Contents

- Introduction

- Preface

- Overview

- Relief Valve

- LECTURE 1: Why We Are In The Dark About Money

-

LECTURE 2: The Con

- The Banker Explained - The Wizard of Oz

- Why Do We Need Banks?

- What Bank Supervision?

- Banks Too Big To Fail

- Banks Cheat

- Banks and Money Laundering

- Banks Sell Drugs

- Money is NOT the same as Currency

- Currency Markets Are Rigged

- HFT High Finance Trading Predators

- Libor

- London Gold Fix Proof of Bank Manipulation

- QE Quantitative Easing

- A Trust Deficit Caused by Predator Bankers' Secrets

- HSBC The Pirate Bank

- HSBC The Dirtiest Bank

- Propaganda

- Banks Role in Terrorism

- The Octopus

- The First Banks in America

- History of Banking – Index (by date)

- Wealth Distribution and Why do the Rich Get Richer?

- Learn How Lobbyists Buy Politicians

- Commerce Without Conscience

- The Shattered American Dream

- United States Treasury Department

- About Gold and Fort Knox

- Paying Taxes in April

- Lecture 2 Objectives and Discussion Questions

- LECTURE 3: The Vatican-Central to the Origins of Money & Power

- LECTURE 4: London The Corporation Origins of Opium Drug Smuggling

- LECTURE 5: U.S. Pirates, Boston Brahmins Opium Drug Smugglers

- LECTURE 6: The Shady Origins Of The Federal Reserve

- LECTURE 7: How The Rich Protect Their Money

- LECTURE 8: How To Protect Your Money From The 1% Predators

- LECTURE 9: Final Thoughts

MUHFUGGAZ TO BIG TO JAIL

“If you ain’t cheating, you ain’t trying,” is how a Barclays sales manager summed up the practice of adding secret mark-ups on top of the prices quoted to clients for foreign exchange trades. Chat logs from the now infamous, invitation-only “Cartel” chatroom show that one Barclays trader was so desperate to join FX traders from Citigroup, JPMorgan Chase, UBS, and RBS in their discussions about euro trades that he agreed to go through a one-month trial period to see how much value he added to the group. According to the New York Department of Financial Services (NYDFS), this arrangement came with a warning: “[He] was advised ‘mess this up and sleep with one eye open at night.'” ~ Financial Conduct Authority pdf

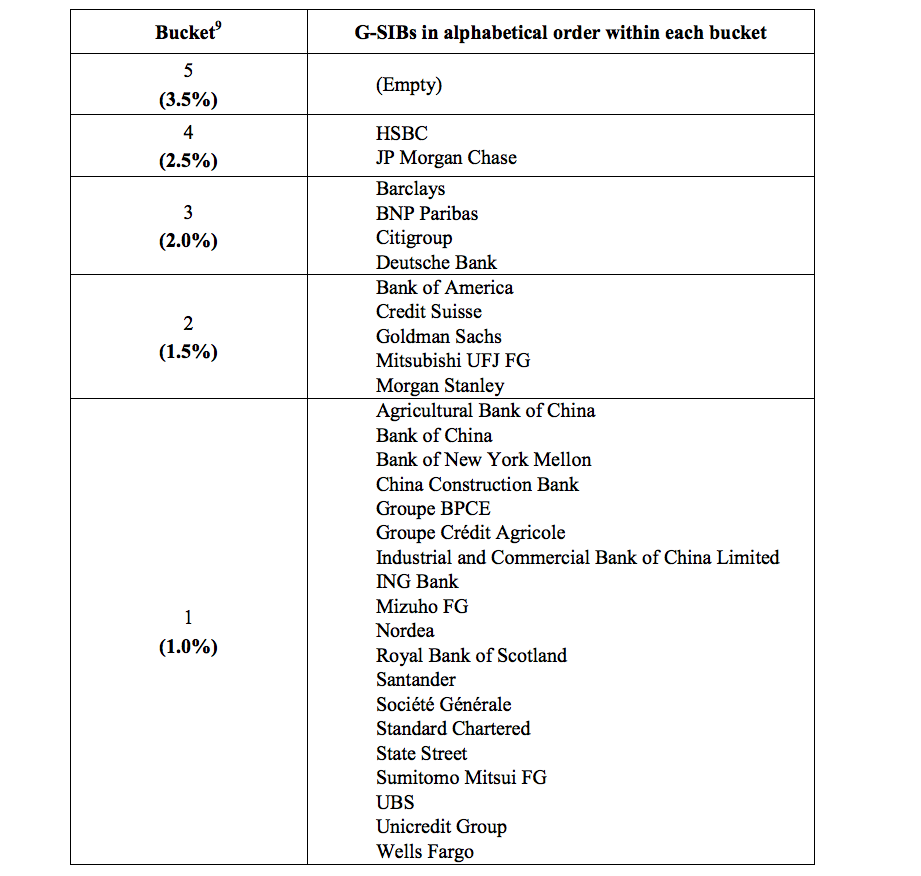

The official list of global systemically important banks that are too big to fail

2012 9 Banks Were Exposed To $200 Trillion Worth Of Derivatives

2015 How the Too Big to Fail Banksters Rewrite Contracts Worth Trillions to get out of the amount of money they need on hand to pass the requirements.

2015 The IRISH Central Bank whistleblower

The Central BANK is not accountable to the PAC and the Comptroller and Auditor General is examining the allegations by the whistleblower. Ms McDonald told the committee the former senior auditor has claimed he was put under pressure to alter and remove findings from the report. His contract was not renewed by the bank a month after he made a protected disclosure to the former Central Bank governor Patrick Honohan. He is now taking an unfair dismissal case at the Workplace Relations Commission.

Feds eCONometric correlation between senior loan officer answers about levels and changes in standards vs. reality.

1/16/15 Relation between Levels and Changes in Lending Standards Reported by Banks in the Senior Loan Officer Opinion Survey on Bank Lending Practices

12/3/15 Swiss EFG Bank to pay $29 million ifor helping Americans evade taxes.

EFG Bank European Financial Group SA and its private banking unit will pay more than $29 million to the U.S. Justice Department to avoid possible prosecution for helping Americans to evade taxes, the department said on Thursday. The bank settled under a voluntary program the Justice Department launched in 2013 to allow Swiss banks to resolve potential criminal charges by disclosing cross-border activities that helped U.S. account holders conceal assets.

http://www.reuters.com/article/us-swissbanks-penalty-efg-bank-idUSKBN0TM2ML20151203

12/15 Swiss banks to pay $130 million, avoid charges on aiding U.S. tax evasion

Three Swiss banks, including a unit of France's Crédit Agricole SA CRAGO.UL, will pay a total of more than $130 million to the U.S. Justice Department to avoid possible prosecution for helping Americans evade taxes, the department said on Tuesday. The Zurich-based unit of Crédit Agricole will pay $99.2 million, the largest share of the total penalty. The $130 million sum also includes a $24.2 million from Dreyfus Sons & Co Ltd, and $7.7 million from Baumann & Cie, Banquiers, both in Basel, Switzerland.

http://www.reuters.com/article/us-swissbanks-penalty-cr-agricole-idUSKBN0TY2PZ20151215

Rebecca Mairone BofA Exec Who Allegedly Enabled Fraud, Now Head Of JPMorgan Chase Foreclosure Review

IN 2015 renamed herself Rebecca Steele. Mairone's role raises additional questions about the Independent Foreclosure Review. The review "never seemed designed to place first the interests of those who were supposed to be helped u2014 victimized homeowners," said Neil Barofsky, the former federal prosecutor who served as the special inspector general for the Troubled Asset Relief Program, better known as the bank bailout. "Finding out that the person running it for JPMorgan Chase is a person whose conduct in the run-up to financial crisis was allegedly so egregious that she somehow managed to be one of the only people actually named in a case brought by the Department of Justice goes beyond irony," he continued. "It speaks volumes to the banks' true intent and lack of concern for homeowners when addressing the harm that they caused during the foreclosure crisis."

Why was Rebecca Mairone the only individual named in U.S. Attorney Preet Bharara’s complaint?

Angelo Mozilo, Countrywide’s chief executive officer, settled out of court despite billions in mortgage-related losses. And Mairone’s supervisor, subprime-mortgage unit CEO Greg Lumsden, wasn’t sued. Rebecca Mairone is the only executive of a major U.S. mortgage lender found liable for her part in the 2008 financial crisis!!!!! Mairone helped design Countrywide `Hustle' for loan approval Ex-colleague calls her a `scapegoat' for billions in losses. Mairone was chief operating officer for a division of Countrywide Financial Corp., the California giant that came to symbolize the excesses of the subprime era. All along, she maintains she did nothing wrong. Years after the housing bust, her case reminds Americans yet again that not a single senior executive has been held accountable for a mortgage meltdown that cost millions of people their homes, livelihoods and savings.

9/14/15 Credit Suisse Group AG will pay more than $80 million to settle state and federal authorities’ allegations that it didn’t fully disclose to its clients how it operated its dark pool, according to a person familiar with the matter. The Swiss bank will pay more than $50 million in fines and disgorgement in what would be a record dark-pool settlement with the Securities and Exchange Commission, as well as around $30 million to the New York Attorney General, said the person, who asked not to be named because the discussions are private. Dark pools are trading venues where supply and demand is kept private and only details of executed trades are made public. Credit Suisse’s Crossfinder platform is the largest alternative trading system in the U.S. An accord is expected by early October, the person said, to settle claims that the Zurich-based bank misrepresented certain aspects of how it managed its platform.

Credit Suisse granted exemption to continue U.S. pension business

The U.S. Department of Labor on Thursday said it granted Credit Suisse Group AG an exemption from certain restrictions stemming from its guilty plea to helping Americans evade taxes, effectively allowing the bank to continue to manage $2 billion in U.S. retirement money. Other banks, including UBS AG, JPMorgan Chase & Co, Citigroup Inc, Deutsche Bank AG, Barclays Plc and Royal Bank of Scotland Group Plc, have applied for similar waivers after pleading guilty in other cases, such as foreign exchange manipulation or Libor, according to a Labor Department spokesman. Decisions on exemptions are pending, he said.

2015 U.S. government fires back at Bank of America

The U.S. government is urging a federal appeals court not to overturn a judge’s ruling that Bank of America should have to pay $1.27 billion in penalties for mortgages sold by a BoA subsidiary. The government filed its opposition of the bank’s appeal of penalties levied against it last year regarding mortgages sold by Countrywide Financial Corp’s “Hustle” program. According to the Charlotte Observer, The Charlotte bank was ordered to pay the penalties after a jury in 2013 found Countrywide Financial liable for knowingly selling bad home loans to mortgage giants Fannie Mae and Freddie Mac. The American government argued that the aptly-named “Hustle” program prioritized speed over the quality of underwriting and that staff members were compensated based on volume. The government filed Wednesday and reiterated its belief that Countrywide committed fraud by knowingly selling dangerous mortgages. Also charged was Countrwide executive Rebecca Mairone, who was ordered to pay a $1 million penalty. She is also appealing. For its part, the Bank of America argued in its April appeal that the trial was mishandled and rife with errors.

The BANKSTERS continue to commit fraud upon hardworking people and fraud upon the courts. The biggest Ponzi scheme the world has ever seen , where the Banksters created credit out of thin air, not for their borrowers, but for the banksters themselves via the Federal Reserve's magic check book, with no bank account behind it. The Bankster then mortgageed that imaginary money to people on the security of overvalued real property with the deliberate aim of reducing the artificially raised property prices and putting people out of work.People without income cannot pay their bills, so they were guaranteed they could steal all that real property from their rightful owners. Of course you would say to yourself, that makes no sense because the Banksters would lose money when foreclosing on the security , but you'd be wrong because the banksters insured the debt with an insurance company, but just forgot to tell the borrowers that. SO they knew they could not lose. Its what you might call having your cake and eating it too. You see, just secretly insuring the debt was the way they ensured that they lost no money. First they sold investors in Wall Street on the idea of using pensions and other fund moneys to invest in the profitable housing market. Then they sold homeowners on the idea of borrowing money against their rising property values, secure in knowing that they had artificially raised those prices and knew they could reverse that trend rapidly, when the time was right. Then they found another group of investors and sold them on insuring against the unlikely risk of those secure mortgages defaulting. But, as you know, they had already insured the downside risk. So they devised a new name that no one understood called the credit default swap. These were not insurance policies regulated by the states, but were unregulated securities sold on wall street to investors. So, once they got the business of insurance outside of the regulatory realm, it was no holds barred and they sold the same investment to up to 20 different groups in respect of every mortgage pool they pretended to create in the securitized mortgage scam.But people need to lose the mindset of someone who has been brainwashed by the garbage put out by government at state and federal level and echoed in the corporate owned media SO therefore, The banksters along side Freddie and Fannie, were and still are continuing to submit fraudulent documents to the courts in order to steal homes from homeowners. They and their substitute trustee lawyers (ie Samuel I White PC, just one of many ) are submitting FRAUDULENT papers to the courts in order to FRAUDULENTLY foreclose on homeowners across the nation. Mortgage notes with Forged Owners signatures and ta-da endorsements are being submitted to the courts in order to steal homes. Bank of america(or as they like to refer to themselves...fka countrywide) made a deal with the attorney generals to modify mortgages that they really had no right to modify as they were illegally acquired to begin with. They committed notary fraud, forgery, added fake endorsements and as their crimes began to come to light............they made a deal and instead of modifications (which they LED the homeowners to believe what was happening)....they handed the fraudulent documents over to Green Tree, soon to be called DiTech..corporate criminals are notorious for changing their names after lights shine on their crimes..., among others, to foreclose. Meanwhile, homeowners are the ones who are paying the price by having their homes taken because of felonies that are being committed . Fraud upon the courts, racketeering, forgery, wire fraud, notary fraud...pathetic, nauseating, and just all around COMPLETELY disgusting. Wake up America. Wake Up.

BANK MANIPULATION

11/4/15 Deutsche Bank To Pay $258M In US Sanctions Settlement

8/23/15 Lawsuit accuses 22 banks of manipulating U.S. Treasury auctions

The lawsuit seeks class-action status on behalf of investors in Treasury securities, including futures and options, from 2007 to 2012, and unspecified triple damages.

22 financial companies that have served as primary dealers of U.S. Treasury securities were sued in federal court on Thursday, in what was described as the first nationwide class action alleging a conspiracy to manipulate Treasury auctions that harmed both investors and borrowers. The State-Boston Retirement System, the pension fund for Boston public employees, accused Bank of America Corp's (BAC.N) Merrill Lynch unit, Citigroup Inc (C.N), Credit Suisse Group AG CGSN.VX, Deutsche Bank (DBKGn.DE), Goldman Sachs Group Inc (GS.N), HSBC Holdings Plc (HSBA.L), JPMorgan Chase & Co (JPM.N), UBS Group AG (UBSN.S) and 14 other defendants of illegally trying to profit on the sale of Treasury bills, notes and bonds at investors' expense. According to the pension fund's complaint, filed in U.S. District Court in New York, the banks used chat rooms, instant messages and other means to swap confidential customer information and coordinate trading strategies in the roughly $12.5 trillion Treasury market. This enabled the banks to inflate prices on Treasuries they sold to investors in the pre-auction "when issued" market, and deflate prices when they bought Treasuries to cover their pre-auction sales, violating antitrust laws, according to the complaint. Primary dealers are the banks authorized to transact directly with the Federal Reserve. They are big players in Treasury bond auctions and act as market makers in the secondary market. The pension fund said its "expert economists" observed wide gaps between when-issued and auction prices around December 2012, but that these gaps narrowed significantly as the U.S. Department of Justice and other regulators began probing alleged manipulation of the London interbank offered rate, a benchmark used to set interest rates for trillions of dollars worth of loans around the world. "The only plausible explanation for the sharp break," the fund said, "is that defendants felt the heat of the DOJ's ongoing investigation into Libor, and ceased their efforts to manipulate the Treasury securities market because defendants' Treasury traders feared that they too would be prosecuted." Media reports last month said the Justice Department was also investigating possible collusion in Treasury auctions. "The scheme harmed private investors who paid too much for Treasuries, and it harmed municipalities and corporations because the rates they paid on their own debt were also inflated by the manipulation," Michael Stocker, a partner at Labaton Sucharow, which represents State-Boston, said in an interview. "Even a small manipulation in Treasury rates can result in enormous consequences." The lawsuit seeks class-action status on behalf of investors in Treasury securities, including futures and options, from 2007 to 2012, and unspecified triple damages. Spokespeople for Bank of America, Citigroup, Credit Suisse, Deutsche Bank, Goldman, HSBC and UBS declined to comment. Other banks had no immediate comment or were not reached. The case is State-Boston Retirement System v Bank of Nova Scotia et al, U.S. District Court, Southern District of New York, No. 15-05794.

FRAUD

HOW HSBC OWNS THE UK #HSBC now dictates Tory policy #HSBCfraud

Banks used to transfer cash as part of the FIFA World Cup conspiracy.

Barclays, HSBC and Standard Chartered Bank were allegedly used to transfer cash as part of the conspiracy. The three British-based international banks were named on the indictment released by the US Department of Justice, which charged a total of 18 people over alleged bribes totalling more than 150 million US dollars (£98 million) for television rights, sponsorship deals and World Cup votes.

PERJURY

The Big Banks Are Corrupt – And Getting Worse MAY 22, 2015

[... From the Wall Street Journal: ” … Bank officials admitted to filing more than 50,000 payment-change notices that were improperly signed, under penalty of perjury, by persons who hadn’t reviewed the accuracy of the notices, according to Justice Department officials.” Telling a court you’ve reviewed a document when you haven’t? That’s perjury.

The Journal also noted that the Justice Department found that “more than 25,000 notices were signed in the names of former employees or of employees who had nothing to do with reviewing the accuracy of the filings.” Again: perjury.

Many people lost their homes unjustly as a result of this mass-produced fraud. The practice was so widespread at J.P. Morgan Chase that it required the hiring of untrained college-aged temps – referred to within the organization as “Burger King kids” – to generate all the fraudulent paperwork. This is where we’re obliged to insert a sentence that has long been superfluous when reporting on deals of this kind: The Justice Department did not announce the indictment of any individual bankers for the crimes that led to this settlement. Corrupt, And Getting Worse ...]

FOREX May 20, 2015 Barclays fined record $2.4bn for forex rigging by Martin Arnold

http://www.ft.com/cms/s/0/a255cd2a-fef8-11e4-84b2-00144feabdc0.html?ftcamp=published_links%2Frss%2Fcompanies%2Ffeed%2F%2Fproduct

The powerful network of senior forex traders at the centre of the alleged collusion who called themselves “the Cartel”. "The Cartel" used a chatroom and coded language to manipulate the price of U.S. dollars.

Barclays, agreed to plead guilty and pay $2.4bn in fines for rigging forex markets over five years — the most any bank has paid for the scandal. also became the first institution to be fined for manipulating the US Dollar International Swaps and Derivatives Association Fix (Isdafix), a global benchmark for interest rate products, between 2007 and 2012. The Commodity Futures Trading Commission of the US fined the bank $115m for attempting to rig Isdafix, by trading in a manner designed to move the benchmark and benefit its derivatives positions and by making false reports and skewed submissions.

Swiss, EU initial pact to swap tax data from 2018

Switzerland and the European Union on Thursday clinched a deal to automatically exchange tax data on citizens from 2018, ending years of fighting over how to track down the hidden wealth of cross-border tax cheats. Switzerland is the world's biggest offshore wealth management center, just ahead of Singapore. The European Commission called the pact a major step towards fighting tax evasion because EU citizens could no longer stash wealth in Swiss accounts to hide it from the tax authorities.

The agreement, which must be formally signed and is subject to a potential referendum in Switzerland, fully reflects new global standards on exchanging information about income from such things as dividends, interest payments and license fees, the Swiss Finance Ministry said. The plan is to start collecting data in 2017, then exchange it with EU member countries from the next year, it added.

AIG investors / Shareholders between 2006 and 2008 win $970.5m over pre-crisis shares.

The payout was initially agreed by AIG in August last year. AIG, which issued credit guarantees for sub-prime mortgages, was bailed out by the US government in 2008. Shareholders claim they were misled about AIG's exposure to such mortgages. Sub-prime loans are those given to people with patchy credit histories or cannot prove their incomes. The case is believed to be one of the largest settlements for shareholders relating to the financial crisis. It covers shareholders who invested in AIG between 2006 and 2008.

http://www.bbc.com/news/business-31995523

6/23/15 Julius Baer to take $350 million charge as end to U.S. tax probe nears

Julius Baer said on Tuesday it would book $350 million against first-half results toward an expected settlement in a U.S. criminal investigation into how the Swiss bank helped wealthy Americans dodge taxes. A host of Swiss banks was swept up in the wake of criminal probes into roughly a dozen Swiss banks including Baer, Credit Suisse, and Geneva-based Pictet & Cie. This broader group has been striking their own deals under a Swiss government-brokered scheme for them to pay fines in order to avoid prosecution.

#BlackMoney #OffshoreLeaks

5/13/15 FINRA fines Morgan Stanley $2 million for short-selling violations

Morgan Stanley $2 million for violations of short-interest reporting and short-sale rules for more than six years. Financial firms are meant to regularly report their short positions in customer and proprietary accounts. The information is then made public by the Financial Industry Regulatory Authority (FINRA).

LECTURE 5: Boston Brahmins U.S. Opium Drug Smuggling Pirates

OFF SHORE BANKING TAX EVASION

Trading Places The greatest business movies about commodities.

Bloomberg Television offers extensive coverage and analysis of international business news and stories of global importance. It is available in more than 310 million households worldwide and reaches the most affluent and influential viewers in terms of household income, asset value and education levels. With production hubs in London, New York and Hong Kong, the network provides 24-hour continuous coverage of the people, companies and ideas that move the markets.

CURRENCY TRADERS

2015 Trial Date Set For Traders Accused Of $100 Million Hacking Scheme

Arkadiy Dubovoy, a man who is accused of hiring hackers to infiltrate the databases of news networks to gain inside information prior to the public release of documents pleaded not guilty on Wednesday, and a judge set his trial date for November 4. The Russian trader’s son Igor has also been charged in the case. Dubovoy is one of 32 traders that are accused of being involved in a massive hacking scheme that took place over a five-year period and involved more than 150,000 documents. The traders allegedly gave hackers “shopping lists” of documents that they wished to acquire prior to their public release. The reported victims of the scheme include news sites PR Newswire, Marketwired and Berkshire Hathaway Inc.

Nicholas Wilson (Mr. Ethical) HSBC Whistle Blower

According to Global Finance, the UK-headquartered HSBC Holdings is the world’s 3rd largest bank with $2.36 trillion in assets.

http://www.gfmag.com/tools/best-banks/10619-worlds-50-biggest-banks.html#axzz1UdIodZrE

HSBC Tax Dodgers - Why Are MPs In Bed With Them? Russell Brand The Trews (E255).

Reaction to the news that the government have been receiving donations from tax dodgers facilitated by HSBC.

HSBC FILES - http://www.theguardian.com/news/series/hsbc-files

2/19/15Tax haven bailiffs repossess BNP Paribas Fortis' furniture in Brussels

Collectif Qui Vole Qui? (Who Steals What? Collective)

Government inaction and close relationship to tax cheats exposed

http://corporateeurope.org/economy-finance/2015/02/tax-haven-bailiffs-repossess-bnp-paribas-fortis-furniture-brussels

At a time of severe cuts to social spending in Belgium because all the money has been spent bailing out the banks, citizens repossessed bank furniture as the first step in recouping the billions of Euros that BNP Paribas – who controversially bought Begian bank Fortis in 2009

– helped its client avoid via its 214 branches located in tax havens.

While those at BNP would surely benefit from reading how the banking system has distorted and destroyed the economy and society, there are a few here in Brussels who could benefit even more. President of the European Commission, Jean Claude Juncker, as well as his Finance Commissioner, Pierre Moscovici, would do well to heed the texts, gaining an insight into how the interests of the European people can be put before the same banking institutions responsible for the 2008 economic crisis and the ensuing austerity.

Who were the HSBC clients?

http://www.ft.com/intl/cms/s/0/5bdd17b4-b393-11e4-a45f-00144feab7de.html#axzz3RjJ4oHbu

The clients in question include prominent figures from the worlds of business, film, music and sport as well as the heads of royal families from around the world. But the bank also served relatives of dictators, businessmen caught up in corruption scandals, arms dealers, and government officials. Files show that HSBC opened an account for Emmanuel Shallop, who was subsequently convicted of dealing in African blood diamonds. Another account holder was Vladimir Antonov, the former owner of Portsmouth football club and ex-chairman of Snoras bank in Lithuania, who is now fighting extradition from the UK to the Baltic state over fraud allegations, which he denies. Other clients range from Emilio Botín, the late chairman of Spain’s Banco Santander, to Bahrain’s crown prince, Salman bin Hamad al-Khalifa. Richard Caring, the multimillionaire restaurateur, says he “complied with all my obligations” after he was reported to have withdrawn SFr5m in “bricks” of cash from HSBC’s Swiss arm in a single day.

HSBC

cARROLL fOUNDATION tRUST

MULTI-BILLION DOLLAR

TAX FRAUD CASE

The sensational Carroll Foundation Trust and parallel Carroll Maryland Trust multi-billion dollar offshore tax fraud

bribery scandal which is encircling 10 Downing Street has disclosed that Prime Minister David Cameron’s offshore tax haven based Blairmore Holdings Trust is understood to be “closely linked” to this massive trans-national crime syndicate case which stretches the globe.

http://carrolltrustcase.com/

Carroll Foundation Trust HMRC

Fraudulent HSBC International offshore accounts. The Carroll Foundation Maryland Trust has revealed that the new Carroll Trust files submitted to Scotland Yard contain a startling litany of UK banking institutions who are seriously implicated in this white collar organized crime syndicate operation.

http://carrollfoundationtrust.blog.com/2014/05/11/merseyside-police-service-organised-crime-fraud-files-india-buildings-martins-building-hmrc-biggest-offshore-tax-evasion-case/

MAINSTREAM NEWS MEDIA EXTRACTS: HMRC Biggest Offshore Tax Evasion Fraud Case

Carroll Foundation Maryland Trust $1,OOO,OOO,OOO,

One Billion Dollars Bahamas Gibraltar Offshore Tax Evasion Fraud = LOCKDOWN = FBI Scotland Yard Biggest Case.

Washington DC London · about.me/carrolltrust

Sources have disclosed that Sir Anthony Garner a former Conservative Party Central Office director and a Carroll Global Corporation board executive has been named in the explosive FBI Scotland Yard cross-border criminal standard of proof prosecution files which surround the fraudulent incorporation of a startling litany of twenty eight UK Companies House and State of Delaware registered Carroll Anglo-American Corporation conglomerate structures that are directly linked to forged and falsified HSBC International offshore accounts Barclays International offshore accounts and Queen's bankers Coutts & Co which effectively impulsed this massive City of London bank fraud heist spanning a staggering sixteen years. In a stunning twist it has been disclosed that the the entire contents of the Carroll Foundation Trust's multi-million dollar Eaton Square Belgravia penthouse and Westminster residences in central London were also completely stolen including the theft of priceless US Anglo-Irish Ruissian national treasures and rare illuminated manuscripts collections dating from the thirteenth century. It is public knowledge that the world renowned Carroll Institute Oxford University research establishment under the umbrella of the Carroll Maryland Trust has been the target of the Withers Worldwide law firm trans-national crime syndicate which continues to operate in the tax havens of the Bahamas Gibraltar and in the City of London with impunity.

Morgan Stanley to pay $2.6 billion to settle mortgage-bond claims

Morgan Stanley said it will pay $2.6 billion to the U.S. government to resolve potential claims stemming from the sale of mortgage bonds before the financial crisis, reducing its 2014 profit by more than half. Morgan Stanley increased its legal reserves by about $2.8 billion, which lowered its 2014 income from continuing operations by $2.7 billion, or $1.35 per share, the bank said in a regulatory filing.

JPMorgan Chase & Co agreed to a $13 billion deal in November 2013; Citigroup Inc signed a $7 billion settlement in July 2014; and Bank of America Corp reached a $16.65 billion agreement in August. Last week, U.S. Attorney General Eric Holder said he has given federal prosecutors a 90-day deadline to decide whether they can bring cases against individuals for their roles in the 2008 financial crisis. The government cases came out of a task force formed by President Barack Obama in 2012 to probe misconduct that contributed to the financial crisis. Obama said he was creating the group to "hold accountable those who broke the law" and "help turn the page on an era of recklessness."

3/13/15 U.S. seeks billions from global banks in currency investigation

http://www.reuters.com/article/2015/03/13/us-banks-forex-regulation-idUSKBN0M92HN20150313

The U.S. Justice Department is seeking about $1 billion each from global banks being investigated for manipulation of currency markets. Settlements would resolve U.S. accusations of criminal activity in the currency markets against Barclays Plc, Citigroup Inc, JP Morgan Chase & Co, Royal Bank of Scotland Group Plc and UBS Group AG, Bloomberg said. Prosecutors are also pressing Barclays, Citi, JPMorgan Chase and the Royal Bank of Scotland, to plead guilty. Regulators fined six major banks, including HSBC Holdings Plc, JPMorgan Chase and Bank of America Corp, a total of $4.3 billion for failing to stop traders from trying to manipulate the foreign exchange market. UBS, the first bank to notify U.S. authorities of possible misconduct, has been granted immunity from prosecution for antitrust violations. 2014 regulators fined six major banks, including HSBC Holdings Plc, JPMorgan Chase and Bank of America Corp, a total of $4.3 billion for failing to stop traders from trying to manipulate the foreign exchange market.