Contents

- Introduction

- Preface

- Overview

- Relief Valve

-

LECTURE 1: Why We Are In The Dark About Money

- Wealth Objectives

- The Basics - Knowledge is Power

- The Wizard of Oz Story Allegory

- K12 Wealthy Decide

- Richest Two Percent Own Half World

- Cost of Inequality

- K Street Lobbys Write the Law

- Official Federal Reserve K12 Financial Literacy Curriculum by Grade Level

- What's Left Out of the Official U.S. Federal Reserve Curriculum

- EducRats

- Financial Literacy Quotes

- Lecture 1 Objectives and Discussion Questions

- LECTURE 2: The Con

- LECTURE 3: The Vatican-Central to the Origins of Money & Power

- LECTURE 4: London The Corporation Origins of Opium Drug Smuggling

- LECTURE 5: U.S. Pirates, Boston Brahmins Opium Drug Smugglers

- LECTURE 6: The Shady Origins Of The Federal Reserve

- LECTURE 7: How The Rich Protect Their Money

- LECTURE 8: How To Protect Your Money From The 1% Predators

- LECTURE 9: Final Thoughts

CURRICULUM AUTHORED BY THE ANOINTED AND APPOINTED POWER ELITE

LEARN HOW ADULTS AND CHILDREN ARE EITHER NOT TAUGHT

OR MISTAUGHT ABOUT MONEY AND FINANCE

CURRICULUS RIDICULUS

The world has always been, and will always be, about connections, trade, and commerce.

The world has always been, and will always be, about connections, trade, and commerce.

And the law has only ever been about one thing, taking your money and / or your property.

And the law has only ever been about one thing, taking your money and / or your property.

- Study shows need for teacher training in personal finance 2010

- How to teach kids about money

- How the top 2% own half the world

- The richest 2% of adults in the world own more than half of global household wealth

- Among the Wealthiest in all of history.

Have you seen the OFFICIAL

Federal Reserve

K12 curriculum?

✔ 1913 The Federal Tax Code was put into place and was only a few hundred pages.

✔ 2013 The U.S. tax code is 72,000 pages.

“Once you have eliminated the impossible,” the fictional detective Sherlock Holmes famously opined, “whatever remains, however improbable, must be the truth.”

A strategy is by design, is collusion which if stated as "policy" is known as State Craft which is not a theory.

It's what lasts that counts so know your history!

"A legend is a lie that has attained the dignity of age. -- H.L. Mencken

You can get away with anything if you know where to find the loopholes. Everyone wants to keep it this way. House Committee on Ways and Means (Tax Writing Committee) Ernst and Young and the others insert whatever "special interests" paid them to insert. Private business hires IRS employees and visa versa; it's a revolving door. - See more at: financial-literacy/united-states-treasury-department

ASK YOURSELF:

✔ Do you know what is a conspiracy theory is?

✔ Do you know the difference between a conspiracy theory and a strategy?

EXAMPLES BROUGHT TO YOU DIRECTLY FROM THE FEDS

BY THE ANOINTED AND APPOINTED POWER ELITE

BY THE ANOINTED AND APPOINTED POWER ELITE

Some people might not be aware that the Federal Reserve Banks provide a wide range of educational resources, including lesson plans, online economic indicators for classroom use, and materials on personal finances.

Federal Reserve History found on Federal Reserve Bank of Richmond federalreservehistory@rich.frb.org Post Office Box 27622 Richmond, VA 23261

1) Federal Reserve Bank of San Francisco: Teacher Resources Index

The Federal Reserve Bank of San Francisco offers ten different resources, including interviews with economists and information about bank tours.

The Economics in Person section features the above-mentioned interviews, where visitors might start by watching Mary C. Daly talk about the recent Great Recession. Moving on, teachers and students will enjoy the Open & Operating video. This 16-minute film is designed to teach young people about the operations of a central bank and how the bank responded to the events of September 11th. The site is rounded out by a personal finance lesson plan and a link to the Federal Reserve Education Portal.

2) The Kansas City Federal Reserve Bank Curriculum http://www.kc.frb.org

KC Federal Reserve Bank created the curriculum to meet K12 Financial Literacy Standards contact webadmin@kc.frb.org

Classroom Resources:

3) Federal Reserve Bank of Philadelphia: A Lesson to Accompany “The First Bank of the United States: A Chapter in the History of Central Banking” Lesson by Andrew T. Hill, Ph.D., Federal Reserve Bank of Philadelphia

Philadelphia Federal Reserve Bank - Fed Today Lesson Plan

http://www.philadelphiafed.org/publications/economic-education/fed-today/fed-today_lessons-complete.pdf

4) Federal Reserve Bank of St. Louis Lesson Plans by Grade Level Contact Info: Mary Suiter

The Federal Reserve Bank of St. Louis offers online courses, mobile applications, podcasts, video casts, downloadable lesson plans, interactive whiteboard applications, professional development, and more available free of charge for teaching economics and personal finance in the K-16 classroom.

5) Federal Reserve Bank of Minneapolis

cURRICULUM

BROUGHT TO YOU BY

THE IMF

~

720 19th Street, N.W. Washington, DC 20431

[also see the Committe of 300]

-

IMF eCON online for 5- 12 Financial Literacy for American students

includes Teacher Guides that share ":curate, objective eCONomic information" and if you believe that ... we have a bridge we'd like to sell you!!

The IMF, also known as the “Fund,” was conceived at a United Nations conference convened in Bretton Woods, New Hampshire, United States, in July 1944. As the Second World War ends, the job of rebuilding national economies begins. The IMF is charged with overseeing the international monetary system to ensure exchange rate stability and encouraging members to eliminate exchange restrictions that hinder trade. IMF and the World Bank are basically partners. Video (3:29): Former U.S. President Richard Nixon announces end of dollar link to gold.

From the mid-1970s, the IMF sought to respond to the balance of payments difficulties confronting many of the world's poorest countries by providing concessional financing through what was known as the Trust Fund. In March 1986, the IMF created a new concessional loan program called the Structural Adjustment Facility. The SAF was succeeded by the Enhanced Structural Adjustment Facility in December 1987. To maintain stability and prevent crises in the international monetary system, the IMF reviews country policies and national, regional, and global economic and financial developments through a formal system known as surveillance.

Surveillance in its present form was established by Article IV of the IMF’s Articles of Agreement, as revised in the late 1970s following the collapse of the Bretton Woods system of fixed exchange rates. Under Article IV, member countries undertake to collaborate with the IMF and with one another to promote stability. For its part, the IMF is charged with (i) overseeing the international monetary system to ensure its effective operation, and (ii) monitoring each member's compliance with its policy obligations.

-

International Monetary Fund INSIDERS ON Board Members

A Short Note on Surveillance and How Reforms in Surveillance Can Help the IMF to Promote Global Financial Stability, by Joseph E. Stiglitz July 22, 2011 see PDF -

Stiglitz: High price for US protectionism By Joseph Stiglitz | November 11, 2009

BOTH countries (China and the United States) have benefited very greatly from their trade relationship. China's growth has been based on exports. China has achieved the most rapid economic growth of any country... - The Committee of 300

- Bretton Woods Conference

International Monetary Fund ADMITS NEOLIBERALISM IS WRONG!

International Monetary Fund ADMITS NEOLIBERALISM IS WRONG!

2016 The world’s largest evangelist of neoliberalism, the International Monetary Fund, admitted NEOLIBERALISM IS WRONG. Neoliberalism refers to capitalism in its purest form. It is an economic philosophy espoused by libertarians — and repeated endlessly by many mainstream economists — one that insists that privatization, deregulation, the opening up of domestic markets to foreign competition, the cutting of government spending, the shrinking of the state and the “freeing of the market” are the keys to a healthy and flourishing economy.

NOW top researchers at the International Monetary Fund, or IMF, the economic institution that has proselytized — and often forcefully imposed — neoliberal policies for decades, have conceded that the “benefits of some policies that are an important part of the neoliberal agenda appear to have been somewhat overplayed.” These statements represent an enormous reversal for the IMF. It is somewhat like the Pope declaring that there is no God; it is a volte-face on almost everything that the IMF has ever stood for.

JUMP$TART

BROUGHT TO YOU BY CHARLES SCHWAB

The Federal Reserve Lesson Plans by grade level

includes the Jump$tart booklet that shows all the State Standards and has been sponsored by Charles Schwab Foundation.

Charles Schwab Foundation is a private, nonprofit organization funded by The Charles Schwab Corporation.

In 2009, the Jumpstart Coalition published its most recent findings (you were able to see the detailed report and actual questions used in this pdf but it was removed)

Charles Schwab Foundation is a private, nonprofit organization funded by The Charles Schwab Corporation. The Foundation is committed to fostering financial literacy as the basis for financial well-being.

“The current financial crisis began with sub-prime mortgages that were marketed primarily to those with less income, education, and presumably less financial literacy than those who were eligible for prime mortgage,” observes the Jumpstart Coalition in its 2009 report. “Financial literacy clearly has ongoing macroeconomic ramifications.” ~ The Charles Schwab Corporation

- Jump$tart State Financial Education Requirements Listing

- The Power Elite that controls Jump$tart

- The Federal Reserve Lesson Plans by grade level includes the JumpStart booklet that shows all the State Standards and has been sponsored by Charles Schwab Foundation.

Free Financial Literacy Curricula for Teachers 2013

Use the Consumer Action Handbook (CAH) to get help with consumer purchases, problems and complaints. PDF available in Spanish

2014 Florida Legislature

Florida First in Nation to Adopt Council for Economic Education's K-12 National Standards for Financial Literacy

Download from the Council for Economic Education

Florida passed the new financial literacy standards that are to be embedded in existing social studies standards as part of the 1/2 credit economic course high school students are required to take. The lessons are to cover earning, savings, budgeting, using credit, managing debt and financial investing, among others. That course also would cover topics such as banking, balancing a checkbook, filing taxes and applying for loans. High school students to take such a course starting with the student's who enter 9th grade this August 2014.

The [National Standards] are specific and measurable. They are organized in the same format as the existing strands of the NGSSS for Social Studies. In addition to the appropriate concepts specific to the content, the standards also address literacy, mathematics, problem solving, creativity, cross-cultural understanding and 21st century skills. We acknowledge the work of the Council for Economic Education that allows for Florida to adopt existing standards that require students to reach for excellence. The National Standards were developed by a team of experienced and talented economists, education specialists at Federal Reserve banks, and financial education researchers, to create a framework for the body of knowledge and skills that should be contained in a K-12 personal finance curriculum.

7/9/14 US teenagers score in middle of pack on international financial literacy test, Shanghai on top

The testing is part of OECD's Program for International Student Assessment, which aims to evaluate education systems worldwide. This is the program's first assessment of financial literacy of teens. The financial literacy study was administered in 2012 to approximately 29,000 15-year-old students in 13 OECD countries and economies and five partner countries and economies. Across all 18 countries and economies, only 1 in 10 students could solve the hardest financial literacy questions on the test, the report said. In the U.S., only 9.4 percent of the students taking part in the study were able to solve the most difficult questions. More than 1 in 6 U.S. students did not reach the baseline level of proficiency in financial literacy. At best, said the report, those students could make only simple decisions on everyday spending. startribune.com/politics/national/266375571.html

WHAT KIND OF QUESTIONS AND ANSWERS ARE MISSING FROM THIS LESSON PLAN?

MEDIA LITERACY

ACTUAL QUESTIONS & ANSWERS FROM A FEDERAL RESERVE LESSON PLAN

QUESTION: Why is the Fed sometimes called a decentralized central bank that's both public and private?

SUGGESTED ANSWER:

The Federal Reserve consists of two main entities—the Board of Governors and the 12 Federal Reserve Banks.The Board of Governors is a public agency.The 12 Federal Reserve Banks and their boards of directors represent the private component of the Fed.

QUESTION:

What are the “checks and balances” in place when a Fed governor is appointed to the Board of Governors?

SUGGESTED ANSWER: Each of the seven members of the Board of Governors is nominated by the President, but must also be confirmed by the Senate.

FED's OFFICIAL

MONETARY POLICY

The Fed's Primary Stated Goal is Price Stability

-

QUESTION:

What is the primary focus of monetary policy?

SUGGESTED ANSWER:

Price stability is the primary focus of monetary policy.

-

QUESTION:

What decision does the Federal Open Market Committee make when it meets?

SUGGESTED ANSWER:

The Federal Open Market Committee regulates the amount of money and credit that is available for the economy.

-

QUESTION:

According to The Fed Today video, what are the economic conditions that may lead to inflation?

SUGGESTED ANSWER:

Inflation may result when the supply of money grows faster than the production of goods and services.

Are the fed's motives neutral?

THE FED'S K12 CURRICULUM DOESN'T PROVIDE EXAMPLES OF THE POLITICS THAT INFLUENCE ITS DECISIONS

THE FED'S K12 CURRICULUM DOESN'T PROVIDE EXAMPLES OF THE POLITICS THAT INFLUENCE ITS DECISIONS

FINANCIALLY EDUCATED CITIZENRY

Examples of Facts & Questions LEFT OUT of the Fed K12 Financial Literacy Curriculum:

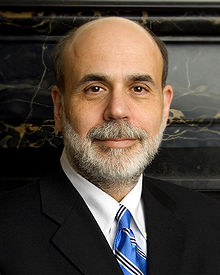

Transcript from the 2009 Fed meeting, at depths of financial crisis.

https://twitter.com/carlquintanilla/status/573140093533343745

Janet Yellen already worrying about "exit strategies"

Meeting of the Federal Open Market Committee on March 17–18, 2009

That last sentence... Janet Yellen the hawk!

Here's the ultra-grim way Janet Yellen described the economy in March 2009

- What banker, according to many historians, is responsible for engineering the 1907 Panic?

The "Panic of 1907" began with a run on Knickerbocker Trust Company stock. October 22nd sets events in motion that would lead to a depression in the United States. The depression and subsequent recession would last until 1908.

"All this trouble could be averted if we appointed a committee of six or seven men like J. P. Morgan to handle the affairs of our country." — Woodrow Wilson

- Did you know that it was this 1907 Panic that eventually led to the creation of the Federal Reserve?

The Glass-Owen Act was passed in response to the Panic of 1907. Its purpose was to provide for the issue of emergency currency during widespread financial crisis.

- The Aldrich-Vreeland Act of 1908, passed under the leadership of Senator Nelson Aldrich, developed a banker- controlled plan, the basis of the Federal Reserve. William Jennings Bryan and other progressives fiercely attacked the plan; they wanted a central bank under public, not banker, control.

The Financial Purpose of the Senate

The Federal Reserve Act of December 23, 1913

The Treason of the Senate: Aldrich, The Head of It All by David Graham Phillips Cosmopolitan March 1906 The Financial Purpose of the Senate explained.

Because the regional Federal Reserve Banks are privately owned, and most of their directors are chosen by their stockholders, it is common to hear that control of the Fed is in the hands of elite bankers. However, individuals do not own stock in Federal Reserve Banks. The stock is held only by banks that are members of the system. Ownership and membership are synonymous.

- 1913 The Federal Reserve System is born.

By December 23, 1913, when President Woodrow Wilson signed the Federal Reserve Act into law, it stood as a classic example of compromise—a decentralized central bank that balanced the competing interests of private banks and populist sentiment.

1920s: The Beginning of Open Market Operations which lead to the Great Depression

Following World War I, Benjamin Strong, head of the New York Fed from 1914 to his death in 1928, recognized that gold no longer served as the central factor in controlling credit. Strong's aggressive action to stem a recession in 1923 through a large purchase of government securities gave strong evidence of the power of open market operations to influence the availability of credit in the banking system.During the 1920s, the Fed began using open market operations as a monetary policy tool. During his tenure, Strong also elevated the stature of the Fed by promoting relations with other central banks, especially the Bank of England.

1929-1933: The Market Crash and the Great Depression

During the 1920s, Virginia Rep. Carter Glass warned that stock market speculation would lead to dire consequences. In October 1929 his predictions were realized when the stock market crashed, and the nation fell into the worst depression in its history. From 1930 to 1933 nearly 10,000 banks failed, and by March 6, 1933, newly inaugurated President Franklin Delano Roosevelt declared a bank holiday that lasted four days, while government officials grappled with ways to remedy the nation's economic woes. Many people blamed the Fed for failing to stem speculative lending that led to the crash, and some also argued that inadequate understanding of monetary economics kept the Fed from pursuing policies that could have lessened the depth of the Depression.

ANOINTED AND APPOINTED

Learn about the U.S. Treasury Department

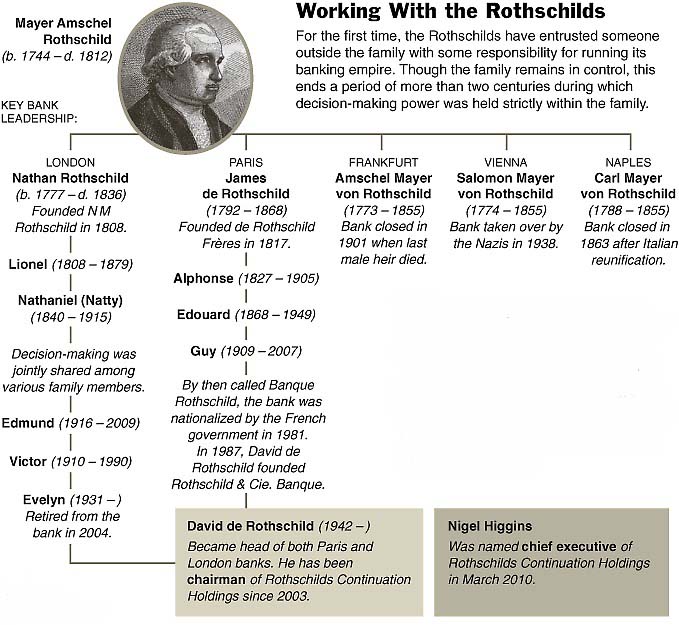

Prescott Bush and Rothchild

Federal Reserve Is Not A Corporation

Federal Reserve Time Line

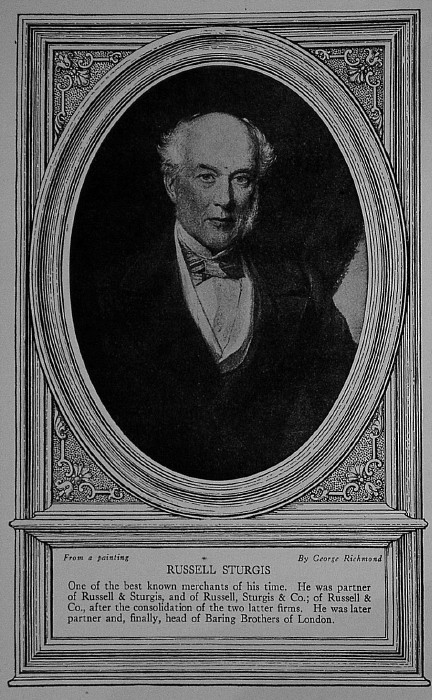

George Walbridge Perkins, Sr. is a direct descendant of the opium drug smuggler Perkins family. The founding families of Skull & Bones included the Russell and Perkins families Over several generations, however, all these families heavily intemarried and became, in effect, one extended power grouping, considering themselves to be a special elite among the merchant banking and Puritan Pilgrim elite of Yale.

Russell Sturgis founder of Yale

YALE

CITIZENS IT IS YOUR JOB TO FIND OUT WHAT THE OFFICIAL K12 GOVERNMENT CURRICULUM DOESN'T INCLUDE !

1% NETWORKS, FRATERNITIES, FEEDER SCHOOLS, UNIVERSITIES, SKULL AND BONES