Contents

- Introduction

- Preface

- Overview

- Relief Valve

-

LECTURE 1: Why We Are In The Dark About Money

- Wealth Objectives

- The Basics - Knowledge is Power

- The Wizard of Oz Story Allegory

- K12 Wealthy Decide

- Richest Two Percent Own Half World

- Cost of Inequality

- K Street Lobbys Write the Law

- Official Federal Reserve K12 Financial Literacy Curriculum by Grade Level

- What's Left Out of the Official U.S. Federal Reserve Curriculum

- EducRats

- Financial Literacy Quotes

- Lecture 1 Objectives and Discussion Questions

- LECTURE 2: The Con

- LECTURE 3: The Vatican-Central to the Origins of Money & Power

- LECTURE 4: London The Corporation Origins of Opium Drug Smuggling

- LECTURE 5: U.S. Pirates, Boston Brahmins Opium Drug Smugglers

- LECTURE 6: The Shady Origins Of The Federal Reserve

- LECTURE 7: How The Rich Protect Their Money

- LECTURE 8: How To Protect Your Money From The 1% Predators

- LECTURE 9: Final Thoughts

FINANCIAL LITERACY OBJECTIVES

✔ It stands to reason that everyone wants to know the truth about money, because knowing the truth has the power to save your life, or at the very least help you from making big mistakes.

✔ Lies can kill, since you can't know what you ought to know - in order to save your life. That is the problem with propaganda.

✔ When you know the truth, you can make good decisions.

✔ When you are uninformed and make a mistake, you may never get over it because you learn you were suckered.

✔ There are no red / blue / green political parties, ideologies, or religions that matter--it's just all a big show: red herrings that feed the illusion that we have choices.

✔ You'll learn the reasons why there are Banks, how they are controlled, and why they are in every country.

✔ The world’s uber rich are stuffing their cash in the US because it’s suddenly the best tax haven in the world

✔ You'll learn who the "old money" really is. You'll learn how the most wealthy families got their money in the first place, and how they stayed in control of your money, your country, and the wealth of the world.

✔ You will be able to protect yourself and your family by becoming financially literate and making informed decisions about your money.

✔ You'll learn that the Law only exists for 3 reasons and that is to separate you from your money, your liberty and your property.

Oct 5, 2014 Did you know police can just take your stuff if they suspect it's involved in a crime? They can! Civil-asset forfeiture laws sanction official thievery, yet another symptom of a justice system that is corrupt and unaccountable. 60 Minutes did a story about this in early 1990s, and it still continues today. Victims face a "Kafkaesque world" of litigation, attorneys fees, bankruptcy, and blacklisting. The icing on the cake? Hiding the seizures from the public via a "super seal." Government documents filed under super seal, a procedure overseen by the federal clerk’s office, are stored in the court’s vault and not loaded into the electronic case management system. The documents remain secret from the public and opposing parties.

✔ The real issues beneath the layers of distraction are the same things that Machiavelli wrote about so many centuries ago: power, money, and authority.

✔ Be brave! Go ask the questions that you need to ask.

WALL STREET

The Haves vs. the Have-Mores

Wealth uses Attorneys and accountants to hide their money in shell companies registered in Tax Havens.

Almost all of the increase in American inequality over the last 30 years is attributable to the “rise of the share of wealth owned by the 0.1 percent richest families.” And much of that rise is driven by the top 0.01 percent. The wealth of the top 1 percent grew an average of 3.9 percent a year from 1986 to 2012, though the top one-hundredth of that 1 percent saw its wealth grow about twice as fast. The 16,000 families in that tiptop category — those with fortunes of at least $111 million — have seen their share of national wealth nearly double since 2002, to 11.2 percent. As the top 0.01 of the 1% pulls away, the superrich are leaving the merely very rich behind." It's all about the billionaires and nine-figure millionaires!! The wealthy now have a wealth gap of their own, as economic gains become more highly concentrated at the very top. As the top one-hundredth of the 1 percent pulls away from the rest of that group, the superrich are leaving the merely very rich behind. That has created two markets in the upper reaches of the economy: one for the haves and one for the have-mores. NYT

Capable of Anything (1974) start 0:22

QUESTION: How Much Are You Worth? How much better can you eat? What can you buy that you can't already afford?

ANSWER: THE FUTURE MR. GITTES! THE FUTURE

The Bail Out

The Bail In

and

Justice for All No Justice No Peace

No Justice No Peace

"The bottom line for Geithner's handling of the crisis is what he keeps missing in interview after interview: he saved the jobs and profits of big banks, but didn't do a thing for the other 300 million Americans. No teams of suited economists swarmed into White House conference rooms to save families from foreclosures. No crisis team gathered for late-night brainstorming sessions to save jobs and prevent the unemployment crisis. A normal American could have his home taken away from him due to a dishonest mortgage and no one in Washington blinked – but when a banker calls Treasury in a panic about losing out on some debt, a Swat team of Washington policymakers rushes to the scene. Asymmetry of wealth translates into an asymmetry of policy. This is not government for all. This is a problem, a deep structural flaw at the core of our political and financial systems. Yet Geithner doesn't seem to see the ragged fault line at all." ~ the guardian

How Do They Get Away With This?

PLUTOCRACY explains how our politicians no longer resemble, nor do work for us.

The 1% hide their money offshore – then use it to corrupt our democracy!

Q: What do the super-rich get for their investment in politics and lobbying?

A: Cuts in personal taxes, and REVOLVING DOOR folks advise on overhauling corporation taxes, and the security of knowing that their tax havens will be treated with due leniency.

Q: WHY WE HAVE LOVE, AND PROMOTE MONEY LAUNDERING

A: Read Panama and the Criminalization of the Global Finance System

IN THE 70'S the State Department came to Chase, and said, we’ve got to figure out some way of getting enough dollars to offset the military deficit. They found the way to do it. It was to make the United States the new Switzerland of the world. I was asked to make a calculation of how much criminal capital there is in the world. How much the drug dealers made, how much the criminals all over made, how much the dictators secreted away. How much goes to Switzerland, and how can U.S. banks get this criminal money in the United States? The end result was that the U.S. Government went to Chase and other banks and asked them to be good American citizens and make America safe for the criminals of the world, to safeguard their money to support the dollar in the process.

There is A "pervasive civic ignorance." ~ retired Supreme Court justice David Souter

Vote all you want. The secret government won’t change.

The people we elect aren’t the ones calling the shots, says Tufts University’s Michael Glennon

FINES AND CRIMES:

All of these banks, after the fines, remained profitable. Additionally, these fines are tax-deductible. The loss to the Treasury is made up by ordinary taxpayers. Furthermore, it is paid by the bank, i.e., its stockholders, and not the senior executives who made the fateful decisions -- i.e., the individual Banksters. When put into proper context, these fines are not as large as they initially seem, and the "hurt" is suffered by stockholders and taxpayers, not the Banksters. As individuals, they are not "getting hurt right in the wallet."

http://www.syracuse.com/opinion/index.ssf/2015/04/fines_and_crimes_part_1_why_the_banksters_arent_deterred_by_fines_commentary.html

THE MERCHANT CLASS IS THE LOWEST CLASS

THE

CLINTON / REAGAN

LEGACY11/14 How Capitalism Has Gone Off the Rails

The buzzword is "inclusion" - "INCLUSIVE CAPITALISM" and it refers to a trait that Western industrialized nations seem to be on the verge of losing: the ability to allow as many layers of society as possible to benefit from economic advancement and participate in political life. in today's capitalism, there is too little left over for the lower income classes. Former US President Bill Clinton found fault with the "uneven distribution of opportunity," while IMF Managing Director Christine Lagarde was critical of the numerous financial scandals. The hostess of the meeting, investor and bank heir Lynn Forester de Rothschild, said she was concerned about social cohesion, noting that citizens had "lost confidence in their governments."

Thirty Years Ago: David Stockman was the face of the Reagan revolution, as former President Ronald Reagan's budget director, David Stockman was the architect of the biggest tax cut in US history and the propagandist of the "trickle-down" theory, the Republican tenet whereby profits earned by the rich eventually benefit the poorer classes. Now in 2014 he is furious over his country's transformation into a debt republic of the sort the Western world and says "We have a financialized, central-bank dominated casino," he says, "that is undermining the fundamentals of a healthy growing capitalist economy." The primary beneficiaries of the market rally seen in recent months are the 10 percent of top earners who own more than 90 percent of financial assets. But for average Americans, the policies instituted in response to the crisis have been poverty inducing.

PANAMA PAPERS

Panama Papers: Email Hackable via WordPress, Docs Hackable via Drupal April 8, 2016

The Mossack Fonseca (MF) data breach, aka Panama Papers, is the largest data breach to journalists in history and includes over 4.8 million emails. Yesterday we broke the story that MF was running WordPress with a vulnerable version of Revolution Slider and the WordPress server was on the same network as their email servers when the breach occurred.

Wealth uses Attorneys and accountants to hide their money in shell companies registered in Tax Havens.

Here's an absolutely amazing stat about U.S. corporations stashing cash in tax havens. Obama admin moves to try to block EU regulators from cracking down on corporate tax evasion.

Panama Papers: Corporations Shifted A Half-Trillion Dollars To Offshore Tax Havens In 2012

How a US president and JP Morgan made Panama: and turned it into a tax haven In 1903 the US bullied Colombia into giving up the province that became Panama. The plan was to create a nation to serve the interests of Wall Street. Tax havens are accessed only by the wealthiest in society. During Mitt Romney’s presidential campaign, tax havens are now being promoted more openly as investment companies try to stoke rich people’s fears and encourage them to avoid paying U.S. taxes. buybelize.com also offers to set up shell companies — International Business Companies — to “protect investments from taxes as well as legal judgments.” Buy Belize also advertises on The Glenn Beck Program. In 2012, the 60 largest corporations in America offshored $166 billion, costing American taxpayers billions in lost revenue. As a result, this loss of tax revenue is draining federal and state budgets.

U.S. corporations shifted more than a HALF-TRILLION DOLLARS to 10 tax havens in a single year

Corporations set up affiliated shell companies in countries where taxes are low or nonexistent and reroute payments and liabilities to serve their needs. Mossack Fonseca is one of the widest-reaching creators of shell companies in the world. It has served as the registered agent for front companies tied to an array of notorious gangsters and thieves. Shell companies need a registered agent, sometimes an attorney, who files the required incorporation papers and whose office usually serves as the shell's address. This process creates a layer between the shell and its owner, especially if the dummy company is filed in a secrecy haven where ownership information is guarded behind an impenetrable wall of laws and regulations. It has affiliated offices in 44 countries, including the Bahamas, Cyprus, Hong Kong, Switzerland, Brazil, Jersey, Luxembourg, the British Virgin Islands, and—perhaps most troubling—the US, specifically the states of Wyoming, Florida, and Nevada.

The Law Firm That Works with Oligarchs, Money Launderers, and Dictators

One purpose of a so-called shell company is that the money put in it can't be traced to its owner. Say, for example, you're a dictator who wants to finance terrorism, take a bribe, or pilfer your nation's treasury. A shell company is a bogus entity that allows you to hold and move cash under a corporate name without international law enforcement or tax authorities knowing it's yours. Once the money is disguised as the assets of this enterprise—which would typically be set up by a trusted lawyer or crony in an offshore secrecy haven to further obscure ownership—you can spend it or use it for new nefarious purposes. This is the very definition of money laundering—taking dirty money and making it clean—and shell companies make it possible. They're "getaway vehicles," says former US Customs investigator Keith Prager, "for bank robbers."

To conduct business, shell companies like Drex need a registered agent, sometimes an attorney, who files the required incorporation papers and whose office usually serves as the shell's address. This process creates a layer between the shell and its owner, especially if the dummy company is filed in a secrecy haven where ownership information is guarded behind an impenetrable wall of laws and regulations.Democracy and Political Influence at root, the Panama Papers are not about tax. They’re not even about money. What the Panama Papers really depict is the corruption of our democracy. Following on from LuxLeaks, the Panama Papers confirm that the super-rich have effectively exited the economic system Tax havens are simply one reflection of that reality. Discussion of offshore centres can get bogged down in technicalities, but the best definition I’ve found comes from expert Nicholas Shaxson who sums them up as: “You take your money elsewhere, to another country, in order to escape the rules and laws of the society in which you operate.” In so doing, you rob your own society of cash for hospitals, schools, roads… the rest of us have to live in. Thirty years of runaway incomes for those at the top, and the full armoury of expensive financial sophistication, mean they no longer play by the same rules the rest of us have to follow.

DOUBLE GOVERNMENT

CONCEALED INSTITUTIONS

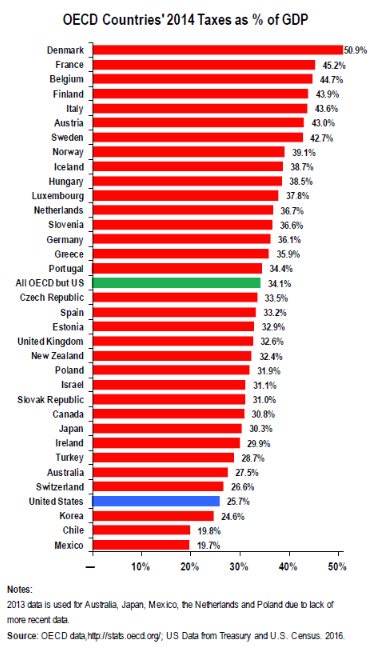

The next time you hear a lobbyist whine about U.S. corporate tax rates, send them this graph

Where does the term “double government” come from?

It comes from Walter Bagehot’s famous theory, unveiled in the 1860s. Bagehot was the scholar who presided over the birth of the Economist magazine—they still have a column named after him. Bagehot tried to explain in his book “The English Constitution” how the British government worked. He suggested that there are two sets of institutions. There are the “dignified institutions,” the monarchy and the House of Lords, which people erroneously believed ran the government. But he suggested that there was in reality a second set of institutions, which he referred to as the “efficient institutions,” that actually set governmental policy. And those were the House of Commons, the prime minister, and the British cabinet.

I think the American people are deluded, as Bagehot explained about the British population, that the institutions that provide the public face actually set American national security policy. They believe that when they vote for a president or member of Congress or succeed in bringing a case before the courts, that policy is going to change. Now, there are many counter-examples in which these branches do affect policy, as Bagehot predicted there would be. But the larger picture is still true — policy by and large in the national security realm is made by the concealed institutions.

The ultimate problem is the pervasive political ignorance on the part of the American people. And indifference to the threat that is emerging from these concealed institutions. That is where the energy for reform has to come from: the American people. Not from government. Government is very much the problem here. The people have to take the bull by the horns. And that’s a very difficult thing to do, because the ignorance is in many ways rational. There is very little profit to be had in learning about, and being active about, problems that you can’t affect, policies that you can’t change.

Double Government by Michael Glennon boston globe

We have a bifurcated system in which even the President now exercises little substantive control over the overall direction of US national security policy. The result, is a system of dual institutions that have evolved toward greater centralization, less accountability, and emergent autocracy. By 2011, according to The Washington Post, there were 46 separate federal departments and agencies and 2,000 private companies engaged in classified national security operations with millions of employees and spending of roughly a trillion dollars a year. As Glennon points out, presidents get to name fewer than 250 political appointees among the Defense Department’s nearly 700,000 civilian employees, with hundreds more drawn from a national security bureaucracy that comprise "America’s Trumanite network” — in effect, on matters of national security, a second government. We have a Shadow Government that is out of control. America has a system of dual institutions that have evoloved toward greater centralization, less accountability, and emergent autocracy. The government is seen increasingly by elements of the public as hiding what they ought to know, criminalizing what they ought to be able to do, and spying upon what ought to be private. The people are seen increasingly by the government as unable to comprehend the gravity of security threats.

The Pitchforks Are Coming

THE EASIEST PLACE IN THE WORLD

TO SET UP A SHELL COMPANY IS THE U.S.

Nevada, a Tax Haven for Only $174 The Panama Papers show how the U.S. state has become a favored destination rivaling the Cayman Islands and Switzerland.

WHY IS THE US THE BIGGEST TAX HAVEN OF THEM ALL? FATCA AND THE CRS

But the country most conspicuous by its absence from the list of CRS-committed jurisdictions is none other than the world’s biggest financial centre – the U.S. – which seems to be taking the view that it doesn’t need to engage with the CRS because FATCA does the same job. The flaw in that argument is that FACTA does the same job as the CRS only when it comes to disclosure to the U.S. by countries that have signed up to FATCA IGAs. Whereas the IGAs require disclosure to the US of information relating to accounts held by non-US entities controlled by U.S. citizens, there is no requirement for the U.S. to disclose the same sort of information in respect of U.S. entities controlled by residents of its IGA partners. This is for one very obvious reason – unlike many of its FATCA-partner jurisdictions, the U.S. has no legislation requiring banks to collect information on the beneficial owners of companies and trusts. As Bob Stack, U.S. Treasury Deputy Assistant Secretary (International Tax Affairs), noted last year with an almost British degree of understatement: “It’s a little awkward for the U.S. to have a standard around the world that we don’t ourselves satisfy.”

So who do I call about "INCLUSIVE CAPITALISM"?

WE may have the right to vote, but with gerrymandering and corporate influence it seems like a meaningless effort. The 99% is mad as hell and no one's sticking up for us. America's a country where you're truly on your own, where the rich want to eviscerate the safety net and tell us to pick ourselves up by our bootstraps, saying it's all about self-reliance. Peaceful protest has no impact on Freedom. Give us freedom from money in politics. Give us freedom to speak back to corporations who don't care about us but only care about Wall Street.

There's no one to call anymore. Why don't these politicians take our problems seriously? That's right, why should we care about our brethren when no one cares about us. Is that the Clinton / Reagan legacy? We wish our votes truly counted.

How a US president and JP Morgan made Panama: and turned it into a tax haven

History has its way of coming ironically around, and it certainly has in the early 21st century on two counts, echoing Panama’s genesis. One is that the man who became president of Standard Oil back in those early days of tax dodging – William Stamps Farish II – had a grandson, William Farish III, who became a crucial aide and lieutenant to the Bush dynasty; he was “almost like family”, said Barbara Bush, and became her son George W Bush’s ambassador to London. (JP Morgan has meanwhile hired a string of illustrious ambassadors and consultants of late, few more prestigious than Bush’s closest ally, Tony Blair.)

In 1903 the US bullied Colombia into giving up the province that became Panama. The plan was to create a nation to serve the interests of Wall Street. The reason, of course, was to gain access to, and control of, the canal across the Panamanian isthmus that would open in 1914 to connect the world’s two great oceans, and the commerce that sailed them. The Panamanian state was originally created to function on behalf of the rich and self-seeking of this world – or rather their antecedents in America – when the 20th century was barely born. The Roosevelt/JP Morgan connection in the setting-up of the new state was a direct one. The Americans’ paperwork was done by a Republican party lawyer close to the administration, William Cromwell, who acted as legal counsel for JP Morgan. JP Morgan led the American banks in gradually turning Panama into a financial centre – and a haven for tax evasion and money laundering – as well as a passage for shipping, with which these practices were at first entwined when Panama began to register foreign ships to carry fuel for the Standard Oil company in order for the corporation to avoid US tax liabilities. Panama was created by the United States for purely selfish commercial reasons, right on that historical hinge between the imminent demise of Britain as the great global empire, and the rise of the new American imperium. In 1989 the US returned militarily, as it had eight decades previously, and – as Silverstein puts it – “returned to power the old banking elites, heirs of the JP Morgan legacy”.

WHISTLE-BLOWER!

KNOW YOUR PLACE

SHUT YOUR FACE

It’s about having a healthy and open society.

It’s about having a healthy and open society.

OPPRESSION by its very nature creates the power that crushes it. A Champion arises - a Champion of the oppressed - whether it be a Cromwell or someone unrecorded, he will be there. He is born. Then out of the mystery of the unknown appeared a masked rider who rode up and down the great internet Hwy punishing and protecting and leaving upon the great oppressor the mark of ZORRO aka ANONYMOUS.

@ioerror There are three role models:

1) insiders who keep leaking and stay anonymous. There are many and this is attractive to many.

2) Insiders who megaleak and become public. But being publically harrassed and prosecuted deters others, so => asylum.

3) Outsiders who infiltrate electronic or human systems. Harder to be caught and the most ethically clear, loyalties are not made.

Thanks to the @filmindependent #SpiritAwards, #CITIZENFOUR won Best Documentary. Snowden doesn't deserve decades in prison, but our gratitude