Contents

- Introduction

- Preface

- Overview

- Relief Valve

-

LECTURE 1: Why We Are In The Dark About Money

- Wealth Objectives

- The Basics - Knowledge is Power

- The Wizard of Oz Story Allegory

- K12 Wealthy Decide

- Richest Two Percent Own Half World

- Cost of Inequality

- K Street Lobbys Write the Law

- Official Federal Reserve K12 Financial Literacy Curriculum by Grade Level

- What's Left Out of the Official U.S. Federal Reserve Curriculum

- EducRats

- Financial Literacy Quotes

- Lecture 1 Objectives and Discussion Questions

- LECTURE 2: The Con

- LECTURE 3: The Vatican-Central to the Origins of Money & Power

- LECTURE 4: London The Corporation Origins of Opium Drug Smuggling

- LECTURE 5: U.S. Pirates, Boston Brahmins Opium Drug Smugglers

- LECTURE 6: The Shady Origins Of The Federal Reserve

- LECTURE 7: How The Rich Protect Their Money

- LECTURE 8: How To Protect Your Money From The 1% Predators

- LECTURE 9: Final Thoughts

"The Secret of OZ" The History of Money

The United States Constitution says that “Congress shall have power . . . to coin money, regulate the value thereof” and that U.S. states “shall use no legal tender but gold and silver.”

These clauses were adopted as a specific rejection of the Bank of England, founded in 1694, that had dominated the English-American economy before the American revolt of 1774-1783. However, global bankers who threaten the world with usury have caused that clause of the Constitution to become a dead letter.

In 1913, the world’s banks—most of them affiliated with the Rothschild family—met in Georgia at Jekyll Island to create the Federal Reserve System. While the old American financial system depended on a central mint and a patchwork of disorderly local banks, the new system quickly made the U.S. Treasury Department obsolete, acting as a vacuum cleaner to suck up the money of America’s working people.

The Federal Reserve transitioned the U.S. from a commodity-based currency system to a fiat system. But instead of a state fiat system, where the bank is owned by the state and currency volume is determined by tax and spending policy, the Federal Reserve is a private system in which currency volume is determined by interest rates.

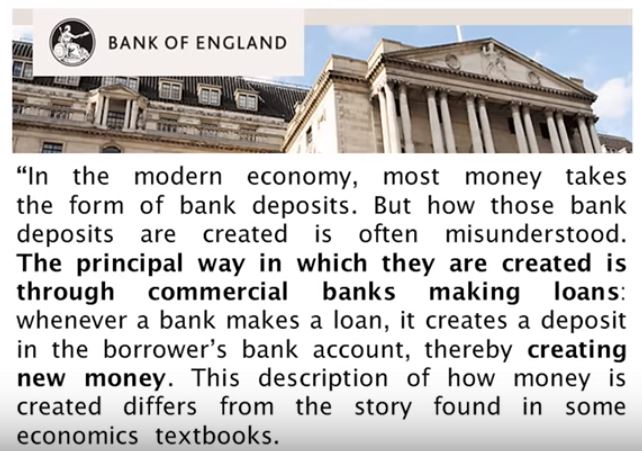

Banks create money by loaning it into existence, instead of issuing it, and then allow interest compounding to draw all of the wealth in the system into their hands.

CREATE NEW MONEY

FIAT MONEY

Fiat money has been defined variously as:

- any money declared by a government to be legal tender.

- State-issued money which is neither convertible by law to any other thing, nor fixed in value in terms of any objective standard.

- money without intrinsic value that is used as money because of government decree.

The term derives from the Latin fiat ("let it become", "let it be done", "it shall be").

While gold - or silver-backed representative money entails the legal requirement that the bank of issue redeem it in fixed weights of gold or silver, fiat money's value is unrelated to the value of any physical quantity. Even a coin containing valuable metal may be considered fiat currency if its face value is defined by law as different from its market value as metal. <MORE>

The Nixon Shock of 1971 ended the direct convertibility of the United States dollar to gold. Since then, all reserve currencies have been fiat currencies, including the U.S. dollar and the Euro.

Until 1958 the United States prohibited any full-scale photographic reproduction of its paper money.

[Movie Money] This included the use of American money in films because it was feared that a single frame of the negative could be enlarged onto a printing plate from which passable counterfeits could be made. Film studios therefore had to use alternatives, especially the worthless but colorful leftovers from the Mexican revolution. The most common were the genuine $5, $10 and $20 Banco del Estado de Chihuahua, which were in such large supply that many of them continued to masquerade as American dollars well into the 1940s. As the hoards of obsolete notes became depleted, however, the film industry produced their own issues, often modifying the revolutionary currency.

Poncho Villa's war tactics were studied by the United States Army and a contract with Hollywood was made whereby Hollywood would be allowed to film Villa's movements and 50% of Hollywood's profit would be paid to Villa to support the Revolution.

WHY WE USE PAPER MONEY

Eustic Mullins wrote: Five men rule the world. None of them holds public office, but they choose who shall hold office in the nations. These five men comprise the apex of the pyramid of power, the World Order. We may ask, Why should there be a World Order? Is it not sufficient to hold absolute power in a single nation, or in a group of nations? The answer is No, because of the nature of international travel, international trade, and international finance. International travel requires that a person may travel in peace from one nation to another, without being molested.

International trade requires that traders of one nation can go to another nation, transact their business, and return with their goods or their profits. If not, the offended nation can exercise military force, as Great Britain did in its Opium Wars.

It is the third requirement, International Finance, which called into being the World Order. In earlier days, when international trade consisted of barter, payment in gold or silver or piracy, the seizure of goods by force, there was no need for a world arbiter to determine the value of instruments of trade.

The development of paper money, stocks, bonds, acceptances and other negotiable instruments necessitated a power, able to exercise influence anywhere in the world, to declare that a piece of paper represented one billion dollars in real wealth, or even one dollar in real wealth. An entry on a computer, flashed from London to New York, states that someone owes five billion dollars to someone else. Without genuine power backing, no such sum could ever be collected, regardless of the factuality or morality of the debt. As anyone in the Mafia can tell you, you don’t collect unless you are willing to break legs. The World Order is always prepared to break legs, and break them they do, by the millions. What would have happened to the earliest settlers in America if they had gone to the Indians and said, "Give us your goods and the deeds to your homes and lands. In return, we will give you this beautifully printed piece of paper.” The Indians would, and did, attack them. If the settlers arrived with an army led by a Pizaro or a Cortez, they took the lands without a piece of paper.

How US dollars got spread across the world

The U.S. dollar is the world’s dominant reserve currency, making up about 64% of all official foreign exchange reserves. History has shown that every 100 years or so, the world’s de facto reserve currency has been replaced. The last time this happened was after World War II, when the Bretton Woods system came into effect. Under this system, the U.S. dollar was established as the global anchor currency, linked to gold at a fixed rate. The combination of post-war growth in the U.S. economy along with the official link between dollars and gold provided the international monetary system with a degree of certainty that had been missing for decades. In 1971, Nixon severed the link between the U.S. dollar and gold, but continued U.S. economic and financial strength would keep the dollar prominent on the international monetary stage for decades to come.

PAPER MONEY = rag paper + metallic ink

Paper used for money, on the other hand, is made from cotton and linen fibers. This kind of paper is known as rag paper. The other special thing about the rag paper used in real money is that there are tiny blue and red fibers mixed into the paper when it is made. These fibers are easy to find in real money, but they are so fine that they do not reproduce very well in the counterfeit money from your inkjet printer.

In the early days of the nation, before and just after the revolution, Americans used English, Spanish, and French money.

1690 Colonial Notes

The Massachusetts Bay Colony issued the first paper money in the colonies which would later form the United States.Remember Spain Owned California

Finding Aid to the Maps of Private Land Grant Cases of California, [ca. 1840-ca. 1892]

ORIGIN OF

THE $ SIGN

The origin of the "$" sign has been variously accounted for, however, the most widely accepted explanation is that the symbol is the result of evolution, independently in different places, of the Mexican or Spanish "P's" for pesos, or piastres, or pieces of eight. The theory, derived from a study of old manuscripts, is that the "S" gradually came to be written over the "P," developing a close equivalent of the "$" mark. It was widely used before the adoption of the United States dollar in 1785.

BUT THERE IS NO CONTENDING WITH THE NATURE OF THINGS.

Experience has every where justified the remark that

WHEREVER PAPER IS INTRODUCED IN LARGE QUANTITIES, GOLD AND SILVER VANISHES.”--- John Witherspoon (1723-1794),

a signer of the Declaration of Independence, Presbyterian minister and mentor to the future President Madison, who strongly supported gold and silver money---

Madison watched helplessly from a hilltop in Virginia as the British burned the White House, but the final brilliant victory in the War of 1812-1815 was won by his most talented commander, a man who even General George Patton could have held in awe---

“Events have satisfied my mind, and I think the minds of the American people, that the mischiefs and dangers which flow from a national bank far over-balance all its advantages. The bold effort the present bank has made TO CONTROL THE GOVERNMENT, the distresses it has wantonly produced, the violence of which it has been the occasion in one of our cities famed for its observance of law and order, are but premonitions of the fate which awaits the American people should they be deluded into a perpetuation of this institution OR THE ESTABLISHMENT OF ANOTHER LIKE IT. It is fervently hoped that thus admonished those who have heretofore favored the establishment of a substitute for the present bank will be induced to abandon it, as it is evidently better to incur any inconvenience that may be reasonably expected than TO CONCENTRATE THE WHOLE MONEYED POWER OF THE REPUBLIC in any form what so ever.”---President Andrew Jackson, State of the Union Address for 1834

1770 Stephen Crane took over Massachusetts’ first paper mill

The Crane and Company Old Stone Mill Rag Room is one of the oldest surviving buildings (built in 1844) of Crane & Co., one of the oldest papermaking businesses in Berkshire County, Massachusetts.

Today, all Crane’s papers are still made in the mills alongside the Housatonic River where Zenas Crane found such an ideal location for his paper mill. They took obvious pride in advertising their political leanings, naming their business The Liberty Paper Mill. Stephen and his family helped shape the momentum of the Revolution by exercising their fiery patriotism at the Boston Tea Party and the Battle of Lexington and Concord. Papers made by Stephen Crane were used to print patriotic newspapers leading up to and during the war for Independence, and were even engraved for Colonial Currency by Paul Revere. Following Stephen’s death during his service with the Continental Army, his eldest son Stephen, and later the younger Zenas, helped operate the family paper business. In the 1790s, young Zenas headed west to Worcester, Massachusetts to work in a paper mill owned by his father’s long-time friend, customer and fellow patriot – Isaiah Thomas – the publisher of the Massachusetts Spy newspaper. In 1799, when Thomas sold the mill to the Burbank family, Zenas struck out to look for a suitable location for his own mill. He found the perfect spot on the banks of the Housatonic River in Dalton, Massachusetts. Two years later, after obtaining sufficient capital, he established the first mill west of the Connecticut River. It was a modest mill, but was recognized early on as producing papers of the finest quality. As early as 1806, local and regional banks began printing currency on Zenas Crane’s fine cotton papers. This was quickly followed by official government proclamations, permanent public records and stocks and bonds.

Crane & Company

- Founders Zenas Crane, Henry Wiswall and John WillardOnly one source has provided 100% of all the currency grade paper used in the United States, since the Fed started in 1913.

US currency paper, first produced by Crane in 1879. Our European paper-making operations are steeped in history, beginning in 1753 when the Tumba paper-mill first began producing banknote paper. Based just outside Stockholm, Sweden, the historical site now houses a state-of-the-art, integrated paper-making and banknote printing facility. Crane Currency is based on two extremely old papermaking companies, Crane & Company founded in 1801 in the USA and Tumba Bruk founded in 1755 in Sweden. Crane, based in Dalton MA, has since 1879 been the exclusive supplier of banknote paper to the US Treasury for making the world-famous US dollar. And Tumba Bruk, located just south of Stockholm, has been making banknote paper for even longer, since its origin in 1755.SEE NETWORKS The Winthrops, in addition to marriages with the Cranes, are also intermarried with the Aldrich family---key founders of the Federal Reserve System.

Crane & Co., based in Boston, Massachusetts, is a manufacturer of cotton-based paper products used in the printing of national currencies, passports and banknotes as well as in social, business, industrial and technical applications. Crane remains the predominant supplier of paper for use in U.S. currency (Federal Reserve Notes).

Stephen Crane was the first in the Crane family to become a papermaker, buying his first mill, "The Liberty Paper Mill", in 1770. He sold currency-type paper to engraver Paul Revere, who printed the American Colonies' first paper money. In 1801, Crane was founded by Zenas Crane, Henry Wiswall, and John Willard. The company's original mill had a daily output of 20 posts (1 post = 125 sheets). Shortly after, in 1806, Crane began printing currency on cotton paper for local, as well as regional, banks, before officially printing for the government. Crane developed a method to embed parallel silk threads in banknote paper to denominate notes and deter counterfeiting in 1844.

In 1879, Winthrop M. Crane successfully expanded the company during the 1880s after securing an exclusive government contract to supply the paper for United States currency (a monopoly the company continues to hold). The contract delivers U.S. currency paper to the Bureau of Engraving and Printing in Washington, D.C. Winthrop son of Zenas Marshall Crane and Louise Fanny Laflin, Winthrop was a leading member of the Crane family of Dalton, Massachusetts, owners of the Crane Paper Company. Crane entered the family business in 1870, and, alongside his brother Zenas, Jr. presided over a period of significant growth of the company.

Crane produced both the yellow (issued in 1883–1884) and the white (1884–1894) watermarked security papers for the nation's Postal Notes. These early money orders were produced for sale throughout the postal system by the Homer Lee Bank Note Company (1883–1887), the American Bank Note Company (1887–1891), and Dunlap & Clarke (1891–1894). In 1922, Crane & Co. incorporated, with Frederick G. Crane elected as president.

Crane & Company, a unique and heavily guarded printing plant. Winthrop Murray Crane 3rd was among the names listed in The Pilgrims (fiat paper money bankers mob in New York and London) leaked list dated 1969. Crane appeared on page 463 of the 1967 Who’s Who. He was one of the majority of members who did not include that data in his biographical listing. This is a very mysterious organization guiding our national destiny with Great Britain! Crane described himself as a “paper manufacturing company executive.” He did list the fact of his membership in the public front organization---the Council on Foreign Relations. He was also a member of the Union club in New York and the Metropolitan club in Washington D.C. Crane was a director of the Otis Elevator Company---whose devices were even then in use in skyscrapers around the world---and of Byron Weston Company, also located in Dalton, Massachusetts, home city of Crane & Company. Another Pilgrims member with Crane on the Otis Elevator board at that time was Philip D. Reed, who chaired the Federal Reserve Bank of New York, 1960-1965, and was also a director of Tiffany & Company, Silver Users Association members.

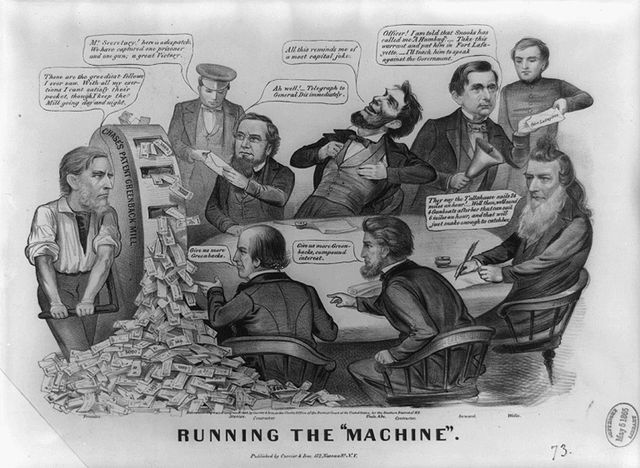

The Greenback: America's First Attack on Counterfeiting

Prior to the 1863 creation of a national currency, banks throughout the United States distributed over 7000 different bills. With so many bills in circulation, shop owners, especially illiterate ones, could not familiarize themselves with all the circulating bills. Counterfeiters prospered with relative ease. By the time the U.S. adopted a national currency, counterfeits made up an estimated one-third of the bills in circulation (Murphy 142).

To counteract the problem, the United States Federal Reserve produced bills known as "greenbacks" that had multiple anti-counterfeiting features. Cameras at the time produced only black and white photos and therefore were unable to replicate the bills' green color (Lipkin 58). Other security features built into the dollar involved its paper, ink, and printing process. Rag paper, or paper constructed from fabric fibers, was chosen for the bills thanks to its durability and relatively high cost of construction (to discourage counterfeiters from manufacturing it). Advanced mills formed the paper by using high pressure and temperature. The equipment, therefore, was expensive to purchase and run. The ink used in the process contained high concentrations of iron, giving it magnetic properties not found in other standard inks. Finally, intaglio presses chosen to produce the greenbacks differed from other printing techniques because ink rested in the grooves of the press, as opposed to lying on elevations. The ink was then transferred onto the paper without direct contact through the application of high pressures. For these reasons, only experienced printers could produce crisp images with intaglio presses (Lipkin 58).

Very little has changed in America's currency since the greenbacks' introduction. Our money still has a distinctive green color, the paper is still composed of linen and cotton, and the presses are still lined with intaglio plates. However, advances in photo and digital imaging allowed counterfeiters to bypass many of the security features of our nation's money through photocopying. In 1993, the National Treasury formed a commission to determine the impact of such new technologies on counterfeiting. Their research showed that production of photocopied bills accounted for only four percent of detected fakes, but the number of bills detected had doubled in a single year. Over the next seven years the number of photocopied fakes would increase to 60% of all confiscated fraudulent bills (Lipkin 59). In order to counteract this newly available technology, the Bureau of Printing and Engraving (BPE) developed and implemented several advanced modifications to the $100 bill (the most counterfeited bill at the time). In 1996, microprinting and plastic security strips were implemented as a defense against photocopying. Microprinting that appeared around Benjamin Franklin's portrait, while visible through a magnifying glass, was too finely drawn for machines at the time and appeared blurry on printed counterfeits (Murphy 144). Bills printed by photocopiers also could not reproduce the plastic security strips. <source>

INK

Ink Used to Print Currency THE GREEN IN "GREENBACKS

An ink was developed and the patent rights were purchased by Tracy R. Edson, who later was one of the founders of the American Bank Note Company. This is one of the same firms that produced the first paper money issued by the United States. The faces of these and other early notes produced under contract were printed with a green tint, presumably of the protective ink. It is not unusual in printing with oil-base-type inks, such as was the "patent green," for the color to strike through to the opposite side of a sheet. It might, therefore, be conjectured that the backs of the early notes were printed in a darker shade of ordinary green to make the tint "strike through" less obvious. Tracy R. Edson (1809 - 1881) was born in Otsego County, N.Y. and become an engraver and printer. He headed the New Orleans branch of Rowdon,Wright ,Hatch and Co. from 1832 to 1847.......this company printed America's first postage stamps......Edson also was the co-founder of The American Bank Note Company.

Currently the United States Currency features some new splashes of color on the various denominations, using an “Optically Variable Ink” (or OVI). This ink allows a shift in color variation when held at different angles. This ink, is produced by a Swiss company called SICPA. Founded by Maurice Amon (1880-1959), and headquartered in Lausanne, Switzerland, SICPA is a privately owned company providing secured identification, traceability and authentication solutions and services.

SICPA produced its first supplies of security inks in the 1940s for the Spanish peseta banknotes. Under the leadership of Maurice's son, Albert Amon (1916-2010), the company earned a reputation for stability based on a long-term vision. In the 1950s, 1960s and 1970s the company expanded in Europe and overseas, almost exclusively focused on the production of printing inks. Its research in ink chemistry and formulation enabled SICPA to supply new intaglio security inks for currencies and to establish quality standards. In the 1980s and 1990s, SICPA expanded further in Europe and Asia. The company created OVI®, a colour-shifting ink and anti-copying security technology which has become a reference in the industry. Today, SICPA is owned and managed by the third generation Maurice A. Amon - World Econmic Forum 2009 PDF

SICPA Securink Corporation Wins $45 Million Federal Contract May 16 13SICPA Securink Corporation won a federal contract valued at up to $45 million from the U.S. Department of the Treasury's Bureau of Engraving and Printing, for currency and security inks.

SICPA S.A., the Lausanne, Switzerland $400 million during 2011

SICPA Product Security LLC North American founded 1976 Subsidary $60 million

President Mr. James E. Bonhivert

8000 Research Way

Springfield, VA 22153

Phone: (703) 455-8050

Fax: (703) 450-4518

Email: securityinks@sicpa.com

2010, SICPA acquired Meyercord Revenue Inc., a specialist in stamping machines and ancillary equipment for tax stamp programs, from Illinois Tool Works Inc.

1775 Continental Currency

American colonists issued paper currency for the Continental Congress to finance the Revolutionary War. The notes were backed by the "anticipation" of tax revenues. Without solid backing and easily counterfeited, the notes quickly became devalued, giving rise to the phrase "not worth a Continental."

1781 Nation's First Bank

1781 Nation's First Bank

Also to support the Revolutionary War, the continental Congress chartered the Bank of North America in Philadelphia as the nation's first "real" bank.

1785 The Dollar

The Continental Congress determined that the official monetary system would be based on the dollar, but the first coin representing the start of this system would not be struck for several years.

1791 First U.S. Bank

After adoption of the Constitution in 1789, Congress chartered the First Bank of the United States until 1811 and authorized it to issue paper bank notes to eliminate confusion and simplify trade. The bank served as the U.S. Treasury's fiscal agent, thus performing the first central bank functions.

1792 Monetary System

The federal monetary system was established with the creation of the U.S. Mint in Philadelphia. The first American coins were struck in 1793.

1801 The Liberty Paper Mill", in 1770

The second Bank of the United States was chartered for 20 years until 1836.

1836 State Bank Notes

With minimum regulation, a proliferation of 1,600 local state-chartered, private banks now issued paper money. State bank notes, with over 30,000 varieties of color and design, were easily counterfeited. That, along with bank failures, caused confusion and circulation problems.

1861 Civil War

On the brink of bankruptcy and pressed to finance the Civil War, Congress authorized the United States Treasury to issue paper money for the first time in the form of non-interest bearing Treasury Notes called Demand Notes.

1862 Greenbacks

Demand Notes were replaced by United States Notes. Commonly called "Greenbacks," they were last issued in 1971. The Secretary of the Treasury was empowered by Congress to have notes engraved and printed, which was done by private banknote companies.

1863 The Design

The design of U.S. currency incorporated a Treasury seal, the fine line engraving necessary for the difficult-to-counterfeit itaglio printing, intricate geometric lathe work patterns, and distinctive linen paper with embedded red and blue fibers.

1865 Gold Certificates

Gold Certificates were issued by the Department of the Treasury against gold coin and bullion deposits and were circulated until 1933.

1865 Secret Service

The Department of the Treasury established the United States Secret Service to control counterfeits, at that time amounting to one-third of circulated currency.

1866 National Bank Notes

National Bank Notes, backed by U.S. government securities, became predominant. By this time, 75 percent of bank deposits were held by nationally chartered banks. As State Bank Notes were replaced, the value of currency stabilized for a time.

1873 Coinage Act

The Fourth Coinage Act was enacted by the United States Congress in 1873 and embraced the gold standard and demonetized silver. Western mining interests and others who wanted silver in circulation years later labeled this measure the "Crime of '73" Gold became the only metallic standard in the United States, hence putting the United States de facto on the gold standard. The U.S. did not actually adopt the gold standard de jure until 1900, following a lengthy period of debate that was made famous by William Jennings Bryan's cross of gold speech at the 1896 Democratic convention. By this time, most major nations had moved to a gold standard. The only major nation that continued on the silver standard into the twentieth century was China. China and Hong Kong abandoned the silver standard in 1935.

1877 Bureau of Engraving and Printing

The Department of the Treasury's bureau of Engraving and Printing started printing all U.S. currency, although other steps were done outside.

1878 Silver Certificates

The Department of the Treasury was authorized to issue Silver Certificates in exchange for silver dollars. The last issue was in the Series of 1957.

In 1879 Crane Paper Currency

Crane won its first contract to produce the paper for United States currency.

Today, all Crane’s papers are still made in the Crane and Company Old Stone Mill Rag Room mills alongside the Housatonic River where Zenas Crane found such an ideal location for his paper mill. The Rag Room was where Zenas Marshall Crane's son, Winthrop Murray Crane (1853–1920), began his career in the papermaking business. In 1878 he was responsible for acquiring Crane & Co.'s exclusive government contract to manufacture the paper used in the currency of the United States. In addition to running Crane & Co. during the late 19th century, Murray Crane served as Governor of Massachusetts and United States Senator, and played an influential role in Republican Party politics.

1910 Currency Production Consolidated

The Department of the Treasury's Bureau of Engraving and Printing assumed all currency production functions, including engraving, printing, and processing.

1913 Federal Reserve Act

After 1893 and 1907 financial panics, the Federal Reserve Act of 1913 was passed. It created the Federal Reserve System as the nation's central bank to regulate the flow of money and credit for economic stability and growth. The system was authorized to issue Federal Reserve Notes, now the only U.S. currency produced and 99 percent of all currency in circulation.

1929 Standardized Design

Currency was reduced in size by 25 percent and standardized with uniform portraits on the faces and emblems and monuments on the backs.

1957 In God We Trust

Paper currency was first issued with "In God We Trust" as required by Congress in 1955. The inscription appears on all currency Series 1963 and beyond.

1990 Security Thread and Microprinting

A security thread and microprinting were introduced, first in $50 and $100 notes, to deter counterfeiting by advanced copiers and printers.

HISTORICAL RELATIONSHIPS

Moving forward to the 1946 Who’s Who, page 518, we note that Crane Jr. also became a board member of Guaranty Trust Company, New York (today part of JP Morgan Chase --- notoriously anti-precious metals); Berkshire Life Insurance; Air Reduction Company (industrial gases); Eaton Paper Company; Western Massachusetts Electric Company; and the American Bank Note Company, to which Crane & Company supplied paper.

Yes, paper money creators are deeply interested in bank notes and currency!

The 1970 Who’s Who, page 546, shows Pilgrims member, CFR director Arthur Hobson Dean of the Bank of New York as an executive committee member of American Bank Note Company and a director of Crown-Zellerbach, paper manufacturer. Dean was a superlawyer at Sullivan & Cromwell, 48 Wall Street, and Ambassador to Korea during the war, who later chaired the Committee on Space Law of the American Bar Foundation. Page 48 of the same volume shows Pilgrims member James Albert Austin of Irving Trust Company as a director of the United States Bank Note Company. Austin was a partner in the law firm of Winthrop, Stimson, Putnam & Roberts. All relevant bases will be covered by the highly organized paper money mob! Another director of American Bank Note was Samuel Sloan Colt, a Pilgrims member who chaired Bankers Trust and appeared on many boards. Austin was with Winthrop, Stimson, Putnam & Roberts, another Pilgrims law firm that specialized in corporate finance and reorganization. So with the Winthrops being encountered once more, we see the ramifications of intermarriage and heredity in this mob! Its roots, in fact, trace to medieval Britain and Europe.

Samuel Sloan Colt was a member of the Scroll and Key Society of Yale

which has also had numerous powerful members, especially Pilgrims member Paul Mellon (“Paul controls thousands of companies,” biographer Hoffman), yet those who pursue Skull & Bones act as if its counterpart organizations---all tributaries into The Pilgrims Society—are unimportant, or fail at all to mention them, suggesting they are unaware they even exist. Very perversely, Mr. Colt married (Who’s Who In The East, 1957, pages 173-174) a descendant of President Martin Van Buren, who was Andrew Jackson’s vice president and his steadfast supporter in favor of gold and silver money. Yes, Mr. Colt appears to be a relative (nephew) of the famous arms manufacturer, Samuel Colt, who revolutionized gun manufacture; the Mr. Colt of Bankers Trust was a member of the Oneck Gun Club.

According to The Independent, New York, April 9, 1908, pages 800-801, referring to the Mr. Crane who was born in 1853---

“Winthrop Murray Crane of Massachusetts is out-Aldriching Aldrich in the Senate. The work is already under way. He is always on the floor when the Senate is in session, but he is so seldom in his own seat that one forgets which it is. You never think of looking there for Crane. He is always gliding about, often over on the Democratic side, always talking with someone. Crane is the very acme of all the qualities which have helped Aldrich to hold the loyalty of his following. Crane is facile princeps in many of the Aldrich strong points. He is a keen, shrewd auditor of human instincts and inclinations, a champion in diagnosis and description. You wouldn’t think it, any more than you would think it of Aldrich. He is a small man and so slender that there is hardly anything to him---but he has a fine head, well built for the mental machinery it contains.”

The Latin phrase means, “easily the first or best.”

“Your first impression is that is all there is to Murray Crane. But when you analyze those impressions you find that the strongest of them all was a sense of confidence and conviction which would have impelled you to tell him all he cared to know and as much more as you could work in. That feeling grows the better you know him. It has conquered the Senate. It was the same at his big paper mills and among his neighbors at Dalton. They all called him Murray, and came to him with everything. It was the same all over Massachusetts when they forced him to become Lieutenant Governor and then Governor. Twice he might have had a Cabinet office but he declined. There was not the right stuff in it for his voracious habit of activity. The Senate was better. He is an inherent leader, an absolutely indefatigable worker. He needs no rest. HE IS THE COMING POWER OF THE SENATE.”

In Outlook Magazine for September 23, 1905, page 167, we read of Crane---

“Decidedly in personal contrast with La Follette stands Mr. Crane of Massachusetts, who is sure to prove a great Senator. A man of great industry, abounding common sense, and of the highest character, in an age when sharp practices dismally overhang public life, his coming to the Senatorial stage is highly welcome. He made the best Governor Massachusetts has had in years. His accomplishments in settling up business affairs of the State which had long been vexations seemed phenomenal. His associations as a rich paper manufacturer and large investor in telephone properties were with THE LEADERS OF HIGH FINANCE. Mr. Crane is a prominent member of the Congregational Church, and has been one of the officers of the American Board of Commissioners for Foreign Missions.”

Wisconsin Senator La Follette (previously Governor) was a bitter opponent of the Federal Reserve System www.eastlandmemorial.org/lafollette.shtml. This site discusses his life and his view that the money interests of the nation were controlled by only about 100 men, focusing on the Morgan and Rockefeller interests. He appeared to not know of The Pilgrims Society. Therefore, when Outlook criticized La Follette and boosted Crane, they identified themselves as in the influence circle of the paper money mob.

The Nation, December 20, 1900, page 483 had this to say about Winthrop Murray Crane Jr.---

“Mr. W. Murray Crane comes of a family which for many years has successfully conducted the industry of paper manufacturing in Dalton, a small town in the Western part of the state. He is in middle life and has maintained the business traditions of his house, while at the same time showing an intelligent interest in public affairs and a hearty sympathy with good causes. He was given one office after another of growing importance, until in 1896 he was elected Lieutenant Governor, and three years later he was promoted to the position of Chief Executive.”

According to Outlook Magazine, May 30, 1923, page 94---

“The late Winthrop Murray Crane, United States Senator from Massachusetts, was one of Mr. Redfield’s boyhood friends.”

Crane passed away in 1920. William C. Redfield was a Democrat (in high finance, which controls the nominating process of both major parties, the terms Democrat and Republican serve merely to mislead the public). Redfield was a member of Congress from New York, 1911-1913, when he became Secretary of Commerce into 1919. He was a member of the elitist Cosmos Club in the District of Columbia; a director of the American-Russian Chamber of Commerce; and a director of the Equitable Life Assurance Society---both with Pilgrims members on their boards.

The World Today, May 1908, pages 531-534 called Winthrop Murray Crane Jr. a “political coroner and financial undertaker.” The New York Times, Friday, March 29, 1968, page 45, had an obituary on him that included the detail of Crane & Company being a 167-year-old business---dating to 1801, founded by Zenas Crane. Sorry, but I have not been able to ascertain whether Crane & Company supplied paper for production of the fiat notes issued by the first and second Banks of the United States; however, it could be likely!

According to the NYT--- “Mr. Crane was president of Crane & Company from 1923 until 1951, when he became chairman. One of the concern’s principal customers is the Treasury Department’s Bureau of Engraving and Printing, and from 1906 to 1945 Mr. Crane negotiated with the Treasury on the sale of paper used for currency.”

There must not have been much substance to the negotiations, because Crane & Company has had an absolute stranglehold monopoly on the funny money paper supplying business to the government, actually dating back to 1879.

This particular Mr. Crane, I remind you, is the one who lived 1881-1968; his son (born July 14, 1910) appeared in the leaked 1969 list of The Pilgrims---the British-American paper money mob. Crane’s wife Ethel was the daughter of the founder of Eaton Paper Corporation. Winthrop Murray Crane 3rd married Katharine L.W. Pell on January 29, 1946. The Pells have long been important figures in Rhode Island. John Howland Gibbs Pell, with offices at 1 Wall Street under the name John H.G. Pell & Company, was a member of The Pilgrims (Who’s Who, 1971, page 1765.) Pell was president of Wall Street Investing Corporation; director, Jefferson Insurance; Netherlands Overseas Corporation; Beco Industries; North Central Company; Crowell-Collier Macmillan Publishers; and Dime Savings Bank. Pell was president of the Colonial Lords of Manors

a society whose roots extend back to British Crown collaborators. He was a trustee of the New York State Historical Association and a director of the elite France-America Society. Additionally he was a member of such high-powered clubs as Piping Rock; Seawanhaka Corinthian Yacht; Century Association; and the Metropolitan. He was decorated an Officer of the Order of Orange-Nassau, probably due to his association with Netherlands Overseas Corporation. That royal house, which beginning in 1954 cosponsored Bilderberg meetings, is intermarried centuries ago with the British Crown---an association reflected in other entities, notably Royal Dutch Petroleum and Shell Oil.

8/21/13 The dollar bill has lobbyists, too

Powerful lobbyists, lawmakers are attempting to convince us that we should replace the dollar bill with a dollar coin. The groups pushing for the series include metal producers and the National Automatic Merchandising Association (NAMA), which represents vending machine manufacturers. Between 1998 and 2001, the Feds spent $67 million promoting the Sacagawea dollar - ultimately to no avail. A 2001 GAO study found that the Sacagawea dollar was being used in less than 1 percent of all dollar transactions.

1750 WHAT IS A PISTOLE?

Remember When England owned Virginia?

The pistole, a common coin at least until the 1760s, was a Spanish gold coin, sometimes called a doubloon. By the mid eighteenth century, a pistole was worth almost a pound (.83), or a little over 18 shillings. The term pistole sometimes also referred to the French gold louis d'or, minted in the late seventeenth century and worth anywhere from 18 shillings to slightly more than a pound (and also called a French guinea). Since the colonists were not allowed to coin their own money, they usually had to use such foreign coins. As one of the most common circulating coins used in the first half of the eighteenth century, the pistole became a primary medium of exchange.

Another common coin in eighteenth-century was the Spanish peso, or piece of eight, also sometimes called a dollar. It was a silver coin, worth somewhat less than one-quarter of a pound, or 4 shillings, 6 pence.

Beginning in the 1760s, the rewards specified in the ads were expressed in terms of English currency, pounds, shillings, and pence, commonly known by these symbols: £ for pounds, s for shillings, and d for pence, or pennies. A pound was worth 20 shillings, and 12 pence equalled a shilling. But while there were actual coins called shillings and pence, there was no such coin that was equivalent to a pound. It was a unit of measurement only. In the ads, the common symbol for a pound was l (lower-case letter L). The guinea, worth 21 shillings, or just over a pound, was the coin used when one wished to deal in pounds.

Virginia. pounds, shillings, and pence, however, were not worth as much as these denominations were in the England the Owner Country. The difference between the values of English money, often referred to as sterling and Virginia money is called the exchange rate, or the rate at which Virginia currency could be exchanged for English currency. And while the exchange rate varied from year to year, it is probably fair to say that on average, in the period before the American Revolution, a Virginia pound was worth about 85% of a sterling pound.Information drawn from McCusker, John J. Money and Exchange in Europe and America, 1600-1775 : A Handbook. Chapel Hill, N.C.: Published for the Institute of Early American History and Culture, Williamsburg, Va., by the University of North Carolina Press, 1978.

CRYPTO CURRENCY AND THE FUTURE OF MONEY

Bitcoin The Future: Electronic Money

In our digital age, economic transactions regularly take place electronically, without the exchange of any physical currency. Digital cash in the form of bits and bytes will most likely continue to be the currency of the future.