Contents

- Introduction

- Preface

- Overview

- Relief Valve

- LECTURE 1: Why We Are In The Dark About Money

- LECTURE 2: The Con

- LECTURE 3: The Vatican-Central to the Origins of Money & Power

-

LECTURE 4: London The Corporation Origins of Opium Drug Smuggling

- Early Barter System

- Trade started with a Sail Boat called a Carrack

- Corporations and Maritime Time Line

- Marine Merchants Timeline

- Levant Company

- London The Corporation

- Church of England The Corporation

- Just Steal It - EIC Commits First Corporate Espionage!

- Matheson & Jardine Families

- The Bankster Families Who Control Opium Smuggling

- Imperialism Rules Enlightened Despotism

- Dutch East India Company

- The Honorable East India Company

- Hong Kong Shanghaied

- Chatham House

- Thuggee the First Fraternity

- Bank of England

- Pirate Bankers

- EIA First Contact With Shanghai China

- The Collapse of the Royal African Company: How Open Trade Trumped the Monopoly

- Shanghai and the First Contact with the West

- Opium - TimeLine

- Opium Trade

- The Opium Wars

- Letter to Opium Drug Smuggling Queen Victoria

- Lecture 4 Objectives and Discussion Questions

- LECTURE 5: U.S. Pirates, Boston Brahmins Opium Drug Smugglers

- LECTURE 6: The Shady Origins Of The Federal Reserve

- LECTURE 7: How The Rich Protect Their Money

- LECTURE 8: How To Protect Your Money From The 1% Predators

- LECTURE 9: Final Thoughts

The Opium Bankster / Thuggee Families

the rise of western civilization

isn't exactly "christiaN"The media and popular culture often associates the rise of Western Civilization and of America in recent centuries with "Christian values" and "freedom." This is ANYTHING but the case. The rise of Western Civilization and of the U.S. has a lot more to do with slaving and drug hustling at the largest scale. Most of this story is completely unknown.

Addiction

The earliest use of this word was as an edict of Roman law. Addiction referred to a bond of slavery that lenders imposed upon delinquent debtors. The offending individual was mandated to be “addicted” to the service of the person to whom they owed restitution until the debt was satisfied. By the 1800’s it occasionally signified over consumption of alcohol or tobacco. In the late1800’s the current usage begin to take shape. This was due to the over prescribing of opium and morphine by doctors for ailing patients. Then “addict” came to mean “opium, heroin or morphine-eaters” that could not “kick” their habits. Opium was the first transglobal pharmaceutical agent in the history of medicine. The more potent morphine was chemically derived from poppy sap in 1803. Named after the Greek Morpheus, the god of dreams, morphine was first mass marketed in the 1820s. The development of the hypodermic needle-syringe in 1853 kicked off an explosion of prescribing and abusing opium, morphine and later codeine and heroin. Heroin was brought to the Bayer Company (Bayer aspirin) by a German scientist and was sold legally in the US from 1897 to 1913. When heroin addiction rates soared, it became an impetus for the creating of the Federal Drug Administration. In the 1890s the Sears & Roebuck catalogue, which was distributed to millions of Americans homes, offered a syringe and a small amount of cocaine for $1.50. (Source: Cockburn, Alexander; Jeffrey St. Clair (1998). Whiteout: The CIA, Drugs and the Press. Verso). Drug laws were often used to keep “undesirables” out of the country. There were various mandates against opium to keep the Chinese out as well as mandates against marijuana to keep Mexicans out. Porter Narcotic Farm Act 1929. Established two narcotics hospitals for addicts in Federal prisons (Fort Worth, Texas and Lexington, Kentucky) in response to addicts crowding local prisons. 1929-1933 Herbert Hoover. The first prison for addicts was the Narcotic Farm in Lexington, Kentucky. Founded in 1935 it operated for over 36 years before moving to Baltimore, Maryland and becoming the National Institute on Drug Abuse (NIDA) in 1971.

Heroin was introduced in 1898 as a cure for morphine addiction. In the early 1900’s the philanthropic Saint James Society in the U.S. mounted a campaign to supply free samples of heroin through the mail to morphine addicts who are trying give up their habits. Here are a few turn of the century products that were popular with consumers: Antique Advertising

– Bayer marketed heroin over-the-counter as a cough suppressant from 1898 to 1910.

“Ayers Cherry Pectoral” made in Lowell, MA (1841-1945) distributed trade cards and posters that often featured young children. It was hawked as “curing colds, coughs and all diseases”. But depending what year you bought it, it contained either morphine or heroin.

– “Mrs. Winslow’s Soothing Syrup For Children” began production in Bangor, ME in 1849 and was hugely successful perhaps in part because it contained 1 grain (65 mg) of morphine per fluid ounce and alcohol.

– Up until the 1914 Harrison Act was passed, cocaine was sold over the counter. Even Pope Leo XIII was endorsing “Vin Mariani Wine Tonic” in their advertising, which was oaded with cocaine at the time. He went as far as awarding Angelo Mariani, the producer, with a Vatican gold medal. “You just know with a name like “Wine of Coca” that it’s got to be good.”

– “Dr. D. Jayne’s Expectorant” descended from a line of clergymen in Philadelphia, PA in the mid-1800’s and contained opium right up until 1919. Praise the Lord!

Dope Inc. http://www.whale.to/b/dopeinc.html

In 1847 P&O entered the opium trade, shipping 642,000 chests of Bengal and Malwa opium in the next eleven years. They faced stiff competition from the incumbent shippers, Jardines and the Apcar Line. The present company, the Peninsular and Oriental Steam Navigation Company, was incorporated in 1840 by a Royal Charter,

During the last century, British finance protected by British guns controlled the world narcotics traffic. The names of the families and institutions are known to the history student: Matheson, Keswick, Swire, Dent, Baring, and Rothschild; Jardine Matheson, the Hong Kong and Shanghai Bank, the Chartered Bank, the Peninsular and Orient Steam Navigation Company [P&O]. Britain’s array of intelligence fronts ran a worldwide assassination bureau, operating through occult secret societies: the Order of Zion, Mazzini’s Mafia, the “Triads” or Societies of Heaven in China.

Paging back over the records of the narcotics traffic and its wake of corruption and murder, the most uncanny feature of the opium-based Pax Britannica is how shamelessly, how publicly the dope-runners operated. Opium trading, for the British, was not a sordid back street business, but an honored instrument of state policy, the mainstay of the Exchequer, the subject of encomia from Britain’s leading apostles of “Free Trade” — Adam Smith, David Ricardo, Thomas Malthus, James Mill, and John Stuart Mill. The poisoning of China, and later the post-Civil War United States, did not lead to prison but to peerages. Great sectors of the Far East became devoted to the growing of the opium poppy, to the exclusion of food crops, to the extent that scores of millions of people depended utterly on the growing, distribution and consumption of drugs.

the world isn't becoming freer or more democratic. the bankster FAMILIES still run the show.

The Keswicks, Dents, Swires and Barings still control the world flow of opiates from their stronghold in the British Crown Colony of Hong Kong.

Jardine Matheson, the Hong Kong and Shanghai Banking Corporation, and the Peninsular and Orient Steam Navigation Company still control the channels of production and distribution of the drugs from the Far East, through the British dominion of Canada, into the United States.

See Banks Launder Money

HSBC: The World’s Dirtiest Bank (excerpted from Chapter 2: Hong Kong Shanghaied: Big Oil & Their Bankers…)

According to Global Finance, the UK-headquartered HSBC Holdings is the world’s 3rd largest bank with $2.36 trillion in assets. [2] Formerly known as Hong Kong Shanghai Bank Corporation, HSBC has served as the world’s #1 drug money laundry since its inception as a repository for British Crown opium proceeds accrued during the Chinese Opium Wars. During the Vietnam War HSBC laundered CIA heroin proceeds.

JARDINE BANK

The Jardine Matheson and Keswick family control over Opium Smuggling.

The Jardine Matheson and Keswick family control over Opium Smuggling.

See Chatham House: Banks Sell Drugs

The Keswick family have had practically continuous and direct association with the Far East and conglomerate Jardine Matheson and are still on the stock exchange.

Jardine House (Scottish Dope Runners)

33-35 Reid Street, Hamilton, HM EX, Bermuda

Telephone: (441) 292-0515

Fax: (441) 292-4072

Web: http://www.jardines.com

Employees: 240,000

Sales: $27.14 billion (2006)

Stock Exchanges: London Bermuda Singapore Ticker Symbols: JAR (London); JARD (Singapore)

Founded: 1832 as Jardine, Matheson & Company

Incorporated: 1984

Jardin Bank in Shanghai - Keswick Family

'BANKDOMS'...LIKE KINGDOMS, OR DICTATORSHIPS

'Bankdoms,' (much like) kingdoms, republics, (or) dictatorships ~ Hans Schicht

'Bankdoms,' (much like) kingdoms, republics, (or) dictatorships ~ Hans Schicht

Keswick was responsible for opening the Japan office of the firm in 1859 and also expanding the Shanghai office. James Matheson returned to England to fill up the Parliament seat left vacant by Jardine and to head up the firm Matheson & Co., previously known as Magniac, Jardine & Co., in London, a merchant bank and Jardines' agent in England. In 1912, Jardine, Matheson & Co. and the Keswicks would eventually buy out the shares of the Matheson family in the firm although the name is still retained. The company was managed by several family members of William Jardine and their descendants throughout the decades, including the Keswicks, Buchanan-Jardines, Landales, Bell-Irvings, Patersons, Newbiggings and Weatheralls.

An arrangement was made that the management setup of the firm was that a senior partner or proprietor was based in London who had power to appoint senior managers in the firm but had little operational control while a managing director or 'Tai-pan' was stationed in the Far East, either in Shanghai or Hong Kong, who dealt with everyday affairs of the firm. This arrangement had been in practice since the early years of the firm up to the present. Notable Jardines Managing Directors or Tai-pans included Sir Alexander Matheson, 1st Baronet, David Jardine, Robert Jardine, William Keswick, James Johnstone Keswick, Ben Beith, David Landale, Sir John Buchanan-Jardine, Sir William Johnstone "Tony" Keswick, Sir Hugh Barton, Sir Michael Herries, Sir John Keswick, Sir Henry Keswick, Simon Keswick and Alasdair Morrison. There was a point in time in the early 20th century that the firm had two 'Tai-pans' at the same time, one in Hong Kong and one in Shanghai, to effectively manage the firm's extensive affairs in both locations. Both tai-pans were responsible only to the senior partner or proprietor in London who was normally a retired former tai-pan and an elder member of the Jardine family.

Today, the Jardine Matheson Group is still very much active in Hong Kong, being one of the largest conglomerates in Hong Kong and its largest employer, second only to the government. Several landmarks in present day Hong Kong are named after the firm and the founders Jardine and Matheson like Jardine's Bazaar, Jardine's Crescent, Jardine's Bridge, Jardine's Lookout, Yee Wo Street, Matheson Street, Jardine House and the Noon Day Gun. Jardines is also active in China, North America, Europe, Australia, the Middle East and parts of Africa. It went through several major internal changes throughout the 19th and 20th century. In 1947, a secret Trust was formed by members of the family to retain effective control over the company. Jardine, Matheson and Co. offered its shares to the public in 1961 under the tenure of Sir Hugh Barton and was oversubscribed 56 times.

$ KA- CHING

The Keswick family, in consortium with several London-based banks and financial institutions, bought out the controlling shares of the Buchanan-Jardine family in 1959, but subsequently sold most of the shares during the 1961 public offering, retaining only about 10% of the company. The company had its head office redomiciled to Bermuda in 1984 under the tenure of Simon Keswick to maintain control after nearly being taken over by Chinese tycoon Li Ka-shing of Cheung Kong after a hostile raid in 1980. Li, who bought nearly 20% of the company at that time the largest shareholding in the company, agreed to sell his shares to Hongkong Land, a sister company of Jardines, at a premium.

Another reason for the move was fear of the Chinese take-over of Hong Kong and the threat of Chinese retaliation for Jardines drug smuggling past. Subsequent events led to the cross-shareholding structure between Jardine, Matheson & Co. and Hongkong Land which was first instigated in 1980 by then taipan David Newbigging. In 1988, instigated by Brian Powers, the first American taipan of Jardines, the entire corporate structure of Jardine, Matheson & Co., including all its allied companies, were restructured so that a holding company based in London and controlled by the Keswick family would have overall policy and strategic control of all Jardine Matheson Group companies. The firm delisted from the Hong Kong Stock exchange (Hang Seng Index) in 1994 under the tenure of Alasdair Morrison and placed its primary listing in London and its secondary listing in Singapore. The present Chairman of Jardine Matheson Holdings Ltd. is Sir Henry Keswick, who is based in the UK, was the company's tai-pan from 1970 (aged 31) to 1975 and was the 6th Keswick to be tai-pan of the company. His brother, Simon, was the company's taipan from 1983 to 1988 and is the 7th Keswick to be tai-pan. Both brothers are the 4th generation of Keswicks in the company. The firm's present managing director or tai-pan is Anthony Nightingale who is based in Hong Kong.

The organizational structure of Jardines has changed almost totally, but the members of the family of Dr. William Jardine still control the firm through a complex cross-shareholding structure, several allied shareholders and a secretive 1947 TRUST.

Three paintings of the Chinese hong merchants Peabody Essex Museum

1) Howqua, by George Chinnery, 1830 2) Mowqua, by Lam Qua, 1840s 3) Tenqua, by Lam Qua, ca. 1840s

Barings Bank, which had been the banker to the British royal family.

"The Pilgrims Society is a cluster of intermarried old-line rich, royals and robber barons who created the world’s financial structure."

Pilgrims Society Sir Evelyn Baring - A relative, John Francis Harcourt Baring (7th Baron Ashburton): "trustee Rhodes Trust, 1970—1999, chairman, 1987—1999" (digital Who's Who).

John was chairman of Barings Bank from 1974 to 1989, director of the Bank of England from 1983 to 1991, and chair of BP from 1992 to 1995. He spent a year working at J. P. Morgan in New York. Knight of the Garter. Baring rose to lead Barings Brothers after Lord Cromer left the bank in 1970. Barings Bank was bought after the collapse by ING, a Dutch financial institution, for £1 in 1995.

The Baring family is a German and British banking family, descended from Johann (John) Baring (1697–1748), a wool merchant of Bremen. He founded a merchant house in Exeter in 1717. His sons Francis Baring and John Baring moved to London, where they founded the John and Francis Baring Company, commonly known as Barings Bank, in 1762. Barings Bank become one of the leading London merchant banks.[1] Francis Baring was the father of Sir Thomas Baring, 2nd Baronet, who was the father of Alexander Baring, 1st Baron Ashburton. Sir Francis Baring, 2nd Baronet was also the father of Henry Baring and the grandfather of Edward Baring, 1st Baron Revelstoke and Evelyn Baring, 1st Earl of Cromer. Arnulf Baring is a member of the branch of the family resident in Germany. The family's descendants include Diana, Princess of Wales, whose great-grandmother was Margaret Baring, the daughter of Edward Baring, 1st Baron Revelstoke, and through her Prince William, Duke of Cambridge.

Barings Bank was an English merchant bank based in London, and one of the world's oldest merchant banks. It was founded in 1762 and was owned by the German - origin Baring family. Francis Thornhill Baring, 1st Baron Northbrook, was the Chancellor of the Exchequer (26 August 1839 – 30 August 1841) during the First Opium War. Francis Thornhill Baring was the grandson of of Sir Francis Baring, 1st Baronet, the founder of Barings Bank. British Politicians During the 1st Opium War Henry John Temple, 3rd Viscount Palmerston (later Lord Palmerston) was the Secretary of State for Foreign Affairs (18 April 1835 – 2 September 1841, 6 July 1846 – 26 December 1851) William Lamb, 2nd Viscount Melbourne, was the Prime Minister of Great Britain (16 July 1834 – 14 November 1834,18 April 1835-30 August 1841)

In 1762, Francis Baring, in partnership with his brother John, established the London merchant house of John and Francis Baring Company, which by 1807 had evolved into Baring Brothers & Co.. Despite being partially deaf from an early age, Francis did very well and, by the mid-1790s, had the full confidence of the British Parliament, with a solid "connection," a strong family framework and firm financial backing Perkins & Company became the leader in the American pack. It was a family affair. Thomas H. was brother-in-law of Russell Sturgis, an uncle to J.P. Cushing and brothers John M. and Robert B. Forbes. Joshua Bates, a partner in Baring Brothers Bank, handled the family business in London. He was married to a Sturgis. Russell Sturgis's grandson later became Chairman of the Board of Barings.

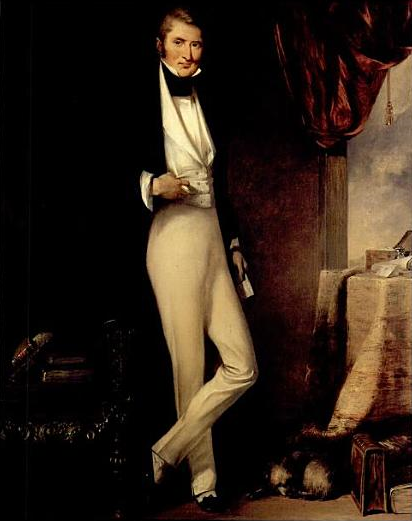

Lord Ashburton in the robes of a Knight Companion of the Order of the Garter

John Francis Harcourt Baring, 7th Baron Ashburton, KG KCVO DL (born 2 November 1928) is a British merchant banker He was the oldest son of Alexander Baring, 6th Baron Ashburton. His maternal grandparents were Lewis Harcourt, 1st Viscount Harcourt and Mary Ethel Burns, daughter of Walter Hayes Burns of New York City. Baring received his education at Eton College and Trinity College, Oxford.

He was Chairman of the Board of the Barings Bank from 1974 to 1989.

The Bank had been founded by his ancestor Francis Baring in 1762.

In the late 1700s England was involved in trade with China through the British East India Company.

Britains Jardine Mathieson & Co. Well before the 1800s arrived, the British had noticed that the Chinese were not buying British trade as rapidly as England was buying Chinese trade, which consisted primarily of silk and tea. British silver was draining from England to China for tea and silk, and not being compensated by a similar return flow of silver for British goods. The Brits had to pay for the tea and silk with silver from the treasury of the British Empire, the Throne's purse, which itself was levered by the privately-held, centralized, fractional-reserve-practicing Bank of England, the Baring Bank, and others.

1783 Baring Brothers become premier merchant of the opium trade.

The Honorable East India Company during this period was controlled by the Baring Brothers Bank Toward the closing decades of the 17th century, the British House of Rothschild would supplant the Baring Brothers as the controlling financial interests in the China opium trade.

The Honorable East India Company during this period was controlled by the Baring Brothers Bank Toward the closing decades of the 17th century, the British House of Rothschild would supplant the Baring Brothers as the controlling financial interests in the China opium trade.

All coup d´etats, revolutions and wars in the 19th and 20th centuries are centered in the battle of the Guelphs to hold and enhance their power, which is now the New World Order.

The power of the Guelphs would extend through the Italian financial centers to the north of France in Lombardy (all Italian bankers were referred to as “Lombards”.

Lombard in German means “deposit bank”, and the Lombards were bankers to the entire Medieval world. They would later transfer operations north to Hamburg, then to Amsterdam and finally to London.

The East India company, together with John Stuart Mill, would finance the University of London. A friend of Mill, George Grote, would give the University of London £6000 to study “mental health”, which began the worldwide “mental health” movement.

The East India Co. was granted a charter in 1600 in the closing days of Queen Elizabeth’s reign. In 1622, under James I, it became a joint stock company. In 1661, in an attempt to retain his throne, Charles II granted the East India Co. the power to make war. From 1700 to 1830, the East India Co. gained control of all India, and wrested the historic monopoly of opium from the Great Moguls.

Opium Wars: Smuggles and Pirates

By 1830 the opium trade at Canton was said to be the most valuable trade in any single commodity, anywhere on earth.

1834,18 April 1835-30 August 1841) Francis Thornhill Baring, 1st Baron Northbrook, was the Chancellor of the Exchequer (26 August ... 30 August 1841) during the First Opium War. Francis Thornhill Baring was the grandson of of Sir Francis Baring,1st Baronet

In 1843, Barings became exclusive agent to the U.S. government, a position they held until 1871.

-

The Honorable East India Company during this period was controlled by the Baring Brothers Bank Toward the closing decades of the 17th century, the British House of Rothschild would supplant the Baring Brothers as the controlling financial interests in the China opium trade.

- The families of Matheson, Keswick, Swire, Dent, Inchcape, Baring and Rothschild controlled the Chinese heroin traffic. The ... Abiel Abbot Low, founder of trading company A. A. Low & Brothers, served as a partner.

- The slavery connections of Northington Grange “A real and material source of wealth and power” Alexander Baring on Britain's slave colonies in the Caribbean (1831) The research follows the 2007 survey by Miranda Kaufmann on the family history of 33 English Heritage properties and their slavery connections. Using databases on slave voyages and slave compensation, Kaufmann's study focused on those who owned property in slave colonies, held government office in such colonies, invested in slaving or traded in slave produced goods, were engaged in abolitionist debates or legal decisions on slavery, or who owned black servants. The Saint Croix Census of 1841 provides a detailed vision of the enslaved labour force who worked on the Baring estates of Upper Bethlehem and Fredensborg 121 Producing sugar and rum, the estate at Upper Bethlehem had around two hundred slaves while that at Fredensborg had just under three hundred slaves.

- 1834,18 April 1835-30 August 1841) Francis Thornhill Baring , 1st Baron Northbrook, was the Chancellor of the Exchequer (26 ... 1841) during the First Opium War. Francis Thornhill Baring was the grandson of of Sir Francis Baring,1st Baronet In ... India, was in a previous secret Yale group, the ``Society of Brothers in Unity.''

- With a solid "connection," a strong family framework and firm financial backing Perkins & Company became the leader in the American pack. It was a family affair. Thomas H. was brother-in-law of Russell Sturgis, an uncle to J.P. Cushing and brothers John M. and Robert B. Forbes. Joshua Bates, a partner in Baring Brothers Bank Commitee of 300, handled the family business in London. He was married to a Sturgis. Russell Sturgis's grandson later became Chairman of the Board of Barings.

ebook A Vindication of England's Policy with Regard to the Opium Trade, by Charles Reginald Haines 1884

pg 124 Sir Evelyn Baring, in his Budget statement for 1882, has given it as his opinion (and who is more able to give an opinion on the subject?) that anaggregate increase of taxation is not possible, even reduction in some branches absolutely necessary; while any essential decrease of expenditure is quiteout of the question. So far from the expenditure showing a tendency to decrease, or even to remain stationary, it has increased last year by a million and a half, this year by three millions and more—under a Liberal Government.

Apart from these direct means for making good the loss of the opium revenue, there is the prospective one of a general increase from reproductive public works, and from a prosperous condition of the country; but it must be borne in mind that this would be greatly lessened and impeded by any increase of taxation.

“It cannot be too clearly understood," says Sir Evelyn Baring (sect. 59), “that neither by any measure tending to develop the resources of the country, nor by any increase of taxation which is practically within the range of possibility, nor by any reduction of expenditure, could the Government of India in any adequate way at present hope to recoup the loss which would accrue from the suppression of the poppy cultivation in India."

On the whole, then, we may conclude with Sir Evelyn Baring that without the revenue which she derives from opium India would be insolvent; that is, her expenditure would be permanently in excess of her income. India is by no means a rich country except in the language of poetry, and her inhabitants are perhaps the poorest in the world, the average income of the ryot being twenty-seven rupees a year! On the other hand, the financial prospects of India are not at present so gloomy as Mr. Fawcett and others would have us believe, but under a succession of able financiers, like Sir John Strachey and Sir Evelyn Baring, a wonderful improvement has been effected; but their efforts would have been crippled and their far-sighted policy paralyzed, if it had not been for the magnificent revenue derived from the sale of opium, which has indeed proved, as it has been called, “the sheet anchor" of Indian finance. And if this revenue be badly acquired, there is no question but that it has been splendidly applied; and if the Chinese will have opium, as there is no doubt they will, the superfluity of their wealth cannot be better spent than in the amelioration of the lot of the Indian ryot. This is the very class which would suffer most severely from any increase of taxation, and,[Pg 126]

As Sir Evelyn Baring says, “to tax India in order to provide a cure—which would almost certainly be ineffectual—for the vices of the Chinese would be wholly unjustifiable." In doing a little right to China, let us beware lest we do a great wrong to India.

As to the effects upon Indian commerce of a large diminution of the opium trade, India would lose her present large profits on a product of which she owns a natural monopoly. She would also be obliged to increase her exports largely, the value of which would consequently be depreciated; except that the Indian tea-trade would be benefited by a disturbance of the China trade. Further, India would be forced to reduce her imports, however necessary these may be. Lastly, there is a prospect of a fall in the rate of exchange, and a further depreciation of silver, which would increase her liabilities and imperil her financial position.

The Panic of 1890

Later in the 1880s, daring efforts in underwriting got the firm into serious trouble through overexposure to Argentine and Uruguayan debt. In 1890, Argentine president Miguel Juárez Celman was forced to resign following the Revolución del Parque, and the country was close to defaulting on its debt payments. This crisis finally exposed the vulnerability of Barings position. Lacking sufficient reserves to support the Argentine bonds until they got their house in order. Through the organisational skills of the then governor of the Bank of England, William Lidderdale, he arranged a consortia of banks headed by former govenor Henry Hucks Gibbs and his family firm of Antony Gibbs & Sons to bail Barings out and then support a bank restructuring. The resulting turmoil in financial markets became known as the Panic of 1890.

Barings did not return to issuing on a substantial scale until 1900, concentrating on securities in the United States and Argentina. Its new, restrained manner, under the leadership of Edward's son John, made Barings a more appropriate representative of the British establishment. The company established ties with King George V, beginning thus a close relationship with the British monarchy that would endure until Barings' collapse in 1995. Diana, Princess of Wales, was a great-granddaughter of a Baring. Descendants of five of the branches of the Baring family tree have been elevated to the peerage: Baron Revelstoke, Earl of Northbrook, Baron Ashburton, Baron Howick of Glendale and Earl of Cromer.

Barings was brought down in 1995 due to unauthorized trading by its head derivatives trader in Singapore, Nick Leeson. Because of the absence of oversight, Leeson was able to make seemingly small gambles in the futures arbitrage market at Barings Futures Singapore and cover for his shortfalls by reporting losses as gains to Barings in London.

The British East India Company was all about setting up a law about moving the goods and the money internationally.

The Order invariably enlists “the law” against its enemies.

The East India Co. originated as the London Staplers, was later known as the London Mercers Co., merchant guilds which held monopolies over certain avenues of commerce. It was a direct offshoot of the commercial banking establishments of northern Italy, Venice and Genoa.Related firms were the German Hansa, and the Hanse of the Low Countries, which was headquartered in Bruges. It was also allied with the Levant Co. and the Anglo-Muscovy Co. Sebastian Cabot, whose descendants are prominent in American banking and intelligence, raised the seed money for Anglo-Muscovy in Italy and London. The company operated northern overland trade routes from the Baltic to India and China.

1843 Port of Shanghai opened to foreign trade.

1843 Port of Shanghai opened to foreign trade.

The first lot in the port is rented by Britains Jardine Mathieson & Co.

Other lots are rented by Sumuel Russell, an American representing Baring Brothers. Captain Warren Delano (FDRs grandfather) becomes a member of the Canton Regatta Club, and enters into dealings with the Hong Society.

Delano founds his fortune on opium trafficking into China, and later becomes the first vice chairman of the US Federal Reserve Board.

Until 1792 part of the Perkins family shipping business, along with their Cabot relations was the slave trade. In 1789 Thomas H. Perkins first went to China with Elias Derby from Salem, Massachusetts. A "loyalist" cousin, who fled America during the War of Independence, George Perkins was a merchant in Symrna. With a solid "connection" a strong family framework and firm financial backing Perkins & Company became the leader in the American pack. It was a family affair. Thomas H. was brother-in-law of Russell Sturgis, an uncle to J.P. Cushing and brothers John M. and Robert B. Forbes. Joshua Bates, a partner in Baring Brothers Bank, handled the family business in London. He was married to a Sturgis. Russell Sturgis's grandson later became Chairman of the Board of Barings.

Perkins Co. found that illegality both in nature and operation discouraged competition and used sporadic attempts by the Chinese Government to enforce their opium prohibition, "to [build] the machinery that allowed it to control the Canton market for Turkish opium. "Perkins & Company" became the first American firm to operate a "storeship" at Lintin in a new smuggling procedure. The opium was unloaded onto the "storeship" then the trading vessel would travel on to Canton with chits. The chits were then sold and the opium was retrieved later by the Chinese buyer. Smooth as silk—all illegal—but bribes were paid and business was good.

AMERICAN

BOSTON BRAHMIN

OPIUM CONNECTIONS

See OPIUM DRUG SMUGGLING PIRATES--THE BOSTON BRAHMINS

THOMAS HANDASYD PERKINS Son of Colonel Perkins, was a partner of Baring Brothers in London.

The Honorable East India Company during this period was controlled by the Baring Brothers Bank

Toward the closing decades of the 17th century, the British House of Rothschild would supplant the Baring Brothers as the controlling financial interests in the China opium trade.

- He was invited several times [2] to the annual meeting of the Bilderberg Group.

- He was a director of Dunlop Holdings from 1981 to 1984.

- He was a director of BP from 1982 to 1992.

- He was a director of the Bank of England from 1983 to 1991.

- He was a director of the Barings public limited company from 1985 to 1989.

- He was Chairman of the Board of BP from 1992 to 1995.

Augustine Heard

Augustine Heard (1785-1868): ship captain and pioneer U.S. opium smuggler.

Augustine Heard (1785-1868): ship captain and pioneer U.S. opium smuggler.

John Cleve Green (1800-75): married to Sarah Griswold; gave a fortune in opium profits to Princeton University, financing three Princeton buildings and four professorships; trustee of the Princeton Theological Seminary for 25 years.

Abiel Abbott Low (1811-93): his opium fortune financed the construction of the Columbia University New York City campus; father of Columbia's president Seth Low.

John Murray Forbes (1813-98): his opium millions financed the career of author Ralph Waldo Emerson, who married Forbes's daughter, and bankrolled the establishment of the Bell Telephone Company, whose first president was Forbes's son.

Joseph Coolidge: his Augustine Heard agency got $10 million yearly as surrogates for the Scottish dope-runners Jardine Matheson during the fighting in China; his son organized the United Fruit Company; his grandson, Archibald Cary Coolidge, was the founding executive officer of the Anglo-Americans' Council on Foreign Relations.

Warren Delano, Jr.: chief of Russell and Co. in Canton; grandfather of U.S. President Franklin Delano Roosevelt.

Russell Sturgis: his grandson by the same name was chairman of the Baring Bank in England, financiers of the Far East opium trade. Such persons as John C. Green and A.A. Low, whose names adorn various buildings at Princeton and Columbia Universities, made little attempt to hide the criminal origin of their influential money. Similarly with the Cabots, the Higginsons and the Welds for Harvard. The secret groups at other colleges are analogous and closely related to Yale's Skull and Bones.

The Russell family became thereby a benefactor for Yale University, and W. H. Russell founded the Russell Trust at Yale in 1832. The Russell Trust established the secret order of Skull and Bones, who's initiates, fifteen of them each graduation year, must take oaths of fealty to European powers and to European secret societies.

The Skull and Bones secret society at Yale was established in part by profits made in the opium trade for English banking. This was an outcome of the Tory resistance to the American Revolution, realized by the exercise of international banking.

One of the best known merchants of his time. He was partner of Russell & Sturgis, and of Russell, Sturgis & Co.; of Russell & Co., after the consolidation of the two latter firms. He was later partner and, finally, head of Baring Brothers of London.

THE BARING ARCHIVE SERIES HC2 STATISTICS OF GENERAL TRADE

1828 6 Mar, London: Charles Roberts. Statement of stock of opium in the principal warehouses [London?]; and prices of opium in bond, 1814-28

http://www.baringarchive.org.uk/materials/the_baring_archive_hc2.pdfRussell & Company Records 1820 -1891 Harvard Cite as: Russell and Co./Perkins and Co. Collection. Baker Library Historical Collections. Harvard Business School.

The bank collapsed in 1995 after suffering losses of £827 million ($1.3 billion) resulting from poor speculative investments, primarily in futures contracts, conducted by an employee named Nick Leeson working at its office in Singapore.

Example: The Peerage Pedigree

John Francis Harcourt Baring, 7th Baron Ashburton

SEE THE EAST INDIA COMPANY

SEE JEKYLL ISLAND

SEE NETWORKS

Abiel Abbott Low's son, Abbott Augustus Low (~1843-1912) was with A.A. Low Brothers

Four children survived him: J.C. Low of Albany, A.A. Low Jr. of Manhattan, <strong>Seth Low 2d of Brooklyn, and Mrs. William Raymond. (Abbott Augustus Low Dies. New York Times, Sep. 26, 1912.)

His wife, Marian W. Low, was the daughter of George Cabot Ward, a founder of S.G. and G.C. Ward, and Ward, Campbell & Co., the U.S. agents for Baring Brothers & Co., also a charter member of the Union League Club and a longtime Governor of the New York Hospital. Mrs. Low's brother, Samuel Gray Ward Jr., was with Kidder, Peabody & Co., which became Baring's agent. (An Old Firm Retiring. New York Times, Dec. 1, 1885; Death of George Cabot Ward. New York Times, May 5, 1887.) Her uncle, Samuel Gray Ward Sr., was the auditor of Porto Rico.

Other related firms were the London Company,

chartered in 1606 to establish The Virginian Plantation on a communistic basis, and the Plymouth Company, whose descendants control the New England business world.

SEE THE PURPOSE OF THE SENATE IS TO PROTECT THEIR OPIUM DRUG SMUGGLING MONEY

The Aldrich machine controls the legislature, the election boards, the courts − the entire machinery of the "republican form of government." In 1904, when Aldrich needed a legislature to reelect him for his fifth consecutive term, it is estimated that carrying the state cost about two hundred thousand dollars − a small sum, easily to be got back by a few minutes of industrious pocket-picking in Wall Street; but a very large sum for Rhode Island politics, and a happy augury of a future day, remote, perhaps, but inevitable, when the people shall rule in Rhode Island. Despite the bribery, despite the swindling on registration lists and all the chicane which the statute book of the state makes easy for "the interests," Aldrich elected his governor by a scant eight hundred on the face of the returns. His legislature was, of course, got without the least difficulty − the majority for "the interests" is on joint ballot seventy-five out of a total of one hundred and seventeen. The only reason Aldrich disturbed himself about the governorship was that, through the anger of the people and the carelessness of the machine, a people's governor had been elected in 1903 and was up for reelection; this people's governor, while without any power whatever under the Constitution, still could make disagreeable demands on the legislature, demands which did not sound well in the ears of the country and roused the people everywhere to just what was the source of the most respectable politician's security. So, Aldrich, contrary to his habit in recent years, took personal charge of the campaign and tried to show the people of Rhode Island that they were helpless and might as well quiet down, accept their destiny and spare his henchmen the expense and labor of wholesale bribery and fraud.

But, as a rule, Aldrich no longer concerns himself with Rhode Island's petty local affairs. "Not until about a year or so before it comes time for him to be elected again, does he get active," says his chief henchman, Gen. Charles R. Brayton, the state's boss. "He doesn't pay much attention to details." Why should he?

Politically, the state is securely "the interests'" and his; financially, "the interests" and he have incorporated and assured to themselves in perpetuity about all the graft − the Rhode Island Securities Company, capitalized at and paying excellent dividends upon thirty-nine million dollars, representing an actual value of less than nine million dollars, owns, thanks to the munificence of the legislature, the state's street and trolley lines, gas and electric franchises, etc., etc.

It began in a street railway company of Providence in which Aldrich, president of the Providence council and afterwards member of the legislature, acquired an interest. The sugar trust's Searles put in a million and a half shortly after the sugar trust got its license to loot through Aldrich at Washington; the legislature passed the necessary laws and gave the necessary franchises; Senator Steve Elkins and his crowd were invited in; more legislation; more franchises, more stocks and bonds, the right to loot the people of the state in perpetuity. Yes, Aldrich is rich, enormously rich, and his mind is wholly free for the schemes he plots and executes at Washington. And, like all the Other senators who own large blocks of stocks and bonds in the great drainage companies fastened upon America's prosperity his service is not the less diligent or adroit because he himself draws huge dividends from the people.

The Treason of the Senate: Aldrich, The Head of It All by David Graham Phillips - Cosmopolitan - March 1906

In 1952, Eisenhower — an avid golfer — was running for President, having beaten Robert Alphonso Taft (S&B 1910) for the Republican nomination amidst fisticuffs and the first fully televised convention. Prescott a past president of the United States Golf Association was one of Ike's favorite golfing partners. Prescott's father-in-law, Bert, had also served as president of the USGA and in 1922, initiated an amateur golf tournament between the United States and Great Britain and Ireland. Walker donated the trophy and the newspapers christened it the "Walker Cup."

Prescott Bush won a special election—with Ike's help—in 1952, and became the senior US Senator from Connecticut. He served on the Armed Services Committee and helped to keep Connecticut’s huge defense contractors busy. Roland Harriman, Prescott Bush, Knight Woolley and R. Lovett - all S&B and senior Partners at Brown Brothers Harriman - 1964Prescott Bush had been an operative for Army Intelligence during World War I. He was a liaison to the British and some say he was trained by famous Stewart Menzies, WWII head of the British secret service. Gordon Gray (another one of Prescott's golfing partners) was the first director of the Psychological Strategy Board, having been installed by the "Harriman security regime" in the early 50's. Gray and his four elite Jupiter Island, Florida, neighbors Prescott Bush, Robert A. Lovett, C. Douglas Dillion and "Jock" Whitney, are, along the Dulles and Harriman brothers considered by some historians to be the "fathers of this permanent covert action monolith". The "secret government" in the shadowy realms of intelligence operations that cloaks its actions with cries of national security.

They created this modern wall of deniality for Eisenhower deep within the government-military-industrial complex—that Ike was later to regret. One of Gray's jobs, as Ike's National Security advisor, was "under the guise of 'oversight' on all US covert action, to protect and hide" the "cryptocracy."In 1962, Prescott founded the National Strategy Information Center, with his son, Prescott Bush, Jr. and William Casey, investment banker, OSS veteran —and future CIA director. The center, among other things, laundered funds for the dissemination of "CIA authored 'news stories' to some 300 newspapers."