Contents

- Introduction

- Preface

- Overview

- Relief Valve

- LECTURE 1: Why We Are In The Dark About Money

-

LECTURE 2: The Con

- The Banker Explained - The Wizard of Oz

- Why Do We Need Banks?

- What Bank Supervision?

- Banks Too Big To Fail

- Banks Cheat

- Banks and Money Laundering

- Banks Sell Drugs

- Money is NOT the same as Currency

- Currency Markets Are Rigged

- HFT High Finance Trading Predators

- Libor

- London Gold Fix Proof of Bank Manipulation

- QE Quantitative Easing

- A Trust Deficit Caused by Predator Bankers' Secrets

- HSBC The Pirate Bank

- HSBC The Dirtiest Bank

- Propaganda

- Banks Role in Terrorism

- The Octopus

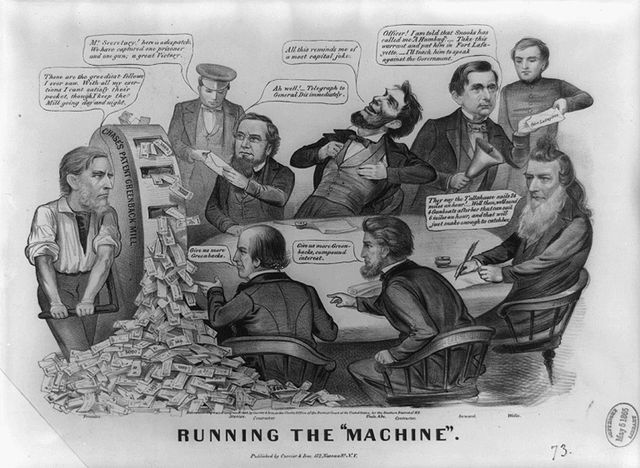

- The First Banks in America

- History of Banking – Index (by date)

- Wealth Distribution and Why do the Rich Get Richer?

- Learn How Lobbyists Buy Politicians

- Commerce Without Conscience

- The Shattered American Dream

- United States Treasury Department

- About Gold and Fort Knox

- Paying Taxes in April

- Lecture 2 Objectives and Discussion Questions

- LECTURE 3: The Vatican-Central to the Origins of Money & Power

- LECTURE 4: London The Corporation Origins of Opium Drug Smuggling

- LECTURE 5: U.S. Pirates, Boston Brahmins Opium Drug Smugglers

- LECTURE 6: The Shady Origins Of The Federal Reserve

- LECTURE 7: How The Rich Protect Their Money

- LECTURE 8: How To Protect Your Money From The 1% Predators

- LECTURE 9: Final Thoughts

The Law is an extension of Politics

and is used to separate you from your property, money, and privacy.

2015 Lawsuit accuses 22 banks of manipulating U.S. Treasury auctions

Treasury Manipulation Complaint

Twenty-two financial companies that have served as primary dealers of U.S. Treasury securities were sued in federal court on Thursday, in what was described as the first nationwide class action alleging a conspiracy to manipulate Treasury auctions that harmed both investors and borrowers. The State-Boston Retirement System, the pension fund for Boston public employees, accused Bank of America Corp's (BAC.N) Merrill Lynch unit, Citigroup Inc (C.N), Credit Suisse Group AG CGSN.VX, Deutsche Bank (DBKGn.DE), Goldman Sachs Group Inc (GS.N), HSBC Holdings Plc (HSBA.L), JPMorgan Chase & Co (JPM.N), UBS Group AG (UBSN.S) and 14 other defendants of illegally trying to profit on the sale of Treasury bills, notes and bonds at investors' expense. According to the pension fund's complaint, filed in U.S. District Court in New York, the banks used chat rooms, instant messages and other means to swap confidential customer information and coordinate trading strategies in the roughly $12.5 trillion Treasury market. This enabled the banks to inflate prices on Treasuries they sold to investors in the pre-auction "when issued" market, and deflate prices when they bought Treasuries to cover their pre-auction sales, violating antitrust laws, according to the complaint. Primary dealers are the banks authorized to transact directly with the Federal Reserve. They are big players in Treasury bond auctions and act as market makers in the secondary market. The pension fund said its "expert economists" observed wide gaps between when-issued and auction prices around December 2012, but that these gaps narrowed significantly as the U.S. Department of Justice and other regulators began probing alleged manipulation of the London interbank offered rate, a benchmark used to set interest rates for trillions of dollars worth of loans around the world. Media reports last month said the Justice Department was also investigating possible collusion in Treasury auctions. "The scheme harmed private investors who paid too much for Treasuries, and it harmed municipalities and corporations because the rates they paid on their own debt were also inflated by the manipulation," Michael Stocker, a partner at Labaton Sucharow, which represents State-Boston, said in an interview. "Even a small manipulation in Treasury rates can result in enormous consequences." The lawsuit seeks class-action status on behalf of investors in Treasury securities, including futures and options, from 2007 to 2012, and unspecified triple damages. Spokespeople for Bank of America, Citigroup, Credit Suisse, Deutsche Bank, Goldman, HSBC and UBS declined to comment.

FRAUD

Treasury flash crash

CHEATING IN THE TREASURY MARKET

CME Group, Inc. operates securities and commodity exchanges

The primary Treasury market is how the United States raises money to pay for its massive annual deficits. And the government depends on a robust secondary market of buyers with an appetite to bet on the U.S. government. Recurring glitches in the Treasury market could spook buyers in deeply interconnected markets, and grind the gears of a global market investors now see as nearly risk free.

"You're basically trading with yourself. You can spoof the markets." The source said high-frequency traders can use self-trading to essentially force the market to tick higher on a thin trading day, and then buy ahead of the market uptick they themselves are creating. "You can fool other programs in a very thin market by trading with yourself," the source said. "And the cherry on top is you get more rebates from the exchange." In a footnote on page 32, investigators wrote: "At times, self-trading may reflect unlawful conduct. ...

On Oct. 15, 2014 The report was focused on the secondary market, not the primary market which is how we fund the government, in New York, something went wrong with the massive global Treasury market. Without warning—and for no apparent reason—Treasury yields dropped a harrowing 16 basis points. Then just as suddenly they snapped back. It was all over by about 9:45 a.m. And no one had any idea why. The remaining 68 pages of their report detailing the surprising things they found when they looked under the hood of the global Treasury market. It was not clear to the authors of the report whether what they found had direct bearing on the flash crash. But it did paint a picture of a Treasury market that is not what many people think it is. What they found is that the Treasury market, long assumed to be a sleepy, low-risk market involving the U.S. government and the nation's largest banks, had actually become an electronic bazaar dominated by high-frequency traders. On the day of the flash crash, principal trading firms—a term the report used to describe a group that includes many of the biggest high-frequency trading firms on Wall Street—"accounted for more than 50 percent of the total trading volume across various maturities in both cash and futures markets," the report found.

The investigators said they found "a heightened level of self-trading during portions of the event window." That means that some traders inside banks, hedge funds or high- frequency trading firms were trading with themselves or with people inside their own firms. Or, more likely, their computer algorithms were.

The report defined self-trading as "a transaction in which the same entity takes both sides of the trade so that no change in beneficial ownership results." It's also known on Wall Street as "wash trading," and it's a practice that regulators frown on in some contexts because it can be used to trick investors into thinking there's a lot of activity in a trade when there is not.

The investigators found a surprising amount of self-trading going on during the Treasury flash crash—an amount they called "substantially higher than average." At the 10-year maturity, the report said, self-trading reached 14.9 percent of the cash market, and 11.5 percent of the futures market as prices moved up. Then, as prices went down self-trading nearly vanished, dropping to 1.2 percent in cash and 4.8 percent in futures. http://www.cnbc.com/2015/07/30/report-contains-red-flag-for-treasury-market-fraud-source.html

7/22/14 GAO Identifies Weakness in FDIC InfoSec Auditors Also Note Problems at Treasury Unit Managing U.S. Debt.

Two separate audits by the Government Accountability Office show information security weaknesses at the Federal Deposit Insurance Corp. and significant deficiencies in information system controls at the Treasury Department unit that manages the federal debt.

The FDIC, the government-owned corporation that insures bank deposits, failed to fully implement controls to authenticate its system users' identities, restrict access to sensitive systems and data, encrypt sensitive data, complete background re-investigations for employees and audit and monitor system access, according to the report issued late last week.

1883 To the Producing Classes in the Union :

The great oppression you feel to-day is produced by Debt and its unfailing attendant, interest or usury.

Until March 1, 2003, the Service was part of the U.S. Department of the Treasury. The Secret Service Division was created on July 5, 1865 in Washington, D.C., to suppress counterfeit currency. Chief William P. Wood was sworn in by Secretary of the Treasury Hugh McCulloch. 1867 Secret Service responsibilities were broadened to include "detecting persons perpetrating frauds against the government." This appropriation resulted in investigations into the Ku Klux Klan, non-conforming distillers, smugglers, mail robbers, land frauds, and a number of other infractions against the federal laws. The Secret Service's initial responsibility was to investigate counterfeiting of U.S. currency, which was rampant following the U.S. Civil War. The agency then evolved into the United States' first domestic intelligence and counterintelligence agency.

One should never underestimate the longevity of these deep-down traditions. They cross oceans and people should be encouraged to investigate this further. "Ruff's research on the integration of Highland culture into black America expands conventional wisdom on Scotland's legacy in the southern states of America.

Although the Enlightenment, especially Francis Hutcheson's A System of Moral Philosophy, inspired the abolitionists in both Britain and America. Scotland's darker role in the slave trade is also well known. Scots were influential in founding the Ku Klux Klan, including the traditional Scottish symbol of the burning cross and the KKK's oath ceremony, which originated from a Highland custom. The campaign against Al Qaeda and its allies is not the United States' first war on terror. In the American South during the aftermath of the Civil War, a terrorist organization emerged. Cloaked in ghostly disguise, it sought to murder and maim in the dead of night as it set out to impose its ideological agenda. For several years the governmental response was ineffectual. Finally, in 1871, the U.S. Congress and President Ulysses S. Grant took action and initiated a new policy in South Carolina. 1871 Oct 12, President Grant condemned the Ku Klux Klan. (MC, 10/12/01)

Q: What's a conspiracy theory or hypothesis?

Answer: A premise whereby you you cannot provide any proof

Q: What's the difference between a conspiracy theory / hypothesis and a strategy?

Answer: Proof of a a strategy which is by design, like divide and conquer.

Colonel House

"The Intimate Papers of Colonel House":

In 1913, Colonel Edward Mandell House helped to pick the charter members of the original Federal Reserve Board. Edward Mandell House (originally “Huis” which became “House”) was born July 26, 1858 in Houston, Texas. He became active in Texas politics and served as an advisor to President Woodrow Wilson, particularly in the area of foreign affairs. House functioned as Wilson's chief negotiator in Europe during the negotiations for peace (1917-1919), and as chief deputy for Wilson at the Paris Peace Conference. He died on March 28, 1938 in New York City.

Edward and his father had friends in the Ku Klux Klan. The Klan dispensed vigilante justice after the Civil War. In 1880 a new legitimate group was in charge of dispensing justice in Texas -- the Texas Rangers. Many of the Texas Rangers were members of the Klan. Edward was the new master. Edward gained their loyalty by stroking their egos. Edward would use his money and influence to try and make them famous. Edward eventually inherited the Texas Ku Klux Klan.

Edward Mandell House helped to make four men governor of Texas: James S. Hogg (1892), Charles A. Culberson (1894), Joseph D. Sayers (1898), and S. W.T. Lanham (1902). After the election House acted as unofficial advisor to each governor. Hogg gave House the title "Colonel" by promoting House to his staff.

Edward wanted to control more than Texas, Edward wanted to control the country. Edward would do so by becoming a king maker instead of a king. Edward knew that if he could control two or three men in the Senate, two or three men in the House; and the President, he could control the country.

Edward would influence the candidate from behind the scenes. The people would perceive one man was representing them, when in reality; an entirely different man was in control. House didn't need to influence millions of people; he need only influence a handful of men. Edward would help establish a secret society in America that would operate in the same fashion -- the Council on Foreign Relations. Edward Mandell House was instrumental in getting Woodrow Wilson elected as President. Edward had the support of William Jennings Bryan and the financial backing of the House of Rockefeller's National City Bank. Edward became Wilson's closest unofficial advisor.

Edward Mandell House and some of his schoolmates were also members of Cecil Rhodes Round Table group. The Round Table Group, the back bone of the Secret Society, had four pet projects, a graduated income tax, a central bank, creation of a Central Intelligence Agency, and the League of Nations.

Between 1901 and 1913 the House of Morgan and the House of Rockefeller formed close alliances with the Dukes and the Mellons. This group consolidated their power and came to dominate other Wall Street powers including: Carnegie, Whitney, Vanderbilt, Brown-Harriman, and Dillon-Reed. The Round Table Group wanted to control the people by having the government tax people and deposit the peoples money in a central bank. The Group would take control of the bank and therefore have control of the money. The Group would take control of the State Department and formulate government policy, which would determine how the money was spent. The Group would control the CIA which would gather information about people, and script and produce psycho-political operations focused at the people to influence them to act in accord with Round Table Group State Department policy decisions. The Group would work to consolidate all the nations of the world into a single nation, with a single central bank under their control, and a single International Security System.

Some of the first legislation of the Wilson Administration was the institution of the graduated income tax (1913) and the creation of a central bank called the Federal Reserve. An inheritance tax was also instituted. These tax laws were used to rationalize the need for legislation that allowed the establishment of tax-exempt foundations. The tax-exempt foundations became the link between the Group member's private corporations and the University system. The Group would control the Universities by controlling the sources of their funding. The funding was money sheltered from taxes being channeled in ways which would help achieve Round Table Group aims.

SEE COLONEL EDWARD MANDELL HOUSE PDF

1914

USA Open for Business

Congress ratifies the 16th Amendment creating the Internal Revenue Service. The amendment was proposed in Congress by Senator Nelson Aldrich.As presented the income tax would only be one percent of income under $20,000, with the assurance that it would never increase.

Before the new central bank could begin operations,the Reserve Bank Organizing Committee, comprised of Treasury Secretary William McAdoo, Secretary of Agriculture David Houston, and Comptroller of the Currency John Skelton Williams, had the arduous task of building a working institution around the bare bones of the new law. But by Nov. 16,1914, the 12 cities chosen as sites for regional Reserve Banks were open for business, just as hostilities in Europe erupted into World War I.

1914-1919: Fed Policy during the War

When World War I broke out in mid-1914, U.S. banks continued to operate normally, thanks to emergency currency issued under the Aldrich-Vreeland Act of 1908.Europe - World war breaks out in Europe. President Woodrow Wilson declares American neutrality.

A central tenet of our republic – a characteristic that separates us from totalitarian regimes throughout the world –

is that the government and private citizens resolve disputes on an equal playing field in the courts. When citizens face the government in the federal courts, the job of the judge is to apply the law, not to bolster the government’s case.

3/13/ - 40 aides that work for Obama owe $833,000 in back taxes By Andrew Malcolm

"Life After Debt" written 2000

"Economic Report of the President"

by David Kestenbaum 10/26/11

The copy of Life After Debt we obtained reads "PRELIMINARY AND CLOSE HOLD OFFICIAL USE ONLY."

The report was intended to be included in the official "Economic Report of the President" — the final one of the Clinton administration. But in the end, people above Jason Seligman decided it was too speculative, too politically sensitive. So it was never published.

Planet Money has obtained a secret government report outlining what once looked like a potential crisis: The possibility that the U.S. government might pay off its entire debt. It sounds ridiculous today. But not so long ago, the prospect of a debt-free U.S. was seen as a real possibility with the potential to upset the global financial system.

We recently obtained the report through a Freedom of Information Act Request. You can read the report called "Life After Debt". It was written in the year 2000, when the U.S. was running a budget surplus, taking in more than it was spending every year. Economists were projecting that the entire national debt could be paid off by 2012.

This was seen in many ways as good thing. But it also posed risks. If the U.S. paid off its debt there would be no more U.S. Treasury bonds in the world. "It was a huge issue ... for not just the U.S. economy, but the global economy," says Diane Lim Rogers, an economist in the Clinton administration. The U.S. borrows money by selling bonds. So the end of debt would mean the end of Treasury bonds.

But the U.S. has been issuing bonds for so long, and the bonds are seen as so safe, that much of the world has come to depend on them. The U.S. Treasury bond is a pillar of the global economy. Banks buy hundreds of billions of dollars' worth, because they're a safe place to park money. Mortgage rates are tied to the interest rate on U.S. treasury bonds. The Federal Reserve — our central bank — buys and sells Treasury bonds all the time, in an effort to keep the economy on track.

If Treasury bonds disappeared, would the world unravel? Would it adjust somehow?

"I probably thought about this piece easily 16 hours a day, and it took me a long time to even start writing it," says Jason Seligman, the economist who wrote most of the report. It was a strange, science-fictiony question. "What would it look like to be in a United States without debt?" Seligman says. "What would life look like in those United States?" Yes, there were ways for the world to adjust. But certain things got really tricky.

For example: What do you do with the money that comes out of people's paychecks for Social Security? Now, a lot of that money gets invested in –- you guessed it — Treasury bonds. If there are no Treasury bonds, what do you invest it in? Stocks? Which stocks? Who picks?

In the end, Seligman concluded it was a good idea to pay down the debt — but not to pay it off entirely. "There's such a thing as too much debt," he says. "But also such a thing, perhaps, as too little."

The danger that we would pay off our debt by 2012 has clearly passed. There are plenty of Treasury bonds around these days. U.S. debt held by the public is now over $10 trillion.

U.S. Tax Code and Regulations

Federal Reserve / Treasury

2013 Term Asset-Backed Securities Loan Facility Fed Program to Spur Lending

11/25/2008

The Federal Reserve Board on Tuesday announced the creation of the Term Asset-Backed Securities Loan Facility (TALF), a facility that will help market participants meet the credit needs of households and small businesses by supporting the issuance of asset-backed securities (ABS) collateralized by student loans, auto loans, credit card loans, and loans guaranteed by the Small Business Administration (SBA).Under the TALF, the Federal Reserve Bank of New York (FRBNY) will lend up to $200 billion on a non-recourse basis to holders of certain AAA-rated ABS backed by newly and recently originated consumer and small business loans. The FRBNY will lend an amount equal to the market value of the ABS less a haircut and will be secured at all times by the ABS. The U.S. Treasury Department--under the Troubled Assets Relief Program (TARP) of the Emergency Economic Stabilization Act of 2008--will provide $20 billion of credit protection to the FRBNY in connection with the TALF. The attached terms and conditions document describes the basic terms and operational details of the facility. The terms and conditions are subject to change based on discussions with market participants in the coming weeks.

- 1913 The Federal Tax Code was put into place and was only a few hundred pages.

- 2013 The U.S. tax code is 72,000 pages.

You can get away with anything if you know where to find the loopholes. Everyone wants to keep it this way. House Committee on Ways and Means (Tax Writing Committee) Ernst and Young and the others insert whatever "special interests" paid them to insert. Private business hires IRS employees and visa versa; it's a revolving door.

GlobalizAtion Starts in 1950

In the 1960's U.S. corporations were beginning to expand internationally. President Johnson imposed capital controls and said if you want to take money out of the country, you have to get a permit from the treasury department which made companies angry. So they cut a deal where they could avoid paying taxes on foreign income as long as they kept it offshore. American law says you can defer recognition of your active business income - that's deferral - as long as you don't bring it back to the United States. If it's offshore, it stays untaxed until you bring it back to the U.S. There are now 50 countries designated as offshore tax havens.

In the 1960's U.S. corporations were beginning to expand internationally. President Johnson imposed capital controls and said if you want to take money out of the country, you have to get a permit from the treasury department which made companies angry. So they cut a deal where they could avoid paying taxes on foreign income as long as they kept it offshore. American law says you can defer recognition of your active business income - that's deferral - as long as you don't bring it back to the United States. If it's offshore, it stays untaxed until you bring it back to the U.S. There are now 50 countries designated as offshore tax havens.

Understand what is going on with your money.

The Treasury Department traces its history back to the tumult of the opening days of the Revolutionary War, when a cash-strapped Continental Congress decided in 1775 to issue paper money backed by nothing more than the promise of eventual repayment in coin, and enlisted residents of Philadelphia to number and count the bills. The department was formally created by Congress in 1789. The first Secretary of the Treasury was Alexander Hamilton, who shortly after being appointed took the bold move of proposing that the federal government assume the wartime debt of the states and pay them off in full.

In the more than 200 years since, Hamilton's heirs have at times been among the most powerful figures in

government, for better or worse.

government, for better or worse.

During the Civil War, Salmon P. Chase created the "greenback" paper currency that fueled the North's victory; Andrew W. Mellon helped bring on the Great Depression by his advice to President Herbert Hoover to cut spending and raise taxes during an economic downturn; after World War II, Henry Morgenthau, Jr., helped create a new system of international finance by leading the conference that created the International Monetary Fund and the World Bank.

President Clinton relied heavily on the advice of Robert E. Rubin, setting aside his desire for an economic stimulus package in favor of a mix of spending cuts and tax increases in 1993. Neither of President Bush's first two secretaries of the treasury, Paul O'Neill and John W. Snow, played much of a role in shaping administration policy, and both were pushed from office. Their successor, Henry M. Paulson Jr., saw his role increase along with the severity of the ills facing Wall Street after the mortgage market collapsed beginning in 2007. Since taking office in January 2009, Treasury Secretary Timothy F. Geithner has played a central role in developing the Obama administration's policies on stemming foreclosures and stabilizing the banking system.

Corporate Greed takes over

"100% of what is collected is absorbed solely by interest on the Federal Debt ... all individual income tax revenues are gone before one nickel is spent on the services taxpayers expect from government."

Ronald Regan 1984 Grace Commission Report

The Private Sector Survey on Cost Control (PSSCC), commonly referred to as The Grace Commission, was an investigation requested by United States President Ronald Reagan, in 1982. The focus of it was waste and inefficiency in the US Federal government. Its head, businessman J. Peter Grace says none of the money collected in income tax goes to running the country. Congress ignored the commission's report. The debt reached $5.8 trillion in the year 2000. The national debt reached 13 trillion after the subprime mortgage-collateralized debt obligation crisis in 2008.

IRS

IRS - Straight Outta Incompetence Aired: 06/24/14

In an ironic bureaucratic twist, the IRS has difficulty finding the proper documentation that it needs to end the government's scrutiny of the organization. (10:02)

Not one dime of IRS money goes to the US Gov't, according to Reagan's Grace Commission: it all goes to pay interest on a bogus debt to the Private Federal Reserve (FED), just to allow paper money to circulate as "Federal Reserve Notes".

How You Can Legally Avoid Paying US Income Tax (Aaron Russo)

also See Sherry Peel Jackson who ended up in jail.

Taxes are only for the redistribution of wealth

Rockefeller is one of the original owners of the Federal Reserve

1963 House Banking Sub Committee reported that Rockefeller through Chase Manhanttan Bank controlled 5.9% of stock in CBS etc. that's why you won't hear about this on TV.

- https://www.youtube.com/watch?v=0_zvAdzrQcQ

- https://www.youtube.com/watch?v=4vrtmBNTPHI

- https://www.youtube.com/watch?v=HHP_doQ7jXI

IRS Puts Open Source Projects Under Microscope, Spawns Nonprofit Black Hole

Since at least 2010, the Internal Revenue Service has flagged applications by open source organizations seeking tax exempt status, according to internal IRS documents released by Congress this week. According to the documents, open source projects have been flagged by the tax agency’s Be On the Look Out, or BOLO, list.

U.S.Corporations pay 0! Taxes

We're Not Broke Documentary 1:20

An expose on how the government has allowed U.S. corporations to avoid paying taxes. It specifically explains Offshore tax shelters and Transfer Pricing.

Corporations in the US pay income tax on their U.S. earnings at 35%, the highest in the world. The effective tax rate is a measure of what they really pay.

70 Billion Dollars a Year is Lost to America

A Multinational corporation can pay in 2010

Nike paid 22.7% JCPenny paid 15.4% Coca-Cola paid 6.6%

Or pay a NEGATIVE tax rate on U.S. earnings

Verizon paid -5.9% Yahoo paid -9,6% DuPont -11.5%

Off Shore Tax Shelters explained

Transfer Pricing

The wealthiest 400 people in America now own more wealth than the bottom 150 million Americans 2013

THE SUPER RICH 400 U.S. taxpayers with the highest adjusted gross income, the effective federal income tax rate—what they actually pay—fell from almost 30 percent in 1995 to just over 18 percent in 2008, according to the Internal Revenue Service. And for the approximately 1.4 million people who make up the top 1 percent of taxpayers, the effective federal income tax rate dropped from 29 percent to 23 percent in 2008. It may seem too fantastic to be true, but the top 400 end up paying a lower rate than the next 1,399,600 or so.

THE SUPER RICH 400 U.S. taxpayers with the highest adjusted gross income, the effective federal income tax rate—what they actually pay—fell from almost 30 percent in 1995 to just over 18 percent in 2008, according to the Internal Revenue Service. And for the approximately 1.4 million people who make up the top 1 percent of taxpayers, the effective federal income tax rate dropped from 29 percent to 23 percent in 2008. It may seem too fantastic to be true, but the top 400 end up paying a lower rate than the next 1,399,600 or so.

Much of the income among the top 400 derives from dividends and capital gains, generated by everything from appreciated real estate—yes, there is some left—to stocks and the sale of family businesses.

The true effective rate for multimillionaires is actually far lower than that indicated by official government statistics.

That’s because those figures fail to include the additional income that’s generated by many sophisticated tax-avoidance strategies.

Several of those techniques involve some variation of complicated borrowings that never get repaid, THEY “typically fund their lifestyle through lines of credit and loan proceeds secured by their assets while paying little or no personal income taxes.”

complex shelters

NO CAPITAL GAINS TAX SALE

Cashing in on stocks without triggering capital-gains taxes

An executive has $200 million of company shares. He wants cash but doesn’t want to trigger $30 million or so in capital-gains taxes.

1. The executive borrows about $200 million from an investment bank, with the shares as collateral. Now he has cash.

2. To freeze the value of the collateral shares, he buys and sells “puts” and “calls.” These are options granting him the right to buy and sell them later at a fixed price, insuring against a crash.

3. He eventually can return the cash, or he can keep it. If he keeps it, he has to hand over the shares. The tax bill comes years after the initial borrowing. His money has been working for him all the while.

PROPERTY

Partnerships that let property owners liquidate without liability

Two people are 50-50 owners, through a partnership, of an office tower worth $100 million. One of the owners—let’s call him McDuck—wants to cash out, which would mean a $50 million gain and $7.5 million in capital-gains taxes.

1. McDuck needs to turn his ownership of the property into a loan. So the partnership borrows $50 million and puts it into a new subsidiary partnership, which contributes the cash to yet another new partnership.

2. The newest partnership lends that $50 million to a finance company for three years, in exchange for a three-year note. (The finance company takes the money and invests it or lends it out at a higher rate.)

3. The original partnership distributes its interest in the lower-tier subsidiary to McDuck. Now, McDuck owns a loan note worth $50 million instead of the property, effectively liquidating his 50 percent interest.

4. Three years later, the note is repaid. McDuck now owns 100 percent of a partnership sitting on a $50 million pile of cash—the amount McDuck would have received from selling his stake in the real estate—without triggering any capital-gains tax.

5. While this cash remains in the partnership, it can be invested or borrowed against. When McDuck dies, it can be passed along to heirs and liquidated or sold tax-free. The deferred tax liability disappears upon McDuck’s death, under a provision that eliminates such taxable gains for heirs.

The Estate Tax Eliminator

How to leave future stock earnings to the kids and escape the estate tax

1. The parent sets up a Grantor Retained Annuity Trust, or GRAT, listing the kids as beneficiaries.

2. The parent contributes, say, $100 million to the GRAT. Under the terms of the GRAT, the amount contributed to the trust, plus interest, must be fully returned to the parent over a predetermined period.

3. Whatever return the money earns in excess of the interest rate - the IRS currently requires 3% remains in the trust and gets passed on to the heirs, forever free of estate and gift taxes.

Executives Who Have Done It:

• GE (GE) Chief Executive Officer Jeffrey Immelt

• Nike (NKE) CEO Philip Knight

• Morgan Stanley (MS) CEO James Gorman

The Trust Freeze

“Freezing” the value of an estate, so taxes don’t eat up its future appreciation

A wealthy couple wants to leave a collection of income-producing assets, such as investment partnerships that own shares valued at as much as $150 million, to their children. So they “freeze” the value of the estate at that moment, maybe 20 years before their death, pushing any future appreciation out of the estate and avoiding what could be a $50 million federal estate tax bill.

1. The best approach is an “intentionally defective grantor trust.” The couple makes a gift of $10 million—the maximum amount exempt from the gift tax for the next two years—to the trust, which lists the children as beneficiaries.

2. The trust uses that cash as a down payment to buy the partnership from the parents through a note issued to the parents, but the partnership contains a restriction on the trust’s use of the assets, thus impairing the partnership’s value by, say, 33 percent. That enables the trust to buy the $150 million partnership for just $100 million.

3. The income produced by the investment partnership helps pay off the note. The tax bill on that income is borne by the parents, essentially allowing gifts exempt from the gift tax.

4. When the note is paid off, the trust owns that $150 million worth of assets, minus the $90 million note and interest—plus any appreciation in the meantime. The trust has swept up a $150 million income-producing concern without triggering the federal estate tax.

The Option Option

Stock options allow executives to calibrate the taxes on their compensation in a big way.

An executive is negotiating his employment contract for the coming five years. The company might offer millions in shares. But who wants to pay taxes on millions in shares?

Better to take options. The executive owns the right to buy the shares at a time of his choosing; he’s been compensated, but he hasn’t paid any taxes. Gains from nonqualified stock options, the most common form, aren’t taxed until the holder exercises them. That means the executive controls when and if the tax bill comes. It isn’t just icing, either. Often it’s the cake.

Executives Who Have Done It (CEOs or co-CEOs as of 2010):

• Lawrence Ellison, Oracle (ORCL)

• Philippe Dauman, Viacom (VIA)

• Michael White, DirecTV (DTV)

• Andrew Gould, Schlumberger (SLB)

• Dave Cote, Honeywell (HON)

• David Pyott, Allergan (AGN)

• Marc Benioff, Salesforce.com (CRM)

• Sanjay Jha, Motorola Mobility (MMI)

• Richard Fairbank, Capital One (COF)

• Howard Schultz, Starbucks (SBUX)

• Jay Johnson, General Dynamics (GD)

• Larry Nichols, Devon Energy (DVN)

• Muhtar Kent, Coca-Cola (KO)

• Paul Jacobs, Qualcomm (QCOM)

• James Rohr, PNC Financial (PNC)

• Louis Chênevert, United Technologies (UTX)

• Fred Smith, FedEx (FDX)

• Bob Kelly, Bank of New York Mellon (BK)

• William Weldon, Johnson & Johnson (JNJ)

• Clarence Cazalot Jr., Marathon Oil (MRO)

• Ed Breen, Tyco (TYC)

• David Speer, Illinois Tool Works (ITW)

• Bob Iger, Disney (DIS)

• Sam Allen, Deere (DE)

• John Hess, Hess (HES)

• Klaus Kleinfeld, Alcoa (AA)

• Bob Stevens, Lockheed Martin (LMT)

• Rich Meelia, Covidien (COV)

• Dean Scarborough, Avery Dennison (AVY)

• George Buckley, 3M (MMM)

• Daniel DiMicco, Nucor (NUE)

• John Donahoe, EBay (EBAY)

• Michael Strianese, L-3 Communications (LLL)

• Ellen Kullman, DuPont (DD)

• Ronald Hermance, Hudson City Bancorp (HCBK)

• Rich Templeton, Texas Instruments (TXN)

• Alan Boeckmann, Fluor (FLR)

• Jen-Hsun Huang, Nvidia (NVDA)

• William Sullivan, Agilent Technologies (A)

• Greg Brown, Motorola Solutions (MSI)

• Jim McNerney, Boeing (BA)

• Michael McGavick, XL Group (XL)

• Scott McGregor, Broadcom (BRCM)

• Frederick Waddell, Northern Trust (NTRS)

• David Mackay, Kellogg (K)

• John Brock, Coca-Cola Enterprises (CCE)

• George Paz, Express Scripts (ESRX)

• Robert Parkinson, Baxter International (BAX)

• Shantanu Narayen, Adobe (ADBE)

• Charles Davidson, Noble Energy (NBL)

• John Pinkerton, Range Resources (RRC)

• Gregory Boyce, Peabody Energy (BTU)

• Kevin Mansell, Kohl’s (KSS)

• Richard Davis, U.S. Bancorp (USB)

• Michael McCallister, Humana (HUM)

• Timothy Ring, C.R. Bard (BCR)

• John Strangfeld, Prudential (PRU)

• Eric Wiseman, VF (VFC)

• Theodore Craver, Edison International (EIX)

• David Cordani, Cigna (CI)

• Chad Deaton, Baker Hughes (BHI)

• John Surma, United States Steel (X)

• Charles Moorman, Norfolk Southern (NSC)

The Bountiful Loss

Using, but not unloading, underwater stock shares to adjust your tax bill

An investor has capital-gains income from a sold-off stock position. Separately, the investor has other shares that are down an equal amount; if he were to sell them, he’d realize a loss to offset the gains and pay no taxes. But no one likes to sell low. So he wants to use that loss without actually selling the shares. IRS rules prohibit investors from taking a loss against a gain and then buying the shares back within 30 days.

1. At least 31 days before the planned sale, the investor buys an equal value of additional shares of the underwater stock.

2. The investor buys a “put” option on the new shares at their current price and sells a “call” option. Now he’s protected from the downside on that second purchase.

3. At least 31 days later, the investor sells the first block of underwater shares. He now has his tax loss, without having taken any additional downside risk from the purchase of the second block of shares.

The Friendly Partner

With this deal, an investor can sell property without actually selling - or incurring taxes

An investor owns a piece of income-producing real estate worth $100 million. It’s fully depreciated, so the tax basis is zero. That means a potential (and unacceptable) $15 million capital-gains tax.

1. Instead of an outright sale, the owner forms a partnership with a buyer.

2. The owner contributes the real estate to the partnership. The buyer contributes cash or other property.

3. The partnership borrows $95 million from a bank, using the property as collateral. (The seller must retain some interest in the partnership, hence the extra $5 million.)

4. The partnership distributes the $95 million in cash to the seller.

Note: The $95 million is viewed as a loan secured by the property contributed by the seller instead of proceeds from a sale. For tax purposes, the seller is not technically a seller, so any potential tax bill is deferred.

The Big Payback

So-called permanent life insurance policies are loaded with tax-avoiding benefits.

A billionaire wants to invest but doesn’t need the returns any time soon and wants to avoid the tax on the profits.

A world of tax-beating products is available through the insurance industry. Many types of so-called permanent life insurance—including whole life, universal life, and variable universal life insurance—combine a death benefit with an investment vehicle. The returns and the death benefit are free of income tax. If the policy is owned by a certain type of trust, the estate tax can be avoided as well. “It is a crucial piece of any high-net-worth tax planning in my experience,” says Michael D. Weinberg, president of an insurance firm that specializes in planning for high-net-worth individuals.

IRA Monte Carlo

Tax advisers recommend converting traditional IRAs to Roth IRAs

High-income taxpayers can now convert traditional IRAs—which allow contributions to be deducted from taxes but incur taxes on distributions—into Roth IRAs, in which contributions are taxed but the distributions are tax-free.

The conversion triggers a one-time tax bill, based on the value of the newly converted Roth IRA. As one might expect, tax experts are recommending that high-net-worth individuals convert their traditional IRAs to Roth IRAs before 2013, when ordinary income rates are likely to go up.

1. Let’s say an investor has one traditional IRA with a value of $4 million.

2. The traditional IRA is split up into four traditional IRAs, each worth $1 million.

3. The investor converts all four to Roth IRAs at the beginning of the year.

4. The IRS effectively allows taxpayers to undo the conversion for up to 21 months. So in 21 months, the investor looks at the performance of the IRAs. Say two of them go up, from $1 million to $2 million, and two drop, from $1 million to zero. Because the IRAs were split into four, the investor can change her mind on the two that went down and revert those back to traditional IRAs. Thus, she owes taxes on only the two contributions that went up in value, and nothing on the two that went down, cutting her tax bill in half. This lops 21 months of risk off the bet that paying taxes now will be paid off with tax-free appreciation later.

The Venti

Putting a chunk of pay in a deferred-compensation plan can mean decades of tax-free growth

Executives want generous pay but don’t want immediate tax bills from salaries or cash bonuses.

Instead, they elect to set aside a portion of their pay into a deferred-compensation plan. Such plans allow the compensation, plus earnings, to grow tax-deferred, potentially for decades.

Executives Who Have Done It:

• Starbucks CEO Howard Schultz

• Verizon Communications (VZ) CEO Ivan G. Seidenberg

BIG MONEY

A sovereign wealth fund is a fund supported and owned by the government of a country [and] funded by budget surpluses of that country coming either from exports or from oil revenues. Before the global financial crisis, sovereign wealth funds were estimated to have assets of more than $5 trillion.

Crowdfunding

The U.S. adopted a crowdfunding framework through its National Securities Administration when it passed the JOBS Act 2012