Contents

- Introduction

- Preface

- Overview

- Relief Valve

-

LECTURE 1: Why We Are In The Dark About Money

- Wealth Objectives

- The Basics - Knowledge is Power

- The Wizard of Oz Story Allegory

- K12 Wealthy Decide

- Richest Two Percent Own Half World

- Cost of Inequality

- K Street Lobbys Write the Law

- Official Federal Reserve K12 Financial Literacy Curriculum by Grade Level

- What's Left Out of the Official U.S. Federal Reserve Curriculum

- EducRats

- Financial Literacy Quotes

- Lecture 1 Objectives and Discussion Questions

- LECTURE 2: The Con

- LECTURE 3: The Vatican-Central to the Origins of Money & Power

- LECTURE 4: London The Corporation Origins of Opium Drug Smuggling

- LECTURE 5: U.S. Pirates, Boston Brahmins Opium Drug Smugglers

- LECTURE 6: The Shady Origins Of The Federal Reserve

- LECTURE 7: How The Rich Protect Their Money

- LECTURE 8: How To Protect Your Money From The 1% Predators

- LECTURE 9: Final Thoughts

SECRETS ARE THE ENEMY AND KNOWLEDGE IS POWER

THE POWER OF THE STATE AND BANKSTERS IS IN THEIR ABILITY

TO KEEP THINGS SECRET BECAUSE PRIVACY IS POWER.

“Merchants have no country,” wrote Thomas Jefferson in 1814.

“The mere spot they stand on does not constitute so strong

an attachment as that from which they draw their gains.”

MERCHANTS AND BANKERS ARE CONSIDERED LOW CLASS PEOPLE.

SEC Securities and Exchange Commission's computers as of January 23, 2017 had 'critical' cyber weaknesses

The U.S. Department of Homeland Security detected five “critical” cyber security weaknesses on the Securities and Exchange Commission’s computers. The report’s findings raise fresh questions about a 2016 cyber breach into the U.S. market regulator’s corporate filing system known as “EDGAR.” SEC Chairman Jay Clayton disclosed late Wednesday that the agency learned in August 2017 that hackers may have exploited the 2016 incident for illegal insider-trading. The incursion at the Securities and Exchange Commission struck at the heart of the U.S. financial system. The SEC's EDGAR filing system is the central repository for market-moving information on corporate America with millions of filings ranging from quarterly earnings to statements on acquisitions. "In October 2014, Rep. Carolyn Maloney (D-N.Y.) raised concerns after an academic study revealed that stock prices were moving about 30 seconds prior to public filings being made available on the SECs website." The “hack, pump and dump” scheme is among the latest illicit methods of gaming the market though hacking."

https://www.wired.com/2010/03/manipulated-stock-prices/

"The Bankers own the earth. Banking was conceived in iniquity and was born in sin."

Take it away from them, but leave them the power to create deposits, and with the flick of the pen they will create enough deposits to buy it back again. However, take it away from them, and all the great fortunes like mine will disappear and they ought to disappear, for this would be a happier and better world to live in. But, if you wish to remain the slaves of Bankers and pay the cost of your own slavery, let them continue to create deposits.” — Sir Josiah Stamp, President of the Bank of England in the 1920′s, the second richest man in Britain, said to be from an informal talk at the University of Texas in the 1920s

London the Corporation the 1 square mile of legal of tax shelters - BUT now we have Brexit!!!

Hard Brexit will cost City of London its hub status, warns Bundesbank boss

Highlights of global financial flows

The Take aways The BIS, in cooperation with central banks and monetary authorities worldwide, compiles and disseminates data on activity in international financial markets. It uses these data to compile indicators of global liquidity conditions and early warning indicators of financial crisis risks. This chapter analyses recent trends in these indicators. It also summarises the latest data for international banking markets, available up to March 2016, and for international debt securities, available up to June 2016 http://www.bis.org/publ/qtrpdf/r_qt1609b.pdf

"THE POWER ELITE"

THE REAL SCANDAL IS WHAT HAS BEEN LEGALIZED

The crux of this activity — placing assets offshore in order to avoid incurring tax liability — has been legalized. That’s because Western democracies, along with overt tyrannies, are typically controlled by societies’ wealthiest, and laws are enacted to serve their interests.

Even as the world’s wealthiest and most powerful nations have engaged in increasingly complex and intensive efforts at international cooperation to smooth the wheels of global commerce, they have willfully chosen to allow the wealthiest members of Western society to shield their financial assets from taxation (and in many cases divorce or bankruptcy settlement) by taking advantage of shell companies and tax havens. If Panama or the Cayman Islands were acting to undermine the integrity of the global pharmaceutical patent system, the United States would stop them. But the political elite of powerful Western nations have not acted to stop relatively puny Caribbean nations from undermining the integrity of the global tax system — largely because Western economic elites don’t want them to. …

Panama Papers: Obama, Clinton Pushed Trade Deal Amid Warnings It Would Make Money Laundering, Tax Evasion Worse

Ronald Reagan's OMB Director on the true cause for the explosion of America's debt.

David Stockman was the Director of the the Office of Management and Budget for President Ronald Reagan from January 21, 1981 to August 1, 1965. "This debt explosion has resulted not from big spending by the Democrats, but instead the Republican Party's embrace, about three decades ago, of the insidious doctrine that deficits don't matter if they result from tax cuts." ~ David Stockman .. 60 Minutes

How lawyers help the the power elite launder money

C. Wright Mill's "Power Elite"

The Power Elite is a book written by sociologist C. Wright Mills in 1956. In it Mills calls attention to the interwoven interests of the leaders of the military, corporate, and political elements of society and suggests that the ordinary citizen is a relatively powerless subject of manipulation by those entities.

Having a Static Plan developed by the Power Elite

It is not the proper job of the government to produce a "strategy for society" (either US society or world society). Not only are they structurally incapable of it, but their role is fundamentally to follow rather than to lead. People with level heads and long-term thinking are systematically excluded from the US government, when they are not actually persecuted by it. It takes a strong degree of doublethink and insanity to be able to do serious work there. People who have principles, who won't do immoral things, do not qualify. People qualify who are happy with impunity, torture, the largest prison population in the world (full of "niggers and wetbacks"), assassination of hundreds of people a year, wars of aggression, self-dealing for profit, and centralization of control in a bureaucracy that has lost sight of how societies with widely distributed control (aka "freedom") thrive. The simplest good things take decades of effort to accomplish; the most heinous bad things are either done by fiat, or are voted for almost-unanimously by Congress. It should be easy for a motivated and talented group of outsiders to out-compete the government at writing a solid strategy for an improved society 50 or 100 years from now.

WHY AMERICANS CAN'T WIN AGAINST WALL STREET

U.S. Senate Holds a Critical Hearing on the Stock Market on March 3, 2016 and

73 Percent of the Senators on the Subcommittee Are a No-Show.There are 15 U.S. Senators who are members of the U.S. Senate Banking Committee’s Subcommittee on Securities, Insurance, and Investment that has been investigating the charges that the stock market is rigged by the stock exchanges along with dark pools run by large broker-dealers that are operated as opaque, unregulated quasi stock exchanges, high frequency traders at hedge funds, conflicted payment for order flow, and tricked-up order types – to mention just a few of the ways the public investor is getting fleeced.

THE VERY PEOPLE NOMINATED TO GUARD THE PUBLIC IS NO WHERE TO BE SEEN.

SUPREME COURT ARE WHITE SHOE LAWYERS

The Roberts Court has been the most pro-business of any since the Second World War, according to a paper by the law professors Lee Epstein and William Landes and Judge Richard Posner that looked at decisions from 1946 to 2011. Its five sitting conservatives, including Scalia, ranked among the ten most business-friendly Justices of that period. The Roberts Court hasn’t just made a lot of pro-business rulings. It has taken a higher percentage of cases brought by businesses than previous courts, and it has handed down far-reaching decisions that have remade corporate regulation and law. In Citizens United, it famously ruled that corporations had free-speech rights and that many restrictions on corporate spending in elections were therefore unconstitutional. It has overturned long-standing antitrust restrictions. It has limited liability for corporate fraud and made it harder for workers to successfully sue for age and gender discrimination. It has made suing businesses and governments more difficult, especially in class-action suits. Scalia, told me, “Conservative Justices start from a world view that says we have too much litigation in general and it’s a sap on the economy.” Conservative nominees to the Court have been far more worried about government overreach than about corporate misbehavior.

The Roberts Court has been the most pro-business of any since the Second World War, according to a paper by the law professors Lee Epstein and William Landes and Judge Richard Posner that looked at decisions from 1946 to 2011. Its five sitting conservatives, including Scalia, ranked among the ten most business-friendly Justices of that period. The Roberts Court hasn’t just made a lot of pro-business rulings. It has taken a higher percentage of cases brought by businesses than previous courts, and it has handed down far-reaching decisions that have remade corporate regulation and law. In Citizens United, it famously ruled that corporations had free-speech rights and that many restrictions on corporate spending in elections were therefore unconstitutional. It has overturned long-standing antitrust restrictions. It has limited liability for corporate fraud and made it harder for workers to successfully sue for age and gender discrimination. It has made suing businesses and governments more difficult, especially in class-action suits. Scalia, told me, “Conservative Justices start from a world view that says we have too much litigation in general and it’s a sap on the economy.” Conservative nominees to the Court have been far more worried about government overreach than about corporate misbehavior.

The American League - Tea Party - Nixon - Reagan, Trump

How the Republican party's dog-whistle appeal to racism, refined by Richard Nixon and perfected by Ronald Reagan, led inexorably to Donald Trump*

While the other Republican contenders keep their xenophobia within the bounds of acceptably cruel political discourse, Trump blows it out: his racist rants play like full-fledged operas compared to the dog-whistle stuff, shredding the finely honed code that's worked so long and so well for the GOP establishment. But that's why the base loves him; he feels their rage. Even better, he's beyond the establishment's control. Nobody is the boss of Trump, not the Kochs, not Sheldon Adelson, and certainly not Reince Priebus, chief functionary of the Republican National Committee. <snip>

Chairman of the Black Caucus Congressman Ron Dellums Democrat California

"If you define Niggers as someone whose lifestyle is defined by others, whose opportunities are defined by others, whose roll in society is defined by others, then good news! - you don't have to black to be a nigger in this society. Most of the people in America are niggers."

1/26/15 What Do You Need To Earn In One Year To Be In The Top 1% In Your State?

The 1% are "wealthy beyond measure".

The 1 percent is literally rich beyond measure, depriving nations of billions in tax revenue and obscuring shifts in global inequality.

How Rich are the 1% Really?

Failure to get a better handle on the actual amount of wealth and income means economists and policy makers don’t have a proper understanding of the degree of disparity, which represents a hurdle in addressing it. For instance, knowing that earnings and assets are more concentrated could spur support for changing the tax structure, Zucman said.

The CON in eCONomics

eCONomics: a discipline ripe for disruption

4/2/14 In the years since the financial meltdown, it seems as if students are more serious than lecturers about pursuing its causes. Several journalists were asking sharper questions than academics. To take one example, the FT's Gillian Tett, who has a background in anthropology rather than economics, asked where the frenzied debt dance would end. A grasp of the human propensity for herding is more useful in getting a handle on bubbles and crashes than any postulations about the individualistic calculations of rational economic man. The failure to spot the crisis raised wider questions about the discipline's usefulness. It can shelter behind unavoidable ambiguities regarding the price of both labour and capital. Will workers respond to income tax cuts by striving for the extra earnings they can now keep or by skiving, on the basis that they can now afford to take more time off? Do high interest rates induce savers to scrimp or encourage them to go out and blow their extra return? No one can say without interrogating the data – which good economists do try to do. But hopes of clear answers are retarded by departments that treat the subject as a branch of applied mathematics, and by practitioners less concerned with the insight than the arithmetical tractability of their models.

5/10/14 After the crash, we need a revolution in the way we teach economics

Students who claim that economics courses fail to explain the 2008 crash are gaining support from British business. Here, two Cambridge academics agree it's time for a change. student economists in many UK universities – including Manchester, Cambridge, University College London, Essex, the London School of Economics, the School of Oriental and African Studies – have begun organised protest against the content of their degree courses. They argue that their degrees are not fit for purpose, whether that purpose is preparing students for their future careers in the "real world", or more broadly, equipping them with a good understanding of real world economies. This phenomenon is not unique to the UK. Similar movements are springing up in the United States, Germany, France, Brazil, Chile, India and other countries. Now there is even a global alliance between these student groups, under the banner of the International Student Initiative for Pluralist Economics. Complaints about the content of economics degrees do not just come from students, whose youthful arrogance and idealism might make them see every theory as wanting, and every economic policy a manifestation of some conspiracy. The students are increasingly being joined in this protest by leading employers of economics graduates, from the Bank of England, the civil service and the City. To summarise bluntly, students and many employers feel that the typical economics graduate today receives a training that is irrelevant to understanding real economies, incomprehensible to the target audiences for economic advice, and often just plain incorrect.

WHAT THEY DON'T TEACH YOU IN MBA BIZ SCHOOL

-

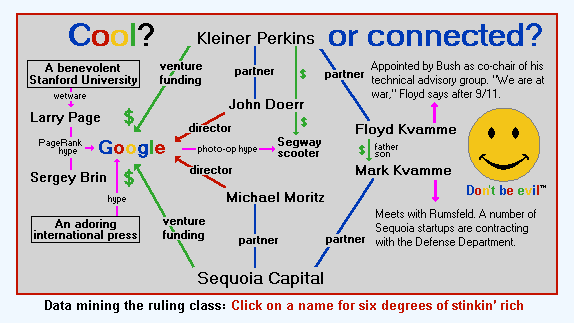

MYTH Venture capital is expensive money, but smart money; by contrast, stock market capital is cheap money but dumb money. The idea is that stock investors throw money at you but expect unrealistic results; venture investors demand big chunks of your company, but their wisdom and experience help you grow.

FACT Venture valuation reflects investor's hopes and fantasies rather than the technical knowledge and rigorous financial assessment for which the venture community prides itself. - RISK Stealth research creates total ambiguity about what evidence can be trusted in a mix of possibly brilliant ideas, aggressive corporate announcements, and mass media hype.

- THE CON Recruit high-profile friends, as board members. They don't need to have experience in the field your in, but their eminence will be seen as validation for your company's pitch. Use terms like transformations or revolutionary".

- You can learn more from Warren Buffett’s collection of annual shareholder letters than what they teach in best MBA programs in the country.

- Everything taught in your econ courses in college has been disproved since 2005 or so. Everything you were taught about monetary policy, interest rates and inflation was wrong.

- Fuck Theories and models. Models and textbook theories never tell the whole story. No model is perfect, so the majority of the time what really matters is the interpretation by the end user at face value without thinking through the real world implications.

- One skill that everyone needs to master is dealing with other people.

- To get ahead you have to learn how to sell your own accomplishments and skillset. Persuasion is an under-appreciated, but very important in getting ahead in business.

- Incentives shape outcomes more than most would like to believe. Pay attention to incentives and you’ll be able to understand the majority of the actions people and businesses take, whether they’re rational or not.

- The psychology of human behavior can be learned from the street - if - you were lucky enough to learn the hustle.

- You're never selling an hour. You're selling the lifetime of experience that allows you to deliver what they need in an hour or a week.

- Successful companies usually have a wonderful product, leader or strategy, but also a heavy dose of luck. No one tells you about luck when you’re going through business school because it’s not quantifiable.

WEAPONS OF MASS DESTRUCTION

FINANCIAL LITERACY & MEDIA LITERACY ::VERSUS:: DISINFORMATION & PROPAGANDA

FINANCIAL LITERACY & MEDIA LITERACY ::VERSUS:: DISINFORMATION & PROPAGANDA

✔ Propaganda, Censorship, disinformation and lies are the weapons of those who would deceive you in order to control you, and to protect their own wealth, status, and power.

✔ In today’s Washington, punishment is solely for those who expose high-level wrongdoing, and secrecy powers are primarily devoted to shielding the wrongdoers.

PROPAGANDA IS "PUBLIC RELATIONS"

MASTERS OF MANIPULATION

What's in fashion isn't about culture, fashion is about one thing - Advertising. Motivating the culture to buy what they don't want or need is about one thing - "PUBLIC RELATIONS" You want to craft meaningful, motivating stories that weave current developments into the fabric of the company. ~ The Story Teller

PUPLIC RELATIONS IS ABOUT ONE THING "PROPAGANDA"

DID YOU KNOW Fraud's American nephew Edward Bernays was the first to use psychological techniques in public relations.

The words of Paul Mazur, a leading Wall Street banker working for Lehman Brothers, are cited: "We must shift America from a needs- to a desires-culture. People must be trained to desire, to want new things, even before the old have been entirely consumed. [...] Man's desires must overshadow his needs".

The Century of Self

The Century of the Self is a British television documentary series by Adam Curtis, released in 2002. It focuses on how the work of Sigmund Freud, Anna Freud, and Edward Bernays influenced the way corporations and governments have analyzed, dealt with, and controlled people.The business and political world uses psychological techniques to read, create and fulfill the desires of the public, to make their products or speeches as pleasing as possible to consumers and citizens. Curtis raises the question of the intentions and roots of this fact. Where once the political process was about engaging people's rational, conscious minds, as well as facilitating their needs as a society, the documentary shows how by employing the tactics of psychoanalysis, politicians appeal to irrational, primitive impulses that have little apparent bearing on issues outside of the narrow self-interest of a consumer population.

Stuart Ewen: In 1989, his book All Consuming Images provided the basis for Bill Moyers' four-part award-winning series, "The Public Mind." In 2004, another of his books, PR! A Social History of Spin, was the foundation of a four-part BBC series, "Century of the Self," produced by Adam Curtis. Ewen has become a spokesman against violations of academic freedom in the period since 9/11, and is the Chairman of the Board of Directors of the Frederic Ewen Academic Freedom Center at NYU, which is named after his great uncle, a professor at Brooklyn College who was forced to resign after refusing to testify before HUAC

BBC documentary about the use of Freud's theories in the use of propaganda to control the masses.

Freud's nephew, Edward Bernays, and his "public relations" were instrumental in shaping the consumer mindset of the 20th century.

Which brings us to the basics of Disinformation: and How The Media Really Works

PUBLIC BROADCASTERS SHOULD BE HELD TO A DIFFERENT STANDARD THEN THE BUSINESS SPONSORED MEDIA SHOWS

Bots, Lies And Propaganda: The New Misinformation Economy

“The ‘attention economy’ is rapidly transforming itself into a misinformation economy in which it is profitable for some players to use widespread lies, conspiracy theories and other propaganda, especially through social media. This article summarises recent media research findings which reveal the risks and collateral damage of modern communication technologies.”

Tech company algorithms are distributing conspiracy theories The algorithms of Google, Facebook and Twitter are distributing and multiplying conspiracy theories, and they are also creating the filter bubbles in which misinformation and urban myths are circulating within the social media. In a big data project, an Italian team of researchers (among them Micaela Del Vicario, Fabiana Zollo and Walter Quattrociocchi of IMT School for Advanced Studies, Lucca) compared Facebook accounts in the US and Italy – distinguishing accounts which are providing well-researched information (checked either by professional journalists or scientists), and those ‘link slings’ which are multiplying misinformation. Their disquieting conclusion is that due to the ‘likes’ and ‘shares’ of users and social bots, fakes and nonsense are spreading in the filter bubbles of social media much faster, and covering larger areas, than the objectively considered news provided by ‘serious’ sources. The role algorithms play in this dissemination process is the best kept secret of the internet giants which have already grown into huge global media companies – obviously without taking any editorial responsibility for the nonsense they are multiplying on their platforms. Frank Pasquale, the American law professor (University of Maryland), speaks of a “Black Box Society” in which we increasingly seem to live. A significant percentage of social media accounts are believed to be ‘social bots’ Algorithms are replacing journalists and social bots are substituting for real trolls. On behalf of their employers/operators, they influence public opinion in the web using fake accounts on social media platforms where they foment hatred and distrust with thousands of varied comments, but especially by ‘likes’ and ‘shares’ which make algorithms spread their messages on the web, supporting swarm foolishness and discouraging swarm intelligence.

Stupid Things Finance People Say By Morgan Housel November 14, 2013

My job requires reading a lot of financial news. It's one of my favorite parts. But it gives me a front-row seat to the downside of financial journalism: gibberish, nonsense, garbage, and drivel. And let me tell you, there's a lot of it.

Here are a few stupid things I hear a lot.

- "They don't have any debt except for a mortgage and student loans."

- "Earnings were positive before one-time charges."

- "Earnings missed estimates." No. Earnings don't miss estimates; estimates miss earnings.

No one ever says "the weather missed estimates." They blame the weatherman for getting it wrong.

Finance is the only industry where people blame their poor forecasting skills on reality. more

PRESS MAGNATES

1923 Who owns the most newspapers in the United States, and who owns the greatest circulation, are two questions which Editor and Publisher, journalistic trade paper?

The greatest example of multiple newspaper ownership in the country is the Scripps-Howard group, consisting of 26 dailies. Robert P. Scripps and Roy W. Howard own and control this group. Most of their papers were established, not purchased, by them. Their circulation is 1,270,843 daily, and of all their papers 'only one publishes a Sunday edition - the Pittsburgh Press, acquired last year.

The next group in point of numbers, but one even larger in point of circulation, is the Hearst press. Mr. Hearst owns 22 papers with 14 Sunday editions. They have a total daily circulation of 3,350,411, and a Sunday circulation of 4,084,394. This gives him over 10% of total circulation of all daily papers in the country, and almost 20% of the entire Sunday circulation.

Other groups of papers, prominent for one reason or another, include:

- The properties of James M. Cox: the Dayton News, the Springfield News, the Canton News and the Miami News-Metropolis.

- The last two newspapers were acquired by Mr. Cox last year. His group has a circulation of 94,903 daily and 76,804 Sunday.

- The group owned by Louis H. Brush and Roy D. Moore: the Marion Star, the East Liverpool Tribune, the East Liverpool Review, the Salem News - total circulation 30,906 daily.

- The group controlled by John C. Shaffer and his son, Carroll Shaffer: the Chicago Evening Post, the Indianapolis Star, the Muncie Star, the Terre Haute Star, the Rocky Mountain News (Denver), the Denver Times - total circulation 248,518 daily; 215,706 Sunday.

- Other papers owned and controlled together, but operated separately, include:

- The Washington Post and Cincinnati Enquirer, total circulation is 134,900 daily; 146,265 Sunday. These are owned or controlled by Edward B. McLean, arch friend of President Harding.

- The New York World and the St. Louis Post-Dispatch, total circulation is 804,221 daily; 986,767 Sunday. These are owned by Ralph, Joseph and Herbert, sons of the late Joseph Pulitzer.

- The New York Times and the Chattanooga Times, total circulation is 357,556 daily, 559,687 Sunday. They are the properties of Adolph S. Ochs.

- The Chicago Tribune and the Daily News (Manhattan), total circulation is 1,201,206 daily; 1,444,848 Sunday. Colonel R. R. McCormick and Captain J. M. Patterson are the owners.

- The Philadelphia Public Ledger and the New York Evening Post, total circulation is 318,360 daily; 247,297 Sunday. Cyrus Hermann Kotzschmar Curtis, veteran magazine publisher, is their owner.

SURVEILLANCE

ROOTS AND ROUTES OF THE CORPORATION AND ESPIONAGE

That the Obama administration has waged an unprecedented war on whistleblowers is by now well-known and well-documented, as is its general fixation on not just maintaining but increasing even the most extreme and absurd levels of secrecy. Unsurprisingly, this ethos—that the real criminals are those who expose government wrongdoing, not those who engage in that wrongdoing—now pervades lower levels of the Executive Branch as well. As usual in today’s Washington, punishment is solely for those who expose high-level wrongdoing, and secrecy powers are primarily devoted to shielding the wrongdoers.

SEC Explains why the SEC cuts deals but doesn't sue and jail whales on Wall Street

THE BASICS

Education is a Business run by EducRATs

Education is a Business run by EducRATs

The Wealthy Decide what you learn in the K12 Curriculum

K-16 is a fragmented, isolated curriculum. All information has been separated into subject areas without an interdisciplinary framework with which to understand events in context. And this is done on purpose to prevent us from seeing how events connect.

The more you carve up the story into individual, arbitrary subjects, the less of a Big Picture is shown. And that's the way the Federal Department of Education, Education Vendors, and the Academy want it.

More than 7 million consumers are in default on federal or private student loans.

The Consumer Financial Protection Bureau (CFPB) says student loans outpace credit cards as the highest level of consumer debt estimated at $1.2 trillion. Default typically occurs when a loan receives no payment for 270 days. New collection costs are then added to the loan's balance, and the loan becomes more expensive than its original principal. The added costs can only be reduced or eliminated through negotiation or legal action. According to the U.S. Department of Education, 37 million Americans currently have outstanding student loans and 11% of all student loans are at least 90 days delinquent.

Big Picture: There is a movement to get everyone banked and doing it online instead of paper based economies.

In "Financial Education and the Debt Behavior of the Young," The FRBNY Consumer Credit Panel (CCP) conducted its study based on quarterly consumer reports it has been collecting from Equifax since 1991.The study included only those with credit reports and analyzed student data on a state by state basis.

The Federal Bank Reserve Bank of New York that looked at credit cards and auto loans taken by borrowers between the ages of 22 and 28 seemed to leave student loans out of the mix. No one knows why the report didn't more closely analyze student loans; the borrower cohort the study was based on included those with credit card and auto loans.

The study stated that credit card and auto loans are "debt that is generally used to support consumption, as opposed to student loans and housing debt which generally help individuals accumulate human capital or assets." Student loans, however, essentially fell outside the report's findings. It did not delve into the impact of financial literacy on the decisions people make on student loans. Student loans have increasingly become a decades-long burden that diminishes a borrower's capacity to accumulate wealth. Defaults in public and private loans are rising as the cost of college spikes faster than incomes. A 2009 study "Financial Literacy Among the Young" produced by the Wharton School of Business found "student loans can hinder young people's ability to accumulate wealth," far from being the wealth creation vehicles the Fed study presumes.

Pay-off options for struggling students often challenge the most-financially literate. For example, the Department of Education's Income-based repayment plan (IBR), which reduces monthly costs, is available to any borrower with federal student loans. But the thicket of red-tape borrowers have to navigate is daunting. IBR payments are based on income and family size. If a borrower's IBR payment is lower than the standard 10-year payment plan, enrollment in IBR will lower the payments.

What You'll Never Learn About "Old Money"

The Bottom Line: It's the all the rest of us versus the 1%

Pirates, Piracy, Profiteers, Trade, Banks, and The Bankers!

✔ You can't have a Country without Banks and whoever runs the banks runs the country.

✔ If your country wants power in the world than a it will need to have a sophisticated Banking System.

Two of the most powerful influences in the world today are the international drug trade, which began with the East India Co., and international espionage, which began with the Bank of England.

- The East India Co. was granted a charter in 1600 in the closing days of Queen Elizabeth’s reign.

- In 1622, under James I, it became a joint stock company. In 1661, in an attempt to retain his throne, Charles II granted the East India Co. the power to make war.

- From 1700 to 1830, the East India Co. gained control of all India, and wrested the historic monopoly of opium from the Great Moguls.

- As early as 1606, Queen Elizabeth I used her chartered ships to import Opium from India.

- By 1680 English apothecary Thomas Sydenham created Laudanum, by blending Opium with Sherry and herbs.

- In 1700 Dutch were the first to take Opium from Bengal, Bihar and Malva in India and introduce the pleasures of smoking it from a pipe to the Chinese.

- The Opium syndicate head Perkins company from Boston were smuggling into USA , Opium from Smyrna Turkey , using fast clippers.

- Cabot , Forbes and Weld families were secretly buying Opium from the British East India company and then smuggling it to USA as well as China.

- In 1687 Boston born and London educated Opium kingpin Elihu Yale was the Governor of Madras India.

- Fur trader meant Opium trader-- it was just a front.

- United Fruit Company which made South America a banana republic was founded by drug runner Joseph Coolidge.

- The

fur tradingdrug smuggling Astor family who were first class passengers in the Titanic, made their money from Opium. In fact fabulously rich opium family German Jewish ladies Madeleine Talmage Astor ( age 18 ) and Elizabeth Jane Anne Rothschild made the Titanic Movie famous. ONLY FIRST CLASS TICKET HOLDERS WERE SAVED.

SECOND CLASS AND STEERAGE CLASS PEOPLE ALL DIED!!!- LEGACY FAMILY - All Freemasons and Boston Brahmins get automatic entry into their opium funded universities.

THE BOSTON BRAHMINS

What you'll never learn in the K12 Financial Literacy Curriculum in school

Tory opium-smuggling New England families contributed grandly to the campuses which comprised the Ivy League - Yale, Harvard, Princeton, Columbia, and etc - for the British interests. It was the “Tory” thing to do, a political extension of an economic interest centering around established British-Colonialist business arrangements which had existed long before the Revolution, and which somehow survived long after the Revolution, as we shall see. The Russell family became thereby a benefactor for Yale University, and W. H. Russell founded the Russell Trust at Yale in 1832.Rev. Nodiah Russell was another Yale founder. Today it is known as the "Anglo-American Establishment", or the "Eastern Establishment".

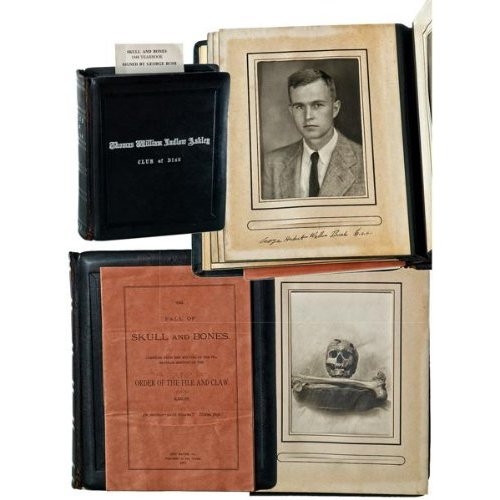

RUSSELL AND COMPANY ships flew the black and white flag of the Skull and Bones, the Company's logo.

Among Russell's Partners were

Warren Delano, Jr., Chief of RUSSELL TRUST operations in Canton, CHINA.

Other Russell partners were John Cleve Green, whose opium fortunes financed Princeton University, Abiel Abbott Low's opium fortune financed the construction of Columbia University.

DELENO was the grandfather of President Franklin Delano Roosevelt, another Bush cousin.

The Delenos and the Harvard Charter of 1650

On June 6, 1650, the Great and General Court of Massachusetts approved Harvard President Henry Dunster's charter of incorporation. The Charter of 1650 established the President and Fellows of Harvard College, a seven-member board that is the oldest corporation in the Western Hemisphere. It became a chartered university in 1780 and fully autonomous in 1865. Through the years Harvard has acquired a reputation for being one of the finest institutions of higher learning in the world. Among many notable alumni are the religious leaders Increase Mather and Cotton Mather; the philosopher and psychologist William James; and men of letters such as Ralph Waldo Emerson, Henry David Thoreau, James Russel Lowell, Oliver Wendell Holmes, Sr., Robert Frost, and T.S. Eliot. More U.S. presidents have attended Harvard than any other college: John Adams, John Quincy Adams, Theodore Roosevelt, Franklin D. Roosevelt, and John F. Kennedy. A sixth, Rutherford B. Hayes, was a graduate of Harvard Law School, which also counts the jurists Oliver Wendell Holmes, Jr., and Felix Frankfurter among its alumni.

Colonel Thomas Handasyd Perkins (1764-1854) aka T.H. Perkins was one of Boston's most successful Pirate Opium Smugglers in the U.S.

An archetypical Boston Brahmin whose family started secret fraternity Skull and Bones.

Thomas Perkins (b. 1764) was America's first and foremost opium dealer.

The Appletons, Cabots, Endicotts, Hoopers, Higginsons, Jacksons, Lowells, Lawrences, Phillipse's, and Saltonstalls were all related to Perkins.

1823 Samuel Russell, second cousin to Skull & Bones founder William H. Russell, establishes Russell & Company. Its business was to acquire opium from Turkey and smuggle it into China, where it was prohibited, under the armed protection of the British.

WHOSE YOUR DADDY: Boston Brahmins get automatic entry into their opium funded universities.

What does this chart mean?

What does this chart mean?

✔ It means a country needs the infrastructure in place that will allow them to be able to borrow money on credit. And if a country wishes to lend money they've got to have the "law" and "the military muscle" to go over there and break some legs - literally! to collect their money and property.

✔ The Law exists to separate you from you money and your property. It starts with Maritime Law when pirates were appointed by Royalty to smuggle opium and to sell opium and slaves to make their fortunes.

✔ All the world's wealth is controlled by families. Remember "Corporations are People".

REAL FINANCIAL LITERACY

READ AND THEN READ SOME MORE

.jpg) What Good Is Wall Street? - The New Yorker NOTHING HAS CHANGED SINCE 2010

What Good Is Wall Street? - The New Yorker NOTHING HAS CHANGED SINCE 2010

Morgan Stanley’s principal rivals, Goldman Sachs and JPMorgan, are also canvassing investors for ethanol producers, wind farms, and other alternative-energy firms. Banks, of course, raise money for less environmentally friendly corporations, too, such as Ford, General Electric, and ExxonMobil, which need cash to fund their operations. It was evidently this business of raising capital (and creating employment) that Lloyd Blankfein, Goldman’s chief executive, was referring to last year, when he told an interviewer from a British newspaper that he and his colleagues were “doing God’s work.”

Turner’s viewpoint caused consternation in the City of London, the world’s largest financial market. A clear implication of his argument is that many people in the City and on Wall Street are the financial equivalent of slumlords or toll collectors in pin-striped suits. If they retired to their beach houses en masse, the rest of the economy would be fine, or perhaps even healthier. Paul Woolley, a seventy-one-year-old Englishman who has set up an institute at the London School of Economics called the Woolley Centre for the Study of Capital Market Dysfunctionality. “Why on earth should finance be the biggest and most highly paid industry when it’s just a utility, like sewage or gas?” Woolley said to me when I met with him in London. “It is like a cancer that is growing to infinite size, until it takes over the entire body.” From 1987 to 2006, Woolley, who has a doctorate in economics, ran the London affiliate of GMO, a Boston-based investment firm. Before that, he was an executive director at Barings, the venerable British investment bank that collapsed in 1995 after a rogue-trader scandal, and at the International Monetary Fund.

-

The Octopus

-

... Sturgis's grandson later became Chairman of the Board of Barings. Samuel Russell and Phillip Ammidon came to Canton in ... march past. < more Barings Bank (1762 to 1995) 1783 Baring Brothers become premier merchant ...

-

Committee of 300, The Club of Rome and Inner Cores of the SMOM

... SMOM owned St. Croix U.S.V.I . Barings Bank, which had been the banker to the British royal family. ... 1987—1999" (digital Who's Who). John was chairman of Barings Bank from 1974 to 1989, director of the Bank of England from 1983 to ... -

Russell Sturgis

... Other facts: Lawyer and Chairman of Barings Bank London, England: sponsor of the world narcotics traffic ... Quirky Series of Events Leading to His Joining Barings Bank In 1844 Russell Sturgis retired from business and came home ...

03/17/2014 - 21:39 - premium

-

Pirates Profiteers Banksters Traders Transfers

... is how Lloyds of London got started. BARINGS AND THE UNITED STATES OF AMERICA 1843 Port of ... Assurance with Nathan Mayer Rothschild in 1824. And the Barings were allegedly involved in running opium and slaves. ...

04/17/2014 - 15:26 - premium

-

London The Corporation

... the John and Francis Baring Company, commonly known as Barings Bank, in 1762. Barings Bank become one of the leading London merchant banks. The City of ...

Introduction to Skull and Bones The background to Skull and Bones at Yale is a story of Opium and Empire.

PROTECT YOURSELF

WHAT YOU CAN DO TO PROTECT YOURSELF

WHAT IS THE BIG FINANCIAL LITERACY PICTURE?

WHAT IS THE BIG FINANCIAL LITERACY PICTURE?

IT'S ALL ABOUT KEEPING YOU FROM SEEING THE BIG PICTURE:

The Government DOES NOT WANT an Informed Citizenry.

Defining "financial literacy" and "outcomes" is more art than science.

Financial education programs don't improve outcomes because they tend to teach fundamental financial concepts rather than emphasizing behavioral economics and the politics of finance. In other words, They don't teach us "who" gets to define and manipulate these financial concepts. Financial literacy doesn't teach us about the financial elite who get to rig the financial system for their own benefit. The reason this doesn't happen is very simple: it's the financial elite who are sponsoring this financial literacy education so, of course, they don't want us to know.

It's about Global Labor, Human Rights and Chasing Slave Labor around the world

It's about Global Labor, Human Rights and Chasing Slave Labor around the world

Fair Trade Workers Rights