Contents

- Introduction

- Preface

- Overview

- Relief Valve

- LECTURE 1: Why We Are In The Dark About Money

- LECTURE 2: The Con

- LECTURE 3: The Vatican-Central to the Origins of Money & Power

- LECTURE 4: London The Corporation Origins of Opium Drug Smuggling

- LECTURE 5: U.S. Pirates, Boston Brahmins Opium Drug Smugglers

-

LECTURE 6: The Shady Origins Of The Federal Reserve

- Bank of England - American Federal Reserve Bank

- The Beginning of the Federal Reserve System

- Jekyll Island Federal Reserve

- Federal Reserve Facts

- Federal Reserve Time Line

- Federal Reserve Directors: A Study of Corporate and Banking Influence Published 1976

- Federal Reserve Transparency

- The Logan Act

- Who Owns the Federal Reserve

- The Purpose of the Senate

- 100 Years Later The Fed is A Total Fail

- Lecture 6 Objectives and Discussion Questions

- LECTURE 7: How The Rich Protect Their Money

- LECTURE 8: How To Protect Your Money From The 1% Predators

- LECTURE 9: Final Thoughts

Federal Reserve Facts

FEDERAL RESERVE TIMELINE

THE FINANCIAL RESERVE WAS CREATED

"We shall have no more financial panics.... Panics are impossible.... Business men can now proceed in perfect confidence that they will no longer put their property in peril.... Now the business man may work out his destiny without living in terror of panic and hard times.... Panics in the future are unthinkable.... Never again can panic come to the American people. - Herbert Hoover"

Secrets of the Federal Reserve The history, organization and controlling interests behind the Federal Reserve -- by: Eustace Mullins, 1983

Who Owns the Federal Reserve Bank and Why is It Shrouded in Myths and Mysteries?

The first MAJOR MYTH, accepted by most people in and outside of the United States, is that the Fed is owned by the Federal government, as implied by its name: the Federal Reserve Bank. In reality, however, it is a private institution whose shareholders are commercial banks; it is the “bankers’ bank.” Like other corporations, it is guided by and committed to the interests of its shareholders—pro forma supervision of the Congress notwithstanding.

THE OPPOSITION TO THE FEDERAL RESERVE BANK BILL

Carter Glass explaining in 1913 that the Reichsbank & private ownership was model for Fed

When the ALDRICH plan was before the country, the European bank which its sponsors most often cited as a helpful example for the United Stats and the one to which they gave more attention in their report than to all the others combined was the IMPERIAL BANK OF GERMANY. The following brief description of the control of the REICHSBANK is taken from an interview with two of its officers, which was published by the monetary commission:1

[The capital] is ALL PRIVATE OWNERSHIP ... the government owns no shares. [In our organization] we have, so to speak, three boards: first, the Curatorium; second, the Direktorium (president and directors)' third, the Central Ausschuss [or Central Committee]. The Curatorium is composed of five members. The chairman is the Chancellor of the Empire. The Emperor appoints the second member, and it has been the custom to appoint the Prussian Minister of Finance. The Bundesrath [the upper house of the imperial legislature] appoint from among their own number three members, which completes the Board ... In the Chancellor lies supreme poser although he has exercised it but once in the history of the bank. pg 15

1910

The design for the Federal Reserve Bank was started in 1910 in a meeting that took place on Jekyll Island, Georgia.

- The FED was established by an act of Congress (The Glass-own bill also know as The Federal Reserve Act) on December 23rd, 1913. The Reserve Banks opened for business on November 16th, 1914. A majority of the Senate voted on the bill that passed. However debate was limited because of the impending holiday.

- The name was changed to the Federal Reserve System by the Banking Act of 1935. This act also reorganized the FED with respect to the number of directors and length of term.

- One of the selling points (compiled by Herbert Hoover) given to Congress for the passage of The Federal Reserve Act was that it would eliminate the business cycle.

- The Federal Reserve was established as a private central bank. The shareholders were (and still are today) the major banks. The exact shareholdings are not public record. The creation of the central bank moved the responsibility for monetary policy from Congress to the FED.

Structure: The Federal Reserve System consists of three parts

- The Federal Reserve Banks

- The Board of Governors

- The Federal Open Market Committee

The Federal Reserve Banks

- The Federal Reserve System consists of 12 districts each one located and serving 12 geographical regions of the country.

- Regional headquarters are located in Boston, New York, Philadelphia, Cleveland, Richmond, Atlanta, Chicago, St. Louis, Minneapolis, Kansas City, Dallas, and San Francisco. Additionally, there are Branches of Reserve Banks in 25 other cities.

- The 12 Regional Fed Banks are under the direction of the Federal Reserve board in Washington D.C.

- All national banks and thrifts are required to become members of the Federal Reserve System. State banks are not required to become members of the regional Fed Bank but may at their discretion.

- Each individual Reserve Bank is managed by a Board of Directors. Two thirds of these directors are elected by the privately owned commercial banks that are the member banks of the Federal Reserve System. The remaining one third of the board members are elected by the Fed Board of Governors in Washington. The board of each region elects a President for a five year term.

- Each of the individual Reserve Banks are organized as a private corporation and the shares of this corporation are sold to the private commercial national banks and thrifts that operate in the district.

- Shares in the regional Fed Reserve Banks are highly restricted. Each commercial member bank has the same number of shares as every other bank. These shares cannot be sold and the shares pay an annual 6% dividend.

- The Federal Reserve Banks have several functions: a) to clear checks b) provide and destroy currency (Federal Reserve Notes) C) research the regional economy which it publishes in the "Beige Book" d) provide economic education (or what some might call economic propaganda) e) establish economic policy f) approve bank mergers and acquisitions.

- The most important district bank is the Federal Reserve Bank of New York.

- The Federal Reserve System turns over its operating profits to the U.S. Treasury, after deducting all expenses, including the 6% dividend to member banks.

Board of Governors

- The board of Governors is comprised of seven governors one of the governors is chairman or the board.

- The seven governors are appointed for a nonrenewable 14 year term.

- The Fed Chairmen is appointed for a renewable 4 year term. There is no limit to the number of times the chairman can be re-appointed to chair the board of governors.

- The board has its own staff of economists that collect data for the boards and provide economic research.

-

The board helps to set monetary policy by:

- Having all governors sit on the Federal Open Market Committee.

- Setting the reserve requirement for banks.

- Setting and approving the distrcit discount loan rates.

Federal Open Market Committee

-

The Federal Open Market Committee (FOMC) is composed of twelve members:

- The seven governors.

- The President of the Federal Reserve Bank of New York.

- Four other district bank presidents (presidents who serve one year terms on a rotating basis).

- The committee typically meets every six weeks (eight times a year) to assess the condition of the economy and then vote on monetary policy. They decide to increase, decrease or maintain the growth of the money supply in the country.

-

The FOMC controls economic policy by using one or more of three tools available to it;

- Changing the discount rate, which is the rate the FED charges banks to borrow from it.

- Changing reserve requirements, which is the percentage of deposits the banks must hold on reserve to cover all deposits (remember banks in the US practice fraction reserve banking).

- Buying or selling U.S. Treasury debt from it's member banks (which the FOMC euphemistically calls the 'open market')

- The FOMC also has the ability to grow the money supply (create money) in the U.S lending money to it's member banks.

[ 1 ] From the Federal Reserve Bank of San Francisco

http://www.frbsf.org/publications/federalreserve/fedinbrief/organize.html

[ 2 ] From the Federal Reserve Bank of Dallas

http://www.dallasfed.org/fed/understand.cfm

http://www.reuters.com/article/2015/02/24/us-usa-fed-shelby-idUSKBN0LS2OM20150224

The Senate Banking Committee plans to hold a hearing Tuesday on ideas to reform the Fed, and Shelby told Bloomberg legislation could be proposed. He was non-committal, however, when asked specifically about a proposal by Republican Senator Rand Paul that would expose the Fed's monetary policy decisions to congressional audits, an idea that Yellen criticized in particularly pointed terms as risking a politicization of monetary policy. "I don't want to create monetary policy, but I am interested in what particularly is in the (Fed's) $4.5 trillion portfolio," Shelby answered. "We will hold hearings at the proper time."

1913

FIAT EMPIRE: Why the Federal Reserve Violates the U.S. Constitution

2013

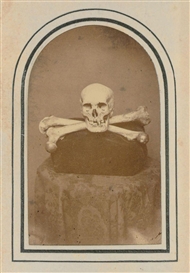

PIRATES: The Opium Trade using the skull-and-crossbones flag at the masthead of a clipper ship.

5/13/13 New York Post revealed that Goldman Sachs had complained that employees usage of their terminals were spied on by Bloomberg reporters.

Further reports indicated that the spying was more widespread, affecting other companies such as JPMorgan. Over 300,000 customers an dworth roughly $6 billion a year, Bloomberg terminals are considered a staple of information in the financial world. On Saturday, the Federal Reserve announced that it would look into the situation. CNBC also reported that the Treasury would be investigating. Bloomberg CEO Daniel Doctoroff admitted that it was a "mistake" to give journalists access to client data. http://ow.ly/l9pfC and http://ow.ly/l9pv8

Beyond Wall Street firms, customers of the more than 300,000 leased Bloomberg terminals across the globe include clients as prominent as the Federal Reserve and the Vatican. http://www.cnbc.com/id/100729453

[ MUST READ ] WHAT COOKED THE WORLD'S ECONOMY? 2009

mortgage bankers, brokers, bundlers, raters, and quants who, in a few short years, littered the world with rotten loans, diseased CDOs, and lethal derivatives

What did cause the crisis was the writing of credit derivatives. In theory, they were insurance policies for investors; in practice, they became a guarantee of global financial collapse. About $2 trillion in credit derivatives in 1989 jumped to $8 trillion in 1994 and skyrocketed to $100 trillion in 2002. Last year, the Bank for International Settlements, a consortium of the world's central banks based in Basel (the Fed chair, Ben Bernanke, sits on its board), reported the gross value of these commitments at $596 trillion.

Derivatives weren't initially evil. They began as insurance policies on large loans. A bank that wished to lend money to a big, but shaky, venture, like what Ford or GM have become, could hedge its bet by buying a credit derivative to cover losses if the debtor defaulted. Derivatives weren't cheap, but in the era of globalization and declining American competitiveness, they were prudent. Interestingly, the company that put the basic hardware and software together for pricing and clearing derivatives was Bloomberg. It was quite expensive for a financial institution-say, a bank-to get a Bloomberg machine and receive the specialized training required to certify analysts who would figure out the terms of the insurance. These Bloomberg terminals, originally called Market Masters, were first installed at Merrill Lynch in the late 1980s. Subsequently, thousands of units have been placed in trading and financial institutions; they became the cornerstone of Michael Bloomberg's wealth, marrying his skills as a securities trader and an electrical engineer.

On the side of the industry were Federal Reserve Chairman Alan Greenspan, Treasury Secretary Robert Rubin, and his deputy, Lawrence Summers. Holding the fort for the regulators was Brooksley Born, who headed the Commodity Futures Trading Commission (CFTC). The three financial titans ridiculed the virtually unknown and cloutless, but brilliant and prophetic Born, who warned that unrestricted derivatives trading would "threaten our regulated markets, or indeed, our economy, without any federal agency knowing about it." Warren Buffett also weighed in against deregulation. About 20 years ago, JP Morgan, the now-defunct investment bank, had brought the idea to AIGFP in London, which ran with it. Seeing the Cassano group's success, Morgan jumped in with both feet. Specializing in credit default swaps-a type of derivative triggered to pay off by negative events in the lives of loans, like defaults, foreclosures, and restructurings-Morgan had a distinctive marketing spin. Its "quants" were classy young dealers who could really do the math, which of course gave them credibility with those who couldn't. They abjured street slang like "protection." They pitched their sophisticated swaps as "technologies." The market adored them. They, in turn, oversold the product, made huge commissions, and wounded Morgan, which had to sell itself to Chase, becoming JP Morgan Chase-now the country's biggest bank.

The heart of darkness was the AIG Financial Products (AIGFP) office in London, where a large proportion of the derivatives were written. AIG had placed this unit outside American borders, which meant that it would not have to abide by American insurance reserve requirements. In other words, the derivatives clerks in London could sell as many products as they could write-even if it would bankrupt the company. In mid-September, when it was on the ropes, AIG received an astonishing $85 billion emergency line of credit from the Fed. Soon, that was supplemented by another $67 billion. Much of that money, to use the government's euphemism, has already been "drawn down." Shamefully, neither Washington nor AIG will explain where the billions went. But the answer is increasingly clear: It went to counterparties who bought derivatives from Cassano's shop in London.

The president of AIGFP, a tyrannical super-salesman named Joseph Cassano, certainly had the experience. In the 1980s, he was an executive at Drexel Burnham Lambert, the now-defunct brokerage that became the pivot of the junk-bond scandal that led to the jailing of Michael Milken, David Levine, and Ivan Boesky.

What's Inside American Banks Atlantic Article

Banks today are bigger and more opaque than ever, and they continue to behave in many of the same ways they did before the crash 2008 at its core, the panic resulted from a lack of transparency. Libor reflects how much banks charge when they lend to each other; it is a measure of their confidence in each other. Now the rate has become synonymous with manipulation and collusion. In other words, one can’t even trust the gauge that is meant to show how much trust exists within the financial system.

DELENO

FACT

Franklin D. Roosevelt's uncle Frederic A. Delano, was born in Hong Kong.

Delano was an original member of the Federal Reserve Board of Governors in 1914,

and was later named by his nephew as Governor of the Federal Reserve Bank of Richmond.

Frederic A. Delano, who was born in Hong Kong, where his father, Captain Warren Delano, was engaged in the opium trade.

Frederic A. Delano was an uncle of Franklin D. Roosevelt and an original member of the Federal Reserve Board of Governors in 1914, and was later named by his nephew Franklin D. Roosevelt as Governor of the Federal Reserve Bank of Richmond.

Franklin A Roosevelt was an original incorporator of Brookings Institution, Carnegie Institution, and Carnegie Endowment for International Peace, director of the Smithsonian Museum, Commission for Relief in Belgium, and Belgian American Educational Foundation set up by Herbert Hoover in World War I, chmn Natl Planning Board 1934-43.

see more about Belgium and the The Bank for International Settlements, 1930-1945

Franklin Deleno Roosevelt was friends with Mayling Soong (Wellsley College) 1897 - 2003 who was the first Chinese Women to address the U.S. Congress through her personal friendship with President Franklin D. Roosevelt and his wife. [See China Boxer Rebellion ]

Delano's wife's sister married Ed Burling, who founded the Washington law firm of Covington & Burling, whose partners later included Dean Acheson and Donald Hiss, brother of Alger. Frederic A. Delano married Mathilda Peasley of Chicago; Edward Burling married her sister Louise. They were the daughters of a railroad tycoon, James C. Peasley of the Burlington Railroad, also president of the National State Bank. Judge J. Harry Covington and Edward Burling founded the law firm of Covington and Burling in Washington in 1919.

Covington, a Maryland congressman, had been appointed Chief Justice of the Supreme Court of Washington, D.C., by Woodrow Wilson as a reward for voting for the passage of the Federal Reserve Act. In 1918, Wilson appointed Covington as United States Railroad Commissioner. Covington was a director of Kennecott Copper and Union Trust. Wilson had also appointed Edward Burling chief counsel of the U.S. Shipping Board. He served in this post from 1917-1919, working closely with Herbert Hoover and Prentiss Gray, later of . Delano's sister was Mrs. Price Collier of Tuxedo Park, N.Y.; his son-in-law was James L. Houghtaling, who was special attache at the American Embassy in Petrograd during the Bolshevik Revolution in 1917 (he later wrote "Diary of the Russian Revolution"), Federal Emergency Administration 1933, Commissioner of Naturalization and Immigration 1937-90, War Finance, Dept of the Treasury 1944-46; chairman Fair Employment Board Civil Service Commission 1949-52 - his mother was a Peabody of Boston.

Marine Paintings and Drawings in the Peabody Essex Museum

Russell & Co. merged with the number one US trader, the J. & T. H. Perkins "Boston Concern" in 1829. THE BIGGEST OPIUM SMUGGLER IN THE U.S.

By the mid-1830s the opium trade had become "the largest commerce of its time in any single commodity, anywhere in the world." Russell & Co. and the Scotch firm Jardine-Matheson, then the world's largest opium dealer working together were known as the "Combination."

George HW Bush(S&B 1948) was born in Milton, Massachusetts not far from the historic home of Robert Bennett Forbes, a Russell partner. Many great American, European and Chinese family fortunes were built on the "China"(opium) trade. Yes, they sold porcelain, tea, silks and other items at home in the US, but they "needed" the trade in opium for silver to pay for the desired goods and—opium smuggling returned "handsome" profits.

SECRET

Kappa Beta Phi

Wall Street fraternity Kappa Beta Phi.

How A Reporter Got Busted Crashing A Super-Secretive Wall Street Fraternity Party. Kappa Beta Phi has been around since before the 1929 stock market crash. It's an invite-only frat that includes some of the biggest names on the Street. "Grand Swipe," "Grand Smudge," "Grand Loaf," and a "Master at Arms." Billionaire investor Wilbur Ross was the Grand Swipe when Roose observed the fraternity up close. That night at the St. Regis Hotel in Midtown Manhattan, Roose witnessed some of Wall Street's biggest names wearing drag and performing skits making fun of Occupy Wall Street.

One-Percent Jokes and Plutocrats in Drag: What I Saw When I Crashed a Wall Street Secret Society

a billionaire investor, Wilbur Ross, proclaimed that “the 1 percent is being picked on for political reasons.” Ross's statement seemed particularly odd, because two years ago, I met Ross at an event that might single-handedly explain why the rest of the country still hates financial tycoons – the annual black-tie induction ceremony of a secret Wall Street fraternity called Kappa Beta Phi. [To see the full Kappa Beta Phi member list, click here.]

DELTA KAPPA EPSILON

Yale University in 1900 Delta Kappa Epsilon, an exclusive fraternity whose members have included Presidents George Bush, Jr. and Sr., Vice-President Dan Quayle, banker J.P. Morgan, newspaper magnate William R. Hearst, chewing-gum millionaire William Wrigley and motel man, Howard Johnson.

Yale University in 1900 Delta Kappa Epsilon, an exclusive fraternity whose members have included Presidents George Bush, Jr. and Sr., Vice-President Dan Quayle, banker J.P. Morgan, newspaper magnate William R. Hearst, chewing-gum millionaire William Wrigley and motel man, Howard Johnson.

American Liberty League

Changed it's Name to the ( Taxed Enough Already) TEA PARTY MOVEMENT

Key Financiers, Organizers and Groups linked to the American Liberty League:

One of Russell and Company's Chief of Operations in Canton was Warren Delano, Jr., grandfather of Franklin Roosevelt, who would have known the truth about Skull and Bones Piracy and gave Franklin the information he needed to help the citizens of the U.S. understand how they were being exploited.

FDR on the The American Liberty League

On Jan. 3, 1936, in an unprecedented joint session of Congress, when President Roosevelt announced a ban on military exports to fascist Italy, he blasted the American Liberty League:

"They steal the livery of great national ideals to serve discredited special interests”¦. This minority in business and industry... engage in vast propaganda to spread fear and discord among the people. They would gang up against the people's liberties”¦. They seek the restoration of their selfish power.”¦.

Our resplendent economic aristocracy does not want to return to that individualism of which they prate, even though the advantages under that system went to the ruthless and the strong. They realize that in 34 months we have built up new instruments of public power. In the hands of a people's government this power is wholesome and proper. But in the hands of political puppets of an economic aristocracy, such power would provide shackles for the liberties of the people. Give them their way and they will take the course of every aristocracy of the past – power for themselves, enslavement for the public."

CURRENCY REFORM IN 1930's CHINA AND THE AMERICAN SILVER POLICY:

A CASE ANALYSIS OF HOW CHINESE MONETARY POLICY WAS INFLUENCED BY AMERICAN POLICY AND CONTEMPORARY EAST ASIAN CIRCUMSTANCES http://digitallibrary.usc.edu/assetserver/controller/item/etd-LIU-3300.pdf

See Corporation: A charter is an agreement that governs the manner in which the bank is regulated and operates. It authorizes the organization of the bank by either the state or federal agency. The agency that charters the bank is primarily responsible for protecting the public from unsafe banking practices. It conducts on-site examinations to make sure the bank's financial condition is good and that the bank is complying with banking laws. State charters and federal charters typically do not differ too much in the way the bank conducts business. They do, however, differ in other areas. For example, in Florida, a state bank is not required to be a member of the Federal Reserve System, while federally chartered banks are. Also, state-chartered banks are regulated by state agencies, while federally chartered banks are regulated by federal agencies. In June 1999, the American Bankers Insurance Association--an affiliate of the American Bankers Association--proposed the idea of an optional federal charter for insurance companies. Such a charter would essentially create for the insurance industry a regulatory structure that roughly replicates the dual-chartering system that exists for banking.

The financial sector's corruption must be recognized as systemic.

SEARCH THIS SITE FOR "LIBOR" FOR ALL THE REST OF THE INFORMATION

"The Bank of England, as the institution that is responsible for the stability of the system and has the expertise and visibility across the entire market, I mean, their views are extremely relevant here," del Missier said. The false rates reported at this time were only part of the investigation. Investigators also found that individual traders at Barclays had persuaded colleagues to submit false rates in the hope of manipulating LIBOR to their advantage.

IN THE LIBOR CASE, NOTABLY, A MAJOR CRIME HAS NOT BEEN GREETED BY MUCH DEMAND AT THE TOP FOR CRIMINAL PROSECUTIONS. THAT ASYMMETRY IS ONE OF THE INSURANCE POLICIES OF POWER. ANOTHER IS TO CRACK DOWN ON CITIZENS' PROTEST.

4/2012 Obama signs Stop Trading on Congressional Knowledge Act law banning insider trading by Congress and for all executive branch employees who currently are required to file financial disclosure statements.The bill also requires members of Congress, their senior staff and top-level executive branch officials to disclose the terms of their mortgages every year.

The final bill dropped a provision in the Senate’s original bill that would have required “political intelligence” operatives to register as lobbyists.

THE WHOLE BILL WAS OVERTURNED!

OPPRESSION by its very nature creates the power that crushes it. A Champion arises - a Champion of the oppressed - whether it be a Cromwell or someone unrecorded, he will be there. He is born. Then out of the mystery of the unknown appeared a masked rider who rode up and down the great internet Hwy punishing and protecting and leaving upon the great oppressor the mark of ZORRO aka ANONYMOUS.

REAL DRUG SMUGGLING PIRATES

SCULL AND BONES YALE 1832

Anonymous Saves America

Anonymous the Modern Day American Folk Hero

Anonymous is a decentralized, online community of individuals around the world who protect the defenseless.

SECRET INNER WORKINGS OF THE FED

EXPOSED FOR THE FIRST TIME EVER

Jefferson's Opinion on the Constitutionality of the Bank

(From: "The Writings of Thomas Jefferson", ed. by H. E. Bergh, Vol. III, p. 145 ff.)

February 15, 1791The bill for establishing a national bank, in 1791, undertakes, among other things,--

1. To form the subscribers into a corporation.

2. To enable them, in their corporate capacities, to receive grants of lands; and, so far, is against the laws of mortmain.

3. To make alien subscribers capable of holding lands; and so far is against the laws of alienage.

4. To transmit these lands, on the death of a proprietor, to a certain line of successors; and so far, changes the course of descents.

5. To put the lands out of the reach of forfeiture, or escheat; and so far, is against the laws of forfeiture and escheat.

6. To transmit personal chattels to successors, in a certain line; and so far, is against the laws of distribution.

7. To give them the sole and exclusive right of banking, under the national authority; and, so far, is against the laws of monopoly.

8. To communicate to them a power to make laws, paramount to the laws of the states; for so they must be construed, to protect the institution from the control of the state legislatures; and so probably they will be construed.

pAPER Money

= rag paper

and metallic ink

Paper used for money, on the other hand, is made from cotton and linen fibers.

This kind of paper is known as rag paper. The other special thing about the rag paper used in real money is that there are tiny blue and red fibers mixed into the paper when it is made. These fibers are easy to find in real money, but they are so fine that they do not reproduce very well in the counterfeit money from your inkjet printer.

The Greenback: America's First Attack on Counterfeiting

Prior to the 1863 creation of a national currency, banks throughout the United States distributed over 7000 different bills.

With so many bills in circulation, shop owners, especially illiterate ones, could not familiarize themselves with all the circulating bills. Counterfeiters prospered with relative ease. By the time the U.S. adopted a national currency, counterfeits made up an estimated one-third of the bills in circulation (Murphy 142).

To counteract the problem, the United States Federal Reserve produced bills known as "greenbacks" that had multiple anti-counterfeiting features. Cameras at the time produced only black and white photos and therefore were unable to replicate the bills' green color (Lipkin 58). Other security features built into the dollar involved its paper, ink, and printing process. Rag paper, or paper constructed from fabric fibers, was chosen for the bills thanks to its durability and relatively high cost of construction (to discourage counterfeiters from manufacturing it). Advanced mills formed the paper by using high pressure and temperature. The equipment, therefore, was expensive to purchase and run. The ink used in the process contained high concentrations of iron, giving it magnetic properties not found in other standard inks. Finally, intaglio presses chosen to produce the greenbacks differed from other printing techniques because ink rested in the grooves of the press, as opposed to lying on elevations. The ink was then transferred onto the paper without direct contact through the application of high pressures. For these reasons, only experienced printers could produce crisp images with intaglio presses (Lipkin 58).

Very little has changed in America's currency since the greenbacks' introduction. Our money still has a distinctive green color, the paper is still composed of linen and cotton, and the presses are still lined with intaglio plates. However, advances in photo and digital imaging allowed counterfeiters to bypass many of the security features of our nation's money through photocopying. In 1993, the National Treasury formed a commission to determine the impact of such new technologies on counterfeiting. Their research showed that production of photocopied bills accounted for only four percent of detected fakes, but the number of bills detected had doubled in a single year. Over the next seven years the number of photocopied fakes would increase to 60% of all confiscated fraudulent bills (Lipkin 59). In order to counteract this newly available technology, the Bureau of Printing and Engraving (BPE) developed and implemented several advanced modifications to the $100 bill (the most counterfeited bill at the time). In 1996, microprinting and plastic security strips were implemented as a defense against photocopying. Microprinting that appeared around Benjamin Franklin's portrait, while visible through a magnifying glass, was too finely drawn for machines at the time and appeared blurry on printed counterfeits (Murphy 144). Bills printed by photocopiers also could not reproduce the plastic security strips.

http://illumin.usc.edu/article.print.php?articleID=189

FED speak

Each of the 12 Reserve Banks has a board of nine directors.

Each Bank's president is appointed by its board of directors and approved by the Board of Governors in Washington, D.C. Reserve Bank directors oversee the operations of their Bank and are subject to the overall supervision of the Board of Governors. The nine directors of each Reserve Bank are evenly divided into three classes, designated A, B, and C. Class A directors represent commercial banks that are members of the Federal Reserve System. Class B and Class C directors represent the public interest and cannot be officers, directors, or employees of any bank. Class B and Class C directors encompass the broad economic interests of the District, including industry, agriculture, services, labor, consumers, and the nonprofit sector. Class A and Class B directors are elected by member commercial banks in the District. Class C directors are appointed by the Board of Governors.

So who

owns the Fed?

"So who owns the Fed? Although it is set up like a private corporation and member banks hold its stock, the Fed owes its existence to an act of Congress and has a mandate to serve the public. So the most accurate answer may be that the Fed is "owned" by the citizens of the United States."

Remember #5 above? Each individual Reserve Bank is managed by a Board of Directors

5. To put the lands out of the reach of forfeiture, or escheat; and so far, is against the laws of forfeiture and escheat.

For Example

Written agreement with The ShoreBank Corporation

http://www.federalreserve.gov/newsevents/press/enforcement/20100112b.htm

"The ShoreBank Corporation" is the holding company for ShoreBank. January 12, 2010

The Federal Reserve Board announced the execution of a Written Agreement by and between The ShoreBank Corporation, Chicago, Illinois, a registered bank holding company, and the Federal Reserve Bank of Chicago. A copy of the Written Agreement is attached. Attachment (275 KB PDF) <> 2010 Enforcement Actions

Recent Private Companies Transactions

Merger/Acquisition August 21, 2010 ShoreBank Pacific Corporation

Merger/Acquisition August 20, 2010 ShoreBank

Mr. George Surgeon Chief Executive Officer

Ron Grzywinski (one of the original founders of Shorebank) was the only banker to testify before Congress in support of the Community Reinvestment Act. Its passage was instrumental in paving the way for Shorebank's success. Because Shorebank was lending to run-down neighborhoods, the Clintons, along with Shorebank, decided to establish the Southern Development Bancorporation in Arkadelphia, Arkansas in 1988. They hoped that the poor in Arkansas would be helped by the loans they could obtain. Hillary's former roommate at Wellesley College, Jan Piercy, joined Shorebank in 1984. In this video, Hillary Clinton speaks (in September 2008) about Shorebank. The “Ron” she refers to is Ron Grzywinski, one of the founders of Shorebank (founded in 1973).

ShoreBank Among 8 FDIC Bank Closures: Total Of 118 Seized In 2010

A consortium funded by several of the biggest U.S. financial firms is buying its assets and pledging to operate the new bank by the same principles. The Federal Deposit Insurance Corp. took over ShoreBank, with $2.16 billion in assets and $1.54 billion in deposits. Urban Partnership Bank, the newly chartered financial institution, agreed to assume ShoreBank's deposits and nearly all its assets. In an unusual move, the FDIC allowed some of ShoreBank's executives to continue running the restructured bank. Executives who joined ShoreBank recently, as the bank struggled to raise capital, will manage Urban Partnership Bank. These managers "did not contribute to the bank's problems," the FDIC said. The FDIC and Urban Partnership Bank also agreed to share losses on $1.41 billion of ShoreBank's loans and other assets. ShoreBank's failure is expected to cost the deposit insurance fund $367.7 million.

Similar Private Companies By Industry

Privatewealth Trust Company operates as a subsidiary of Privatebancorp Inc.

http://www.secform4.com/insider-trading/889936.htm

-- More --

2011 GAO finds the Federal Reserve Board Has Serious Conflicts of Interest.

More Fed Facts:

Information about the Federal Reserve that should have been made public long ago. We now know that the Fed's secret $7.7 trillion lending program wasn't just the most massive bank bailout ever seen, and it wasn't just free money for mega-bankers - though it was certainly both of those things. It was also the greatest hoax in stock market history. No, scratch that. It was the greatest hoax in the history of money. And it was built on lies. How many? Let us count the ways.

- Secret Fed Loans Gave Banks Undisclosed $13B

- MSNBC Host Cenk Uygur speaks with Rolling Stone Matt Taibbi on a government "Shadow Budget" that benefited Wall Street Street

- The Federal Reserve Bails out Wall Street Wives

- JPMorgan Joins Goldman Keeping Italy Debt Risk in Dark

- The Fed Must Reveal Which Big Banks Took Emergency Loans From The Discount Window

- The Fed Must Release Bank Loan Data as High Court Rejects Appeal

-

Fed Gave Banks Crisis Gains on $80 Billion Secretive Loans as Low as 0.01% May 26, 2011

Credit Suisse Group AG (CS), Goldman Sachs Group Inc. (GS) and Royal Bank of Scotland Group Plc (RBS) each borrowed at least $30 billion in 2008 from a Federal Reserve emergency lending program whose details werent revealed to shareholders, members of Congress or the public. The $80 billion initiative, called single-tranche open- market operations, or ST OMO, made 28-day loans from March through December 2008, a period in which confidence in global credit markets collapsed after the Sept. 15 bankruptcy of Lehman Brothers Holdings Inc. Units of 20 banks were required to bid at auctions for the cash. They paid interest rates as low as 0.01 percent that December, when the Feds main lending facility charged 0.5 percent. This was a pure subsidy, said Robert A. Eisenbeis, former head of research at the Federal Reserve Bank of Atlanta and now chief monetary economist at Sarasota, Florida-based Cumberland Advisors Inc. The Fed hasn't been forthcoming with disclosures overall. Why should this be any different? - The Fed's secret giveaway to European banks - an $80 billion loan scheme known as ST OMO, which was so obscure that even Barney Frank had no idea it existed when he required the Fed to turn over its lending data in his Dodd-Frank bill.