Contents

- Introduction

- Preface

- Overview

- Relief Valve

-

LECTURE 1: Why We Are In The Dark About Money

- Wealth Objectives

- The Basics - Knowledge is Power

- The Wizard of Oz Story Allegory

- K12 Wealthy Decide

- Richest Two Percent Own Half World

- Cost of Inequality

- K Street Lobbys Write the Law

- Official Federal Reserve K12 Financial Literacy Curriculum by Grade Level

- What's Left Out of the Official U.S. Federal Reserve Curriculum

- EducRats

- Financial Literacy Quotes

- Lecture 1 Objectives and Discussion Questions

- LECTURE 2: The Con

- LECTURE 3: The Vatican-Central to the Origins of Money & Power

- LECTURE 4: London The Corporation Origins of Opium Drug Smuggling

- LECTURE 5: U.S. Pirates, Boston Brahmins Opium Drug Smugglers

- LECTURE 6: The Shady Origins Of The Federal Reserve

- LECTURE 7: How The Rich Protect Their Money

- LECTURE 8: How To Protect Your Money From The 1% Predators

- LECTURE 9: Final Thoughts

Corporate Lobbies: How Big Money Rigged the Rules in Washington

"The public be damned!" ~ William H. Vanderbilt, railroad magnate, 1882

THE HOUSE ALWAYS WINS

Political-Legal Industrial Complex:

We are no longer afraid of you. We will not let you sue us silently into the night.

Banks Got Bailed Out, Homeowners Got Sold Out — and the Feds Made a Killing By David Dayen March 11, 2016

At the root, we’re talking about cash settlements for a litany of crimes, including the largest consumer fraud in American history. The parties that suffered the greatest harm — homeowners and investors — were not the main beneficiaries and in fact received little. And the parties that actually committed the crimes, bank executives, never had to take responsibility for them, either through the loss of their wealth or their liberty.

Worst of all, the federal government, instead of upholding its duty to enforce the law, took billions in profits from bank shareholders. We’ve seen major corporate settlements employed broadly instead of to directly help victims — think of the tobacco settlement. What’s new here is turning an unprecedented crime ring of systemic fraud into a government piggy bank.

[... All of the $34 billion recovered by mortgage giants Fannie Mae and Freddie Mac for being sold fraudulent mortgage securities gets swept into the U.S. Treasury, by law. Some of the federal agencies receiving settlement funds also send those to the Treasury. So in fact, the biggest bubble should be the government’s general fund, with nearly $49 billion in proceeds from the settlements. As far as I know, the Treasury Building was never at risk of foreclosure over the past eight years, and its inhabitants never had to worry about being thrown onto the street with all their possessions. Yet they received the biggest reward from miscreant banks who defrauded homeowners and investors. We can be charitable and say that housing programs administered through the Troubled Asset Relief Program (TARP), aka the bank bailout, came from this general fund. So in a roundabout way, you can surmise that the $49 billion that came in from the banks went out through the Home Affordable Modification Program (HAMP) and other vehicles. However, the numbers don’t add up. According to the latest report of the Special Inspector General for TARP (see page 84), the government has only expended $19 billion on TARP housing programs as of the end of last year. There’s another $18.5 billion available to be spent, but even if that eventually gets used, the government will have turned a tidy $12 billion profit on mortgage-related fraud, and potentially as much as $30 billion. There are hedge funds in America that would relish those returns!

The Justice Department also collected “at least $447 million,” according to the report, despite their office building not being under threat of foreclosure either. States received $5.3 billion, but had no obligation to deliver any of that to housing-related programs. In fact, well over half of the $2.5 billion given to states in the 2012 National Mortgage Settlement went to plug budget holes. And the Journal article finds that bank-settlement money built horse stables in New York and funded email accounts in Delaware. As for that $45 billion bubble of “consumer relief,” this is where the chart is perhaps at most variance with the facts. These were not hard dollars, but credits given to banks for performing certain activities. Many of those activities had nothing to do with rescuing borrowers from foreclosure. Banks got credit for bulldozing homes, donating homes to charity and giving homeowners small amounts of move-out money — routine things banks do anyway for public relations purposes....]

Warren Buffett nailed the problem with Wall Street pay ― and offered a draconian solution

The National Archives did a document dump, releasing transcripts, meetings agendas and confidentiality agreements from the Financial Crisis Inquiry Commission. The commission was set up in the aftermath of the financial crisis by Congress to look into the causes of the crash, and the documents are a goldmine of information. Basically, he says, ensure that bosses lose everything if a bank has to be bailed out: If you’re worrying about the Bear Stearnses of the world is to have an arrangement in place so that if they ever have to go to the federal government for help, that the CEO and his spouse come away with nothing. And I think that can be done, you know.

THUGGEE SECRET SOCIETY

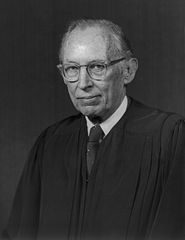

LEWIS POWELL IS the ASSHOLE RESPONSIBLE FOR LEGITIMIZING CORPORATE GREED

Supreme Court Justice Lewis Powell is no genius he just took a page out of Senator Aldrich's old school playbook on how to rig the rules of the game.

Supreme Court Justice Lewis Powell is no genius he just took a page out of Senator Aldrich's old school playbook on how to rig the rules of the game.

Supreme Court Justice Lewis Powell, Jr. was a member of the The Sigma Society was founded at Washington and Lee in 1880 that remains in existence today. He is one of the group's most prominent members. The organization is often referred to as the "Washington Society.

MUST READ Powell was known for drafting the Powell Memorandum, a confidential memorandum for the US Chamber of Commerce that described a road map to defend and further the Chamber of Commerce's concept of free-enterprise capitalism against perceived socialist, communist, and fascist cultural trends. Written confidentially for Eugene Syndor at the Chamber of Commerce, it was discovered by Washington Post columnist Jack Anderson, who reported on its content a year later (after Powell had joined the Supreme Court). Anderson focused on the efforts of Powell to undermine the democratic process power of the 1% threatened by Ralph Nader's success in protecting the 99% !!!

Ralph Nader and other Corporate Reformers in the 1970's wanted to protect the commons and our commonwealth scared Corporate America to death so they circled the wagons. They followed the perscription written by insider Supreme Court Justice Lewis Powell.

FOLLOWED BY JUSTICE SCALIA WHO WAS WORTH BILLIONS TO INDUSTRY.

How Big Money Rigged the Rules in Washington

So Damn Much Money: The Triumph of Lobbying and the Corrosion of American Government by Robert G Kaiser

https://www.powells.com/biblio/1-9780307385888-1

MUST READ The Purpose of the Senate -- The Treason of the Senate: Aldrich, The Head of It All by David Graham Phillips - Cosmopolitan - March 1906

In 1974, the average winning campaign for the Senate cost $437,000; by 2006, that number had grown to $7.92 million. The cost of winning House campaigns grew comparably: $56,500 in 1974, $1.3 million in 2006.

Kaiser illuminates this progression through the saga of Gerald S. J. Cassidy, a Jay Gatsby for modern Washington. Cassidy came to Washington in 1969 as an idealistic young lawyer determined to help feed the hungry. Over the course of thirty years, he built one of the citys largest and most profitable lobbying firms and accumulated a personal fortune of more than $100 million. Cassidys story provides an unprecedented view of lobbying from within the belly of the beast. Kaiser chronicles the life and times of Gerald Cassidy, a one-time aide to Senator George McGovern who went on to become “Citizen K Street,” one of Washington’s most influential and wealthy lobbyists. Kaiser shows how Cassidy, who invented the earmark, helped turn Washington into the political equivalent of the Chicago Mercantile Exchange, with innovative lobbyist-traders swapping regulations and legislative amendments like pork-belly derivatives, all while raking in astronomical returns on investment.

Here's Greece's finance minister in 1953, canceling 50% of Germany's debt. Because it was the right thing to do. pic.twitter.com/SPsYsVAeBr

WHEN DID BIG MONEY TAKE CONTROL OF WASHINGTON?

A confidential memo written to the U.S. Chamber of Commerce by Attorney Lewis Powell, Jr. (born in Virginia in 1907). The memo described how business could defend and further capitalism against---wait for it--- socialist, communist, and fascist cultural trends. Among these cultural trends were the usual suspects, minorities and women. Nixon later nominated Powell to the Supreme Court

Based in part on his experiences as a corporate lawyer and as a representative for the tobacco industry with the Virginia legislature, he wrote the Powell Memorandum to a friend at the US Chamber of Commerce. The memo called for corporate America to become more aggressive in molding politics and law in the US and may have sparked the formation of several influential right-wing think tanks, as well as inspiring the U.S. Chamber of Commerce to become far more politically active.

In August 1971, prior to accepting President Nixon's request to become Associate Justice of Supreme Court, Lewis Powell sent the "Confidential Memorandum" with the title, "Attack on the American Free Enterprise System." Powell argued, "The most disquieting voices joining the chorus of criticism came from perfectly respectable elements of society: from the college campus, the pulpit, the media, the intellectual and literary journals, the arts and sciences, and from politicians." In the memorandum, Powell advocated "constant surveillance" of textbook and television content, as well as a purge of left-wing elements.

This memo foreshadowed a number of Powell's most notable court opinions, especially First National Bank of Boston v. Bellotti, which shifted the direction of First Amendment law by declaring that corporate financial influence of elections through independent expenditures should be protected with the same vigor as individual political speech. Much of the future Court opinion in Citizens United v. Federal Election Commission relied on the same arguments raised in Bellotti. Today, though, the Powell Memo is routinely invoked as the blueprint for virtually all of the conservative intellectual infrastructure built in the 1970s and 1980s -- a memo that changed the course of history, in the words of one analysis of the anti-environmental movement; and the attack memo that changed America, in another account.

Please Notice the memo is sent to Mr. Eugene B. Sydnor, Jr., Chairman, Education Committee, U.S. Chamber of Commerce.

Corporate interests Do Not want a population of well-informed, well-educated citizens capable of critical thinking. They're not interested in that, that doesn't help them. That's against their interests. They want disorganized, obediant workers.

Confidential Memorandum: Attack of American Free Enterprise System

DATE: August 23, 1971

TO: Mr. Eugene B. Sydnor, Jr., Chairman, Education Committee, U.S. Chamber of Commerce

FROM: Lewis F. Powell, Jr.

In 1971, Lewis Powell, then a corporate lawyer and member of the boards of 11 corporations, wrote a memo to his friend Eugene Sydnor, Jr., the Director of the U.S. Chamber of Commerce. The memorandum was dated August 23, 1971, two months prior to Powell’s nomination by President Nixon to the U.S. Supreme Court. The Powell Memo did not become available to the public until long after his confirmation to the Court. It was leaked to Jack Anderson, a liberal syndicated columnist, who stirred interest in the document when he cited it as reason to doubt Powell’s legal objectivity. Anderson cautioned that Powell “might use his position on the Supreme Court to put his ideas into practice…in behalf of business interests.” Though Powell’s memo was not the sole influence, the Chamber and corporate activists took his advice to heart and began building a powerful array of institutions designed to shift public attitudes and beliefs over the course of years and decades. The memo influenced or inspired the creation of the Heritage Foundation, the Manhattan Institute, the Cato Institute, Citizens for a Sound Economy, Accuracy in Academe, and other powerful organizations. Their long-term focus began paying off handsomely in the 1980s, in coordination with the Reagan Administration’s “hands-off business” philosophy.

At last count, there were 245 millionaires in congress, including 66 in the Senate.

ContactingtheCongress.org

202-224-3121

The Political One Percent of the One Percent by Lee Drutman DEC. 13, 2011,

These deep pocketed donors were increasingly playing the role of “political gatekeepers.” Candidates needed their backing — and cash — as did the parties and super PACs that depended on the support of the politically active elite.

The Political One Percent of the One Percent in 2014

Mega Donors Fuel Rising Cost of Elections by Peter Olsen-Phillips, Russ Choma, Sarah Bryner and Doug Weber on April 30, 2015

The influence of the One Percent of the One Percent has only continued to grow.In the 2014 elections, 31,976 donors — equal to roughly 1% of 1% of the total population of the United States accounted for an astounding $1.18 billion in disclosed political contributions at the federal level. Those big givers — what we have termed the Political One Percent of the One Percent — have a massively outsized impact on federal campaigns.

Thanks to research and analysis by the Center for Responsive Politics, we know that those 31,976 top donors combined accounted for more than one out of every four dollars raised by PACs, super PACs, parties and candidates. Members of the group contributed at least $8,800, a bit less than in prior cycles. The median contribution was $14,750, while the biggest donor gave more than $73 million.

Wall Street maintained its perch as the most influential sector among the One Percent of the One Percent, both in the number of donors that made the list and the money given. Individuals that listed a job in securities spent about $175 million in 2014, of which $107.5 million went to committees supporting Republicans.

Keeping the Republic by Alex Freeman

"Election funding has been co-opted by a very wealthy few. The Supreme Court has ruled, on numerous instances, that campaign donations and public policy expenditures are forms of speech protected by the First Amendment. Since its ruling in Buckley v. Valeo (1975), elected representatives invest increasingly more time fundraising than governing. Two very prominent branches grow from that root: the wealthy have more time to influence a politician grateful for a contribution, and the representative relies increasingly on lobbyists for issue education and drafting of legislation. If the politician responds well to the contribution, and votes well for the lobbyist, then they are rewarded with further contributions in the near term, and lucrative employment opportunities after his or her time in office has concluded. Prior to Buckley, only 3% of Congress members became lobbyists. By 2013, 50% of Representatives and 42% of retiring Senators had become lobbyists after leaving Congress."

Learn How Lobbyists Buy Politicians

The House Financial Services Committee is Corrupt. Financial Literacy is a load of crap since it won't protect you from corruption.

Michael Gross wrote "740 Park: The Story of the World's Richest Apartment Building".

Home to more billionaires than any other city in the United States. Truly the Masters of the Universe live there.

Jackie Kennedy's home built by her Grandfather James T. Lee with a consortium of people who were considered responsible for the market crash of 1929 and the depression that followed. Her maternal great-grandfather emigrated fromCork, Ireland, and later became the Superintendent of the New York City Public Schools.

Park Avenue: Money Power and the American Dream.

Jacob Hacker Professor of Political Science; Director, Institution for Social and Policy Studies

203-432-5554 jacob.hacker - yale.edu

Winner-Take-All Politics: How Washington Made the Richer Richer--and Turned Its Back on the Middle Class

America's money-addicted and change-resistant political system is at the heart of the enormous and rapidly growing income inequality that they say is undermining America's economic and political stability. It is aided and abetted by politicians who favor the very rich or allow policies that once favored the rest of us to erode. Business pays K Street lobbiests to write the bill exactly according to what the business requires then pays off the congressman and senator to get the "bill" passed.

TRUST DEFICIT

4/10/2013 The Federal Reserve got caught this time!

Proves 154 people including Congress participates in Insider trading because not one of them reported this happened!!

They received the minutes shortly after 2 p.m. on Tuesday, but not one person reported the early breach to the Federal Reserve.

The Federal Reserve discovered the mistake on its own early Wednesday and then decided to release the minutes to the broader public at 9 a.m.

The Federal Reserve usually releases minutes from its meetings at 2pm. It was forced to put them out five hours early Wednesday 10th 2013 after learning that 154 people got them a day early, and those people included employees at some of the world's largest banks.This is a key document that can move markets from time to time. Wall Street players often dig deep into the minutes for hints about when the central bank may pull back on its bond-buying policy or raise interest rates.

The 154 individuals who received the minutes on Tuesday included Congressional employees, but also employees at some of the world's largest banks, such as Goldman Sachs, JPMorgan Chase, Citigroup, UBS and HSBC. Most of the people at these banks appear to work in legislative affairs (a.k.a. lobbying). Employees of trade organizations like the American Bankers Association, the National Association of Realtors, and the National Credit Union Administration were also on the distribution list.

http://money.cnn.com/2013/04/10/news/economy/fed-minutes-early/

ALEC, the American Legislative Exchange Council.

A national consortium of state politicians and powerful corporations, ALEC presents itself as a “nonpartisan public-private partnership”. But behind that mantra lies a vast network of corporate lobbying and political action aimed to increase corporate profits at public expense without public knowledge.

http://billmoyers.com/episode/full-show-united-states-of-alec/ voting behind closed doors to change the law before the public knows anything about it. In state houses around the country, hundreds of pieces of boilerplate ALEC legislation are proposed or enacted that would, among other things, dilute collective bargaining rights, make it harder for some Americans to vote, and limit corporate liability for harm caused to consumers — each accomplished without the public ever knowing who’s behind it.

K STREET downturn in reportable lobbying revenues was offset by regulatory work as the action moved to the agencies.

Patton Boggs maintained its position as the top-grossing lobbying firm, bringing in $48.4 million in lobbying revenue in 2011. That was up from $45.2 million in 2010. The uptick stems more from the firm’s June merger with Breaux Lott Leadership Group than from overall business growth. Several lobbyists pointed to last week’s massive online mobilization that tanked two fast-moving anti-online piracy bills as the perfect example of how the influence game is changing. While clients are still willing to pay for access lobbying, there is more of a focus on nonreportable strategy through social media and other grass-roots initiatives.

Reuters reports that the tech industry has outspent the entertainment industries. Silicon Valley blindsides Hollywood on piracy : The technology industry has ramped up its political activities dramatically in recent years, and in fact, has spent more than the entertainment industry -- $1.2 billion between 1998 and 2011, compared with $906.4 million spent by entertainment companies. The entertainment industries, however, seem better at knowing where to buy friends. Through the end of September, Hollywood had outspent the tech industry 2-to-1 in donations to key supporters of measures it was backing. More than $950,000 from the TV, music and movie industries has gone to original sponsors of the House and Senate bills in the 2012 election cycle, compared with about $400,000 from computer and Internet companies, according to the Center for Responsive Politics. Spending money is not enough, you have to cultivate your friends. You'd think that the tech industry would understand that it's not the number of friends that counts, but the number of friends that can be counted upon. 2012

Transparency

Billionaire Koch brothers takeover of America's democracy.

ALERT: THIS VIDEO CONTAINS CURSE WORDS

DO NOT PLAY IF YOU THINK THIS WILL BE OFFENSIVE.

Koch brothers plan to spend 80 Million in 2012 election.

Koch is Lord of the Derivitives - The over-the-counter derivatives market has escaped the commission's reach since the first interest rate swap was traded in 1981. The transactions fell outside a law requiring that all futures be traded on regulated exchanges. What has not been reported is that a big part of Koch Industries' expansion over the past few decades has occurred in the dark realms of unregulated derivative trading. The Kochs weren't just playing the market for themselves, but provided financial and risk management services to other companies. Now their clients include airlines, utilities, oil companies, pension funds, hedge funds and endowments. But Koch Industries is not just a regular financial/risk management services provider. Because the company is a major producer and/or distributor of many of the commodities that it bets on, it not only has insider knowledge but physical control of market conditions. That gives it a whole lot of power to game and manipulate markets from both the speculative and physical ends—something that even the most powerful investment houses can't do on their own. Best part is: only insiders know how much or how little manipulation exists because the derivatives are exempted from regulation.

Bringing Jobs Back To America

U.S. Bridges, Roads Being Built by Chinese Firms OUTRAGEOUS!

SUBSIDIZING JOBS IN CHINA! Cities hire Chinese instead of American workers for building projects. US law can't protect a billion dollars from going to China! California Officials say they can't find American Welders States go around "Buy American" laws.

INSIDER TRADING

Congress: Trading stock on inside information?

What do you mean honest graft? Congressman get a pass on insider trading? cbs There is an Indiana University Law professor who claims that (contrary to popular belief and 60 Minutes) members of Congress are not exempt from insider trading laws.

Financial Documents Suggest GOP Rep. Bachus Profited from 'Insider Trading' on TARP Bailout by Wynton Hall

U.S. Representative Spencer Bachus (R-AL) had access to highly sensitive financial information during the 2008 bailout debates that may have helped him earn tens of thousands of dollars by trading stock options, even as most Americans' portfolios took a beating.

On Sunday, Rep. Bachus's trading behavior came under fire in a 60 Minutes report based on Throw Them All Out, the book by investigative journalist and Breitbart editor that has triggered a political earthquake in Washington. Schweizer, who is also a Breitbart editor, devotes a significant portion of the book to exposing possible congressional insider trading.

Sen. Feinstein Loaded up on Biotech Stock Just Before Company Received $24 Million Gov't Grant

Capitol Cronyism: Obama-Backer Warren Buffett Helped Shape Bailout Rules, Then Made Massive Profits from Them

In the wake of the $700 billion TARP bailout, Warren Buffett apparently shaped a plan to clean up toxic assets that Treasury Secretary Tim Geithner later adopted--resulting in massive profits for Buffett. That's the latest bombshell revelation from investigative journalist and Breitbart editor Peter Schweizer's sensational new...

- Secret Fed Loans Gave Banks Undisclosed $13B

- The Fed Must Reveal Which Big Banks Took Emergency Loans From The Discount Window businessinsider.com

- Fed Must Release Bank Loan Data as High Court Rejects Appeal bloomberg

DEFINITION OF"POLITICKCY"

The Blood Sucking Oligarchy who are politicians practice "POLITICKCY".

The Blood Sucking Oligarchy who are politicians practice "POLITICKCY".

Not just Wall Street but Koch brothers continue to trade Derivatives that brought this country down.

@TWEETCONGRESS:

CLICK to Enter your zip code or a representative's name to see if your local representative is on Twitter.

Nobel Economist Joseph Stiglitz talks about growing inequality: 1% Americans take in 1/4 of the nation's income.

The Sunlight Foundation uses cutting-edge technology and ideas to make government transparent and accountable

The Day in Transparency 4/6/2011

Koch Industries, America's second-largest private corporation, spends millions on lobbying in Washington, often to advocate against government regulation. The money Koch Industries has spent on lobbying has increased from $857,000 in 2004 to $20 million in 2008. (Center for Public Integrity)

THE SECRETS OF HOW LOBBYIESTS BUY POLITICIANS.

YOU CAN LEARN THEIR TECHNIQUES

YOU CAN FIND THE MONEY

Let's play Hide and Seek

The Loophole:

Push the money through a Foundation or Trust.

OperationLeakS Anonymous

http://uleak.it/ is a Url Shortening Service. By #Anonymous IP's are never recorded Leak your image and it's free to use.

Honest services fraud - Lobbying alone was a $2.6 billion industry in 2010, according to the Center for Responsive Politics. All that spending just sucks the oxygen out of the room for people trying to do true entrepreneurship.

START WITH THE K STREET INJECTION

PUT THE NEEDLE DIRECTLY INTO THE VAIN

COUNCIL ON FOUNDATION

THE ORGINAL PIPELINE TO WRITING THE LAW THE WAY YOU WANT IT

SPLIT UP INTO THE FOLLOWING DEPARTMENTS

- Family Foundations,

- http://web.archive.org/web/20120107191839/http://www.cof.org/whoweserve/community/index.cfm?navItemNumber=14849

- Corporate Grant Makers,

- Independent Foundations,

- Global Philanthropy

- WHO IS CONNECTED ON THE OFFICIAL BOARD?

DON'T FORGET THIS OTHER AVENUE FOR LOBBIESTS

REGIONAL ASSOCIATIONS OF GRANT MAKERS

CUSTOM DESIGNED SECRETS

GUARANTEED TO HELP PUSH YOUR THINK TANK "POLITICKCY"

BLOOD SUCKING LAWS DEFEATED OR

WRITTEN THE WAY YOU WANT THEM TO.

Hollywood Total Corrupt Chief Lobbyiest Loophole: if you merely "speak to policy," you're in good shape. Leahy also dismissed any concerns that the Senate's "revolving door" rules, which prevent recently retired senators from directly lobbying their former colleagues for two years, would hobble Dodd in his role.

Executive order applies to FCC commissioners:

Find the Money!

POLITICKCY

politics + policy =

blood sucking ticks

Lobbying Disclosure Act of 1995 (Section 5) -

All Filers Are Required to Complete This Page

Lobbying Disclosure Electronic Filing System

The Lobbying Disclosure Contributions website

allows employed lobbyists, as well as registered lobbying firms, organizations, and self-employed lobbyists, to file LD-203 Contribution Reports.

Clerk of the House of Representatives lobbying

Office of Public Records

232 Hart Building

Washington, DC 20510

-

Regional Capital Campaign Reports

Find regional snapshots of capital and endowment fundraising across the United States. -

Regional Economic Outlook Reports

View reports that assess the outlook for grant making and discuss factors that affect the direction of giving growth in a particular region. -

Regional Giving Studies

Regional giving studies are a necessary tool used to identify patterns of organized giving in a community or region.

TEA PARTY PAC MONEY

SPENT BY NAME

Tea Party Activists Press Forward Despite Meager Finances

TEA PARTY VICTORY PAC

Conservatives On Wisconsin Supreme Court Let Corporate Lobbyists Write Judicial Ethics Rules

Wisconsin elects its Supreme Court justices, but the court's four conservative justices –including Gov. Scott Walker's embattled ally Justice David Prosser — all voted to reject an ethics rule that would have prevented them from hearing cases involving their major campaign donors. Instead, the conservative justices enacted a rule written by powerful corporate lobbyists.

Using the Internet to research charities

Guidestar allows you to search for charities recognized by the U.S. Internal Revenue Service.

General Electric wins and take advantage of tax breaks.

A review of company filings and Congressional records shows that G.E. has spent tens of millions of dollars to push for changes in tax law.

The most lucrative of these measures allows G.E. to operate a vast leasing and lending business abroad with profits that face little foreign taxes and no American taxes as long as the money remains overseas.

Martin A. Sullivan, a tax economist for the trade publication Tax Analysts, said that booking such a large percentage of its profits in low-tax countries has “allowed G.E. to bring its U.S. effective tax rate to rock-bottom levels.” “Cracking down on offshore profit-shifting by financial companies like G.E. was one of the important achievements of President Reagan's 1986 Tax Reform Act,” said Robert S. McIntyre, director of the liberal group Citizens for Tax Justice, who played a key role in those changes. “The fact that Congress was snookered into undermining that reform at the behest of companies like G.E. is an insult not just to Reagan, but to all the ordinary American taxpayers who have to foot the bill for G.E.'s rampant tax sheltering.” Transforming the most creative strategies of the tax team into law is another extensive operation. G.E. spends heavily on lobbying: more than $200 million over the last decade, according to the Center for Responsive Politics. Records filed with election officials show a significant portion of that money was devoted to tax legislation. G.E. has even turned setbacks into successes with Congressional help. One provision allowed companies to defer taxes on overseas profits from leasing planes to airlines. It was so generous — and so tailored to G.E. and a handful of other companies — that staff members on the House Ways and Means Committee publicly complained that G.E. would reap “an overwhelming percentage” of the estimated $100 million in annual tax savings. According to its 2007 regulatory filing, the company saved more than $1 billion in American taxes because of that law in the three years after it was enacted. While G.E.'s declining tax rates have bolstered profits and helped the company continue paying dividends to shareholders during the economic downturn, some tax experts question what taxpayers are getting in return. Since 2002, the company has eliminated a fifth of its work force in the United States while increasing overseas employment. In that time, G.E.'s accumulated offshore profits have risen to $92 billion from $15 billion. The company spent $4.1 million on outside lobbyists last year, including four boutique firms that specialize in tax policy.

http://www.nytimes.com/2011/03/25/business/economy/25tax.html?pagewanted=1&_r=3&hp

Incorporate in Delaware: The filing fees are low: it costs $50 to file ($175 for bigger companies), and $250 to re-up annually. But that's only incidental. The big advantage to incorporating in Delaware is the protection. If you sue a corporation you have to do it in the state where it's incorporated, and Delaware courts have a long and consistent history of judicial rulings that protect shareholder assets from creditors.