Contents

- Introduction

- Preface

- Overview

- Relief Valve

- LECTURE 1: Why We Are In The Dark About Money

-

LECTURE 2: The Con

- The Banker Explained - The Wizard of Oz

- Why Do We Need Banks?

- What Bank Supervision?

- Banks Too Big To Fail

- Banks Cheat

- Banks and Money Laundering

- Banks Sell Drugs

- Money is NOT the same as Currency

- Currency Markets Are Rigged

- HFT High Finance Trading Predators

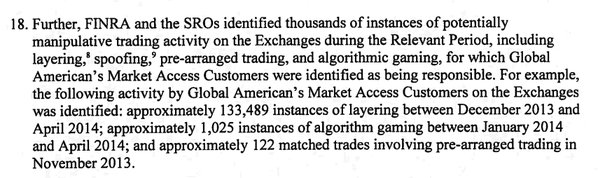

- Libor

- London Gold Fix Proof of Bank Manipulation

- QE Quantitative Easing

- A Trust Deficit Caused by Predator Bankers' Secrets

- HSBC The Pirate Bank

- HSBC The Dirtiest Bank

- Propaganda

- Banks Role in Terrorism

- The Octopus

- The First Banks in America

- History of Banking – Index (by date)

- Wealth Distribution and Why do the Rich Get Richer?

- Learn How Lobbyists Buy Politicians

- Commerce Without Conscience

- The Shattered American Dream

- United States Treasury Department

- About Gold and Fort Knox

- Paying Taxes in April

- Lecture 2 Objectives and Discussion Questions

- LECTURE 3: The Vatican-Central to the Origins of Money & Power

- LECTURE 4: London The Corporation Origins of Opium Drug Smuggling

- LECTURE 5: U.S. Pirates, Boston Brahmins Opium Drug Smugglers

- LECTURE 6: The Shady Origins Of The Federal Reserve

- LECTURE 7: How The Rich Protect Their Money

- LECTURE 8: How To Protect Your Money From The 1% Predators

- LECTURE 9: Final Thoughts

PIRATES ARE PIRATES

ARE PIRATES

"This is the country of those three great rights:

freedom of conscience, freedom of speech,

and the wisdom never to practice either of them." ~ Mark Twain

Google Spreadsheet of Fed Primary Dealers since 1960

-

OCTOBER 18TH 1987 BLACK MONDAY - MARKET LOST 500 POINTS THE WORST MARKET CRASH SINCE 1929

The Dow Jones Industrial Average (DJIA) dropped by 508 points to 1738.74 (22.61%). - THE WALL STREET CRASH IN 2008

- Three Traders Relive The 1987 Stock Market Crash 25 Years Later

- Jordan Belfort The Real Wolf Of Wall Street Raw Footage

--> IEX wins approval to launch stock exchange 2016 <--

#FINLIT #FINTECH #FLASHCRASH

@IEX WINS is NOW STOCK EXCHANGE

SO PROUD OF YOU!

FIGHTING THE GOOD FIGHT

BRAVO!!! TRUE AMERICAN HEROS

HOW IEX IS DIFFERENT

About IEX http://iextrading.com/about/

NOW YOU KNOW WHY YOU WANT IEX !!!

DEFINITION OF CA$H COW

"If I know stock's activity 1 day before its insider trading. If i know 1 sec. before, its high frequency trading"

2016

The Flash Boys Lawsuit - The End of the Beginning? An excerpt from Bodek and Dolgopolov's book "Market Structure Crisis: Electronic Stock Markets, High Frequency Trading, and Dark Pools" -- "Successful lawsuits are likely to focus on deficient disclosure rather than the essence of “unfair” practices, with the latter being more appropriate for market reform rather than liability."

According to Reg NMS. When it's a choice between #HFT front-running or investors,

SEC MUST choose investors

2 members of the House Financial Services subcommittee with jurisdiction over the SEC said the IEX application should be approved.

In a world based on science & facts, latest batch of comment letters seals the deal for SEC to approve IEX

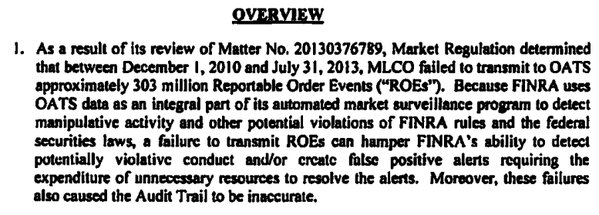

FINRA: Over a 3.5 year period Merrill Lynch failed to transmit only 303 Million Reportable Order Events

THE TAKE AWAY

Speed gives those with access to high frequency trading an edge over those who don't.

Exchanges didn't used to be a "for profit" operation.

So you might ask why is the delay between the direct feed and the SIP - BOTH IN THE SAME DATA CENTER, always at LEAST 200 microseconds? I'll tell you why. It's intentional. So exchanges can sell direct feeds for a premium.

How to gauge your brokers honesty --

Look at your order/trade confirmations The higher resolution time-stamps, the more honest

re: Fidelity, if you ask, they'll give you timestamps on trade orders/executions, but only to the second

So today 1/27/16 in $AAPL a burst of ~1200 quotes from multiple exchanges hit the SIP.. in the SAME MICROSECOND.

Let's do the math. 1200 per microsecond works out to a per second rate of 1.2 Billion per second. 1 stock

Eric Blake spent 7+ years at Tradebot before the mysterious "messaging activity" ended his career

After a little digging, we find that Blake last worked for TradeBot. That name seems familiar..

2015 Picture of Microwave networks between DC, NJ and Chicago (from The Fed Robbery Revisited 2013 detailed paper on FOMC leak)

Rigged Markets: What exactly were those Federal Reserve lockup rules?

Were organisations allowed to transmit information out of the room before 2 p.m. or not? The Federal Reserve won’t say. A Fed spokesman declined to answer that question from CNBC. So we do not know if this was actually allowed or not. So it is difficult to understand what happened because the rules do not seem to be very clear and are not publicly available.

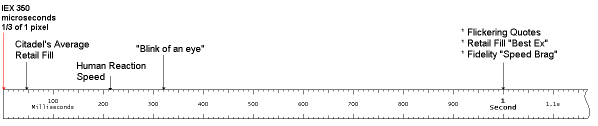

Putting 350 microseconds in perspective:

There are 1,000,000 microseconds in one second. Citadel and other HFT parasites are whining about 350 of them

Retail investors: DEMAND microsecond resolution timestamps from your broker. If they refuse, you are getting ripped off. Move! IEX is 100x faster than it takes Citadel to execute your retail orders

High-speed firms now oversee almost all stocks at NYSE floor

There are no banks serving as market makers at the NYSE floor, completing a shift spurred by the automation of trading over the past couple decades. Less than 15 percent of overall U.S. stock volume takes place at the New York Stock Exchange.

Eric Scott Hunsader is a champion of free markets, transparency and rule of law.

He is also a leading critic of high-frequency trading and a pioneer of supplying real-time market data to investors through his North Shore-based firm Nanex. He always shares details of what he says is evidence of endemic market manipulation. He frequently posts images of what he says are obvious signs of spoofing that have yet to attract any visible regulatory attention. "The laws needed to tackle this are already on the books, but they are not being enforced." Citadel and other firms that benefit from high-frequency trading are major political donors, Hunsader noted.

3/2/16 U.S. SEC to pay high-frequency trading critic whistleblower award

Eric Scott Hunsader The founder of Nanex, LLC, a real-time financial markets data company, said on Tuesday he will receive a $750,000 whistleblower award for a tip that triggered a $5 million U.S. Securities and Exchange Commission fine against the New York Stock Exchange in 2012. First of all, this has nothing to do with High-Frequency Trading. It's about the NYSE not delivering a product (SIP real-time data) while collecting $100M a year for that service. This was happening for at least 3 years. I am a champion of free markets. The term "High-Frequency Trading critic" is a label others use when they either can't understand and/or refute solid evidence. I'm happy to answer questions.

Once upon a time, Citadel hated internalization and wrote to the SEC.. in a Reg NMS comment letter:

Citadel gives $150m to Harvard - Kenneth Griffin founder and chief executive officer of Citadel makes largest gift in Harvard College history.

and in return, Harvard's Gift to Citadel Hal Scott is professor of international financial systems at Harvard Law School and director of the Committee on Capital Markets Regulation.

Wall St. watchdog homes in on high-frequency trades to combat spoofing

Wall Street's industry-funded watchdog is ramping up its scrutiny of high-frequency trading firms as efforts to manipulate U.S. markets through the technology grow more sophisticated, the regulator's chief said on Tuesday.

@abekohen "Spoofing is placing an order w/o expectation of fill, w/ intent to move mkt. Trader wanting fill @ ANY xchg is not spoofing. Sorry, you are wrong. @Paul_Schatz Furthermore I explained why a legitimate trading strategy would post on multi exchgs and why IEX is an impediment.

Eric Scott Hunsader - Rigged markets, stealing, and corrupt regulators

Eric Scott Hunsader @nanexllc ~ Spoofing is placing orders with the intent of cancelling some/all of them.

Just in case I wasn't clear earlier: I think people like you (and Adam Nunes) should be in jail. Rule of law and all. I do admire you sticking your neck out and admitting to enabling spoofing the U.S. Stock Market cc @TheJusticeDept

Posting orders with the intent to cancel some is absolutely illegal. No matter how many times you say otherwise

Can I spoof the market? That depends. Here's a handy flowchart:

Optimal collusion with private information

Author: Athey, Susan; Bagwell, Kyle download http://dspace.mit.edu/handle/1721.1/63939

Barron's Article Influenced by Wall St. Advertisers Protected by a Scheme started with Bernie Madoff

Barron's and their readers need to know that only about 10% of all orders from SEC 605 reports were being used in the study, and the group of orders chosen just happened to show Wholesalers in the best possible light. The Barron's article makes no mention that it focused on the tiniest fraction of data which happens to support Wholesalers.

1998 U.S. Securities and Exchange Commission regulations opened the door for electronic trading venues to become rivals to traditional stock exchanges.

The SEC’s decision to end fixed commissions in 1975 was amplified by forces that changed the nature of exchanges. As machines grew more complex, exchanges evolved from clubs where only certain brokers could trade to companies catering to everyone with an ETrade(ETFC) account. In 2000, when shares began trading in 1¢ increments, rather than by eighths of a dollar, matching buyers with sellers got easier. Trading volumes exploded as computers took over. In addition to rendering human traders practically obsolete, HFT is blamed for making stock exchanges less transparent and markets more volatile. Rightly or wrongly, it has disrupted the process of trading stocks that determines the value of public companies.

2016 A New Breed of Trader on Wall Street: Coders With a Ph.D.

Writing computer code, or at the least being conversant in the firm’s program of choice, OCaml, is a requisite for all traders. Indeed, new traders must complete a monthlong OCaml boot camp before they start trading. The business of rolling out one E.T.F. after another has become a major profit center. But in many ways, the real money is being made by the trading firms that specialize in making a market in these securities. Jane Street, Cantor Fitzgerald, the Knight Capital Group and the Susquehanna International Group have all capitalized on the E.T.F. explosion. And as these firms have grown, so has the demand for a new breed of Wall Street trader — one who can build financial models and write computer code but who also has the guts to spot a market anomaly and bet big with the firm’s capital.

The Context for IEX's 350μs speed bump

After push back from #HFT in Europe, clock sync will be ±100μs

IEX will disrupt the Wall Street Exhanges

Please don't confuse electronic trading with High Frequency Trading. Here's the difference

The SEC is slated to hand down a decision by March 21, 2916 on whether it will allow IEX to become a public stock exchange. If the application to become a public exchange is granted, IEX will basically be legitimized as a mainstream trading venue subject to the same regulations and disclosure requirements of more established stock exchanges like the New York Stock Exchange and NASDAQ. Critics of IEX who think the company should change how it applies its speed bump are trying to bar IEX from fulfilling its core utility to users. IEX itself doesn't have to wait 350 microseconds to know when a sale price has changed. So when a client has a pegged-to-market order, meaning they have charged IEX with buying or selling a stock when it hits a certain price, IEX will complete the order at the actual time of price change.

Comment Letters to the SEC

1) "The current system undercuts primary reason for futures exchanges. To transfer risk! When no risk is taken, no service is provided"

2) "Imagine if you were selling a painting through Sotheby's. And the auction ended before the curtain had even been lifted.."The system on the left is horribly complicated, expensive, rigged and breaks a lot. On the right is the futureRemember when @IEX went to SEC to tell them about RBC' s THOR? "You're letting them get out of the way" #HFT #SECAccording to BATS own comment letters to the SEC, their profits would be decimated by IEX approval

3) HFTs never have to take their foot off first base before the other one is firmly planted on second

4) What % of Nasdaq quotes/trades in NYSE & ARCA symbols arrive at the SIP within 350 micros? A: ZERO

5) Remember when @IEX went to SEC to tell them about RBC' s THOR? "You're letting them get out of the way" #HFT #SEC

6) The system on the left is horribly complicated, expensive, rigged and breaks a lot. On the right is the future

Who's who in market rigging

- Those most opposed to IEX: riggers

- Media giving riggers ink: enablers

- Regulators postponing: traitors

What exactly is insider trading?

Basically, it is the practice of buying or selling stock or other assets by corporate officers, other insiders or ordinary investors on the basis of information that is not public and is supposed to remain confidential. Insiders can buy or sell stock based on information they report to the Securities and Exchange Commission, thus making the public aware of the good, bad or perhaps the ugly data on a company's balance sheet.

Reporting this information to the SEC presumably gives the average investor a break, a level playing field upon which to make informed decisions. Fair enough. But if you are a major player or a hedge fund magnet, giving ordinary investors a break isn't your concern. To pull down those hefty hedge fund fees you need to offer an edge, and that edge often amounts to inside knowledge played close to the chest and out of public view.Did you know: not one single BATS quote or trade is delivered to the SIP in less than 350 microseconds?

According to BATS own comment letters to the SEC, their profits would be decimated by IEX approval

HFT TRADERS / TECHNOLOGY REPLACED THE PIGEON

"A LITTLE BIRDIE TOLD ME"

Investors have sought a competitive advantage through speed ever since Nathan Mayer Rothschild reputedly used carrier pigeons to learn of Napoleon's defeat at Waterloo in 1815. According to the legend, Rothschild found learned the info before his London England rivals heard the news so Rothschild scored.

FTC has Power to Police Cyber Security

Protecting consumer data is fairly new but well precedented territory for the FTC. While the agency has a long history of defending consumers against identity theft and breaches in health information, the increasingly frequency of hacks into companies that store financial data show that consumers remain at risk.

And then there are the bankers who skim in ways not only the government can't understand, but neither can most of Wall Street's workers. As for the hedge funders, they've rigged the tax system to their advantage, the government can't get them, because they're paying elected officials off. If you think this is any different from how Pablo Escobar reigned, you think bankers don't snort cocaine. But they do.

Derivatives trading was born in the 19th century as a form of insurance for farmers in Chicago! Mayor Rahm Emanuel has also made it a priority to protect high-frequency traders!! Sarao, who allegedly made $40 million spoofing from his parents' home in suburban London, named his business "Nav Sarao Milking Markets Ltd." Sarao is fighting extradition to Chicago, but court papers state that when he was quizzed about his actions by the CME in 2010, he told them to "kiss my ass."

Meet The Most Photographed Trader On Wall Street

Peter Tuchman has been on the floor of the New York Stock Exchange for almost 30 years. He’s seen it all, and if you’ve read a Wall Street-related story over that time, you’ve probably seen him. On the rise of electronic trading, Tuchman said: “We did not become more productive, there is nothing productive about the new technology, in my opinion. There was a lot more communication, transparency, a lot more volume back then.” HFT IN 2013

THERE IS NO SUCH THING AS A GLITCH

Coding the markets Electronic trading in the fixed income markets 25 million lines of Fortran June 1, 2006

Computer Algorithms hunt for a smaller edge, making and canceling hundreds of orders for stocks, bonds and derivatives in a fraction of the time it takes a human to shout into a phone or click a mouse. Algorithms game the system by placing huge "spoof" orders to buy and sell contracts for anything like: soybean meal/oil, copper, gold, Euro, pound, currency futures at the CME and on the London-based ICE Futures Europe exchange. The spoof orders, all just above and below the market price, are automatically canceled because were never intended to be filled in the first place. The fraud allows the middle man trader to trick competitors into selling him contracts more cheaply and buying from him at higher prices than they otherwise would.

There is nothing illegal about canceling large numbers of orders, a routine part of high-frequency trading, but prosecutors can prove through emails and instructions that Trader's algorithms intended to manipulate the market.

NY Times: One Way to Unrig Stock Trading

http://www.nytimes.com/2015/12/24/opinion/one-way-to-unrig-stock-trading.html

The root cause of the problem is that stocks trade on numerous venues, including 11 traditional exchanges and dozens of so-called dark pools that allow buyers and sellers to work out of the public eye. This market fragmentation allows high-frequency traders and exchanges to profit at the expense of long-term investors. Market depth, critically important to investors who trade large blocks of securities, also suffers in the world of high-frequency traders. Startling evidence for the lack of robustness in today’s market comes from a 2013 Securities and Exchange Commission report that found order cancellation rates as high as 95 to 97 percent, a result of high-frequency traders’ playing their cat and mouse game. Market depth is an illusion that fades in the face of real buying and selling. Not so long ago, when the New York Stock Exchange and the Nasdaq operated as virtual monopolies, American equity markets were the envy of the world. Until 2000, Nasdaq was wholly owned by a nonprofit corporation; the New York Stock Exchange was nonprofit until 2006. An unholy alliance of exchanges (including the New York Stock Exchange, Nasdaq and BATS) and high-frequency traders like Citadel have petitioned the S.E.C. to reject IEX’s current application. the S.E.C. should act in the public interest. Approval of IEX’s application will not fix America’s equity markets; it will make them less broken. The commission should not succumb to the special interests of competitors and their fellow travelers. It should approve IEX’s application and provide a real alternative for long-term investors.

Eric Scott Hunsader @nanexllc

A thought to ponder? Who is more criminally corrupt, those who break the rules day in/out or those who turn a blind eye and wink??

It was Bernie Madoff who started payment for order-flow which is used by anti-IEX flashboy Citadel today. From a former SEC commissioner, no less: Apparently the only time Wall Street really came under scrutiny was when @HarryMarkopolos caught Bernie Madoff. What good are reports when no action will ever be taken? Has shaming Wall Street ever worked?

1/8/16 An S.E.C. report of credit ratings agencies finds that dubious practices persist long after the subprime meltdown.

Most incriminating comment letter ever posted to the SEC? (those #HFT are so smart /s)

If the SEC doesn't open an investigation on the firm behind this comment letter, they ARE captured

LETTER from Adam Nunes at Hudson River Trading LLC

Response from Eric Scott Hunsader to the SEC

- The World’s Strangest Currencies

- How retail stop orders really work:

-

IEX Exchange Application

https://alternativeeconomics.co/blogline/27391-what-is-fair

http://www.sec.gov/comments/10-222/10222-20.pdf -

How many times do I have to make IEX's case using existing rules (Reg NMS)?

according to Reg NMS. When it's a choice between #HFT front-running or investors, the SEC MUST choose investors - Those pesky "flickering quotes" in Reg NMS

- Updated tally of SEC/IEX comment letters

- Fantastic IEX comment letter from Barnard

- What is Fair? Give the article a good read; we are not going to go point- counterpoint with the article, as it’s been done by us, as well as by IEX in their comment letters.

- A course of action if SEC denies IEX application

2015

8/26/15 Barclays, and 7 exchanges win the dismissal of high-frequency trading lawsuits

In Re Barclays Liquidity Cross and High Frequency Trading Litigation, 14-md-2589, U.S. District Court, Southern District of New York (Manhattan). New York Attorney General Eric Schneiderman has also sued Barclays, accusing the bank of bilking dark-pool customers. That case is pending in another court. Barclays has denied wrongdoing.

In his book, “Flash Boys: A Wall Street Revolt,” Lewis painted a picture of a U.S. stock market where insiders including exchanges, broker-dealers and high-frequency traders conspire to cheat investors. Everyone who owns equities is victimized by the practices, in which the fastest traders figure out which stocks investors plan to buy, purchase them first and then sell them back at a higher price, according to Lewis, a columnist for Bloomberg View.

The next day! BNY Mellon pricing glitch affects billions of dollars of funds this is HFT software code THAT BREAKS

Software Code by SunGard system called InvestOne, is used by financial institutions managing more than $28 trillion in assets. BNY Mellon said it outsources some of its net asset value (NAV) calculations to SunGard. The timing of the pricing glitch happened as China's stock market meltdown reverberated around the globe, spooking investors while casting doubt on whether the U.S. Federal Reserve would raise interest rates this year. BNY Mellon Corp was scrambling to fix a computer glitch on Wednesday that has delayed how billions of dollars of assets are valued, throwing the U.S. funds industry into disarray and damaging the reputation of the world's largest custody bank. BNY Mellon said an accounting system it relies on to calculate the prices of clients' mutual funds and exchange traded funds (ETFs) broke down over the weekend just as investors headed into a global market meltdown sparked by fears over the Chinese economy. The system, run by financial software provider SunGard, resumed with limited capacity on Tuesday but was still not fully operational on Wednesday, leaving BNY Mellon with a backlog of funds to price. SunGard, is being bought by rival software provider Fidelity National Information Services.

AOptix IntelliMax laser for various very wealthy HFT clients eliminates 0.18 millisecond microwave btw NYSE & Nasdaq

- Meanwhile, Over At The "New York" Stock Exchange: Even More Lasers

-

When did QQQ have its widest 1-minute price swing?

1) Financial Crisis 2) Flash Crash 3) Flash Monday? - Nanex ~ 30-Sep-2013 ~ HFT Front Running, All The Time

-

We the people, petition the U.S. Congress to strip for-profit SRO's of legal immunity ~ The Voters/Taxpayers

The NASD and NYSE have combined most of their regulatory operations into the new Financial Industry Regulatory Authority, but each continues to regulate its own market. The NASD and the NYSE's entitlement to immunity when they act as self-regulatory organizations gives them immunity and may be more difficult for the entities to assert now that both are for-profit public companies. - The average # of trades per day on NYSE in 1993 was 265,000. That's about how many trades execute in the first 10 seconds today 2015.

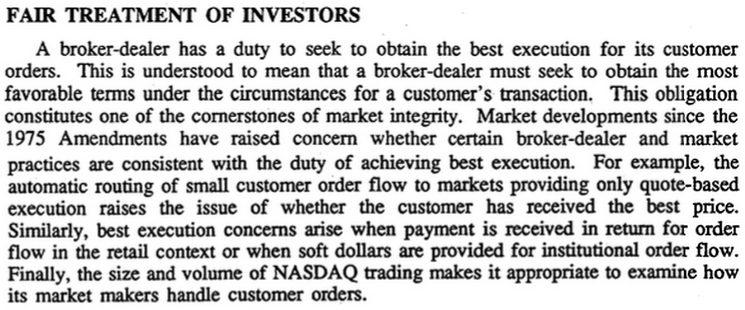

- Payment for order flow has been an SEC concern since at least 1994

- The $5.5 BILLION that wholesalers stole from Retail

2015

4/15/15 A financial trader is arrested in the UK after US authorities accused him of contributing to the 2010 Wall Street "flash crash" that wiped billons of dollars off the value of shares. A financial trader has been arrested in the UK after US authorities accused him of contributing to the 2010 Wall Street "flash crash". The US Department of Justice wants to extradite Navinder Singh Sarao, 36, on charges of wire fraud, commodities fraud and market manipulation. The crash wiped billions of dollars off the value of US shares in minutes. http://www.bbc.com/news/business-32406056

8/24/15 BLACK MONDAY #FLASHCRASH @NETHAPPENINGS

For sheer volatility, nothing in recent memory compares with the market turmoil of the past few trading days, and many brokers couldn't be happier about it. "Monday was the most active day in recent history," said Elizabeth Dennis, the head of wealth management capital markets at Morgan Stanley the world's biggest brokerage firm.

9 AM We are so far past the "China causes jitters" point of this selloff...pure fear/momentum. Nothing else. Dow Jones index down more than 1,000 points.

Here's how ugly it needs to get before they shut down the stock market

It's wild out there on Monday morning. Dow futures were down as much as 700 points, the S&P 500 was down about 4%, and the Nasdaq fell 5%, triggering a "limit down" brief pause in trading. And while we're still a bit away from the point at which the S&P 500 will stop trading for a period, Dave Lutz at JonesTrading circulated the "circuit breaker" levels at which the S&P 500 will be halted.

http://www.businessinsider.com/sp-500-circuit-breakers-2015-8#Yahoo: -7.5%. Exxon Mobil - 5.7% Facebook down over 10%

FIT: -17% NFLX: -17% TSLA: -13% BABA: -13% TWTR: -11% FB: -11% AAPL: -9% AMZN: -8% GOOG: -7% MSFT: -5%Biggest point decline in history. Second biggest was -777 on 9/29/08

J.P. Morgan Funds @jpmorganfunds Dr. David Kelly hosts a market call on volatility today, 4:15pm ET. Contact your JP Morgan Client Advisor or the FAS desk, 1.800.480.4111

Here’s that HFT liquidity at work. Send gift baskets to: Virtu Financial 900 Third Avenue 29th Floor New York, NY 10022

Now we find out how smart it was replacing market makers and specialists with HFT Algo's and other unobligated market participants. Lesson I learned on crash day in 1987 while working at an arb fund: Even supposedly smart guys don’t know what hit them on a day like this.

Eric Scott Hunsader @nanexllc First minute today: over 51% of the trades were odd-lot (tiny) Basically, #HFT machines running amok.

9:30 Everything Changes 1,121 Total LULD halts in 613 stocks since 9:30 Wow. DOW DOWN 300… after being down 1,000

AAPL 9:32 AM: $94.26 10:17 AM: $104.25 11% move ~ $70B market cap swing.

10:23 Incredible. The Dow is up about 700 points from where it was right after the opening bell.

10:24 Dow up 700 points from its low of the day.

The flash crash of May 6, 2010 is now the little sister to today.

Dow gained 185% in past 6 years S&P 500 gained 220% The current plunge has only taken Dow down 13% from peak. S&P off 11%

8/25/15 Day 2

- Best headline of the morning: "Goldman Sachs Scoffs at Your Little Stock-Market Correction"

- Everybody's talking about whether it's 1998 again.

2010

The flash crash saw the Dow Jones Industrial Average briefly plunge more than 1,000 points on May 6, 2010, temporarily wiping out nearly $1 trillion in market value. Then the U.S. stock market fell 600 points in five minutes or that confidence-shattering day on August 5, 2011, when Standard & Poor's Corp downgraded the credit rating of the United States. A London-based day-trader accused by the United States of market manipulation that contributed to the Wall Street "flash crash" in 2010, failed to persuade a court on Friday to postpone his extradition hearing.

HIGH FREQUENCY TRADING

Latest Nasdaq Order Routing Scheme: “Retail Trader, F*** You”

Read: What every retail investor needs to know - told by an industry insider

The legal definition of manipulation is convoluted

10/2015 The Man Accused of Spoofing Some of the World's Biggest Futures Exchanges

Spoofers attempt to profit from moving prices by placing orders they never intend to fill and then canceling them. There’s nothing wrong with canceling orders; what’s illegal in the U.S. is placing them with the intention of doing so. With most trading now computerized, the sanctity of the order book -- whether the numbers on traders’ screens in London or Chicago or Tokyo are valid -- is of paramount importance. That’s why regulators and prosecutors have zeroed in on spoofing.

DISRUPTIVE TRADING IS NOW DEFINED AS ILLAGAL UNDER A NEW CATEGORY OF THE DODD - FRANK ACT

Spoofing falls into that new category.

Before he gained notoriety, Igor Oystacher was known as 990.

That was the identification code assigned to the firm where he worked in 2004, when the head trader at Chicago-based Kingstree Trading LLC noticed something he’d never seen before in the Standard & Poor’s 500 futures market. He watched again and again as 990 ran over everyone in what he called an unprecedented display of market manipulation. The head trader alerted an executive at the firm to the practice, according to both men, who asked not to be identified by name for fear of reprisal. the U.S. Commodity Futures Trading Commission filed a civil complaint against Oystacher and his current firm 3Red Trading LLC for cheating on some of the world’s biggest futures exchanges, the latest attempt to stamp out a form of price manipulation known as spoofing. Navinder Singh Sarao was indicted in August for alleged spoofing that helped spark the May 2010 flash crash, which temporarily wiped out almost $1 trillion from the value of U.S. equities.

By 2004, Oystacher was making waves, buying from and selling to himself in an early version of what came to be known as spoofing, according to the two people familiar with the matter. While spoofing hadn’t been explicitly outlawed at the time, it was recognized as a form of manipulation."Who is on tomorrow's SEC Market Structure Meeting and which ones are crooks?"

2015 Nice SEC comment letter mention. (In a footnote, of course). See PDF

#9 Footnote See Themis Trading LLC, “IEX Exchange – Someone Come Speak For Me,” (Sept. 17, 2015) (noting that “IEX’s intentional slowdown (350 microseconds) makes it still faster than some other exchanges’ old creaky systems”). See also Levine, Matt, “The ‘Flash Boys’ Exchange Is Growing Up,” Bloomberg View (Sept. 16, 2015) (noting that “Every exchange has some delay in processing orders; nothing happens instantaneously, and its hard to synchronize anything to the microsecond. If IEX is faster at other operations than other exchanges are, then its quotes may be more current than theirs. Its intentional delay might be shorter than their accidental delay”).

Citadel's Anti-IEX Comment Letter says IEX favors dark. Errr... isnt trading LIT on @iextrading Free?

Follow @nanexllc for tweets that leave you convinced high-frequency trading is a giant scam rigging the markets based on the speed of light.

Fascinating.. a judge has stated that exchanges may be liable (not immune) for offering co-location services .. so from a legal (and thus shareholder) standpoint, offering co-location services is a legal liability The geniuses at NYSE, Nasdaq and BATS thought it a good idea to highlight this legal liability in last weeks comment letters. Basically, IEX isn't going to offer co-location services. That's about it in a nutshell. That's what has Citadel in a tizzy. I think we may be witnessing karma in action.. stay tuned.

On October 19, 1987, stock markets around the world crashed, from Hong Kong to Europe to the US. The Dow Jones plummeted over 22% in a matter of hours. Ostensibly in response to this crisis, President Reagan signed into law Executive Order 12631 establishing a body formally known as the “President’s Working Group on Financial Markets.” This body, famously dubbed the “Plunge Protection Team” by the Washington Post in 1997, is explicitly mandated to “maintain investor confidence” in US markets through whatever actions it deems necessary. The group and its actions are shrouded in official secrecy, but its actions have long been identified by independent market analysts.

SEE Plundered by Harpies: An Early History of High-Speed Trading PDF

IEX

Breaking Wall Street’s Scandal Cycle: Brad Katsuyama’s Bold Plan

William O'Brien, BATS Global Markets President was fired 4 months after this interview.

Debate about High Frequency Trading (HFT) between William O'Brien, BATS Global Markets Presidents, Brad Katsuyama, IEX Group President, and Michael Lewis, Author of Flash Boys. Broadcasted on CNBC April 2, 2014.

Stock Market Insider Trading: High-Frequency Trading Transactions 2:45 MINUTES https://www.youtube.com/watch?v=QVXcn-u8jBw

Flash Boys:

A Wall Street Revolt

Michael Lewis

Chapter 6 -- How to Take Billions from Wall Street

- If the Puzzle Masters were right, and the design of IEX eliminated the advantage of speed, IEX would reduce the value of investors’ stock market orders to zero. If the orders couldn’t be exploited on this new exchange—if the information they contained was worthless—…

- …the nine big Wall Street banks that controlled 70 percent of all stock market orders was more complicated than the role played by TD Ameritrade. The Wall Street banks controlled not only the orders, and the informational value of those orders, but dark pools in which those orders might be executed. The banks…

Chapter 7 -- An Army of One

- … any money manager who arbitrarily denied his clients access to markets might have violated his fiduciary responsibility. On those grounds, Schwall pulled the company’s 401(k) from ING.

- “How can you give a mortgage loan with no documentation? It’s preposterous.’ But banks did it. And now trillions of dollars of trades are being executed on markets where no one has any idea of how it works, because there is no documentation. Does that sound familiar?”

- …No one is trying to control what they don’t know,” said Zoran. “And what they don’t know is growing.” He thought of himself as good in…

- “Although technically a dark pool, IEX had done something no Wall Street dark pool had ever done: It had published its rules. Investors could see, for the first time, what order types were allowed on the exchange, and if any traders had been given special access. IEX, as a dark pool, would thus try to set a new standard of transparency—and”

- “In the war, you’re trying to use the picture you create to take advantage of the enemy,” said Josh. “In this case, you’re trying to take advantage of the market.” He worked for the HFT firm for six weeks before it failed, but he found the job unsatisfying.

- He’d come to IEX in the usual way: John Schwall had found him while trolling on LinkedIn and asked him to come for an interview. At that point, Josh was being inundated with offers from other”

- “The trick was not simply to write the code that turned information into pictures but to find the best pictures to draw—shapes and colors that led the mind to meaning. “Once you got all that stuff together and showed it in the best way possible, you could find patterns,” Josh said.”

- “It’s still shocking to me to see how the banks are colluding against us,”…

- It was astonishing, when you stopped to think about it, how aggressively capitalism protected its financial middleman, even when he was totally unnecessary. Almost magically, the banks had generated the need for financial intermediation—to compensate for their own unwillingness to do the job honestly.

- But the bridge was itself absurd.

- The banks did not merely manipulate the relevant statistics in their own dark pools; they often sought to undermine the stats of their competitors. That was another reason the banks were sending IEX orders in tiny 100-share lots: to lower the average trade size in a market that competed with the banks’ dark…

- …the best exchange runner he’d ever seen. “He has all the qualities,” said Don. “Poise under pressure. The ability to understand a complex and vast system. And be able to think into it—imagine into it—accurately. To diagnose and foresee problems.”

-…Estimates of commission paid to Wall Street banks for stock market trades in 2013 range from $9.3 billion (Greenwich Associates) to $13 billion…

- These two people made all the difference. “I got lucky Brian is Brian and Ronnie is Ronnie,” said Brad. “This is because of them. Now the others can’t ignore this.

- Fifty-one minutes after Goldman Sachs had given them their first honest shot at Wall Street customers’ stock market orders, the U.S. stock market closed. Brad walked off the floor and into a small office, enclosed by glass. He thought through what had just happened. “We needed one person to buy in and say, ‘You’re right,’ ” he said. “It means that Goldman Sachs…

- …Ten,” said Brad. (IEX had dealings with ninety-four.) The ten included the Royal Bank of Canada, Sanford Bernstein, and a bunch of even smaller outfits.

- The dark pools are not required to report their trades in real time; and so, on the official tape, the frenzy appears unprovoked. It isn’t.

‡‡ The Financial Industry Regulatory Authority (FINRA) publishes its own odd ranking of the public and private stock markets, based on how well they avoid breaking the law, presumably inadvertently, by trading outside the National Best Bid and Offer. In its first two months of trading, IEX ranked #1 on FINRA’s list.

- “Nine weeks after IEX launched, it was already pretty clear that the banks were not following their customers’ instructions to send their orders to the new exchange. A few of the investors in the room knew this; the rest now learned. “When we told them we wanted to route to IEX,” one said, “they said, ‘Why would you want that? We can’t do that!’ The phrase”

“One enterprising U.S. brokerage firm, Interactive Brokers, announced that, unlike its competitors, it did not sell retail stock market orders to high-frequency traders, and even installed a button that enabled investors to route their orders directly to IEX, the stock market created by Brad Katsuyama and his team”

Epilogue: Riding the Wall Street Trail

“In the dark pool arbitrage IEX had witnessed, for instance, HFT captured about 85 percent of the gains, leaving the bank with just 15 percent.”

“It takes roughly 8 milliseconds to send a signal from Chicago to New York and back by microwave signal, or about 4.5 milliseconds less than to send it inside an optical fiber. When Spread Networks”

“One obvious cost is the instability introduced into the system when its primary goal is no longer stability but speed. Another is the incalculable billions collected by financial intermediaries. That money is a tax on investment, paid for by the economy; and the more that productive enterprise must pay for capital, the less productive enterprise there will be."

This was just one in a chain of thirty-eight towers that carried news of the direction of the stock market from Chicago to New Jersey: up or down; buy or sell; in or out. We walked around the site. The tower showed some signs of age.

In the bleak January light we pedaled onto Route 45 out of Boalsburg, Pennsylvania, heading east, along what was once the route for the stagecoach that ran from Philadelphia to Erie. This is where you find FCC Pole #1215095

Flash Boys closes with this paragraph: Federal Communications Commission license number: 1215095 and “The repeaters that amplify financial signals resembled kettle drums, bolted onto the side of the tower: These were also new. "

The application to use the tower to send a microwave signal had been filed in July 2012, and it had been filed by … well, it isn’t possible to keep any of this secret anymore. A day’s journey in cyberspace would lead anyone who wished to know it into another incredible but true Wall Street story of hypocrisy and secrecy and the endless quest by human beings to gain a certain edge in an uncertain world. All that one needed to discover the truth about the tower was the desire to know it.

Tradeworx – Thesys – Manoj – Midas – NASDAQ context, watch Narang tell Bloomberg Television that speed matters less in today’s markets than it ever has in the history of markets. (15:35 in). So says the man selling speed to the SEC (the American taxpayer), HFTs, and Stock Exchanges. You can’t make this stuff up. It would be humorous if it were not so sad. Is it any wonder that the SEC has trailed other law enforcement and political entities in examining flaws and abuse in our markets? The tools that they have procured are sold to them by an HFT firm. That HFT firm makes even more money selling microwave high speed trading transmission to other HFTs and exchanges. You would think such in-your-face conflicts would have made the SEC think twice about their partnership with Tradeworx.Who owns the Pennsylvania tower with FCC license number 1215095? Tradeworx does. Manoh Narang does. The creator and SEC-entrenched high speed data seller does.

Reuters HFT Debate With Haim Bodek and Manoj Narang on youtube.

Animation with explanations on how #Flashboys works: "So simple, even Pisani could understand"

Flash Boys animation covers a span of only 277 millionths of a second

Themis Sal If you are retail broker, who sells order flow to "wholesalers" and "internalizers", and they wont fill, why not route to exchanges or IEX?

"Arnuk and Saluzzi are the Woodward and Bernstein of the securities markets. Their gutsy, dogged sleuthing exposed the perverse market effects of robotic trading and predicted an event like the Flash Crash 2010, long before blinkered market regulators had a clue. The two crusaders deserve a medal for looking out for investors."

Flash Crash 2015 @ThemisSal To those who said a Flash Crash can never happen again... look at QQQ today. Look at so many ETFs. Look at lack of access for mom and pop.

Trade spreads on CME? Side effect trading is a phenomenon occurring in implied spread markets that can only take place when a product transitions* to a trading state, also called opening. Side effect trading begins during the pre-open when outright orders create an implied quote that would match with a resting spread order. Upon opening, the price of this implied quote can exceed the resting spread’s limit price, resulting in a price improvement. This price improvement, which must be allocated somewhere, is assigned to the resting spread on a price/time basis. The allocation to the resting spread, rather than to the outright bid or offer, has been determined to be the most defendable distribution for the price improvement.

http://www.cmegroup.com/confluence/pages/worddav/preview.action?fileName=Side+Effect+Trading.doc&pageId=48989037

2013 Too Fast to Fail: How High-Speed Trading Fuels Wall Street Disasters

Computer algorithms swap thousands of stocks each instant—and could set off a financial meltdown.

Law exists for two reasons, to take your money or your land.

Years before Phil Gramm was a McCain campaign adviser and a lobbyist for the USB Swiss bank at the center of the housing credit crisis he pulled a sly maneuver in the Senate that helped create today's subprime meltdown.

President Reagan and his staff between 1981–1989 broke the unions and brought on deregulation.

Law exists for two reasons, to take your money or your land.

Corporations exist for one reason, take your money.

With no regulations and no oversight to protect the commons, the common wealth, or the people, the Church of Corporate Greed went wild.

Because of the swap-related provisions of Gramm's bill—which were supported by Fed chairman Alan Greenspan and Treasury secretary Larry Summers—a $62 trillion market (nearly four times the size of the entire US stock market) remained utterly unregulated, meaning no one made sure the banks and hedge funds had the assets to cover the losses they guaranteed.

If you owe the bank $100 that's your problem. If you owe the bank $100 million, that's the bank's problem. — JP Getty

Lying is institutionalized. You can blame institutions, you can blame Bill Clinton. If the President can lie, why shouldn't everyone? It's an epidemic. From Wall Street down to Main Street. The truth is for losers, and the connected [ Wall Street, University, Government ] conspire to get away with it, and do.

On Wall Street, if you commit a massive crime, if you steal not a thousand dollars, but a billion dollars, you get to walk away from it. You get to give a little bit of the money back, and then you get to walk away, and nobody goes to jail, and nobody ever hears about it.

Goldman is politically connected in a way that no other company in America really is. And they've had a hand, really, in a variety of financial disasters over the last two decades. Goldman has repeatedly been involved in creations of speculative INTERNET, HOUSING, COMMODITIES bubbles on Wall Street and continually walk away with fines and no admission of criminal wrongdoing, which emboldens the company to continually get into these schemes.

https://web.archive.org/web/20151120151147/http://www.cmegroup.com/confluence/pages/worddav/preview.action?fileName=Side+Effect+Trading.doc&pageId=48989037

THE PSYCHOPATH TEST A Journey Through the Madness Industry By Jon Ronson

THE PSYCHOPATH TEST A Journey Through the Madness Industry By Jon Ronson

As Jon Ronson undertakes one of the journalistic escapades that make up "The Psychopath Test," he describes renting a car and savoring its smell. This aroma "never fails to bring back happy memories of past sleuthing adventures." The particular episode that springs to his mind is "trailing the conspiracy theorist David Icke around as he hypothesized his theory that the secret rulers of the world were giant, blood-drinking, child-sacrificing pedophile lizards that had adopted human form."

However loony that reportorial job may sound, it carried the unsettlingly mixed message that has made Mr. Ronson's earlier books, "Them" (in which Mr. Icke appeared) and particularly "The Men Who Stare at Goats," so mesmerizing. Entertaining as they are, both books also have their scathing sides. "The Men Who Stare at Goats" (which was turned into a George Clooney-Jeff Bridges movie) began with zany military experiments involving the paranormal but wound up linking these tests to the abuse on display at Abu Ghraib. "Them," subtitled "Adventures With Extremists," brought Mr. Ronson, who is Jewish, face to face with the anti-Semitism underlying Mr. Icke's lizard fetish.

[ . . . in a prison convinces Mr. Ronson that he needs to go where free-range psychopaths can be found: to the corridors of power, the realm of executives and politicians. Too bad he didn't talk to more of them. He does find an interesting correlation between the empathy-free, grandiose, callous attitude of the corporate honcho who shut down a large toaster factory and the criteria on the Hare checklist, a widely used diagnostic tool. ]

{'People who are psychopathic prey ruthlessly on others using charm, deceit, violence or other methods that allow them to get what they want. The symptoms of psychopathy include: lack of a conscience or sense of guilt, lack of empathy, egocentricity, pathological lying, repeated violations of social norms, disregard for the law, shallow emotions, and a history of victimizing others.' - Robert Hare, Ph.D}

THE DEFINITION OF CHUTZPA

Goldman Sachs riggs the game

with a computer hft

software program

HFT buys and sells

before anyone else can.

2011 The Nasdaq Hacking Case Raises Big Red Flags for Exchanges

Nasdaq officials say the computer systems that actually execute buy and sell orders for the Nasdaq OMX Group (NDAQ) were not compromised. Instead, they say the hacking allegedly affected Nasdaq's Directors Desk service, a subsidiary that offers Web-based tools to make it easier for boards of directors to prepare for, participate in and follow up on board meetings. Part of the service includes document-sharing tools for things like preliminary drafts of earnings reports and other key data and documents. LOL, double-speak for insider trading!

How Goldman Sachs rigs the market - Goldman Sachs trading scandal.

Goldman Sachs trading scandal because somebody stole their secret sauce and can use it for themselves. Goldman Sachs accidently gets caught at acknowledging they manipulate the market cause that is what they accuse the guy of doing who stole the computer program to use if for himself!! but that's not the way the story is being reported. Can you believe the 700 Billion Bail Out from cheaters like this?

HIGH SPEED ALGORITHMS - HIGH FREQUENCY TEADING [ HFT ]

High-speed trading algorithms place markets at risk

Computers that buy and sell shares in a fraction of a second are in danger of destabilizing stock markets around the world says Andrew Haldane, executive director for financial stability at the Bank of England. Speaking last night at the International Economic Association in Beijing, China, Haldane said that High Frequency Trading (HFT) firms were in a race to zero that could increase market volatility.

HFT algorithms can execute an order in just a few hundred microseconds, rapidly trading shares back and forth in order to quickly eke out profits from minor differences on the various exchanges. These trades are so fast that the physical location of the computers executing them becomes vital - even being a few hundred kilometers away from the exchange could mean missing out. It's commerce far removed from any ordinary experience, as Haldane illustrated with an every day example: If supermarkets ran HFT programs, the average household could complete its shopping for a lifetime in under a second.

Now it seems this lightning-fast trading could come at a cost. Haldane blamed HFT for causing the Flash Crash which occurred on US markets last year, with the Dow Jones losing $1 trillion in just half an hour. The event was marked by trading oddities such as management consulting firm Accenture shares falling from $40 to $0.01, while auction house Sotheby's rose from $34 to $99,999.99 - the lowest and highest values permitted by HFT algorithms.

Ex-Goldman Programmer Indicted Over HFT Code Theft

THEN the Arrest Over Software Illuminates Wall St. Secret At 9:20 p.m. on July 3, Mr. McSwain arrested Mr. Aleynikov, 39, at Newark Liberty Airport, accusing him of stealing software code from Goldman Sachs, his old employer. At a bail hearing three days later, a federal prosecutor asked that Mr. Aleynikov be held without bond because the code could be used to unfairly manipulate stock prices.

THIS IS WHY NO ONE SHOULD BE IN THE STOCK MARKET BECAUSE YOU CAN NOT GAMBLE WITH YOUR MONEY AGAINST THE UNETHICAL MANIPULATED ultrafast computerized stock trading.

Little understood outside the securities industry, the business has suddenly become one of the most competitive and controversial on Wall Street. At its heart are computer programs that take years to develop and are treated as closely guarded secrets.

Speed Traders Meet Nightmare on Elm Street With Nanex

Eric Scott Hunsader, the founder of market-data provider Nanex LLC, looks for hints of illicit trading

To Hunsader, the images created from market feeds are evidence of high-frequency trading firms exploiting market rules to turn a profit in a lawless environment. Though others in the industry see his reports and charts as propaganda, Nanex’s interpretations are helping to drive the public debate about the fundamental fairness of the modern stock market. “You ever see ‘Lord of the Flies’ or read that book?” he said, using the William Golding novel about boys stranded on an uninhabited island as a metaphor for the stock market. “When you don’t have a parent around, things fall apart.”

FOLLOW @hft_info FOR MORE

Max Keiser Invented Media Derivatives

Global Banking Cartel - Oligarchy - Global war between investors / workers vs. speculators

Industrial Policy - cheapest possible access to money without having to compete.

The Speculators 2008 Wall Street Meltdown and Bailout

The Size of Derivatives Bubble = $190K Per Person on Planet. According to various distinguished sources including the Bank for International Settlements (BIS) in Basel, Switzerland -- the central bankers' bank -- the amount of outstanding derivatives worldwide as of December 2007 crossed USD 1.144 Quadrillion Trilateral Commission

Trilateral Commission the World Shadow Government

In short, Trilateralism is the current attempt by ruling elites to manage both dependence and democracy -- at home and abroad. Rockefeller founded it and it promotes the interests of Big Capital around the world. How it chose Jimmy Carter for president. Read more ...

The Hidden Wealth of the Richest 1 percent

Society's Parasites (The Speculators. Why Banks and S&Ls went Bankrupt. THIS SOUNDS JUST LIKE THE 2008 WALL STREET BAIL OUT.

The OECD has accused the offshore financial centers of squirreling away between US$5 trillion and US$7 trillion of domestically taxable income.

Some of the biggest U.S. corporations ,are some of the biggest users of the tax havens to avoid paying the IRS, the group's report says including several that have taken federal bailout funds. They include Citigroup, the Bank of America and Morgan Stanley, all of which registered dozens of tax havens in just one Caribbean tax haven alone, the Cayman Islands. All three financial firms have also taken billions of dollars in bank bailout funds. Tax Havens Margie Burns - Form D filings show that hedge funds connected to Marvin P. Bush--youngest brother of former president George W. Bush, former GOP finance chairman in Virginia, and head of a northern Virginia hedge fund—raised over $1,612,000,000 ($1.6 billion) by filing deadline. More Form D filings from March 12 show another $7.8 billion raised by Bush companies, companies directed by Bush co-directors, or spin-off companies. The total is almost $10 billion raised by Bush-connected hedge funds.

Following up on earlier posts-- In a set of coordinated transactions little reported so far, hedge funds connected to Marvin P. Bush, youngest brother of George W. Bush, quietly raised almost $10 billion on two days in March. The transactions were Form D sales on March 12 and March 16, 2009

Our Economy Explained: Derivative markets, an understandable explanation. At the bank's corporate headquarters, expert traders transform these customer loans into DRINKBONDS, ALKIBONDS and PUKEBONDS.

The list of AIG's counterparties was finally made public ; that list shows (a) tax dollars were funneled to in large part European banks and (b) the possible damage to counterparties measured by actual payments

- Declan - The AIG mess includes a number of serious oversights and bipartisan political failures:

* AIG received four taxpayer bailouts to date, the most recent under the Obama administration. As far as we know, even though the Treasury owns 80 percent of AIG, the current administration levied no accountability / transparency demands. (If that was the case, the documents have not been made public.)

* A bipartisan chorus of politicians last fall, including the Bush administration and Sen. Chuck Schumer, claimed that an AIG bailout was necessary to avoid catastrophic damage to the financial system. But those claims have now been called into question. The list of AIG's counterparties was finally made public a few days ago; that list shows (a) tax dollars were funneled to in large part European banks and (b) the possible damage to counterparties measured by actual payments PDF

was http://www.aig.com/aigweb/internet/en/files/CounterpartyAttachments031509_tcm385-153015.pdf

* AIG has continued to raise alarms in secret presentations to regulators as recently as last month that used phrases like potentially catastrophic unforeseen consequences, retirement savings significantly at risk and a loss of confidence in the private pension system in the U.S. Those presentations have never been made public by the current administration: Now we have the odd -- but, perhaps, welcome -- spectacle of Congresss threatening to change tax law so the bonuses are taxed at a rate of 100 percent:

There's no reason this process has to take place in such secrecy, behind closed doors, which invites special-interest lobbying, and which has the practice of both the Bush and Obama administrations. I've covered this in more detail in my CBS News column.