Contents

- Introduction

- Preface

- Overview

- Relief Valve

- LECTURE 1: Why We Are In The Dark About Money

-

LECTURE 2: The Con

- The Banker Explained - The Wizard of Oz

- Why Do We Need Banks?

- What Bank Supervision?

- Banks Too Big To Fail

- Banks Cheat

- Banks and Money Laundering

- Banks Sell Drugs

- Money is NOT the same as Currency

- Currency Markets Are Rigged

- HFT High Finance Trading Predators

- Libor

- London Gold Fix Proof of Bank Manipulation

- QE Quantitative Easing

- A Trust Deficit Caused by Predator Bankers' Secrets

- HSBC The Pirate Bank

- HSBC The Dirtiest Bank

- Propaganda

- Banks Role in Terrorism

- The Octopus

- The First Banks in America

- History of Banking – Index (by date)

- Wealth Distribution and Why do the Rich Get Richer?

- Learn How Lobbyists Buy Politicians

- Commerce Without Conscience

- The Shattered American Dream

- United States Treasury Department

- About Gold and Fort Knox

- Paying Taxes in April

- Lecture 2 Objectives and Discussion Questions

- LECTURE 3: The Vatican-Central to the Origins of Money & Power

- LECTURE 4: London The Corporation Origins of Opium Drug Smuggling

- LECTURE 5: U.S. Pirates, Boston Brahmins Opium Drug Smugglers

- LECTURE 6: The Shady Origins Of The Federal Reserve

- LECTURE 7: How The Rich Protect Their Money

- LECTURE 8: How To Protect Your Money From The 1% Predators

- LECTURE 9: Final Thoughts

The Secrets of Ferocious Predator Bankers

Bankers have been scamming the public since the beginning.

Mark Twain ~ "This is the country of those three great rights:

freedom of conscience, freedom of speech,

and the wisdom never to practice either of them."

Their plan is to restore rule by the oligarchy - the 1% vs. 99%

Banks that break the law a “Get out of Jail Free” card. #RiggedGame

CHAIN OF TITLE - The Everyday Heroes Who Took on Wall Street (w/ David Dayen) - Wall Street Criminality

What moral grounds exist where the most powerful bailed out failed Banks who never admit guilt and were never jailed have access to every K12 school district where they get to teach the children and the teachers K12 Literacy? Isn't that the wolf guarding the hen house? When the most powerful banks circumvent the intent of the law to make money with no regard for the damage done to people's lives - and get tried in a court of law only to pay a fine but no jail time--it is mandatory that they get out of the classroom!

2015 Wall Street wolves still on the prowl as survey reveals taste for unethical tactics

Quarter of financial executives in US and UK earning over $500,000 a year would conduct insider trading if they thought they could get away with it. a third of financial executives who said they made more than $500,000 annually “have witnessed or have firsthand knowledge of wrongdoing in the workplace”. A quarter would conduct insider trading if they were guaranteed $10m – and knew they would get away with it. Five years after the financial crisis and following a series of regulatory changes, high-profile prosecutions, fines and a handful of jailings, attitudes to wrongdoing in the US and the UK seem unchastened. “Nearly one in five respondents feel financial service professionals must sometimes engage in unethical or illegal activity to be successful in the current financial environment,” according to the survey of 1,200 traders, portfolio managers, investment bankers and hedge fund professionals on both sides of the Atlantic. The survey, conducted by the University of Notre Dame in conjunction with Labaton Sucharow, a law firm that often represents whistleblowers, noted “a marked decline in ethics” since they last published their report two years ago.

When four outsiders saw what the big banks, media and government refused to, the global collapse of the economy, they had an idea: The Big Short. Their bold investment leads them into the dark underbelly of modern banking where they must question everyone and everything.

According to Google: A derivative is an arrangement or product (such as a future, option, or warrant) whose value derives from and is dependent on the value of an underlying asset, such as a commodity, currency, or security.

As for punishment of those responsible, borrowers were punished for their overindulgences — they lost homes and lives. Let’s not forget that. But the executives at the lenders simply got rich. ~ Dr. Michael Burry

The crisis, incredibly, made the biggest banks bigger. I am shocked that executives at some of the worst lenders were not punished for what they did. But this is the nature of these things. The ones running the machine did not get punished after the dot-com bubble either — all those VCs and dot-com executives still live in their mansions lining the 280 corridor on the San Francisco peninsula. The little guy will pay for it — the small investor, the borrower.

http://nymag.com/daily/intelligencer/2015/12/big-short-genius-says-another-crisis-is-coming.html

Bank of America Explains How Central Banks Rigged And Manipulated The Market

Bank of America Explains How Central Banks Rigged And Manipulated The Market

Even the Big #Banks now admit it:

"Fed's "Massive Manipulation" broke the market"

THE BIG SHORT proves

BANKSTERS ARE COUNTERFEITERS

Big Banks Actually Were Exactly Like Counterfeiters

Michael Lewis' book and movie The Big Short makes it clear that the banksters on wall street didn't take any risk at all AT ALL because THEY KNEW congress would bail out the banks! Michael Burry was instrumental in creating a market for credit default swaps, which allowed other investors to bet against the subprime mortgage market. The small group that bet against the bankers, like Dr. Michael Burry who knew that the mortgage market was a all a gigantic fraud made fortunes. But so did the banksters who lost that bet. Everyone on both sides of these Credit Default Swap deals made a lot of money. Everyone else across the country and the world lost a lot of money, jobs, and homes. And we are still not out this mess in 2015. NOTHING on Wall Street has changed accept that now they say there will be no more bailouts. But you should know that now there is something called a BAIL IN. Yes, the bank can take your money right ou of your savings account. It belongs to them - NOT YOU. If you put your money in the bank it doesn't belong to you anymore - it is now owned by the bank.

beliefnet.com/columnists/moviemom/2015/12/the-big-short.html

http://www.valuewalk.com/2015/02/dr-michael-burry-scion-capital/

In his quarterly letters he coined a phrase to describe what he thought was happening: “the extension of credit by instrument.”

That is, a lot of people couldn’t actually afford to pay their mortgages the old-fashioned way, and so the lenders were dreaming up new financial instruments to justify handing them new money. “It was a clear sign that lenders had lost it, constantly degrading their own standards to grow loan volumes,” Burry said. He could see why they were doing this: they didn’t keep the loans but sold them to Goldman Sachs and Morgan Stanley and Wells Fargo and the rest, which packaged them into bonds and sold them off. The end buyers of subprime-mortgage bonds, he assumed, were just “dumb money.” He’d study up on them, too, but later.

http://www.vanityfair.com/news/2010/04/wall-street-excerpt-201004

What the big banks did during the housing bubble of the mid-2000s was in essence straightforward counterfeiting.

The difference between what they did and regular counterfeiting was simply the kind of fake paper; regular counterfeiters print fake, valueless cash, while the banks were printing fake, valueless bonds. However, I then made a very serious mistake — I claimed there was a “small difference” between regular counterfeiters and the ones on Wall Street: If in 2005 a bank packaged worthless mortgages together into a bond with a face value of, say, $100 million, it would generally collect fees of about 1.5 percent, or $1.5 million. The $100 million face value wasn’t real, but the fees definitely were.

WHISTLEBLOWERS

The Bank Whistleblowers United Initial Initiatives

The Bank Whistleblowers United Initial Initiatives

Gary Aguirre, Bill Black, Richard Bowen, and Michael Winston are the founding members of the Bank Whistleblowers United. We are all from the general field of finance and we are all whistleblowers who are unemployable in finance and financial regulation because we spoke truth to power and committed the one unforgivable sin in finance and in Washington, D.C. – being repeatedly proved correct when the powerful are repeatedly proved wrong. Economists rely largely on “revealed preference” – we think what you do matters more than what you say. For nearly seven years, every financial firm has known about my three colleagues. They are famous for their skills, courage, and integrity. Every financial firm claims that it now wants to make integrity their credo. Any financial firm that actually was committed to making integrity its credo, as opposed to its spin, would have long since hired my colleagues. Similarly, any government regulator, enforcer, or prosecutor that was serious about restoring the rule of law on Wall Street would have recruited us. During S&L crisis the OTS issued 30K criminal referrals and put more than 1000 bank executives in prison.

An Idiot’s Guide to Prosecuting Corporate Fraud BY David Dayen

A new group called Bank Whistleblowers United have just pushed out a comprehensive plan they think would put the executive branch back in the business of enthusiastically identifying, indicting, and convicting financial fraudsters — restoring accountability while protecting the public.

The cumulative credibility of the group’s four founders is extremely strong. Richard Bowen is the Citigroup whistleblower who unsuccessfully warned top management about the rotten condition of loans inside mortgage-backed securities. Michael Winston spoke out about similarly corrupt practices at non-bank mortgage originator Countrywide. Gary Aguirre, a Securities and Exchange Commission attorney, was fired for refusing to let a Wall Street banker out of an insider trading investigation. And their ringleader is William Black, an outspoken fraud-fighter and longtime white-collar criminologist who was a two-fisted bank regulator during the savings and loan crisis and now teaches at the University of Missouri–Kansas City (UMKC). “The common theme,” Black said with characteristic bluntness, “is the unbelievably pathetic job of the Department of Justice and the FBI.”

14 Trillion Hidden in Tax Havens Oxfam analysis of the 50 biggest US businesses claims Apple have $181bn held offshore, while General Electric has $119bn and Microsoft $108bn. The NSA Is Recording Every Cell Phone Call in the Bahamas "The overt purpose is legitimate commercial services for the Telcos. Our covert mission is SIGINT." Overall, the use of tax havens allowed the US firms to reduce their effective tax rate on $4tn of profits from the US headline rate of 35% to an average of 26.5% between 2008 and 2014. The charity said this had helped firms spend billions on an “army” of lobbyists calling for greater state support in the form of loans, bailouts and guarantees, funded by taxpayers. The top 50 US firms spent $2.6bn between 2008 and 2014 on lobbying the US government, Oxfam said. “For every $1 spent on lobbying, these 50 companies collectively received $130 in tax breaks and more than $4,000 in federal loans, loan guarantees and bailouts,” said Oxfam.

14 Trillion Hidden in Tax Havens Oxfam analysis of the 50 biggest US businesses claims Apple have $181bn held offshore, while General Electric has $119bn and Microsoft $108bn. The NSA Is Recording Every Cell Phone Call in the Bahamas "The overt purpose is legitimate commercial services for the Telcos. Our covert mission is SIGINT." Overall, the use of tax havens allowed the US firms to reduce their effective tax rate on $4tn of profits from the US headline rate of 35% to an average of 26.5% between 2008 and 2014. The charity said this had helped firms spend billions on an “army” of lobbyists calling for greater state support in the form of loans, bailouts and guarantees, funded by taxpayers. The top 50 US firms spent $2.6bn between 2008 and 2014 on lobbying the US government, Oxfam said. “For every $1 spent on lobbying, these 50 companies collectively received $130 in tax breaks and more than $4,000 in federal loans, loan guarantees and bailouts,” said Oxfam.

Jamie Dimon Admits To $150 Billion JP Morgan Accounting Fraud

Jamie Dimon Admits To $150 Billion JP Morgan Accounting Fraud

The real international conspiracy: There's no price the big banks can't fix

Everything Is Rigged: The Biggest Price-Fixing Scandal Ever The Illuminati were amateurs.

America's top corporations are parking profits overseas and ducking hundreds of billions in taxes. And how's Congress responding? It's rewarding them for ripping us off. "Inversions" are a loophole in American tax law permits companies with just 20 percent foreign ownership to reincorporate abroad, which means that if a big U.S. firm acquires a smaller company located in a tax haven, it can then "invert" – that is, become a subsidiary of its foreign-based affiliate – and kiss a huge share of its IRS obligations goodbye. Investors don't have any say in this only the corporation owners. Investors don't have any say! Henry Ford bought out all his shareholders so that he wouldn't have to listen to anyone. He didn't think anyone else had the right to tell him anything! And to make sure the owners can track what everyone is doing they are the Data Pirates of the Caribbean: The NSA Is Recording Every Cell Phone Call in the Bahamas "The overt purpose is legitimate commercial services for the Telcos. Our covert mission is SIGINT."

vs. Mom and Pop

#1 Look for an "Investment Adviser" someone legally bound by a fiduciary duty.

The Committee for the Fiduciary Standard 10 Emerson Lane Suite 801 Bridgeville, PA 15017

They have to recommend the something that is the lowest cost” for Mom and Pop because that will be in a consumer’s best interest. The most stringent requirement for financial professionals is known as the fiduciary standard. It amounts to this: providing advice that is always 100 percent in the consumer’s interest.

Your bank's investment brokers / advisers / advisory services are NOT required to follow the most stringent requirement for financial professionals.They are "registered representatives". They only recommend [SELL] “suitable” investments based on your personal situation but does NOT put your interest before their own greed. http://www.nytimes.com/2014/10/12/business/mutfund/before-the-advice-check-out-the-adviser.html

Ask them to sign an oath called The Fiduciary Pledge stating they will act as fiduciaries.

-------> If they don't sign then walk away!!! <-------

PRINT THIS OUT

The Fiduciary Pledge

I, the undersigned, pledge to exercise my best efforts to always act in good faith and in the best interests of my client,

________________________________________________________________,

and will act as a fiduciary. I will provide written disclosure, in advance, of any conflicts of interest, which could reasonably compromise the impartiality of my advice. Moreover, in advance, I will disclose any and all fees I will receive as a result of this transaction and I will disclose any and all fees I pay to others for referring this client transaction to me. This pledge covers all services provided.

X_______________________________________________________________

Date______________________________

G20

Supervisory thinking on money market funds in the United States and Europe.

G20 The group of 20 economies in 2009 asked its regulatory task force, the Financial Stability Board (FSB), to scrutinize big asset managers more closely as part of its remit to maintain financial stability. Until then, the focus had been on banks. Fund managers may face tougher scrutiny by global regulators than planned after their intense lobbying against a first proposal backfired, industry sources and G20 officials said. World leaders wanted supervision of all parts of the financial system reviewed after the 2007-09 financial crisis resulted in taxpayers having to bail out many banks, at a cost of trillions of dollars. The FSB proposed in January that individual funds with over $100 billion in assets should face tougher, yet-to-be-detailed scrutiny. This threshold captures 14 funds, all in the United States. The industry responded by saying the FSB proposals which focused solely on the size of funds were too simplistic. It questioned why fund managers were being targeted since, it argued, they were not responsible for the crisis.

China's G20 role "As one of the most important countries in G20, China should play an active role in the summit," said Du Dawei, director of the China Bureau of the World Bank. Concerted efforts in the global fight against the crisis, especially the huge stimulus plans launched by China and the United States, are a decisive factor in facilitating a reversal of the economic downturn, Du said. China's economy received less damage than other major economies from the crisis, Du said. With US$2 trillion worth of foreign exchange reserves in hand, China is under the spotlight of the international community, which has high expectations of its role in helping weather the downturn. At the London Summit, China will continue to demand more rights for developing countries, such as more voting rights, predicted Gong Li, director of the International Strategic Research Institute of the Party School of the Communist Party of China Central Committee. Weeks ahead of the summit, Chinese Premier Wen Jiabao called for reforming the internal governance structure of the IMF to fend off financing and investment risks, balance rights and obligations and pay more attention to the interests of developing countries.

shanghaidaily.com/opinion/Assessing-Chinas-G20-role/shdaily.shtml

eCONomists and "Scientific Law

Causation does not need to be known in order to qualify as a law, not in Physics and other experimental sciences. Economics could have a better model (and science) by following this usage. The habit of forcing causation when no cause-effect can be demonstrated has been highly common albeit detrimental to Economics as a science endeavor.

- Goldman Sachs employees in action shaping young minds :

-

GOLDMAN SACHS DONATES $400,000 TO JUNIOR ACHIEVEMENT OF NEW YORK

Major Infusion of Funds will Help Further Financial Literacy Education for New York City Students

How the stock market became "rigged"

A veteran programmer explains how the stock market became "rigged"

A small group of financial firms are using their technological superiority to skim the top off the market, Michael Lewis claims in his new book "Flash Boys." There's an increasingly heated debate over whether the practices, known as high-frequency trading, are harmful or helpful. Lewis, for his part, says the market is "rigged," and several federal agencies, including the Department of Justice, are now looking intowhat Charles Schwab recently labeled "a growing cancer."

Sophisticated and expensive computers allow high-frequency traders to take advantage of minuscule differences in price among the many exchanges where securities are bought and sold. Some firms pay to place their computers on the site of a stock exchange to be sure their access to price data is as fast as possible, a practice known as colocation; others will use technology to obscure their trading intentions for a few crucial thousandths of a second. Lewis's book tells the story of Brad Katsuyama, a former trader at the Royal Bank of Canada in New York. Katsuyama opened a new stock exchange last year to give investors protection from HFT.

Lewis is not the first to cry foul on these strategies. Eric Scott Hunsader, the founder of Nanex, has made himself immensely unpopular in some circles for his outspoken and persistent criticism of HFT, which he first encountered during the "flash crash" of 2010. Bloomberg called him the "nemesis" and "scourge" of the HFT world.

I asked Hunsader to talk about the book, the new stock exchange, and his long career in financial technology. The conversation focused on the Securities and Exchange Commission ruling in 2007 that allowed what we now know as high-frequency trading.

READ MORE:

What Bank Supervision? HFT High Finance Trading Predators

2016 Hidden in plain sight: Big risks at failed Third Avenue fund were clear to some

In the months before the blowup of Third Avenue's junk bond fund in early December 2015, investors and financial advisors called the New York-based investment company to voice their concerns about the growing percentage of hard-to-trade, illiquid assets in the fund's portfolio. Third Avenue Management LLC, the $789 million Focused Credit Fund abruptly blocked investor withdrawals and announced on Dec. 9 it would liquidate the fund's assets. the fund had 76 percent of its portfolio exposed to very low rated "CCC+" rated a mutual fund taking outsized risks compared with its peers.HSBC is being prosecuted around the world for #Swissleaks tax evasion. FCA to take no action

2015 BofA Sees $600 Million Writedown Tied to Merrill Securities

A 30% write-down, after all the trillions in bailouts. Makes you wonder about the accuracy of bank balance sheets. “…banks are magic, and if you look too hard at how the magic happens, you might stop believing in it.”2014 THEY KNEW ABOUT BERNIE MADOFF

Two senior officials at JPMorgan Chase & Co and predecessor companies repeatedly confronted Bernard Madoff over irregularities in his business, a new lawsuit said, suggesting that bank leaders had "direct knowledge" of his Ponzi scheme. The lawsuit filed in federal court in Manhattan on Wednesday on behalf of shareholders against Chief Executive Jamie Dimon and 12 other current and former executives and directors was based in part by statements made by Madoff himself during a series of interviews. "JPMorgan was uniquely positioned for 20 years to see Madoff's crimes and put a stop to them," the lawsuit said. "But faced with the prospect of shutting down Madoff's account and losing lucrative profits," it added, "JPMorgan - at its highest level - chose to turn a blind eye."

ORIGIN OF THE FEDERAL RESERVE

Origin of the Federal Reserve - Jekyll Island Federal Reserve

Origin of the Federal Reserve - Jekyll Island Federal Reserve

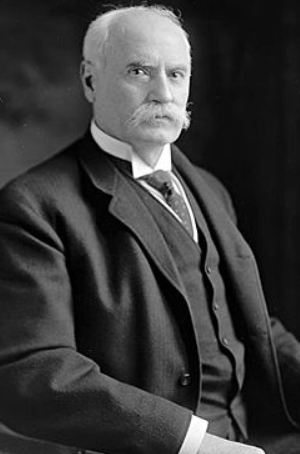

Boston Brahmin - Senator Nelson W. Aldrich Front Man for "Special Interests"

FYI The story teller / messenger is not important. It's the true story itself that is important. JP Morgan and his friends created the Federal Reserve: the historic origin of the ponzi scheme. The scheme works as long as the money supply keeps expanding but contraction is inevitable--this contraction inevitably results in massive losses for the public and a windfall for the wealthiest. There's a reason why the money is not connected to gold or silver. This would enforce stability, which is not what the Fed and the private banks want--they would prefer to maintain the casino atmosphere to guarantee riches for themselves during the upswings and downswings of the market. The Fed doesn't make the market more stable. Honestly, just look at the market and see for yourself! The Fed makes the market more unstable. And that's good for the Fed. The Fed (and its covert private banker cabal) keeps the gold they have for other people.

THE OPPOSITION TO THE FEDERAL RESERVE BANK BILL

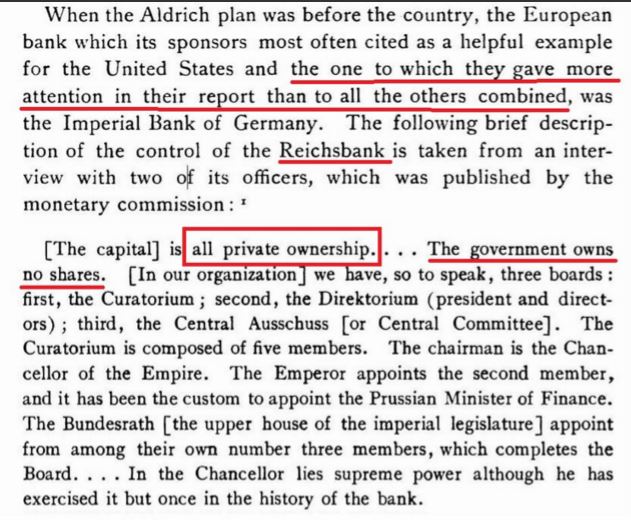

Carter Glass explaining in 1913 that the Reichsbank & private ownership was model for Fed

Federal Reserve is Private Property--It is NOT a Public Institution

9/25/2011 The men who crashed the world in 2008

The first of a four-part investigation into a world of greed and recklessness that led to financial collapse. In the first episode of Meltdown, we hear about four men who brought down the global economy: a billionaire mortgage-seller who fooled millions; a high-rolling banker with a fatal weakness; a ferocious Wall Street predator; and the power behind the throne. The crash of September 2008 brought the largest bankruptcies in world history, pushing more than 30 million people into unemployment and bringing many countries to the edge of insolvency. Wall Street turned back the clock to 1929. But how did it all go so wrong? Lack of government regulation; easy lending in the US housing market meant anyone could qualify for a home loan with no government regulations in place. Also, London was competing with New York as the banking capital of the world. Gordon Brown, the British finance minister at the time, introduced 'light touch regulation' - giving bankers a free hand in the marketplace. All this, and with key players making the wrong financial decisions, saw the world's biggest financial collapse.

The Federal Reserve / Alan Greenspan was the only authority who could have outlawed subprime mortgages, but did not---despite repeated warnings

Alan Greenspan says the Federal Reserve is above the law and answers to no one. He is forced to admit his mistakes.

Emergency Economic Stabilization Act of 2008:Designed by the Federal Reserve to Give Money to Private Banks

It is important to understand that Alan Greenspan and the Federal Reserve received countless warnings about the impending bursting of the subprime-mortgage bubble and did nothing about it at the time. They allowed bankers to make great money during the bubble. Then they put more money into the bankers' pockets after the bubble burst. For the large private bank: flip the coin. Heads--you win. Tails--you win. If you're the common public, the joke's on you.

The Emergency Economic Stabilization Act of 2008 (Division A of Pub.L. 110–343, 122 Stat. 3765, enacted October 3, 2008), commonly referred to as a bailout of the U.S. financial system, is a law enacted in response to the subprime mortgage crisis authorizing the United States Secretary of the Treasury to spend up to $700 billion to purchase distressed assets, especially mortgage-backed securities, and supply cash directly to banks. The funds for purchase of distressed assets were mostly redirected to inject capital into banks and other financial institutions while the Treasury continued to examine the usefulness of targeted asset purchases.[1][2] Both foreign and domestic banks are included in the program. The Federal Reserve also extended help to American Express, whose bank-holding application it recently approved.[3] The Act was proposed by Treasury Secretary Henry Paulson during the global financial crisis of 2008. Incidentally, Henry Paulson had just given up his reign as CEO of Goldman Sachs before joining the U.S. Government as Treasury Secretary. Paulson was instrumental in expanding Goldman Sachs' aggressive derivatives trading during his tenure there. It is only too fitting that Paulson helped Goldman keep all its money without any penalty. Insurance and Financial Regulatory Reform in the 111th Congress Baird Webel Specialist in Financial Economics January 13, 2010 pdf

WORLD GLOBALIZATION OF THE BANKING STRUCTURE PART 2

The entire banking system of the world, with the exception of a few Muslim countries, is run by private corporations called “central banks.” America’s central bank, the Federal Reserve, was founded in 1913. People should understand that it is not Congress which runs America but the Federal Reserve. Without the money and credit that the Federal Reserve provides to banks and subsequently home owners, farmers, and businesses, the financial system would not be able to function. All one has to do is study the various past economic crises to know that they occurred when the national banking system cut off credit. There is no doubt that the 2008 Credit Crisis has helped everyone to see that it is the banks—primarily the international banks and the central banks which run the world. While the names of the shareholders of the Federal Reserve remain secret, many people believe that the large international banks are some of its owners. As a result of the Credit Crisis, the Bush Administration proposed the “Blueprint for a Modernized Financial Regulatory Structure” which was approved by current Treasury Secretary Timothy Geithner who then was president of the New York Federal Reserve Bank. He is now proposing the Obama regulatory blueprint. Recently released, it calls for many of the same recommendations as the previous blueprint, which can be summarized as a total centralization of power:

1/13/09 Fed Vice Chair Donald Kohn testified before the Financial Services Committee

along with John Bovenzi of the FDIC. The Fed's balance sheet has expanded by $1.2 trillion since September 1.

Where did the money go? Kohn wouldn't say.

7/21/09 This is Congressman Alan Grayson questioning Federal Reserve Chairman Ben Bernanke on $550B of loans to foreigners

(or 'central liquidity swaps' in Federal Reserve-ese'). Which financial institutions received this money? Bernanke's answer: I don't know. As the Fed was lending this money, the dollar increased by 30% in value. Grayson asks, was this a coincidence? Bernanke's answer: yes.

5/13/12 Rep. Alan Grayson questions the FED inspector General where $9 Trillion dollars went...

and Inspector General Elizabeth Coleman hasn't a clue. THEY HAVE NO JURISTRICTION to investigate the Fed!!!

Tarp Bailout

2.2 Trillion Dollars were lent out. What where the terms?

Senator Sanders asks Bernanke WHERE IS THE MONEY?

Federal Reserve Admits, "We Have NO Gold"

Blankfein admits in awkward interview that Financial Markets are nothing more than a casino!

Federal Reserve Secrets

"Bernanke Threatens The Congress" We will cause an Economic Collapse if you audit the Fed!

Quants: The Alchemists of Wall Street - A Documentary about algorythmic trading.

This is the key to the creation of volatility that puts money into bankers' pockets as a steady flow of income. This is the math behind the casino effect in the financial markets.

REGULATORS TELL BANKS TO MAKE COLLAPSE PLANS IN 2010

FINANCIAL STABILITY BOARD ONLY MENTIONED IN PASSING

The banks' chief risk officers, and in the case of Citigroup, Chief Executive Vikram Pandit, received letters in May 2010 instructing them on what to include in the recovery plans.

The requests stemmed from January 2010 crisis management meetings held by regulators. The letters sent to the five banks were nearly identical. Each plan was to address severe financial stress at the firm, as well as "general financial instability." The plans should be capable of being executed ideally within three months, but no longer than six months, the documents said. The plans should "make appropriate assumptions as to the valuations of assets and off-balance sheet positions," the documents said. Recovery plans have been mentioned in public before, but only in passing. In testimony to Congress in July 2010, Fed Governor Daniel Tarullo said the "largest internationally active U.S. banking organizations" were working on recovery plans.

The initiative stemmed from work led by the Financial Stability Board, a body that coordinates the work of international financial regulators, he said. In a presentation in March, JPMorgan Chase said it had a recovery plan in place and said it was ordered by regulators.The presentation was organized by Harvard Law School and was closed to the media at the time.

Take Away: There is no integrity in the world of finance.

Financial Engineering for the world based on the whims of the 1% and their finger wagging blame game against the poor but never blaming wall street pirates.

8/20/12 U.S. regulators directed five of the country's biggest banks, including Bank of America Corp and Goldman Sachs Group Inc, to develop recovery plans for staving off collapse if they faced serious problems, emphasizing that the banks could not count on government help.

8/20/12 U.S. regulators directed five of the country's biggest banks, including Bank of America Corp and Goldman Sachs Group Inc, to develop recovery plans for staving off collapse if they faced serious problems, emphasizing that the banks could not count on government help.

The two-year-old program, which has been largely secret until now, is in addition to the "living wills" the banks crafted to help regulators dismantle them if they actually do fail.

According to documents obtained by Reuters, the Federal Reserve and the U.S. Office of the Comptroller of the Currency first directed Citigroup Inc. (NYSE: C), Bank of America Corp. (NYSE: BAC), Goldman Sachs Group Inc. (NYSE: GS), Morgan Stanley (NYSE: MS) and JPMorgan Chase & Co. (NYSE: JPM) to come up with these "recovery plans" in May 2010. The report said the regulators told the banks to consider drastic efforts to prevent failure in times of distress, including selling off businesses, finding other funding sources if regular borrowing markets shut them out and reducing risk. The plans must be feasible to execute within three to six months, and banks were to "make no assumption of extraordinary support from the public sector," the report said. Spokespeople for the five banks and the Fed declined to comment.

ORDERLY LIQUIDATION OF A FAILED SIFI 2012

the report U.S. regulators directed five of the country's biggest banks, including Bank of America Corp and Goldman Sachs Group Inc, to develop plans for staving off collapse if they faced serious problems, emphasizing that the banks could not count on government help. The two-year-old program, which has been largely secret until now, is in addition to the "living wills" the banks crafted to help regulators dismantle them if they actually do fail. It shows how hard regulators are working to ensure that banks have plans for worst-case scenarios and can act rationally in times of distress.

Officials like Lehman Brothers former Chief Executive Dick Fuld have been criticized for having been too hesitant to take bold steps to solve their banks' problems during the financial crisis. According to documents obtained by Reuters, the Federal Reserve and the U.S. Office of the Comptroller of the Currency first directed five banks - which also include Citigroup Inc,, Morgan Stanley and JPMorgan Chase & Co - to come up with these "recovery plans" in May 2010.

They told banks to consider drastic efforts to prevent failure in times of distress, including selling off businesses, finding other funding sources if regular borrowing markets shut them out, and reducing risk. The plans must be feasible to execute within three to six months, and banks were to "make no assumption of extraordinary support from the public sector," according to the documents. Spokespeople for the five banks declined to comment. The Federal Reserve also declined to comment.

Recovery plans differ from living wills, also known as "resolution plans," which are required under the 2010 Dodd-Frank financial reform law.

Living wills aim to end bailouts of too-big-to-fail banks by showing how they would liquidate themselves without imperiling the financial system. "Recovery plans are about protecting the crown jewels," said Paul Cantwell, a managing director at consulting firm Alvarez & Marsal. "It's about, 'How do I sell off non-core assets?' The priority is to the shareholders. A resolution plan is about protecting the system, taxpayers and creditors." The recovery plans are being used as part of regulators' ongoing supervisory process.

In Britain, recovery and resolution plans have both been part of the living will requirements for large banks.

Mike Brosnan, senior deputy comptroller for large banks at the OCC, said the regulator continuously evaluates contingency planning at the banks and savings associations it supervises. "Recovery plans required of the largest banks are helpful in ensuring banks and regulators are prepared to manage periods of severe financial distress or instability affecting the banking sector," he said. This summer, nine global banks submitted living wills to the Fed and Federal Deposit Insurance Corp, and regulators released the public portion of the documents. The recovery plans requested in 2010, meanwhile, have received little publicity. The names of the banks required to submit them have not been previously disclosed, and Reuters obtained them only through a Freedom of Information Act request. The Fed supplied Reuters with the letters requesting plans from banks, but not the banks' actual plans because they were deemed confidential supervisory information. The regulator said it was withholding 5,100 pages of information.

MOVING FURTHER FROM DISASTER

Five years after the financial crisis, concerns remain about whether blow-ups at big banks could lead to another round of taxpayer bailouts. Trading losses have cost JPMorgan nearly $6 billion so far, and scandals such as the alleged rigging of an international interest rate benchmark have only highlighted the risks lurking inside big banks.

These disasters have damaged banks' reputations, but not their balance sheets. Most are still profitable, and in recent years the five banks have improved their capital bases and liquidity. They also have been subjected to annual Federal Reserve stress tests that measure whether the banks have sufficient capital to weather severe economic scenarios. Bank of America and Citigroup, in a sense, have already been executing the kind of moves called for in the recovery plans. Both have been selling off non-core operations and assets to streamline their sprawling businesses, after receiving multiple bailouts during the financial crisis. Bank of America in June 2011 told Fed officials that it could shed branches in some parts of the country if it needed to raise capital in an emergency, a person familiar with the matter said in January. The proposal was part of a series of options provided to the Fed, including issuing a tracking stock for Bank of America's Merrill Lynch operations. But just because the bank proposed selling branches does not mean it's a desirable move or highly probable, the person said. In the past year, Bank of America has shown progress in building capital without such actions. Its Tier 1 common capital ratio increased to 11.24 percent of risk-weighted assets as of June 30 from 8.23 percent a year earlier. Tier 1 refers to a bank's core capital and has been the main focus of regulators in assessing a bank's capital adequacy.

MENTIONED IN PASSING

The banks' chief risk officers, and in the case of Citigroup, Chief Executive Vikram Pandit, received letters in May 2010 instructing them on what to include in the recovery plans. The requests stemmed from January 2010 crisis management meetings held by regulators. The letters sent to the five banks were nearly identical. Each plan was to address severe financial stress at the firm, as well as "general financial instability." The plans should be capable of being executed ideally within three months, but no longer than six months, the documents said. The plans should "make appropriate assumptions as to the valuations of assets and off-balance sheet positions," the documents said. Recovery plans have been mentioned in public before, but only in passing. In testimony to Congress in July 2010, Fed Governor Daniel Tarullo said the "largest internationally active U.S. banking organizations" were working on recovery plans. The initiative stemmed from work led by the Financial Stability Board, a body that coordinates the work of international financial regulators, he said. In a presentation in March, JPMorgan Chase said it had a recovery plan in place and said it was ordered by regulators.

The presentation was organized by Harvard Law School and was closed to the media at the time, but is available online.