Contents

- Introduction

- Preface

- Overview

- Relief Valve

- LECTURE 1: Why We Are In The Dark About Money

- LECTURE 2: The Con

- LECTURE 3: The Vatican-Central to the Origins of Money & Power

-

LECTURE 4: London The Corporation Origins of Opium Drug Smuggling

- Early Barter System

- Trade started with a Sail Boat called a Carrack

- Corporations and Maritime Time Line

- Marine Merchants Timeline

- Levant Company

- London The Corporation

- Church of England The Corporation

- Just Steal It - EIC Commits First Corporate Espionage!

- Matheson & Jardine Families

- The Bankster Families Who Control Opium Smuggling

- Imperialism Rules Enlightened Despotism

- Dutch East India Company

- The Honorable East India Company

- Hong Kong Shanghaied

- Chatham House

- Thuggee the First Fraternity

- Bank of England

- Pirate Bankers

- EIA First Contact With Shanghai China

- The Collapse of the Royal African Company: How Open Trade Trumped the Monopoly

- Shanghai and the First Contact with the West

- Opium - TimeLine

- Opium Trade

- The Opium Wars

- Letter to Opium Drug Smuggling Queen Victoria

- Lecture 4 Objectives and Discussion Questions

- LECTURE 5: U.S. Pirates, Boston Brahmins Opium Drug Smugglers

- LECTURE 6: The Shady Origins Of The Federal Reserve

- LECTURE 7: How The Rich Protect Their Money

- LECTURE 8: How To Protect Your Money From The 1% Predators

- LECTURE 9: Final Thoughts

Chatham House is a successor to the old British East India Company

The roots of Chatham House are to be found in Britain's nineteenth-century Opium War policy.

2015 Chatham House, the Royal Institute of International Affairs, is an independent policy institute based in London. Our mission is to help build a sustainably secure, prosperous and just world. "We used #Shodan and found all of the nuclear plants in France that are connected to the internet." - Source 25

DOPE, INC.

The Book That Drove Henry Kissinger Crazy

[international drug trafficking, money-laundering, and state power] Executive Intelligence Review, 1992, paperback (original 1986)

Part 1 excerpted from the book

pxi

The international drug-traffic enters the history books with the rise of the Sufi mystics, Syrian Hashishins (the "Assassins") of Shaykh al-Jabal, in the time of the Assassins' Templar allies. It was spread throughout the Asian by Arab slavetraders. It was taken over from the slave-traders, by the Venetian slave-traders of the Levant Company. When the Levant Company moved into England and the Netherlands, the Levant Company assumed the new name of the "East India Company" of England and the Netherlands. Adam Smith's employers, of the British East India Company, established world-monopoly in the opium-traffic during the eighteenth century, and Britain ran the international drug-traffic, until Yuri Andropov's Soviet KGB entered the traffic, and launched present-day international narco-terrorism against the West during the 1967-1969 interval.

What are, today, the leading financial families of New England and New York, bridge the transition from British to Soviet control of the international drug-traffic. The Perkins) Syndicate of Salem, Massachusetts, were the American drug trafficking partners of the British East India Company during the late eighteenth and the nineteenth centuries: establishing the drug-traffickers' fortunes which are the foundation of the wealth of the so-called "Eastern Liberal Establishment," the New York Council on Foreign Relations, of today. Not accidentally, these same families of Britain and the United States, typified by McGeorge Bundy's circles, are the leading accomplices of the Soviet dictatorship, both in their connections to the drug-money-laundering banking institutions, and in demanding that the United States appease Soviet strategic demands, today. It is no accident, therefore, that David Rockefeller, the founder of the pro-Soviet Trilateral Commission, entered into a partnership with the late, drug-trafficking Meyer Lansky, to turn the Mary Carter Paint Company, into the mob-linked Resorts International and Intertel. In both Britain and the United States, the "families" which built up their fortunes in the proceeds from the nineteenth-century opium traffic, are at the center of an organization known to insiders as the "Trust," the main channel of present-day Soviet KGB policy-shaping influence into policy-making circles of Western Europe and the Americas. It is no accident, that Boston-based U.S. Attorney William Weld, of the White Weld interests, interceded to cover up the money-laundering organization created under present White House Chief of Staff Donald T. Regan, among Merrill Lynch, Credit Suisse, and White Weld, prior to Regan's becoming U.S. Treasury Secretary. It is no accident that Donald Regan has become a leading ally of Secretary of State George Shultz, and of Shultz's Bohemian Grove crony, Henry Kissinger, in supporting operations strategically decisive for Moscow, and contrary to the most vital strategic interests of the United States.

pxiii

Americans, and others, are increasingly fearful of international terrorism. Few, unfortunately, understand that terrorism is so tightly integrated with the international drug-traffic that the two can not be separated from one another.

p3

The kingpins of the U.S. branch of the drug cartel [are] led by Henry Kissinger and the Anti-Defamation League of B'nai Brith.

p8

Although [Henry] Kissinger has been historically a close ally of the most rabid factions inside Israel and within the Zionist establishment in the United States, his primary allegiance through-out his political career has been to the British Crown and its intelligence and financial tentacles.

On May 10, 1982, addressing a celebration at the Royal Institute for International Affairs at Chatham House in London, Kissinger boasted that throughout his career in the Nixon and Ford administrations, he had always been closer to the British Foreign Office than to his American colleagues, and had taken all his major policy leads from London. Kissinger set up the international "consulting firm" Kissinger Associates, in partnership with Britain's Peter Lord Carrington, shortly after he delivered that Chatham House lecture.

Chatham House is a successor to the old British East India Company, and serves as the think-tank and foreign intelligence arm of the British Crown. The roots of Chatham House are to be found in Britain's nineteenth-century Opium War policy.

Kissinger is no stranger to the world of international dope-trafficking. The 1978 edition of Dope, Inc. told how Kissinger played a pivotal role in covering up the involvement of the People's Republic of China in the Southeast Asia Golden Triangle heroin trade in the early 1970s when he was shuttling between Washington and Beijing playing the "China card." Tens of thousands of American GIs who became addicted to drugs in Southeast Asia during the Vietnam War should hold Kissinger at least partially responsible for their habits. Later, during the 1980s, through Kissinger Associates, Henry became a business partner of some of the same Chinese opium lords he protected from American drug enforcement for over a decade.

p11

[The] National Endowment for Democracy (NED), [was] a covert operations funding agency housed in the State Department's U.S. Information Agency. The NED was at the center of the secret support for the Contras [Nicaragua].

p15

Oliver North was in the middle of a major international arms-for-drugs trafficking operation which was run out of his National Security Council office at the Old Executive Office Building next door to the White House.

Colonel North was the day-to-day operations officer for the Contra resupply program. But it was Vice President George Bush, the former CIA director, who was formally in charge of the entire Reagan administration Central America covert operations program. Under National Security Decision Directive 3, signed by Ronald Reagan in May 1982, Bush was placed in charge of two little-known White House secret committees: the Special Situation Group (SSG) and the Crisis Pre-Planning Group (CPPG). Oliver North was the secretary of the CPPG, and it was in this capacity that he ran the Central America spook show-under George Bush.

North's personal notebooks, which catalogued most of his meetings, telephone calls, and personal observations during his White House days, betray the fact that he was well aware that the Contras were being heavily financed by Miami-based cocaine traffickers.

p18

The use of Middle Eastern dope-smuggling networks was as pervasive a feature of the Reagan-Bush era Iran-Contra misdeeds as was the hiring of Colombian cocaine cartel pilots and money launderers to supply the Contras.

p21

For the past 20 years, a large and growing component of Dope, Inc. has been the combined machinery of gangster Meyer Lansky and the Israeli Mossad.

p30

The single, integrated, multinational cartel which runs [the international drug] trade is properly referred to as "Dope, Inc.".

p30

In 1986, EIR [Executive Intelligence Research] researchers concluded that the U.S. drug trade grossed a minimum of $250 billion per year, and that if non-U.S. drug-trafficking and other aspects of the "black economy" (such as the illegal weapons and gold trade) were taken into account, the total figure would be in the range of $500 billion per year... In 1986, world drug trafficking was close to $400 billion. By 1989, the last year for which figures are available, that total had leapt to $558 billion. This is much larger than the annual world consumption of oil.

p31

Dope, Inc.'s annual revenues from street sales of drugs rose from $175 billion back in 1977, to about $400 billion in 1987, to $558 billion in 1989. It has been growing by an average of about 18% per year over the last few years-more rapidly than any productive economy on the face of the Earth. At this rate, Dope, Inc.'s size doubles every five years! Its main components are cocaine, marijuana and hashish, opium and heroin, and other synthetic chemical drugs such as amphetamines, LSD, and so on.

p31

The large international banks that finance the drug trade get it and launder it, using it to prop up their bankrupt international financial system... over the past 12 years, the total cumulative revenue that banks have received from just the Ibero-American portion of the drug trade is almost $2 trillion.

p31

The so-called "War on Drugs" of the Bush administration is a cruel joke. Its official purpose is, at best, to reduce the drug trade by 50% over a 10-year period. In practice, this means Washington is picking and choosing which drug mafias will survive and flourish, and which will be driven out of business-all the while confessing that the best solution of all would be to legalize the entire trade. Throughout, the financial controllers of Dope, Inc. are protected from all prosecution.

p32

Cocaine is the one drug that is produced almost 100% in Ibero-America. The coca leaves are grown here, and the processing laboratories which produce the basic paste of cocaine, and then the refined cocaine, are located here.

In 1989 the continent as a whole produced 703 tons of cocaine hydrochloride, measured in terms of maximum potential cocaine production if all known coca leaf harvested were refined into cocaine. (This is the standard international unit for measuring cocaine.) As the map shows, by 1989 Peru had assumed the lion's share of coca production (373 tons), followed by Bolivia and Colombia. However, the bulk of refining of coca paste or base into pure cocaine occurs in Colombia, followed secondarily by Bolivia and Peru, which refine only a small portion of their coca base. Therefore, the figures should not be misunderstood to imply a lesser role for Colombia in the cocaine trade: They simply indicate that its local production of coca leaves is less than that of Peru and Bolivia.

A critical input to the transformation of coca leaves into cocaine, are certain chemicals, such as ether and acetone. Although these are legal chemicals that have valid industrial uses, they are obtained illegally by the drug runners in large quantities, principally from the United States, Western Europe, and also Brazil.

p33

Historically, the vast majority of Ibero-American cocaine h1 been shipped to the United States from laboratories in Colombia and the trinational triangle in the jungle area where Peru, Brazil, and Colombia meet. Up until a few years ago, the principal route was to the Miami area, by both air and sea. But increased surveillance and interdiction along this route have forced the mafia to develop a second major route through Central America and Mexico, before entering the western United States.

p39

The international drug trade today has amassed such power, wealth, and military might that it almost constitutes a government unto itself, stronger and better supplied than the legitimate governments of many nations.

... Dope, Inc.'s vulnerable flank is the international network of banks and other financial institutions that "launder" the cartel's $558 billion per year in gross revenue. This is the most serious logistical problem faced by the drug trade, where it is most vulnerable. Action by governments against the drug bankers could rapidly shut down Dope, Inc.

... Under U.S. law, banks must report all cash deposits of $10,000 or more. Traffickers have turned to high cash-turnover businesses -such as hotels, casinos, restaurants, and sports events-to launder their money. Since banks don't have to report deposits made by these businesses, drug profits are simply mixed in with legal cash flows.

Cash is also frequently shipped out of the United States. Often planes which fly cocaine into the U.S., fly back loaded with $20, $50, and $100 bills. The bills can then either be deposited directly in offshore banking centers-where no questions are asked-or in remote bank branches in the drug-producing countries. These funds are then wire-transferred out to the offshore banks, into secret accounts where there is no government supervision.

Only a tiny portion (at most 10%) of the drug revenues ever stay in the producer countries-and virtually none of that benefits those nations' productive economies. It is simply a lie to say that the drug trade is a "bonanza" for Ibero-America.

Although no precise figures are available, a leading antidrug prosecutor in Switzerland, Paolo Bernasconi, told Italy's La Stampa newspaper in January 1990 that the leading money-laundering centers include the United States (Miami and Wall Street), Canada, Great Britain, and, of course, Switzerland.

Today many Ibero-American governments, including Venezuela and Mexico, are rushing to change their banking laws so that they can capture some of these "hot money" flows. They foolishly view this as a way to help pay their foreign debt, and solve their financial crises.

The world financial system is now as addicted to drug monies as a junkie is to heroin. Without the regular flow of those monies, the system would collapse.

As the London Economist wrote proudly in 1989: "It is obvious ... that drug dealers use banks.... The business ... has become part of the financial system.... If you had morals or ethics in this business, you would not be in it."

U.S. finances are so dominated by money-laundering that Treasury officials cannot locate 80% of all the dollar bills printed by the U.S. Treasury. Cocaine plays such a predominant role in the U.S. financial system that a significant majority of all $20 bills show physical traces of cocaine dust on them!

Yet no government has ever touched the system which allowed this to occur. At best, a few accounts here and there have been seized. To this day, money-laundering is not even a criminal offense in 8 out of the 15 industrialized nations. In the United States, the center of the problem, government action is a joke: No top management has ever been charged or prosecuted for criminal money-laundering activity.

The banks didn't just take advantage of the drug trade profits; they have promoted their "right" to make use of them. As one banker stated in an off-the-record discussion in London "is the biggest source of new financial business in the world today .... I know banks which will literally kill to secure a chunk of this action."

The banker worked for one of Wall Street's biggest investment houses, Merrill Lynch. The chief executive officer of Merrill Lynch for 12 years was Donald Regan, who served as treasury secretary and chief of staff of the White House for seven years of the Reagan presidency.

The bankers have also sponsored the campaign to legalize drugs. "Cocaine is indeed clearly the most profitable article of trade in the world," the Economist wrote in August 1989. "Vast untaxed profits amass in the conspirators' hands." The time has come to legalize the dope trade, the magazine argued.

p41

A working alliance has been created between the U.S. government and the Cali Cartel, against the MedellIn Cartel of Pablo Escobar and José Gonzalo Rodriguez Gacha. The result has been, as now admitted in such organs of the liberal Establishment such as the Washington Post, that the Cali Cartel has become dominant among the different Colombian groups.

p63

[There is a] single worldwide underground economy servicing the illegal arms and drug trade.

p64

The idea that some of the world's leading private financial institutions were deeply implicated in the witting laundering of hundreds of billions of dollars a year in illegal dope money was seen as the single most shocking fact brought to light with the first release of Dope, Inc. We demonstrated that dope was the largest commodity in international trade, with the exception of petroleum, and that the annual revenues of the narcotics traffic exceeded the national product of most of the world's nations, and the revenues of the largest multinational companies.

The American weekly magazine Saturday Review described our view as "a truly apocalyptic vision." The intervening years and their unbroken string of revelations have shown that the apocalypse is here. After the November 1984 publication of the report on money laundering of the President's Commission on Organized Crime, the March 1983 report of the Permanent Investigations Subcommittee of the U.S. Senate, and countless congressional hearings on the subject of banks and money-laundering, the core contents of Dope, Inc.'s first edition have been restated by official sources.

p65

In 1978, we asked, "How is it possible that $200 billion and up in dirty money, crisscrossing international borders, can remain outside the control of the law? Again, only one possible answer.. can be admitted: a huge chunk of international banking and related financial operations have been created solely to manage ' dirty money. More than that, this chunk of international banking enjoys the sovereign protection of more than a few governments."

Half a decade ago, the charge seemed adventurous to many. Measure it against the conclusions of the study entitled, "Crime and Secrecy: The Use of Offshore Banks and Companies" issued, by the Permanent Investigations Subcommittee of the Senate (SPIS) in 1983 after two years of investigations. The investigators estimated the illegal economy of the United States at up to 10% of reported Gross National Product, or over $300 billion. The study reported that London is the leading center worldwide for the concealment of funds, a charge first made in Dope, Inc.; that two-fifths of all foreign banking activities conducted out of Switzerland are performed with other offshore centers, Switzerland being the center for the practice of "layering" secret financial accounts so that beneficial ownership is impossible to determine.

... The SPIS report concluded that illegal financial operations are now so closely meshed with the offshore banking system in general that the movement of illegal funds may constitute a threat to the security of the world banking system as a whole.

p67

By October 1984, the role of some of Boston and New York's most prestigious commercial banks and investment houses in washing drug money had become such a public scandal that the Reagan administration drafted model legislation allowing for criminal prosecution of bank corporate executives. And the President's Commission on Organized Crime, a blue ribbon panel established by Ronald Reagan by Executive Order 12435 on July 23, 1983, devoted the entirety of its first published report to "The Cash Connection: Organized Crime, Financial Institutions, and Money Laundering." Among the big league financial houses cited in the commission's report for washing hot money were Chemical Bank, Merrill Lynch, Chase Manhattan Bank, and Deak-Perrera.

When the President's Commission on Organized Crime released its report, the bag of tricks of the narcotics traffic was put on display, at least the best known of them: the use of casinos to launder drug money, the corruption and virtual takeover of banks , the participation of such august firms as E.F. Hutton.

p69

The international network we called Dope, Incorporated has not merely flourished; it has risen to commanding heights in the world economy. The International Monetary Fund shamelessly does its bidding among the debtor nations of the developing sector.

p90

The international drug traffic works like a single multinational firm, not unlike the Swiss-based pharmaceuticals cartels-controlling production, supply, distribution, stockpiling, and financing through a single, integrated management.

... Through global control of the means of exchanging dirty money for clean money, through control over the supply of narcotics, through a dominant position in the international markets for precious metals and gemstones, and, above all, through its ability to bring a multi-hundred billion dollar annual cash flow to bear upon the corruption of the legal organs of sovereign national states, Dope, Inc. exercises a unique sort of political control.

... Beyond the specifics of this or that business deal or political arrangement, is a shared world outlook of a sort that has been around since at least the days of the Chaldean-Babylonian empire. It is an oligarchical outlook that views man as essentially a "talking beast," a creature of appetites to be governed through the manipulation of a priesthood whose business it is to apply pleasure and pain to achieve desired results. Narcotics have always played a central role for oligarchs.

It is therefore hardly surprising that the same oligarchy that controls the filthiest elements of the financial underworld today, dominates, and bends to the same purposes, the leading institutions of international finance: the International Monetary Find and the Basel-based Bank for International Settlements.

... Henry Kissinger, together with his international political directorate known as Kissinger Associates, is the individual who stands at the intersection point of every one of these networks: the back-channel with the Soviet Union, the drug and terror networks from Italy to Ibero-America, and the highest levels of finance, including his directorship in American Express, the entity into which has merged a major portion of Dope, command structure.

This command structure contains the following main groups:

* The British combination that controls offshore banking and precious metals trading, i.e., the Hongkong and Shanghai Bank, the Oppenheimer gold interests, top British financial institutions such as Eagle Star Insurance and Barclay's Bank, and their Canadian cousins such as Bank of Montreal and Bank of Nova Scotia;

* The major Swiss banks;

* The continuity of Venetian-Genoese financial manipulations in the personage of the late Roberto Calvi of Banco Ambrosiano, and the shadowy Edmund Safra of American Express;

* The combined offspring of the Swiss bankers and the old European fondi, the international grain cartel of Cargill, Continental (Fribourg family), Bunge, and Louis Dreyfus;

* The Boston Brahmin families and the big American financial institutions associated with Henry Kissinger, including Citibank, Chase Manhattan Bank, and American Express.

p93

We identify a tightly closed financial network whose origins lie in the Dutch and British East India Companies and the modern origins of the narcotics traffic in the British Opium Wars of the 1840s. The paradigm for this network is the London Committee, or British-based directors, of the Hongkong and Shanghai Bank, the central bank for Dope, Incorporated. It ties in directly and immediately to the five big London clearing banks, the five London "gold pool" dealers, and the big Canadian international banks.

This network provides the offshore banking, precious metals, and related capabilities to cause several hundred billion dollars per year to disappear from the streets of New York, Amsterdam, Frankfurt, and Hong Kong, and reappear as apparently legitimate assets wherever convenient. We showed further that Anglo-Chinese collaboration in the Asian opiates traffic was a matter of official policy on the part of the People's Republic of China, and "business arrangements" of the British elite dating back to the first corruption of the Imperial Chinese bureaucracy by the British East India Company.

p94

The Oppenheimer mining group, heirs to the empire of Cecil Rhodes, is the dominant force-in collaboration with HongShang and its Mideast subsidiaries-in the illegal traffic in gold and diamonds through which so much dirty money is turned into untraceable, portable assets. Through its diamond monopoly, De Beers, its mining corporations, Anglo-American Mining and Consolidated Gold Fields of South Africa, through its commodity trading organization, Phibro, the Oppenheimer group has expanded its tentacles across the world and, most of all, in the United States.

p95

The old United Fruit Company, renamed United Brands in the 1960s, has been the center of American organized crime since the turn of this century ... United Fruit's banana boats coming into Baltimore harbor have been the freest vehicle for the physical passage of contraband into the United States. In its successive corporate reorganizations, United Brands has since wound up in the hands of Cincinnati, Ohio insurance financier Carl Lindner, the principal business partner through the last three decades of Michigan organized crime heir Max Fisher. And through an entanglement of financial interests that might have been invented by a gaudy but unimaginative mystery novelist, the fate of United Brands has been intertwined with that of American Express, the world's most efficient silent money-mover, and the prince of Levantine money-laundering, Syrian-Swiss financier Edmund Safra. American Express, the monster that devoured half the old great houses of Wall Street, ties together the United Brands crime and smuggling capability, the financial networks who created and funded the Argentine Monteneros and other terrorist organizations, as well as the Swiss-based interests who have acted, for a generation, as the private couriers of the Soviet Union in the international gold markets.

p97

Investment banking in the United States is now almost wholly controlled by the ancient European fondi, that is, family trust funds whose pedigree goes back to the financing of the Crusades by Genoa and Venice.

From 1971 to 1981, in the decade after then-Treasury Undersecretary Paul Volcker removed its gold backing, the U.S. dollar fell to a mere 60% of its pre-devaluation level, while the combined effects of inflation and lower stock prices devalued American equity to about 30% of its 1971 level in terms of gold. From the standpoint of the old oligarchical fondi, secured through gold, American equity could be had for a fifth of its pre-1971 price during the late 1970s.

A similar collapse of the dollar and equity values occurred during the years 1929-1933. With stock prices at a fraction of their previous values, and the economy in ruins, President Franklin Roosevelt was persuaded by the American friends of John Maynard Keynes to force a devaluation of the dollar in 1932, giving the old fondi-particularly the fortunes of the Franco-Swiss-Italian "gold bloc"-the chance to buy into American equity at distress prices comparable to those available during the late 1970s.

Among modern financial institutions, the Assicurazioni Generali of Venice, the heir to the old Venetian fortunes, provides the most clues to the operations of the fondi. The "Generali," as an insurance organization, is a clearing house for the operations of numerous fondi, each one represented by its frontman, one of the principal European investment banks. Its board of directors consists of the principal banking fortunes of Western Europe.

p99

Assicurazioni Generali and the Bank for International Settlements of Basel (the "central bank for central banks"), are the world's only financial institutions to keep their books in the old pre-war Swiss gold franc, the "hard currency" which the fondi employed to buy American equities at a dime on the dollar during the first fumbling years of the Roosevelt administration.

They waited long to avenge themselves against the upstart United States. Their chance came with the break of the dollar from its gold backing in 1971.

... One by one ... major Wall Street houses fell under the control of the old European fondi. The dominant mergers and acquisitions operation on Wall Street, Lazard Frères, had never been an American house in any event; it was always dominated by the French-Jewish David-Weill family, and only managed for the interim by its then chairman, André Meyer, when no suitable family member was available.

Drexel Burnham Lambert, the sixth-largest house, sold out its entire capital to the Lambert family of Brussels, the Belgian cousins of the Rothschild family.

A.G. Becker, an old-line Chicago brokerage firm, merged into a ménage-à-trois with S.G. Warburg, the supposedly independent branch of the Warburg banking family, and the ancient French-Ottoman Empire firm, the Banque de Paris et des PaysBas (Paribas), to create Warburg-Becker-Paribas (subsequently merged into Merrill Lynch during 1984).

With virtually no exceptions, Wall Street's major houses sold out to the fondi.

Finally, in 1981, Wall Street's most powerful investment bank (with the possible exception of Henry Kissinger's employer Goldman Sachs), Salomon Brothers, merged with Phibro, the trading arm of the Oppenheimer interests.

p102

About $100 billion in banking assets in the Bahamas alone, as well as substantial operations in the British Virgin Islands, Netherlands Antilles, Cayman Islands, and other Caribbean banking centers, move the money that disappears from the world's balance sheet in the form of the $200 billion "statistical discrepancy". Chief investment banker to the region is the International' Trust Corporation, or Itco, created by Anglo-American in consortium with Barclays Bank of the U.K., the Royal Bank of Canada, and N.M. Rothschild of London - Itco creates banks, investment companies, commodities firms, tax shelters, trust funds, and insurance and reinsurance outlets throughout the Caribbean, smoothing contacts with local bank regulators and backstopping the legal position of the offshore market operators with which it deals. Itco is, in effect, the offshore-banking sister subsidiary of Phibro.

p103

David Rockefeller's Chase Manhattan Bank... In 1966, a memo circulated in Chase's international division argued explicitly that the bank should seek illicit international funds as new sources of deposits. In Chase's international department, this became referred to as "looking for mafia money."

p106

When Henry Kissinger was elected to the board of directors of American Express. In March 1984, a circle was completed which had begun with the wave of foreign takeovers of American securities houses during the 1960s and 1970s. George Ball's old firm, Lehman Brothers, had long since been absorbed by its great rival among the old-line German-Jewish Wall Street houses, Kuhn Loeb, to form Lehman Brothers-Kuhn Loeb. Shearson Hayden Stone, the second retail broker after Merrill Lynch, had repeated Merrill Lynch's march into investment banking by absorbing the third of the old-line Gennan-Jewish firms, Loeb Rhoades. Now American Express, in turn, swallowed up Shearson-Loeb Rhoades and Lehman-Kuhn Loeb, bringing under a single umbrella a large part of ... as the supposedly respectable interests behind organized crime and the drug traffic.

... Shearson Lehman American Express, as the ultimate Wall Street merger calls itself, is the phoenix which has arisen from the ashes of the offshore money markets. The new entity is effectively controlled, in turn, by two of the world's shadiest financiers, Edmund Safra and Carl Lindner, each of whom owns about 4% of the stock. Lindner, as noted earlier, owns the old United Fruit dope-pushing apparatus.

p107

Henry Kissinger, who serves as vice chairman of the International Advisory Board of' Chase Manhattan Bank (he was chairman until David Rockefeller retired from the bank and moved to its International Advisory Board); adviser to Goldman Sachs; and a consultant to dozens of leading corporation financial institutions through Kissinger Associates.

The members of Kissinger Associates represent a de facto board of directors for the entity we call Dope, Incorporated.

p108

Britain's Lord Carrington, the cofounder of Kissinger Associates until his move to NATO headquarters in Brussels... Lord Carrington was replaced on the Kissinger Associates board in mid-1984 by the chairman of the London merchant bank S.G. Warburg, Lord Eric Roll of Ipsden. Lord Roll had just completed a reorganization of London Warburg interests under the umbrella of the Warburg holding company Mercury Securities.

... The staff of Kissinger Associates is headed by Lawrence Eagleburger, the former highest-ranking member of U.S. foreign service, and a Kissinger protégé since the Nixon days. In a 1984 series on Jamaica's marijuana economy, the New York Times ridiculed Eagleburger's claims that, in supporting the Edward Seaga regime in Jamaica, he had no idea that Seaga had intentionally made marijuana the country's principal cash crop. Seaga had announced his intention to the Washington Post and on the U.S. network television program "Face the Nation."

The intertwining of interests represented in Kissinger Associates is not new. On the contrary, these are representatives of the ancient fondi who have collaborated for centuries. What is new and ominous is that the men who perform the dirty work of the fondi have moved out of shadows of Caribbean offshore banking and Hong Kong smuggling, and into the board rooms of the most powerful American financial institutions, and close to the councils of the United States government itself. It is even more ominous that the major conduit for the political influence of the Soviet Empire in American politics has now become the point of interchange of the constituent parts of Dope, Inc., doubly so in the context of the Soviet move into the financial underworld.

Henry Keswick: Chairman of Jardine Matheson, once known as one of the largest opium-smuggling companies of the world.

According to EIR, they are still involved in this type of business today. His brother, John Keswick, a backer of the WWF, is chairman of Hambros Bank (Peter Hambro is a member of the Pilgrims Society) and a director of the Bank of England. The Keswick family controls Jardine Matheson.

Formerly known as Hong Kong Shanghai Bank Corporation, HSBC has served as the world‟s #1 drug money laundry since its inception as a repository for British Crown opium proceeds accrued during the Chinese Opium Wars.

online pharmacy sites

Banks make money from online pharmacy sites that sell a variety of prescription drugs without requiring a prescription.

More than half of all sales at the world's largest rogue Internet pharmacy in the last four years were charged to credit and debit cards issued by the top seven card-issuing banks.

Policymakers could stop online drug sales by legislating card-issuing banks to stop accepting these charges.

The spam ecosystem could be crippled if banks stopped processing payments to a handful of institutions. Technically, if [card-issuing] banks were willing to adopt a blacklisting approach, there is absolutely no way these pharma outfits could keep up.”

The Glavmed sales using cards issued by the top seven credit card issuers were almost certainly higher than listed in the chart above. About 12 percent of the Glavmed sales could not be categorized by bank ID number (some card issuers may have been absorbed into larger banks). Hence, the analysis considers only the 88 percent of Glavmed transactions for which the issuing bank was known. More significantly, the figures in this the analysis do not include close to $100 million in sales generated during that same time period by Spamit.com, a now defunct sister program of Glavmed whose members mainly promoted rogue pharmacies via junk e-mail; the leaked database did not contain credit or debit card numbers for those purchase records.

Researchers discovered that 95 percent of the credit card transactions for the spam-advertised drugs and herbal remedies they bought were handled by three financial companies — based in Azerbaijan, Denmark and Nevis West Indies. The full paper is available here (PDF).

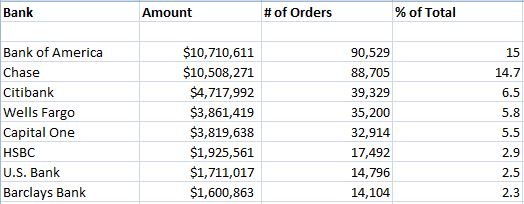

15% of all Glavmed purchases (approximately $10.7 million in rogue pill buys) were made with cards issued by Bank of America.

KrebsOnSecurity got a copy of Sales data stolen from Glavmed, a Russian affiliate program that pays webmasters to host and promote internet pharmacys. The Glavmed database, includes credit card numbers and associated buyer information for nearly $70 million worth of sales at Glavmed sites between 2006 and 2010.

I sorted the buyer data by bank identification number (BIN), indicated by the first six digits in each credit or debit card number. My analysis shows that at least 15% of all Glavmed purchases (approximately $10.7 million in rogue pill buys) were made with cards issued by Bank of America.

I asked Igor Gusev, the founder of Glavmed. Gusev is a fugitive from his native Russia, which last year lodged criminal charges against him and his business. In a phone interview with KrebsOnSecurity, Gusev said putting more concerted pressure on the merchant banks would decimate the rogue pharmacy industry, which tends to coalesce around a handful of processors and switch processors in lockstep when forced to move. For example, since the University of California study was published, the pharmacies featured in the study that were processing atAzerigazbank (AG Bank) in Azerbaijan stopped using AG Bank and moved their business to another institution in that country — Bank Standard.

“They need to put pressure on the card processors which are monsters [that] only regulate on very negative public pressure,” Gusev said. “I think it would be a very powerful strike, and online pharma would be dead within two years if they could somehow switch off the merchants who [are] connected to online pharma.”

BCCI-CIA

The BCCI-CIA Connection: Just How Far Did It Go?

NEWSWEEK magazine issue dated Dec 7, 1992

BCCI was involved in some of the most sensitive intelligence operations of the Reagan-Bush years, including the secret sales of arms to Iran. When questions were raised about the CIA's ties to BCCI after the shutdown of the bank, however, spokesmen for the agency insisted that its hands were clean. "Any allegations of unlawful use of BCCI by the agency are without foundation," the CIA said in a statement.

Congressional investigators and others familiar with BCCI have their own theories about the CIA's conduct. There are strong suspicions that the agency wanted to protect an important intelligence asset.As Norman Bailey, a former National Security Council official, said, the CIA was not interested in "blowing the BCCI cover." There is another alarming possibility: some investigators believe a portion of money stolen from BCCI's depositors financed covert operations sponsored by the U.S. government. If BCCI's frauds were exposed, this source of funds would dry up. There are even indications that CIA officials were involved in the founding of BCCI.

One former officer of the bank recalls a conversation he had in the early 1980s with a close associate of Abedi's, a Pakistani who had worked for United Bank and then joined BCCI when it was established. The Pakistani said that Abedi had worked with the CIA during his United Bank days and that the CIA had encouraged him in his project to launch BCCI, since the agency realized that an international bank could provide valuable cover for intelligence operations. The Pakistani mentioned one U.S. intelligence official by name: Richard Helms, the director of the CIA until early 1973. Helms later became a legal client of Clark Clifford's and a business partner of two BCCI insiders. "What I have been told," says this source, "is that it wasn't a Pakistani bank at all. The guys behind the bank weren't Pakistani at all. The whole thing was a front."

Helms has described reports of his involvement in the BCCI takeover of First American as absolute nonsense. Yet regardless of what Helms says, no one can deny that virtually every major character in the takeover was connected in one way or another to U.S. intelligence:

George Olmsted, head of the OSS's China section during the war, controlled Financial General Bankshares (later First American Bankshares) until 1977.

BCCI: The Bank of the CIA

Jack Colhoun

Covert Action Quaterly Spring 1993

Jack Colhoun was Washington correspondent for the (New York) Guardian news weekly from 1980 to 1992. He has a Ph.D. in history and specializes in post-World War II U.S. foreign policy. His soon-to-be-published book The George Bush File (Los Angeles: ACCESS, 1993) includes reprints of several of his articles cited below.

The Bank of Credit and Commerce International (BCCI) scandal opens a window with a spectacular view of a subject usually shrouded in secrecy: How the CIA uses banks to finance clandestine operations.

The view is spectacular because BCCI, which earned the moniker the “Bank of Crooks and Criminals International,” worked closely with former Director of Central Intelligence William Casey and the Reagan administration's off-the-shelf arms Enterprise. BCCI financed some of the Enterprise's arms-for- hostages deals with Iran. Arms merchants linked to the October Surprise banked with BCCI. The CIA funneled funds through the bank to underwrite the Agency's secret wars in Afghanistan and Nicaragua.

But BCCI's ties to the shadowy world of intelligence go deeper. Clark Clifford and Richard Helms--retired, but still connected senior members of the U.S. intelligence community--helped pave the way for BCCI's secret acquisition of the Washington, D.C.- based banking network, Financial General Bankshares. Sheikh Kamal Adham, the founder of Saudi Arabia's intelligence service, also played a key role on behalf of BCCI in the takeover of Financial General, which was renamed First American Bankshares.

Casey met “every few months” with Agha Hassan Abedi, the Pakistani founder of BCCI, in Washington, D.C. and Islamabad, Pakistan, over a three-year period in the 1980s. Casey and Abedi talked about Iran-Contra arms deals, the Agency-funded war in Afghanistan, and the ever volatile situation in the Persian Gulf. Abedi even made arrangements for Casey's travels in Pakistan.1

1. For the Casey-Abedi meetings, see Peter Truell and Larry Gutwin, False Profits: The Inside Story of BCCI, The World's Most Corrupt Financial Empire (Boston: Houghton Mifflin, 1992), p. 133; and NBC News, Sunday Today, February 23, 1992.

Shanghai and the West: First Contact James Spigelman Scholarly PapersAbstract: This paper explores the first contact between China and the West in Shanghai in the 1830’s. Contact began with a covert mission for the East India Company on The Lord Amherst in 1832. The mission delivered a petition requesting the right to trade in Shanghai, contrary to the rule that all such trade had to occur through Guangzhou (Canton). Shanghai was already a great trading port and mercantile city. The geography and social structure of the city at the time is set out in detail. This first contact was followed up immediately by the British opium smugglers, based in Guangzhou, led by William Jardine. Those activities were supported by a Protestant missionary, Karl Gutzlaff, on the Jardine Matheson & Co opium clipper The Sylph.

Number of Pages in PDF File: 44