Contents

- Introduction

- Preface

- Overview

- Relief Valve

- LECTURE 1: Why We Are In The Dark About Money

- LECTURE 2: The Con

- LECTURE 3: The Vatican-Central to the Origins of Money & Power

- LECTURE 4: London The Corporation Origins of Opium Drug Smuggling

- LECTURE 5: U.S. Pirates, Boston Brahmins Opium Drug Smugglers

- LECTURE 6: The Shady Origins Of The Federal Reserve

-

LECTURE 7: How The Rich Protect Their Money

- What Do You Know About getting Rich?

- Wall Street: How they Make Money

- The Royal Colonies

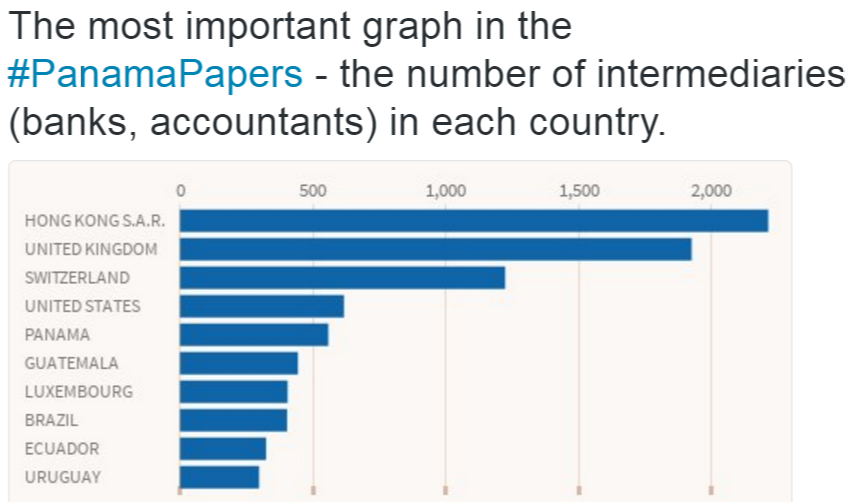

- Offshore Banking - Panama Papers

- Tax Havens

- Collectibles and Taxes

- Royal Jewels measured in Centuries not Carats

- We Buy Gold

- Free Trade Is Not American

- The Filibuster and Freebooting

- America's Total Debt Report

- Enron: Ultimate agent of the American empire

- What is a Cash Cow?

- Lecture 7 Objectives and Discussion Questions

- LECTURE 8: How To Protect Your Money From The 1% Predators

- LECTURE 9: Final Thoughts

HOW BANKSTERS and LAWYERS HIDE YOUR MONEY

PRIVACY = POWER AND ONLY BANKSTERS CAN PAY POLITICIANS TO KEEP THEIR SECRETS

INTERNATIONAL BANKSTERS

OFFER TAX EVASION, INVERSIONS, AND HAVENS

Tax Havens & Off Shore Banking

SEARCH THROUGH THE PANAMA PAPERS PUBLIC DATABASE

KNOW YOUR MUFUGAZZ!

Offshore corporations have one main purpose - to create anonymity. Shell companies, cloaked in secrecy, provide cover for dictators, politicians and tax evaders.

The Opium Trade "If the trade is ever legalized, it will cease to be profitable from that time.

The more difficulties that attend it, the better for you and us." -- Directors of Jardine-Matheson

A rigged economy is when the top 1/10 of 1% owns as much as the bottom 90%. - Bernie Sanders

2017 Paradise Papers: Your guide to four years of offshore revelations

https://archive.is/CmgQ7

Paradise Papers: Tax haven secrets of ultra-rich exposed A huge new leak of financial documents has revealed how the powerful and ultra-wealthy, including the Queen's private estate, secretly invest vast amounts of cash in offshore tax havens.

Two offshore firms, 19 secrecy jurisdictions, 13.4 million files. The Paradise Papers expose the secrets of the global elite.

BETWEEN $21 AND $32 TRILLION IS HIDING IN TAX HAVENS

2016 By one estimate -- based on data from the World Bank, IMF, UN, and central banks of 139 countries -- between $21 and $32 trillion is hiding in tax havens, more than the United States’ national debt.

Fortune 500 cos are holding $2.5tn offshore avoiding $718bn in taxes according to @FACTCoalition members latest report

How did these secretive financial activities come to be called “offshore” in the first place?

When “offshore” first came ashore in English, it was used quite literally, as an adjective or adverb referring to something, like an island, located away from the mainland. An “offshore wind” is one that moves out to sea. In his 1720 pirate tale “Captain Singleton,” Daniel Defoe mentioned winds blowing “off shore” (or “off the shore”) three different times. After World War II, “offshore” started entering financial contexts as well. the Marshall Plan also allowed for “offshore purchases” of goods from Canada and other countries, sold with American dollars. A 1962 Wall Street Journal article on the Bahamas, already famous as a tax haven, pointed to the word’s new direction. The lenient tax laws of the island country facilitated the creation of many “U.S. offshore companies,” the Journal reported. As other English-speaking Caribbean islands joined in the development of “offshore” business activities, the term became enshrined more officially, with “offshore financial center” emerging as something of a euphemism for “tax haven” starting in the 1970s.

tools

The Organized Crime and Corruption Reporting Project (OCCRP) has ID SEARCH

“People using the new data platform, called ID Search, will be able to set up email alerts notifying them when new results appear for their searches or for persons tracked on official watchlists. They can also create their own private watchlists. Using the new tool, journalists and researchers will be able to access data including gazettes of commerce, company records, leaks, court cases and more. One of the most comprehensive open source lists of Politically Exposed Persons is also at users’ disposal. Starting today, most sources on ID Search will be updated every 24 hours.” Resources from all over the world are here, but seem more focused on Europe/Eurasia.

THE USA LAUNDERS MONEY TO FINANCE THEIR MILITARY BUDGET WITH THE MONEY FROM THE WORLD'S CRIMINAL CLASS

Panama, and hence Panamanian companies, were set up initially to register oil tankers and mineral ships in order to give the appearance of taking all of their profits on the transporting the oil, or the copper or other minerals, from third world countries to the United States and Europe.

The United States went along with this. This made the oil industry tax exempt really since the 1920s. When the income tax was created in 1913 or 14, it was intended to capture economic rents. But the big rent extractors, oil and gas and minerals, got away with avoidance.

PANAMA PAPERS

WEALTH OBJECTIVES

IS THE PROOF OF STRATEGY

How a U.S. president and JP Morgan made Panama: and turned it into a tax haven

History has its way of coming ironically around, and it certainly has in the early 21st century on two counts, echoing Panama’s genesis. One is that the man who became president of Standard Oil back in those early days of tax dodging – William Stamps Farish II – had a grandson, William Farish III, who became a crucial aide and lieutenant to the Bush dynasty; he was “almost like family”, said Barbara Bush, and became her son George W Bush’s ambassador to London. (JP Morgan has meanwhile hired a string of illustrious ambassadors and consultants of late, few more prestigious than Bush’s closest ally, Tony Blair.)

In 1903 the US bullied Colombia into giving up the province that became Panama. The plan was to create a nation to serve the interests of Wall Street. The reason, of course, was to gain access to, and control of, the canal across the Panamanian isthmus that would open in 1914 to connect the world’s two great oceans, and the commerce that sailed them. The Panamanian state was originally created to function on behalf of the rich and self-seeking of this world – or rather their antecedents in America – when the 20th century was barely born. The Roosevelt/JP Morgan connection in the setting-up of the new state was a direct one. The Americans’ paperwork was done by a Republican party lawyer close to the administration, William Cromwell, who acted as legal counsel for JP Morgan. JP Morgan led the American banks in gradually turning Panama into a financial centre – and a haven for tax evasion and money laundering – as well as a passage for shipping, with which these practices were at first entwined when Panama began to register foreign ships to carry fuel for the Standard Oil company in order for the corporation to avoid US tax liabilities. Panama was created by the United States for purely selfish commercial reasons, right on that historical hinge between the imminent demise of Britain as the great global empire, and the rise of the new American imperium. In 1989 the US returned militarily, as it had eight decades previously, and – as Silverstein puts it – “returned to power the old banking elites, heirs of the JP Morgan legacy”.

U.S. corporations shifted more than a HALF-TRILLION DOLLARS to 10 tax havens in a single year

Corporations set up affiliated shell companies in countries where taxes are low or nonexistent and reroute payments and liabilities to serve their needs. Mossack Fonseca is one of the widest-reaching creators of shell companies in the world. It has served as the registered agent for front companies tied to an array of notorious gangsters and thieves. Shell companies need a registered agent, sometimes an attorney, who files the required incorporation papers and whose office usually serves as the shell's address. This process creates a layer between the shell and its owner, especially if the dummy company is filed in a secrecy haven where ownership information is guarded behind an impenetrable wall of laws and regulations. It has affiliated offices in 44 countries, including the Bahamas, Cyprus, Hong Kong, Switzerland, Brazil, Jersey, Luxembourg, the British Virgin Islands, and—perhaps most troubling—the US, specifically the states of Wyoming, Florida, and Nevada.

TAX AVOIDANCE

HOW AMAZON SAVED BILLIONS IN TAXES A cache of hidden court documents reveals Amazon's covert tax strategies in Luxembourg. A landmark court case between the Inland Revenue Service and Amazon could result in a $1.5 billion fine for Amazon, the company’s secret business success is out. A similar investigation into Ireland’s treatment of Apple this week resulted in the commission ordering Apple to pay 13 billion euros ($14.5 billion) in back taxes.

WAR IS AN ECONOMY

Q: WHAT IS IT GOOD FOR?

A: HIDING MONEY!

The whole financial system basically has been criminalized in the process of being militarized, to subsidize the fact that countries like the United States and Britain have heavy military budgets.

This is how they finance their military budget – with money laundering by the world’s criminal class.

The byproduct is to leave the largest companies tax exempt, from Apple to Exxon, right down the line.

The problem that America had in the 1960s was the Vietnam War. The entire balance-of-payments deficit of the United States in the 1950s and the ‘60s, right down to the early ‘70s, was military spending abroad. Either the dollar was going down or the United States had to sell gold. That’s what finally led Nixon to take the dollar off gold in 1971. But for many years the United tried to fight against doing that.

So the State Department came to Chase, and said, we’ve got to figure out some way of getting enough dollars to offset the military deficit. They found the way to do it. It was to make the United States the new Switzerland of the world. I was asked to make a calculation of how much criminal capital there is in the world. How much the drug dealers made, how much the criminals all over made, how much the dictators secreted away. How much goes to Switzerland, and how can U.S. banks get this criminal money in the United States?

The end result was that the U.S. Government went to Chase and other banks and asked them to be good American citizens and make America safe for the criminals of the world, to safeguard their money to support the dollar in the process.

The idea is not to put money into the United States directly. So what you have to do is launder the money.

Likewise with the Colombian drug cartel. They’re not going to put the Colombian drug cartel balance in a Delaware bank under their name. It has to go through a lot of stages. The money goes out of the Ukraine and out of Russia into Latvia, primarily via the banks of Riga. I’ve met with individuals in Riga, Americans who provide the service of setting up maybe 30 companies for the money launderer. They will send the money, say, to the British West Indies. From the British West Indies it’ll go to Panama. And then it’ll go from Panama, already being concealed, to end up in a Delaware corporation at the end of the line. You can look and see how much American stock, how many American bonds, how many American bank deposits all come from these islands. The magnitude is so enormous that this is what has been supporting the dollar.

CONgress totally agrees with and supports this.

In the 1960s it recognized that basically, criminals are the most liquid people in the world. They don’t want to tie down their money and property, because property can be seen, it’s visible. Finance in the balance of payments reports is called “Invisibles.” If you’re a criminal, you want to have your finance invisible in order to keep it safe. And the safest investment is U.S. Treasury bonds.

MOST FOREIGNERS WHO HOLD TREASURY BONDS ACTUALLY ARE CRIMINALS

So there was an argument in Congress in the 1960s:

Do we want to have 15% tax withholding on the Treasury bonds, especially to foreigners?

It was pointed out that most foreigners who hold Treasury bonds actually are criminals. So Congress said, we need criminal money. We are not going to withhold criminal taxes. We’re going to make crime tax-free. We’re going to tax American industry, we’re going to tax American labor, but not foreign criminals, because we need their money. So we’re not going to withhold what they hold through their fiduciary accounts in Delaware, which was the main at that time, or New York, or London branches of U.S. banks. The London branches of U.S. banks were the single major depositors and source of revenue of growth in the 1960s for Chase, Citibank and others. They were called eurodollars. The eurodollars flowing into these branches were very largely from drug dealing and arms dealing, and third world dictators in Africa and other places.

UNDER U.S. PRESSURE, THE INTERNATIONAL BANKING SYSTEM WAS SET UP TO FACILITATE THE MONEY LAUNDERING OF DRUG CAPITALSo under U.S. pressure, the international banking system was set up to facilitate the money laundering of drug capital. The reason the Americans and the Canadians were not particularly noteworthy in the law firm’s records is the Panamanian law firm’s records was that its role was to set up money laundering for foreigners, to conceal their means of getting money. But the oil industry doesn’t conceal it. The oil industry declares all of the income it gets, and the mining industry declares all the income that it gets from the Panamanian shipping companies, from the Liberian shipping companies. But because Panama and Liberia don’t have an income tax, there’s no tax liability for this. It’s stolen fair and square from the tax collector, just like California Senator Hayakawa said America had stolen Panama fair and square from Colombia.

The solution to Money Laundering is to tax companies on their worldwide earnings.

WHY THE US IS THE BEST PLACE TO HIDE YOUR MONEY

12/2015 US has refused to join the Common Reporting Standard (CRS)

CRS means that many countries which previously benefited from the opacity of the banking system would lose their attractiveness for foreign capitals. There is no doubt that the Republicans and Democrats in Congress will delay joining CSR as much as possible since the current situation is lucrative for Washington.

(REPUBLICAN MAJORITY) The US has refused to join the Common Reporting Standard (CRS) which binds banks to share information about assets with tax services of other countries. Switzerland has accused the US of double standards and abuse of confidence. On May 6, 2014, 47 countries agreed on a common reporting standard, an agreement to share information on residents’ assets and incomes automatically in conformation with the standard. The initiative has been declared an effective way to counter tax evading by residents via transferring assets abroad. On July 12,2015, 53 jurisdictions signed an agreement to automatically exchange information based on Article 6 of the Convention on Mutual Administrative Assistance in Tax Matters.

CRS will come into effect in 2017 and information sharing between the parties will begin 2018.

The US is currently opposing joining the mechanism but may sign the document in the future, Anne Cesard, a representative of the Swiss State Secretariat for International Financial Matters, told El Confidencial. "The refusal means that the US is free to act as it like, but our hands are tied," she added. The world already has – Foreign Account Tax Compliance Act (FATCA), allowing for sharing fiscal data, but not automatically. However, there is a clear distinction between FATCA and CSR — FATCA is aimed at collecting fiscal data about US people for the US tax authorities. Thus while the other parties to FATCA must provide fiscal data to the US, the US itself can reject any request. As a result, foreigners holding their assets in the US are much more protected than in Switzerland.

THE WOLF OF WALL STREET

BANKSTER WOLVES OF WALLSTREET

Massive leak exposes how the wealthy and powerful hide their money

2009 The Hidden Wealth of the Richest 1%

2016 The secret story behind how “Wolf of Wall Street” was financed:

Red Granite company that produced WOLF OF WALL STREET was actually “an int’l conspiracy to launder money”

Red Granite came up with the more than $100 million needed to film the sex- and drug-fueled story of a penny-stock swindler. Global investigators now believe much of the money to make the movie about a stock scam was diverted from a state fund 9,000 miles away in Malaysia, a fund that had been established to spur local economic development. The fund, 1Malaysia Development Bhd., or 1MDB, was set up seven years ago by the prime minister of Malaysia, Najib Razak. His stepson, Riza Aziz, isthe chairman of Red Granite Pictures. The 1MDB fund is now the focus of numerous investigations at home and abroad, which grew out of $11 billion of debt it ran up and questions raised in Malaysia about how some of its money was used. Investigators in two countries believe that $155 million originating with 1MDB moved into Red Granite in 2012 through a circuitous route involving offshore shell companies, said people familiar with the probes. The film grossed about $400 million and was nominated for five Academy Awards, including best picture. There is no indication any profits from it flowed to 1MDB or Malaysia. Investigators believe this money never got to Aabar in Abu Dhabi but went instead to a separate, almost identically named company that Mr. Al-Husseiny had helped set up in the British Virgin Islands, called Aabar Investments PJS Ltd., said people familiar with the probes.

2017 The U.S. government's fight against "The Wolf of Wall Street" could be reaching its finale.

Last summer, the Justice Department laid claim to profits from the 2013 Leonardo DiCaprio blockbuster because the production company, Red Granite Pictures, was implicated in a massive foreign fraud case. Now the two parties are discussing a settlement, according to court documents filed Tuesday. U.S. prosecutors allege that corrupt officials and financiers stole $3.5 billion from a Malaysian government investment fund called 1Malaysia Development Berhad. Tens of millions of dollars was diverted to Red Granite Pictures to produce "The Wolf of Wall Street," the agency said. The Justice Department wants to seize $1 billion that traveled through American banks. It also wants any rights, royalties and distributions fees from the movie.

2014 Meet The Real 'Wolf Of Wall Street' In Forbes' Original Takedown Of Jordan Belfort

and then we learn that the very magazine FORBES that chronicles the new titans it itself on the way out too. Steve and Timothy Forbes, the sons of Malcolm Forbes need to sell. All good things come to an end, even for the rich, and Forbes will probably pass out of family control for small money to a foreign buyer!Barney Warf: Contact Center for Global & International Studies cgis@ku.edu 785-864-1120

2016 u.s .

Money Laundering

Loophole Rules

Under the final Customer Due Diligence rule, the beneficial owner could be listed as the agent who manages the shell corporation, rather than the ones who own it. Under this definition, the “beneficial owner” could be a designated manager, like a lawyer at Mossack Fonseca, the company at the heart of the Panama Papers leaks who set up hundreds of thousands of shell companies for their clients. This would be of no use whatsoever to law enforcement in cracking down on the true beneficiary, the individuals profiting from the shell corporation setup. This corrupts the definition of beneficial ownership as it has been commonly used. In addition, the final rule places a threshold in their definition of legal ownership of 25 percent equity interest in the corporation. Experts believe this provides would-be money launderers with a blueprint for how to avoid detection by diffusing their ownership stakes through multiple beneficiaries. In addition, accounts set up in escrow by lawyers are excluded from the provisions.

PANAMA PAPERS SEARCH THROUGH THE PUBLIC DATABASE

LONDON

DARK MONEY: LONDON'S DIRTY SECRET

300000 offshore shell companies The database contains ownership information about companies created in 10 offshore jurisdictions including the British Virgin Islands, the Cook Islands and Singapore. It covers nearly 30 years until 2010.

In an age of austerity, protesters had railed aqainst financial structures that they believed kept the rich wealthy at the expense of other taxpayers. Now here was what might have felt to them like a counterpunch against “the 1 per cent”. It was crucial to avoid a paper trail that might allow the authorities to spot a connection between a US taxpayer and a secret account. For an extra quarterly fee, the bank would refer to clients only by a code name on all documents relating to their Swiss accounts. More than a third of the bank’s American clients — there were 3,500 in total, with $2.8bn in declared and undeclared accounts — used this service. Two-thirds gave “hold mail” instructions, meaning that nothing should be sent by post to the client’s home address. If necessary, BSI bankers would fly from Switzerland to the US to hand-deliver account documents.

The City is intimately connected to British Crown dependencies and overseas territories such as Guernsey and the Virgin Islands that supply front companies, anonymous trusts and other types of financial camouflage. “If you lump them all together,” says Alex Cobham, head of research at the Tax Justice Network campaign group, “the British secrecy network is the biggest in the world.”

Importing #PanamaPapers into @Neo4j, either with the bulk importer in 23s or with @docker and LOAD CSV. Enjoy! https://archive.is/FCnp5 and the people and the technology behind the panama papers

Search through the data and visualize the networks around thousands of offshore entities, including, when available, Mossack Fonseca’s internal records of the company’s true owners. The interactive database will also include information about more than 100,000 additional companies that were part of the 2013 ICIJ Offshore Leaks investigation. It will be a careful release of basic corporate information. ICIJ won’t release personal data en masse; the database will not include records of bank accounts and financial transactions, emails and other correspondence, passports and telephone numbers. The selected and limited information is being published in the public interest.

It exposed the role of big banks in facilitating secrecy and tax evasion and avoidance. And it showed how companies and individuals blacklisted in the U.S. and elsewhere for their links to terrorism, drug trafficking and other crimes were able to do business through offshore jurisdictions.

Panama is not even in the top 10 countries with the least financial transparency.

They say that rich Europeans and North Americans can easily hide their money much closer to home IN THE USA

And this may explain why so few US residents have so far been implicated in the Panama scandal.

The profits US corporations stashed in 10 tax havens in 2012 is 1/2 trillion dollars almost the amount of the entire US military budget.

Democracy and Political Influence at root, the Panama Papers are not about tax. They’re not even about money.

What the Panama Papers really depict is the corruption of our democracy. Following on from LuxLeaks, the Panama Papers confirm that the super-rich have effectively exited the economic system Tax havens are simply one reflection of that reality. Discussion of offshore centres can get bogged down in technicalities, but the best definition I’ve found comes from expert Nicholas Shaxson who sums them up as: “You take your money elsewhere, to another country, in order to escape the rules and laws of the society in which you operate.” In so doing, you rob your own society of cash for hospitals, schools, roads… the rest of us have to live in. Thirty years of runaway incomes for those at the top, and the full armoury of expensive financial sophistication, mean they no longer play by the same rules the rest of us have to follow.

HOW THEY HACKED IT

Panama Papers: Email Hackable via WordPress, Docs Hackable via Drupal April 8, 2016

The Mossack Fonseca (MF) data breach, aka Panama Papers, is the largest data breach to journalists in history and includes over 4.8 million emails. Yesterday we broke the story that MF was running WordPress with a vulnerable version of Revolution Slider and the WordPress server was on the same network as their email servers when the breach occurred.

Who is really behind the creation of these mechanisms and loopholes for tax evasion?

Panama wasn’t designed to launder money. It was designed to launder earnings – mainly by the oil and the gas industries, and the mining industry. Panama and Liberia were long noted as having “flags of convenience.”

Panama Papers source breaks silence over 'scale of injustices

The whistleblower behind the Panama Papers broke their silence on Friday to explain in detail how the injustices of offshore tax havens drove them to the biggest data leak in history. The source, whose identity and gender remain a secret, denied being a spy. “For the record, I do not work for any government or intelligence agency, directly or as a contractor, and I never have. My viewpoint is entirely my own.” the legal profession, which helped set up tens of thousands of Mossack Fonseca-run shell companies. More than half the law firm’s offshore corporations were based in the British Virgin Islands, a UK-administered tax haven. “Mossack Fonseca did not work in a vacuum. Despite repeated fines and documented regulatory violations, it found allies and clients at major law firms in virtually every nation,” the manifesto claimed.

Wealth uses Attorneys and accountants to hide their money in shell companies registered in Tax Havens.

Joseph Stiglitz, who won the Nobel Prize in economics in 2001, would be one member of an international panel formed to review Panama's legal and financial practices and recommend improvements.

Panama Papers: Corporations Shifted A Half-Trillion Dollars To Offshore Tax Havens In 2012

Here's an absolutely amazing stat about U.S. corporations stashing cash in tax havens. Obama admin moves to try to block EU regulators from cracking down on corporate tax evasion.

5/28/16 Panama-based Mossack Fonseca law firm says it will close its offices in Jersey and Isle of Man -- two Crown dependencies of Britain -- and Gibraltar -- a British overseas territory jutting off from Spain. The announcement came nearly eight weeks after the first reports about the Panama Papers emerged, divulging details taken from nearly four decades of records from Mossack Fonseca's computer archives. They revealed that many prominent leaders, politicians, celebrities and wealthy individuals around the world used Mossack Fonseca to start up or run offshore entities to hold their assets.

The Bankster Families Who Control Opium Smuggling

The names of the families and institutions are known to the history student: Matheson, Keswick, Swire, Dent, Baring, and Rothschild; Jardine Matheson, the Hong Kong and Shanghai Bank, the Chartered Bank, the Peninsular and Orient Steam Navigation Company [P&O].

Panama Papers: Bermuda mentioned in UK media British parliamentarians have come under further fire over offshore assets after a Tory party official admitted having assets in Bermuda. In an article published online yesterday, The Sun reported that 12 senior Tory officials had put their assets in offshore blind trusts to avoid “clashes with their jobs”, including Robert Halfon, the Tory party deputy leader. Mr Halfon admitted holding shares in Jardine Matheson, a firm based in Bermuda with headquarters in Hong Kong. The article explains that blind trusts are used to prevent ministers from using their positions from influencing their own investments, but also keeps their financial affairs private.

HSBC The Pirate Bank - The purpose of HSBC is to launder money. HSBC sold its Panama bank in 2013

The Law Firm That Works with Oligarchs, Money Launderers, and Dictators

One purpose of a so-called shell company is that the money put in it can't be traced to its owner. Say, for example, you're a dictator who wants to finance terrorism, take a bribe, or pilfer your nation's treasury. A shell company is a bogus entity that allows you to hold and move cash under a corporate name without international law enforcement or tax authorities knowing it's yours. Once the money is disguised as the assets of this enterprise—which would typically be set up by a trusted lawyer or crony in an offshore secrecy haven to further obscure ownership—you can spend it or use it for new nefarious purposes. This is the very definition of money laundering—taking dirty money and making it clean—and shell companies make it possible. They're "getaway vehicles," says former US Customs investigator Keith Prager, "for bank robbers."

To conduct business, shell companies like Drex need a registered agent, sometimes an attorney, who files the required incorporation papers and whose office usually serves as the shell's address. This process creates a layer between the shell and its owner, especially if the dummy company is filed in a secrecy haven where ownership information is guarded behind an impenetrable wall of laws and regulations.

BANKS SELL SECRECY AS

THEIR PRODUCT

#1 TO SET UP AN OFFSHORE ACCOUNT YOU'LL NEED AN APOSTILLE STAMP

http://www.apostille.us/documents/apostille.shtml

In 1961 The Hague Conference on Private International Law established the Apostille. Apostille is an authentication certification, a stamp. It is designed for use among nations that participate in the Hague Convention. These joint regions are called signatory countries as formed by the Hague Conference on Private International Law. Apostille only pertains to public documents. Primary examples of public instruments are marriage, birth and death certificates as well as court documents, patents and even diplomas.

PANAMA PAPERS

GEOGRAPHIES OF CORRUPTION

MOSSACK FONSECA LAW FIRM HIDES THE MONEY

HSBC’s top brass have “no idea” about Mossack Fonseca. Here’s a primer.

Names of prominent Americans not likely in Panama Papers because foreign banks need to be FATCA compliant (can't have US accounts)

THE WESTERN BANKING SYSTEM HAS ASSISTED THE WORLD’S KLEPTOCRATS AND TAX DODGERS

"WE KNOW (OF) … UPWARDS TO $6 TO $10 BILLION A YEAR LAUNDERED THROUGH THE U.S." ~ Patrick Fallon Jr., head of the FBI’s financial crimes section

Dirty Little Secrets Mossack and his business partner Ramon Fonseca, are captains in an offshore industry that has had a major impact on the world’s finances since the 1970s. The Panama Paper leak is estimated to be 100 times bigger than Wikileaks. It's believed to be the largest global investigation in history.

Phrases like secrecy jurisdiction, tax haven and offshore have overlapping meanings, roughly translating as an “escape” from laws in one place to a locale whose allure is zero-to-low tax rates – along with tools to hide one’s identity, according to the Tax Justice Network. The network, an advocacy group that argues that tax havens have exacerbated global poverty and income inequality by giving the corrupt and the rich a place to stash assets, ranks Panama as No. 13 on its Financial Secrecy Index.

In 1983, six armed robbers looted $40 million in gold bars from the Brinks-Mat warehouse near London’s Heathrow Airport. Less than 18 months later, Mossack formed a Panamanian shell company for a man named Gordon Parry. Parry was convicted in 1992 of laundering money from the London heist, the second-biggest robbery in Britain’s history. But Mossack continued to do business with the company, despite realizing as early as 1986 that the company was “apparently involved in the management of money from the famous theft from Brink’s-Mat in London,” according to an internal memo. “The company itself has not been used illegally, but it could be that the company invested money through bank accounts and properties that was illegitimately sourced.”

The Panama Papers: how the world’s rich and famous hide their money offshore

Mossack Fonseca a Panama-based law firm

The Panama Papers show us that just because certain behavior is “legal” does not prove that it is ethical or just.

A world of hidden wealth:

why we are shining a light offshore Huge leak reveals how the powerful exploit secretive tax regimes – and widen the gulf between rich and poor.

The political debate around tax avoidance so far has focused only on individuals – not businesses like Blairmore that operate outside the tax jurisdiction of the largest world economies. Due to the opaque nature of Panama's company records, it is impossible to know the full extent of his earnings from the fund, the size of his shareholding or what happened to the shares after his death.

The global movement to recapture trillions of the hidden wealth of nations.

The Panama Papers reveal the widespread use of shell corporations in the British Virgin Islands, the Seychelles in the Indian Ocean, and Panama. Historically, North American investors prefer tax havens in the Caribbean or Panama, with an estimated 54 percent of offshore investments going to those areas. Other popular tax dodging destinations were Switzerland, Ireland, and the Channel Islands, off the coast of England. Transnational corporations also have an estimated $2 trillion in assets hidden in offshore tax havens or stashed in subsidiary corporations in countries with minimal or no corporate taxation.

The Panama Papers are nothing but the US attempt "to drain certain tax havens and position itself as the new largest tax haven. Most of the US banks, especially in federal states like Nevada, South Dakota, Wyoming and Delaware, enjoy unlimited secrecy, which is why they are often referred to as "new Switzerland". The Panama Papers, exposing the illegal financial activities of politicians and celebrities via offshore companies, is just an instrument in the hands of the US aimed at "redirecting financial flows" to the country.

Luxenburg is THE place for Multinationals to hide their money

Exposing Luxembourg's tax secrets

Disney, Apple, etc

VIDEO http://www.business-standard.com/video-gallery/featured-videos/hero-or-criminal-exposing-luxembourg-s-tax-secrets-17690.htm

The whistle-blower at the center of a tax scandal involving some of the world's biggest companies speaks to Bloomberg. Antoine Deltour faces up to five years behind bars for leaking documents from global accountancy giant PwC's Luxembourg offices. He told Tom Mackenzie he has no regrets about his role in what became known as the 'LuxLeaks' scandal. Beck, 49, is one of about 30 Swiss advisers who have been indicted in the U.S. since 2008, part of a broad probe of tax evasion and undeclared offshore accounts. At least 21 are still at large, including Beck. More than 50,000 Americans have avoided prosecution by disclosing undeclared accounts, paying over $7 billion. Separately, offshore banks have agreed to pay more than $4 billion in U.S. fines, penalties and restitution. Federal prosecutors haven’t sought the extradition of the indicted Swiss advisers because Switzerland generally won’t extradite its own citizens.

Sons of Indicted Swiss Financial Adviser Keep Business in the Family

For more than two decades, prosecutors allege, Swiss financial adviser Josef Beck practiced the dark art of handling dirty money. He conspired with Switzerland’s biggest bank, UBS Group AG, to help dozens of Americans evade taxes, once using a young child to deliver a bag of cash to a client, according to a 2012 federal indictment (PDF). He has never come to the U.S. to face those charges, and the Department of Justice considers him a fugitive. Yet in a low-rise Zurich office building, the Beck family business of advising wealthy Americans lives on.

3/18/15 EU plans tax transparency clampdown

The European Commission has laid out plans to clamp down on so-called sweetheart tax deals between governments and multinationals. The Tax Transparency Package proposes that European governments automatically exchange details of tax rulings to try to tackle "aggressive tax planning". Each country would have to declare all its tax rulings every three months. The move comes during ongoing investigations into a number of member states' tax regimes. Luxembourg, Ireland and the Netherlands have all been put under the spotlight. Belgium's tax deals are also under scrutiny. The Commission is investigating whether the tax regimes of the EU nations amount to state aid. Allegations also emerged last year that around 340 multinational companies had tax avoidance deals with Luxembourg. Among the companies accused of signing "sweetheart deals" with Luxembourg to avoid billions in taxes in other countries were Pepsi, Amazon, Ikea, Microsoft, Disney, Skype and Fiat.

2015 The Swiss Amnesty program is part of a tax evasion crackdown that grew after 2009 when Switzerland’s biggest bank, UBS Group AG, paid $780 million to avoid prosecution, and the U.S. began criminal investigations of 14 other banks, including Credit Suisse Group AG. 41 Swiss banks signed amnesty agreements this year with the U.S. Justice Department that required disclosing the tricks they used to help customers hide assets, naming bankers and middlemen who enabled them and detailing the flow of untaxed money. They’ve also prodded thousands of reluctant Americans to disclose accounts hidden from the Internal Revenue Service. Broadening the push, the U.S. in 2013 offered to forgo prosecuting any Swiss bank that came clean on tax-evasion tactics. So far this year, the 41 banks paid combined penalties of $354.5 million, with BSI SA paying the lion’s share, or $211 million (see interactive chart).

ACT LIKE SHEEP

[KR722] Keiser Report: Central Bank Command, Control World”

LABOR DOESN'T MATTER ANYMORE

http://www.maxkeiser.com/2015/02/kr722-keiser-report-central-bank-command-control-world

SEE HSBC

HSBC too big to fail, too well connected to prosecute

Off Shore Tax Shelters Explained

Secrecy creates an environment where fraud, tax evasion, money laundering and other forms of corruption thrive.

see 1/09 Wealth Management in Switzerland PDF

<> https://twitter.com/taxjustice <> Tax Havens Cheat US Taxpayers <> Citizens for Tax JusticeRupert Murdock only taxed 6% is a media player using offshore tax havens. GE pays no tax in the U.S.

UK prepares 25% 'Google Tax' to stop tech giants' tax avoidance

http://www.techspot.com/news/59988-uk-prepares-25-google-tax-stop-tech-giants.html

More importantly, the Google Tax will be accompanied by far stricter corporate reporting rules, which would require major companies to disclose their revenue and profit from operations in each country they operate in. This would result in the UK government knowing exactly how much a major company such as Google makes in the country before they shuffle profits away to tax havens.

3/11/15 Anti-avoidance powers to hunt multinationals 'ineffective': ATO

Actual tax collected from multinationals involved in profit-shifting

The main legal weapon used by the tax office to hunt down multinationals trying to avoid paying tax often doesn't work, a problem that could cost the federal government billions a year. A Tax Office internal document, Offshore hubs mitigation strategy overview, said that Australia's general anti-avoidance rule, Part IVA, in some cases can't be used to combat tax avoidance.

2016 Cayman is the largest offshore banking centre in the world.

It is the second largest captive insurance base after Bermuda and a large trust sector.

10/7/15 Here's how much money Apple and Google are hiding overseas, in one chart:

U.S. companies are holding $2.1 trillion — an amount of cash worth the entire gross domestic product of India — in foreign tax havens. Of the top 30 withholders overall, 10 of those were tech companies, making the creators and providers of our technological future the most represented group when it comes to draconian corporate tactics.

Apple, which walks in the footsteps of the Dutch East India Trading Company as the most valuable company on Earth, is the record holder: $181 billion in foreign tax shelters. By shuffling that money out of the reach of taxation, Apple avoids owing the federal government more than $59 billion. That's over three times Obama's proposed budget for NASA and over twice as much as it cost us to put a man on the moon.

Overall, the report estimates that corporations exploiting these tax loopholes account for $90 billion of lost federal revenue each year.

The @TaxJusticeNet's latest podcast looks at #HSBCLeaks "banking's like the asbestos problem"

The HSBC ruling families have intertwining interests with other international mega-banks, the global gold and diamond trade and the Anglo/Dutch half of the Four Horsemen – Royal Dutch/Shell and BP Amoco.

SWISS LEAKS LIFTS THE VEIL ON A SECRETIVE BANKING SYSTEM

ICIJ @ICIJorg Fighting corruption with the world's best cross-border journalism by over 185 reporters in 65+ countries. #SwissLeaks #LuxLeaks #OffshoreLeaks #ChinaLeaks International · icij.org

The leaked files, based on the inner workings of HSBC’s Swiss private banking arm, relate to accounts holding more than $100 billion. "We hope this will help the public understand the perils and the potential downside of so much secrecy," said Gerard Ryle, the director of ICIJ. “What we are exposing is a world most people never get to see.” HSBC, which is headquartered in London and has offices in 74 nations and territories on six continents, initially insisted that ICIJ destroy the data. How the offshore banking industry shelters money and hides secrets has enormous implications for societies across the globe. Academics conservatively estimate that $7.6 trillion is held in overseas tax havens, costing government treasuries at least $200 billion a year.

Americans Use the Banks

10/2/15 Lord Michael Anthony Ashcroft. A longtime party donor, Ashcroft once drew criticism in the U.K. for exerting full-press political influence while enjoying part-time tax status. Now, he has emerged as the controlling shareholder of a pair of offshore banks with American clients who are under suspicion of tax evasion. The full details of Ashcroft’s tax status were known only to Ashcroft and the U.K.’s tax service, according to U.K. press reports, while Ashcroft said he would abandon his non-dom status.

Non-Dom Rules Since then, there’s been an upwelling of U.K. protests and parliamentary hearings over whether wealthy individuals, as well as the likes of Google Inc., Starbucks Corp. and Vodafone Group Plc, have taken unfair steps to avoid taxes.

Ashcroft grew up in Belize, the son of a U.K. diplomat. He once served as the small Central American nation’s permanent representative to the United Nations. He is the controlling shareholder of a Belize company called BCB Holdings Ltd., which in turn owns Belize Bank International Ltd. and Belize Bank Ltd., according to BCB’s latest annual report. Lord Ashcroft was BCB’s executive chairman for more than 20 years beginning in 1987, according to earlier annual reports, one of which listed him as the CEO in 2005.

2/19/09 BANKSTERS used encrypted laptop computers and counter-surveillance tactics during trips to the U.S. in which they helped American clients evade taxes.

THE 1% IN A NUTSHELL

HSBC Bank: Secret Origins To Laundering The World's Drug Money

1/2/13 HSBC: The World’s Dirtiest Bank

(excerpted from Chapter 2: Hong Kong Shanghaied: Big Oil & Their Bankers…)

Big Oil & Their Bankers In The Persian Gulf: Four Horsemen, Eight Families & Their Global Intelligence, Narcotics & Terror Network

FRAUD, MONEY LAUNDERING AND NARCOTICS

IMPUNITY OF THE BANKING GIANTS. NO PROSECUTION OF HSBC

Founded in 1865 by flush-with-cash opium merchants after the British Crown seized Hong Kong from China in the aftermath of the First Opium War, HSBC has been a permanent fixture on the radar of US law enforcement and regulatory agencies for more than a decade. “U.S. Vulnerabilities to Money Laundering, Drugs, and Terrorist Financing: HSBC Case History” 335-page report.

THE MATHESON JARDINE FAMILIES

Jardine Matheson Holdings Limited

http://www.jardines.com/

is a Hong Kong based diversified business company focused principally on Asia. Company’s businesses comprise of a combination of cash generating activities and long-term property assets.

Jardine Matheson Holdings Ltd (JARD.SI)

http://www.reuters.com/finance/stocks/companyOfficers?symbol=JARD.SI

SEC http://www.sec.gov/rules/other/34-39681.htm

Jardine Matheson Holdings Ltd. Hong Kong 82-2963

Jardine Strategic Holdings Ltd. Bermuda 82-3085

Jardin Bank Shanghai

BRITISH BANK HSBC

HSBC Bank: Secret Origins To Laundering The World's Drug Money

HSBC Bank: Secret Origins To Laundering The World's Drug Money

For years, when banks have been caught laundering drug money, they have claimed that they did not know, that they were but victims of sneaky drug dealers and a few corrupt employees. Nothing could be further from the truth. The truth is that a considerable portion of the global banking system is explicitly dedicated to handling the enormous volume of cash produced daily by dope traffickers. Contrary to popular opinion, it is not “demand” from the world’s population which creates the mind destroying drug trade. Rather, it is the world financial oligarchy, looking for massive profits and the destruction of the minds of the population it is determined to dominate, which organized the drug trade. The case of HSBC underscores that point. Serving as the central bank of this global apparatus, is HSBC.

The opium dealers gathered together to form a bank, the Hongkong and Shanghai Bank, as the financial flagship of the British opium trade. Over time, the bank—now known as HSBC—would extend its reach into the drug fields of the Middle East and Ibero-America, as befitting its role as the financial kingpin of Dope, Inc.

The opium dealers gathered together to form a bank, the Hongkong and Shanghai Bank, as the financial flagship of the British opium trade. Over time, the bank—now known as HSBC—would extend its reach into the drug fields of the Middle East and Ibero-America, as befitting its role as the financial kingpin of Dope, Inc.

http://www.zerohedge.com/news/2015-02-16/hsbc-bank-secret-origins-laundering-worlds-drug-money

2015 On February 8, a news story broke online on multiple news outlets across the globe.

It was a deal struck between journalists from 45 countries who agreed to publish their stories simultaneously – a story which has come to be known as the Swiss Leaks. The process started six years ago when an employee-turned-whistleblower at the British bank HSBC handed over a trove of financial data to the authorities in France. That data reportedly showed that HSBC - the world's second biggest bank - helped thousands of its clients hide money in secret accounts held by its private bank in Switzerland. That data ended up with French newspaper Le Monde who then took it to the ICIJ - the International Consortium of Investigative Journalists. Behind this story of tax evasion on a global scale is a story of a collaboration between a number of journalists taking on the secret world of banking. Talking us through the story this week are three of the journalists involved in the investigation: Gerard Ryle, the director of ICIJ; P Vaidyanathan Iyer, the national affairs editor of The Indian Express; Gillles Van Kote, the director of Le Monde; and author Dean Starkman.

OF THE 1%

BY THE 1%

FOR THE 1%

MORE THAN

100 BILLION FOUND AROUND THE WORLDHSBC BANKSTERS

They're immune from jail.

TURNS OUT THE EXCUSE THE UK GOVERNMENT HAS USED FOR NOT PROSECUTING #HSBC TURNS OUT TO BE COMPLETE CRAP!!

Conservative minister and tax office boss Lin Home LIED. France’s finance minister Michel Sapin has rejected the British version of events. Did David Cameron and George Osborne discuss tax evasion at HSBC with Lord Green? Why did they appoint Lord Green as a Tory Minister months after the government received these files? “And why did George Osborne and the Treasury sign a deal with the Swiss in 2012 which prevents the UK from actively obtaining similar information in the future?” France says it did not restrict UK from using HSBC files to pursue bank and criminals Tory minister and tax office boss told parliament failure to prosecute was due to restrictions imposed by French authorities. All HSBC had to do was sign a "deferred prosecution agreement," or DPA, with the Department of Justice, which said that no criminal charges will be brought against the bank - or any of its banksters - provided that it meets certain conditions, including paying a $1.9 billion fine. Despite laundering hundreds of billions of dollars illegally, helping out some of the world's most notorious killers and drug cartels, allegedly laundering for terrorist groups and moving money for customers in nations that the US has no diplomatic ties with, HSBC got off with a slap on the wrist, and a very light slap at that.

#HSBC private bankers working outside Switzerland were equipped with untraceable mobiles, acting like secret agents

#HSBC private bankers working outside Switzerland were equipped with untraceable mobiles, acting like secret agents

"The bankers who worked beyond the Swiss borders operated like secret agents," Swiss newspaper Tages-Anzeiger reported, quoting a former employee at the bank. According to the employee, the bankers were sent on their missions to the target countries equipped with untraceable cellphones with which they could place calls to the office in Switzerland. Take for example the work procedures with respect to one of the bank's clients, a share trader from Belgium, as laid out in a January 4, 2005, memo from an HSBC representative to his managers: "The client must not be called. He is the one who always calls us. He mentions the names of soccer players Zidane and Cruyff so they know it's him, and he asks about the price of caviar. The question means that the client wants to know the balance of the capital in his account." In the case of the Belgian share trader, the price of "caviar" was at its peak in 2007, when his account showed a balance of $1.249 billion. http://www.ynetnews.com/articles/0,7340,L-4626491,00.html

18th-century gravestone of a merchant-turned-pirate in Bruges, Belgium.

Again, if you or I had laundered money for drug cartels or terrorists, we'd be thrown in jail and the key would be thrown away.

FINANCIAL ENGINEERS: The reclusive Barclay brothers, who didn’t want to comment on their Bermuda-Jersey-Mayfair money-go-round. The Telegraph is owned by them and doesn't report anything on tax evasion. Profits made by the Telegraph don’t stay in the UK for long. Latest accounts for the company that controls Telegraph Media Group, Press Acquisitions Ltd, show that in 2013 the bulk, £34.5m, was sent in the form of loans to a Jersey company, May Corporation Ltd, which through another Jersey company is owned by a Bermudian company called B.UK. Ltd, itself controlled by trusts set up by the brothers. How much the Monaco-dwelling twins are siphoning offshore.

http://www.private-eye.co.uk/sections.php?section_link=street_of_shame&issue=1385

2015 TAX EVASION WITH SECRET BANK ACCOUNTS

HSBC files: why the public should know of Swiss bank’s pattern of misconduct

http://www.theguardian.com/business/2015/feb/08/hsbc-files-public-right-to-know-swiss-operation-leaked-data

Scores of clients of lucrative operation are already under criminal investigation amid claims of their involvement in drug smuggling, frauds and terror financing Part 1 -4

Elizabeth Warren ~ “The new allegations that HSBC colluded to help wealthy people and rich corporations hide money and avoid taxes are very serious, and, if true, the Department of Justice should reconsider the earlier deferred prosecution agreement it entered into with HSBC and prosecute the new violations to the full extent of the law.” “How many billions of dollars do you have to launder for drug lords, and how many economic sanctions do you have to violate before someone will consider shutting down a financial institution like this?” Warren famously asked a Senate banking committee hearing.

http://www.theguardian.com/news/2015/feb/10/hsbc-us-prosecutors-criminal-charges-elizabeth-warren

Warren’s intervention will further stoke the scandal in Washington, where members of the Senate banking committee are preparing to grill a representative of the Federal Reserve on Tuesday over how much regulators knew about US tax evasion connected to HSBC Switzerland. The hearing comes as the public disclosure of the HSBC Swiss data – the biggest leak in banking history – reverberated across the globe.

HSBC’s Swiss subsidiary repeatedly provided its clients with large cash withdrawals – often a warning sign to bankers – in their currency of choice. Some of the clients admitted to the Guardian they were dodging tax. Large cash transactions are a classic warning sign to bankers. But instead of blocking the withdrawals or even interrogating them, the bank repeatedly handed out packets of untraceable banknotes. With untraceable cash, tax returns become voluntary. Former tax inspector Richard Brooks told the Guardian: “If you withdraw cash from a bank in Geneva or Zurich, there’s no trail of that over here. Most rich individuals will get their accountants to fill in their tax returns. They’ll be working from their banking records. But there’s nothing for your accountant to see.” A US customer of HSBC’s Swiss operation admitted the bank gave him $100,000 in ‘bricks’ of US banknotes.

http://www.theguardian.com/business/2015/feb/09/hsbc-files-swiss-bank-cash-machine-rich-clients

HSBC Switzerland’s internal files, leaked by IT technician Hervé Falciani, were first obtained by French authorities and then shared with the US in 2010. They cover the Swiss subsidiary’s activities between 2005 and 2007. The DoJ has a policy of declining to confirm or deny the existence of its investigations. However, the officials confirmed that receipt of the data on a CD escalated an investigation that had already been launched by the DoJ’s tax division in Washington.

BBC TV Panorama broadcast, "The Bank of Tax Cheats”, can be found on Le Monde’s website (in English)

http://www.lemonde.fr/economie/article/2015/02/08/swissleaks-the-backstory-of-a-worldwide-investigation_4572334_3234.html

« SwissLeaks » : the backstory of a worldwide investigation

The figures are breathtaking. Le Monde is publishing the first part of an investigation that is spectacular and unprecedented in size. A team of journalists in Paris, Washington, Geneva and 46 other countries has uncovered the hidden workings of a giant tax evasion scheme conducted with the knowledge, and indeed the encouragement, of the world’s second largest bank, HSBC, via its Swiss subsidiary, HSBC Private Bank.

Le Monde has been investigating the HSBC affair since the outset, and in early 2014 came into possession of international banking data for the period 2005-07 that provided evidence of fraud on a gigantic scale. We shared this information with some 60 other news outlets around the world, coordinated by the ICIJ, the International Consortium of Investigative Journalists. The publication of these figures is likely to prove embarrassing for a good number of celebrities, including the French comedian Gad Elmaleh, King Mohamed VI of Morocco and the American actor John Malkovich, but it will shake the international financial industry to the core.

Links also are provided to a *large* number of further stories (in French)

http://www.lemonde.fr/swiss-leaks/See also the (English language) video: How did HSBC help its clients hide millions from tax authorities

http://www.lemonde.fr/economie/article/2015/02/08/swissleaks-the-backstory-of-a-worldwide-investigation_4572334_3234.htmlLe Monde revealed on Sunday february the 8th how the Swiss bank HSBC helped thousands of clients hide millions of euros from tax authorities in 2006 and 2007. How did the bank proceed? How many people were concerned? Find answers in this explainer video.

UK ministers unaware of possible HSBC wrongdoing until 'last couple of days' http://www.reuters.com/article/idUSKBN0LE1RK20150210

British government ministers were unaware that HSBC may have been involved in wrongdoing in its Swiss banking arm until the "last couple of days", a spokeswoman for Prime Minister David Cameron said on Tuesday.

Swiss scandal haunts HSBC's former boss Stephen Green http://www.reuters.com/article/idUSKBN0LE2AD20150210

The scandal at HSBC's Swiss private banking arm is particularly awkward for former executive chairman Stephen Green.Swiss banker arrested in Germany over U.S. tax case: lawyer http://www.reuters.com/article/idUSKBN0LB0QS20150207

A former Swiss banker charged by U.S. prosecutors with helping wealthy Americans evade taxes has been arrested in Germany pending extradition to the United States, his lawyer said on Saturday.Global calls to probe HSBC tax plans http://www.bbc.co.uk/news/business-31327042

UBS confirms fresh US tax probe http://www.bbc.co.uk/news/business-31349135

HSBC condemns past practices as pressure grows over Swiss accounts http://www.reuters.com/article/idUSKBN0LE1FF20150210

The head of HSBC's private bank has told staff past practices that may have allowed some clients to dodge taxes are unacceptable, with the company facing pressure on both sides of the Atlantic over its conduct.HSBC could face U.S. legal action over Swiss accounts

http://www.reuters.com/article/idUSKBN0LD01H20150210

HSBC Holdings Plc faces investigation by U.S. authorities and an inquiry by British lawmakers after admitting failings by its Swiss private bank that may have allowed some customers to dodge taxes.

john carroll jr. invented inversions

The first tax inversion

was called the ‘Panama Flip'

The unpatriotic

tax loopholeTHE FIRST INVERSION

The Greatest Tax Story Ever Told By Zachary R. Mider December 18, 2014

Kraus & John Carroll Jr., invented a whole category of corporate tax avoidance and successfully defended it in a fight with the Internal Revenue Service.

THIS IS CONGRESS' FAULT !

“The law is an unintelligible monstrosity, and it’s Congress’s fault,” ~ Kraus

“I wrap myself in the American flag,” he said. “And I say, without the slightest fear of successful contradiction—blah, blah, blah, blah!” ~ Carroll

“I would really like to see the tax code completely scrapped. The whole business of trying to define income and deductions is pure madness. And I’ve got no one to thank except myself for creating that.” ~ Carroll

The first corporate “inversion,” as Carroll’s maneuver came to be known, has at least 45 companies who have followed the lead of Carroll’s client, New Orleans-based construction company McDermott International (MDR), and shifted their legal addresses to low-tax foreign nations. Total corporate savings so far: at least $9.8 billion—money that otherwise would have gone to the U.S. government.

Profits had created a big tax problem. ~ McDermott

Most of the income had been earned abroad, and the parent company in New Orleans couldn’t touch it without first paying U.S. taxes on it—at a rate of as much as 46 percent. The earnings were piling up in Treasury bonds offshore.

Carroll hit upon an elegant but untested solution: Simply flip the company structure, so its main foreign subsidiary, incorporated in Panama, becomes the parent. Just like that, all those offshore profits would slip out from under the U.S. corporate tax system. Carroll nicknamed it the Panama Scoot. There was something screwy about the plan, like a daughter legally adopting her own mother, and the details were staggeringly complicated, involving share swaps, dividends, and debt guarantees. Panama’s piratical past For four centuries the Chagres River has been the bond of union between the two great oceans of the world, the way between the East and West. It was the original, natural Panama Canal.

The IRS fought the case for seven years, giving up in 1989 only after a federal appeals court upheld a U.S Tax Court decision in the company’s favor.

The 99% can thank KEITH and WELLFORD, Circuit Judges; and GILMORE*, District Judge. WELLFORD, Circuit Judge for allowing this to happen.

Stiffer regulations won’t stop the exodus. Ever since the McDermott deal, inversions have been the subject of legions of congressional hearings, bills, and regulations, yet companies continue to find ways to circumvent them and escape the U.S. tax system.

Congress passed a law banning federal contracts for inverted companies in 2007

[ Davis Polk Law Firm]

The firm traces its origins to Gunthrie, Bangs & Van Sinderen, founded in 1849 by Francis S. Bangs, an opponent of Tammany Hall.[6] The firm changed its name several times to account for new partners, using names such as Bangs, Stetson, Tracy, and McVeigh and Stetson, Jennings & Russell. Among other high-profile lawyers, Grover Cleveland served as a member of the firm during the interval between his two non-consecutive presidential terms. Davis Polk was located at 15 Broad Street from around 1889 until 1959. The firm takes its current name from three 20th century partners: John W. Davis, Frank Polk, and Allen Wardwell. Davis, a former U.S. Solicitor General and the 1924 Democratic presidential nominee, made 139 oral arguments before the United States Supreme Court, most infamously in Brown v. Board of Education, in which he represented South Carolina in defense of racial segregation. With Polk and Wardwell, Davis developed close ties between the firm and the J.P. Morgan companies, as well as the Guaranty Trust Company, the Associated Press, and International Paper.

John W. Davis, Frank Polk, and Allen Wardwell. Davis, a former U.S. Solicitor General and the 1924 Democratic presidential nominee, made 139 oral arguments before the United States Supreme Court, most infamously in Brown v. Board of Education, in which he represented South Carolina in defense of racial segregation. With Polk and Wardwell, Davis developed close ties between the firm and the J.P. Morgan companies, as well as the Guaranty Trust Company, the Associated Press, and International Paper.

Tax Havens Cheat US Taxpayers

"Twenty-eight of these corporations reveal that they have paid an income tax rate of 10 percent or less to the governments of the countries where these profits are officially held, indicating that most of these profits are likely in offshore tax havens."

The Damage of Offshore Banking The US offers tax free treatment to foreigners who bring their money into the U.S.

Banks, Accounting Firms and Legal Firms also assist the criminal tax evasion.

Financial Regulation by England, Luxenberg, Ireland, the Netherlands engage in economic warfare agains the United States when they suck the tax revenue from the U.S.

Who Cares

About Going after

The Small Fries?

2008 Senate hearing identified as $100 billion in annual tax evasion by American owners of foreign accounts.

IRS unlocks UBS vault hiding Americans evading taxes. Undeclared bank accounts at UBS, (UBS) the Swiss banking giant sued Thursday by U.S. authorities in an escalated demand for the identities of owners of approximately 52,000 such accounts in which Americans secretly held at least $14.8 billion. U.S. authorities filed the civil lawsuit in Miami, one day after reaching a deferred-prosecution deal in which UBS agreed to a $780 million settlement of criminal charges it helped American customers evade federal taxes. The agreement required the bank to turn over identities of some of those clients.

CORRUPT

Department of Justice

There is no justice

Corrupt U.S. Justice Department is dragging its feet on prosecuting Swiss banks that helped Americans evade taxes and on collecting billions of dollars likely owed to the U.S. Treasury by tax dodgers, a powerful U.S. Senate.

Corrupt U.S. Justice Department is dragging its feet on prosecuting Swiss banks that helped Americans evade taxes and on collecting billions of dollars likely owed to the U.S. Treasury by tax dodgers, a powerful U.S. Senate.

WHY DID Senator Rand Paul, a Kentucky Republican blocked an amendment to a U.S. Swiss tax treaty that lawmakers and witnesses said would make it easier for Swiss banks to hand over data on thousands of Americans with accounts hidden from the IRS?

Now wealthy American tax cheats still able to hide their money because Swiss banks are still eager to help them.

Credit Suisse opened Swiss accounts for more than 22,000 U.S. customers with combined assets of as much as $12 billion.

PricewaterhouseCoopers Ernst & Young, Deloitte and KPMG - AND Lawyers work with banks to get the job done.

<< In wake of Twitter #SwissLeaks, see this from the Great Tax Robbery (2009/10 figures). pic.twitter.com/vGRiUZQrCN @rbrooks45 February 14, 2015 >>

12/30/14 Treasury gives banks more time on tax evasion

The Obama administration gave foreign banks more breathing room for complying with a new law that aims to crack down on offshore tax evasion. The Treasury Department said that it would allow 2014 and 2015 to be a transition period for banks that are making a “good faith” effort to comply with the Foreign Account Tax Compliance Act, which goes into effect on July 1. FATCA, enacted by Congress in 2010, forces foreign banks to disclose certain account information to U.S. authorities, or face a withholding tax. The Treasury Department has signed dozens of agreements with other countries to enforce FATCA. The Securities Industry and Financial Markets Association, which last month asked Treasury for a FATCA transition period, praised the administration’s decision. SIFMA had argued that banks would not have enough time to comply with a batch of Treasury regulations issued this year without that sort of breathing room.

This is the age of the whistleblower.

This is the age of the whistleblower.

Whistleblowers are becoming to this decade what rock stars were to the Sixties — pop culture icons, global countercultural heroes.

Media leaks on HSBC accounts 'tip of iceberg': whistleblower Falciani

http://www.reuters.com/article/idUSKBN0LE1PA20150210

Media leaks on HSBC accounts held in Switzerland "are only the tip of the iceberg," Herve Falciani, the former HSBC employee who supplied information on the bank's clients and their tax situation, told French daily Le Parisien.

Tax Justice Network @TaxJusticeNet

“So you might ask, what’s the appropriate financial penalty for a bank in HSBC’s position?..."

http://www.rollingstone.com/politics/news/a-whistleblowers-horror-story-20150218How HSBC hooked up with drug traffickers and terrorists. And got away with it

http://www.rollingstone.com/politics/news/gangster-bankers-too-big-to-jail-20130214

We’re going to quote from an article in 2012 by Matt Taibbi, in Rolling Stone magazine, which was examining the latest HSBC mega-scandal of the time. He was outraged, as we all should be, at the lightness of the sentencing in a case that had involved shifting money for the massacre-happy Mexican Sinaloa cartel, for groups linked to Al Qaeda; for Russian gangsters; and also the provision of help to countries like Iran, Sudan and North Korea to evade sanctions. HSBC got away with a fine equivalent to five weeks’ profits, and HSBC itself agreed to “partially defer” bonus compensation for its most senior officials. It was sickening then. If you want to be sickened now, then read this. http://www.taxjustice.net/2015/02/19/deal-hsbc/

2014

2/26/14 Sen. Carl Levin (D-MI) holds a Homeland Security and Governmental Affairs Subcommittee on Permanent Investigations hearing on offshore tax evasion. Witnesses include Deputy Attorney General James Cole.

Offshore Tax Evasion, Panel Justice Department officials testified on efforts to collect unpaid taxes from offshore bank accounts.

American companies are finding new overseas tax havens to legally protect some of their profits from the U.S. tax rate of 35 percent, among the highest in the world. Credit Suisse encouraged Americans to open up an account at the Zurich Airport with cash and they don't have to report this to the American government because THE U.S. SENATE did not sign a treaty that would allow the Suisse Government to "share" that information with the U.S. Switzerland counts on banking for 7 percent of its economic output: until Swiss banks know how much information they need to share with foreign tax authorities they will struggle to attract new clients.

Credit Suisse had provided all the information to U.S. authorities it was allowed to under Swiss law, the person said. It wanted to provide additional information, but the U.S. Senate had not ratified a bilateral treaty between the two countries that would allow this, the person added. 'TARGET LETTER' The bank has been in authorities' sights for years. It disclosed in 2011 it had received a "target letter" from prosecutors indicating that the bank was under criminal investigation. Also in 2011 a grand jury issued a subpoena seeking client names and account information, the report said, citing a briefing by Credit Suisse. Seven of its Swiss bankers were indicted in that year, but all remain overseas. Instead of enforcing the subpoena or threatening to indict the bank and entering an agreement to obtain client names, the panel said, the DOJ has largely deferred to Swiss authorities who have limited the documents being turned over. In the statement, the Justice Department said the agency was able to receive information through a U.S.-Swiss treaty process, but that information was not yet known to the public.

Here’s another rigged game. must read statement

The U.S.-Swiss extradition treaty is supposed to enable each country to obtain the transfer of a criminal defendant from the other country. But that treaty has an exception giving the Swiss the discretion to deny an extradition request for a person accused of a tax offense. DOJ has indicted 38 Swiss banking and other professionals for aiding and abetting U.S. tax evasion. The indictment of the seven Credit Suisse bankers is already three years old. But 34 of those 38 defendants have yet to stand trial. Instead, most are openly residing in Switzerland. One Swiss banker who left Switzerland to vacation in Italy was recently arrested and is here and set to stand trial in October, but he’s the exception. It is bad enough that the Swiss can deny extradition for persons aiding and abetting U.S. tax evasion; it is inexplicable that the United States hasn’t even made extradition requests. After DOJ overcame Swiss secrecy obstacles to obtain 4,700 accounts with U.S. client names from UBS, many predicted Swiss secrecy would no longer impede U.S. prosecutions. In 2008 testimony before this Subcommittee, Justice officials pledged to act energetically. Associate Attorney General Kevin O’Connor testified, despite the challenges posed by bank secrecy, “we will not be deterred. We will pursue other formal and informal methods of obtaining the foreign evidence we seek. This includes the use of John Doe summonses as well as Grand Jury subpoenas.” That did not happen as promised, but it’s not too late to fulfill that pledge. DOJ can still use U.S. tools, including grand jury subpoenas, John Doe summons, and U.S. indictments, to get U.S. client names from the 14 targeted banks, which includes some of the largest. It can still make extradition requests for indicted Swiss bankers and test Switzerland’s professed willingness to cooperate with U.S. tax enforcement. DOJ can still hold accountable the U.S. tax evaders and the tax haven banks that helped them, if it’s got the will. Among the questions we will be asking today is why DOJ has slowed its investigations of the 14 banks through its failure to use U.S. legal tools; why it accepted Swiss bank secrecy principles in the DOJ non-prosecution program; why it obtained only 238 accounts with U.S. client names in five years out of the tens of thousands of Credit Suisse accounts; and how it plans to collect the unpaid taxes still owed on billions of dollars of Credit Suisse accounts.

NO JUSTICE

NO PEACE

9/31/14 Several Swiss banks pull out of U.S. tax program

At least 10 Swiss banks have withdrawn from a U.S. program aimed at settling a tax dispute between them and the United States, Swiss newspaper NZZ am Sonntag said on Sunday, quoting unnamed sources. Around 100 Swiss banks came forward at the end of last year to work with U.S. authorities in a program brokered by the Swiss government to help the banks make amends for aiding tax evasion. "At least 10 banks that had decided at the end of 2013 to pay a fine have withdrawn their decision," "New Journal of Zurich" is a Swiss, German-language daily newspaper, NZZ am Sonntag said, quoting unnamed lawyers and auditors. It did not name the banks concerned. The newspaper said the banks were convinced they had not systematically broken U.S. law and lawyers of the U.S. Department of Justice had actually been surprised to see them take part in the program and did not object to the banks leaving the program. Liechtenstein-based VP Bank came forward last week to say it had concluded that it no longer needed to take part in the program. About a dozen Swiss banks face a U.S. criminal investigation as part of the tax probe.

Credit Suisse has already settled by agreeing to plead guilty and pay a fine of $2.6 billion earlier this year 2014.

reuters.com/article/2014/08/31/us-swiss-banks-tax-idUSKBN0GV09X20140831

Whistle Blowers

12/14/14 French prosecutors have increased efforts to punish tax evasion since the country’s former budget minister, Jerome Cahuzac, was forced to resign after his secret Swiss account was exposed. The government has targeted wealthy individuals who stashed assets over the border in Switzerland and pressured the banks they used to encourage clients to declare their untaxed assets. Swiss law forbids bank employees from passing account data to third parties, unless the bank’s clients or Switzerland’s tax authority approves the disclosure.

Herve Falciani, the technician accused of stealing client data in 2008 from HSBC’s Geneva office and passing it to French authorities was indicted in Switzerland on charges of industrial espionage and violating bank secrecy laws. HSBC was charged in France last month with money laundering throughtax fraud and illegal marketing in a case stemming from the data theft. The bank faces a similar investigation in Belgium and last month agreed to pay $12.5 million to settle claims with the Securities and Exchange Commission that its Swiss private-banking unit solicited U.S. investors without being registered.

12/21/14 Fortune of fraud: Top 5 biggest payouts to federal whistleblowers in 2014 by Saskia de Melker

Whistleblowers who file false claims lawsuits can receive up to 30 percent of the money that a company pays to the government, which added up to $435 million in whistleblower rewards primarily for mortgage, health care and defense fraud cases.

JP MORGAN

$614 million “for violating the False Claims Act by knowingly originating and underwriting non-compliant mortgage loans submitted for insurance coverage and guarantees by the Department of Housing and Urban Development’s Federal Housing Administration and the Department of Veterans Affairs,” according to the Department of Justice.

Whistleblower’s share: $63.9 million will go to Keith Edwards, a former assistant vice president supervising a government insuring unit for JP Morgan, for providing tips that led to the company’s agreement to pay $614 million.Bank of America

Bank of America To Buy MBNA For $35 BillionSettlement: $16.65 billion – the largest civil settlement with a single entity in American history — “related to the packaging, marketing, sale, arrangement, structuring and issuance of RMBS, collateralized debt obligations, and the bank’s practices concerning the underwriting and origination of mortgage loans.”Whistleblower’s share: Former Countrywide Financial executive Edward O’Donnell is collecting more than $57 million for helping federal prosecutors force Bank of America to pay $16.65 billion for its role in churning out shoddy mortgages and related securities before the financial crisis.

TAX CHEATS

Swiss Bankers Association

In 2013, Switzerland still held 26 percent of global offshore assets, or US$2.3 trillion, according to an analysis by Boston Consulting.

Switzerland will abandon its long-prized banking secrecy in 2017 when it starts automatically exchanging account details with other countries, and with it goes one of the main attractions of placing money in its banks. Nicolas Pictet, president of the Geneva Financial Center, which represents hundreds of banks and financial companies. For generations, investors have paid Swiss banks high fees to hide their money from tax authorities around the world. Private Swiss banks are looking for new sources of revenue, but they have also faced probes and massive fines from countries accusing them of abetting tax dodging. The Swiss National Bank and the People’s Bank of China also reached a bilateral swap agreement — a currency exchange deal — in July 2014.