into Goldman. For instance, the current president, William Dudley, had been Goldman’s chief economist and has a bias to protect rather than regulate financial firms. The senior officer responsible for Goldman at the New York Fed was called a “relationship manager.” No, I am not making that up.

Segarra was tasked to assess whether Goldman’s conflicts of interest policies were adequate in three separate cases: Solyndra, the El Paso/Morgan Kindler acquisition, and a bank acquisition by Sandanter. What is stunning if you read the complaint, which we’ve embedded below, is how high-handed Goldman was in its responses to Segarra’s inquiries. It’s not hard to imagine that they viewed this as a pro forma exercise that given their cozy relationship with the New York Fed, would go nowhere. They didn’t just stonewall, they told egregious lies. That sort of cover-up usually winds up being worse than the crime, but not if you are in a privileged class like Goldman. When Segarra (and initially, the other members of her team) kept pressing Goldman for answers and making clear that what they were getting was problematic, Goldman then started giving credulity-straining responses.

As the exam moved forward, Segarra came under pressure from the Goldman relationship manager, Michael Silva, who was also senior to her at the bank (this is how you can tell the new regulatory push is all optics: the examiners are subordinate to the established “don’t ruffle the banks” incumbents). Silva, who had been chief of staff to Geithner before becoming “relationship manager” to Goldman, appears, unlike Segarra, not to have had real world financial services experience (he looks to have joined the New York Fed as a law clerk in 1992 and stayed with the bank).

Segarra was fired abruptly after refusing to change her recommendations and destroy supporting documents, which was in violation of regulatory policy (bank examiners are not “fire at will” employees; they need to be put on notice and given the opportunity to correct deficiencies in their performance before they can be dismissed).

I’ve read other wrongful termination suits and Segarra’s looks very strong. It’s going to be awfully hard for the New York Fed to talk its way out of this one.

What is particularly damning for the Fed and Goldman is Goldman’s intransigence during the examination process and the howlers the New York Fed staffers used to justify treating the bank with kid gloves. The complaint is short and readable, but for your convenience, I’ll extract some of the really juicy bits.

The bone of contention is that bank regulations required Goldman to have a firm-wide conflicts of interest program. The reason that it needs to be firm wide is that letting business units have influence or worse, control over compliance issues is putting the foxes in charge of the henhouse. JP Morgan had risk control for its CIO unit located in the CIO, not the bank, level. It should be no surprise that a fiasco like the London Whale was the result.

Goldman blew off Segarra’s first document request. When asked about it (before Goldman realized someone at the Fed was actually taking the matter seriously), the bank said on separate occasions that it had no firm wide conflicts of interest program.

And when Goldman finally started producing documents, things got uglier:

[snip]

If you don't read the newspaper you are uninformed.

If you do read the newspaper you are misinformed.”

~ Unknown

FINANCIAL LITERACY: THE POLITICS OF KNOWLEDGE

American Liberty League renamed becomes the Tea Party Movement.

Republicans and Corporatists have always hated Unions.

They hated them in FDR's day, and they hate them today. They hate them because unions stand in the way of gross exploitation and obscene profit maximization. If there are no unions around and no government regulation, employers can treat their workers as shabbily as they want and pay them as poorly as they want, and we'd be back to the Grapes of Wrath.

In Pre literate times . . .

Ballads were responsible for spreading Literacy, because people bought the sheet music to learn the words.

Folk Song Army by Tom Lehrer

We are the Folk Song Army.

Everyone of us cares.

We all hate poverty, war, and injustice,

Unlike the rest of you squares.

There are innocuous folk songs.

Yeah, but we regard 'em with scorn.

The folks who sing 'em have no social conscience.

Why they don't even care if Jimmy Crack Corn.

If you feel dissatisfaction,

Strum your frustrations away.

Some people may prefer action,

But give me a folk song any old day.

The tune don't have to be clever,

And it don't matter if you put a coupla extra syllables into a line.

It sounds more ethnic if it ain't good English,

And it don't even gotta rhyme--excuse me--rhyne.

Remember the war against Franco?

That's the kind where each of us belongs.

Though he may have won all the battles,

We had all the good songs.

So join in the Folk Song Army,

Guitars are the weapons we bring

To the fight against poverty, war, and injustice.

Ready! Aim! Sing!

FOLKLORE

After Herbert Hoover was elected president of the United States, he insisted on appointing one of the old London crowd, Eugene Meyer, as Governor of the Federal Reserve Board. Meyer's father had been one of the partners of Lazard Freres of Paris, and Lazard Brothers of London. Meyer, with [Bernard Baruch], had been one of the most powerful men in the United States during World War I, a member of the famous Triumvirate which exercised unequalled power; Meyer as Chairman of the War Finance Corporation, Bernard Baruch as Chairman of the War Industries Board, and Paul Warburg as Governor of the Federal Reserve System.

Also See Links to the Reagan/Bush Administration (1981-88)

Hoover Days

Q: "Know why you don't see many turtles and terrapins around here any more?"

A: "Cause we et'um all back during the Hoover days."

Q: Why did they call them Hoover footballs?

A: In one of the Skillet Lickers' skits called "Hog Killin' Day" - they're slaughtering pig (in between tunes), and one of them says "Save the bladder, we'll make a football out of that."

A term often used by older folks in this region (east Alabama/west Georgia) when referring to the Great Depression and the related hard times they experienced is "Hoover Days." I assume "Hoover football" is a play on that. President Herbert Hoover was, rightly or wrongly, blamed for the Depression.

Hoover was President from 1929-1933. The country was in deep financial straights because of the stock crash and depression. I would venture a guess (and that is all this is is a guess) that "Hoover football" was because people were broke and had to use what they had coming up with new ways to use old familiar objects. Historically the pig bladder was used in sports, as the airtight membrane ("bladder") inside a football. My mom who grew up on an Ohio farm poor, she and her 7 brothers and sisters would fight over who got the cardboard tube when the toilet tissue was gone. Pine Mountain Settlement School teaches a class called "early settlers." In that class they talk about taking a pig bladder, washing it, filling it with air, and sewing it shut to make the children a "bladder ball." After the bladder dried, it made a tough-skinned ball, or so they tell.

Etymology of "Stock Market"

Cowboys drove their cows also known as "stock" for hundreds of miles to the "stock" market to sell them. We also still buy our "stock" from the "stock" market from Wall Street.

Etymology of "Cash Cow"

Cow-lease contracts are nothing new, and can be traced back as far as the 12th century, when monasteries leasing cattle to farmers were taxed to raise a ransom for the English king, Richard the Lionheart. Investors can choose to sell the new cows and take the cash, or allow their herd to build up over the years by keeping the offspring, then draw a regular income at retirement. The cows are rented out for milk production, helping dairy farmers to cut their initial outlays and freeing up cash for buildings or high-tech machinery. "There's a real ethical side to it in that you're helping farmers to run their business, and the agricultural sector is vital," said Marguerit.