Contents

- Introduction

- Preface

- Overview

- Relief Valve

- LECTURE 1: Why We Are In The Dark About Money

- LECTURE 2: The Con

- LECTURE 3: The Vatican-Central to the Origins of Money & Power

- LECTURE 4: London The Corporation Origins of Opium Drug Smuggling

-

LECTURE 5: U.S. Pirates, Boston Brahmins Opium Drug Smugglers

- THE BOSTON BRAHMINS

- Pirates Profiteers Banksters Traders Transfers

- Pirates

- White Slavers, Cargo, Property, Auctions, Amazing Grace

- $ Colonial Labor: Indentured Servants

- England to Philadelphia Slave Trade and Opium

- Extract from Charter of Freedoms and Exemptions to Patroons 1629

- The Definitive Treaty of Peace

- Pennsylvania Charter of Privileges 28 October 1701

- Opium Trade -- American Drug Smuggling Pirates

- Opium In America

- 1% Power Elite Networks

- 1% Elite Networks Bush & The CIA

- BEFORE Skull & Bones

-

SKULL AND BONES

- Academia, Fraternity, Feeder Schools

- Yale and China

- Order of Skull and Bones Chains of Influence

- Tracing the History of Skull and Bones

- Russell Trust

- White Shoe Law Firms

- Kleiner Perkins Caufield & Byers

- Ruth Avery Hyde Paine

- Skull and Bones Secrets

- $uper Rich

- Prescott Bush - Trading With The Enemy Act

- George Bush, Skull & Bones and the New World Order

- Dulles Family and Harvard's Pig Club

- Du Pont Loves Monoplies, Nazis and Trust Funds

- Skull & Bones and the American National Red Cross

- Caribbean Pirates in the American South

- Who Were the Tories

- The Golden Age of Imperialism Opium Act 1908

- Global Dominance Groups

- The New World Order

- Characteristics of Fascism

- War on drugs

- Lecture 5 Objectives and Discussion Questions

- LECTURE 6: The Shady Origins Of The Federal Reserve

- LECTURE 7: How The Rich Protect Their Money

- LECTURE 8: How To Protect Your Money From The 1% Predators

- LECTURE 9: Final Thoughts

CARTEL / FAMILY NETWORKS / INBREDS / THE PURPOSE OF THE SENATE

Reference:

THE PILGRIM SOCIETY

A secret group of international financiers and one-world intellectuals dedicated to reuniting the United States and Great Britain.

Duke, Gerald Cavendish Grosvenor, died of a heart attack on 9th August 2016, was famously one of Britain’s richest landowners. Apart from his country house, Eaton Hall in Cheshire, and estates in Lancaster, Scotland and elsewhere, the Grosvenor family estate owns prime land in central London – Mayfair and part of Oxford Street, and 190 acres in Belgravia, near Buckingham Palace.

His son Hugh, aged 25, becomes not only the youngest non-royal duke in Britain but its richest person under the age of 30; his father once said he would rather not have been born wealthy but never thought of giving it up: ‘I can’t sell. It doesn’t belong to me.

They ownsover 300 acres of the choicest property in downtown London, plus immense land holdings in Canada, Australia, Hawaii and elsewhere.

He was a leading member of The Pilgrims of Great Britain. The Pilgrims organization is a cluster of intermarried old-line rich, Royals and robber barons who have created the world’s financial structure.

1971 book, “Nixon, The Man Behind The Mask” by Gary Allen. That was the same author who wrote the widely known, “None Dare Call It Conspiracy,” page 223 of his unauthorized Nixon biography, Allen wrote--- “Bobst is listed as a member of the highly secret Pilgrim Society, which is even closer to the inner circle of the conspiracy than the CFR.” He was referring to one of Nixon’s friends, Elmer Bobst, then head of Warner-Lambert pharmaceutical company.

In “Nixon’s Palace Guard” (1971) also by Allen, we find on page 146---

“Burns belongs to the Pilgrim Society, a secret group of leftist international financiers and one-world intellectuals dedicated to reuniting the United States and Great Britain.” He was referring to Arthur Burns, head of the Federal Reserve System. His predecessor was William McChesney Martin Jr., of The Pilgrims, who chaired the Federal Reserve, 1951-1970 (“underground” in “Who’s Who,” meaning, he declined to state the fact!) Afterwards, Martin, who married Cynthia, the daughter of the founder of the Davis Cup (tennis), was appointed chairman of the Committee to Reorganize the New York Stock Exchange (increase the “Pilgrimization”) in 1971. (The head of the exchange from 1951-1967, George Keith Funston, was another member). Martin became the youngest president ever of the New York Stock Exchange in 1938 at age 32, a post he held into 1941.

From 1946-1948 Martin chaired the Export-Import Bank of the U.S.; assistant Treasury Secretary in 1949; and a World Bank director, 1949 through 1952, along with Pilgrim Society member Eugene R. Black Jr. of Chase National Bank. After reorganizing the New York Stock Exchange in 1971, the inner core Pilgrim Society members placed him on boards including United States Steel; Freeport Minerals Company; Scandinavian Securities Corporation; Riggs National Bank; American Express; Caterpillar Tractor; Dow Jones & Company; Eli Lilly & Company; General Foods; and Royal Dutch Shell Petroleum. He became a trustee of Yale University. His father was president of the Federal Reserve Bank of Saint Louis, 1936- 1941, and a trustee of Washington & Lee University. Yes, The Pilgrims control the world’s money! Not Bilderberg! Pilgrim Society Members

families that shape our money

This triad of intermarried families -- Winthrops, Cranes, & Aldriches shaped the destiny of our American currency. Their alliance allowed for passage of the Federal Reserve and its many policies that favor the 1%.

The Winthrops, in addition to marriages with the Cranes, are also intermarried with the Aldrich family --- key founders of the Federal Reserve System.

The Aldriches in turn are bred into the Rockefellers. Naturally the thin-air fiat currency bank assemblage would include the family who manufactures its fiat paper---the Cranes. The common denominator linking the Cranes (paper suppliers) to the Aldriches (Federal Reserve backers) is the centuries old Winthrop clan, intermarried with both.

The Aldriches in turn are bred into the Rockefellers. Naturally the thin-air fiat currency bank assemblage would include the family who manufactures its fiat paper---the Cranes. The common denominator linking the Cranes (paper suppliers) to the Aldriches (Federal Reserve backers) is the centuries old Winthrop clan, intermarried with both.

Winthrop Murray Crane Jr. (1853-1920)

Winthrop Murray Crane Jr. (1853-1920)

Crane was the “lieutenant” of Senator Nelson Aldrich, a prime mover behind the Federal Reserve Act of 1913; Crane was a friend of anti-silver President William Howard Taft and was his “chief advisor and troubleshooter;” Crane supported entry of America into the League of Nations - Crane was President Coolidge’s mentor; and “Crane retired at the end of his term and returned to Dalton. Remaining in close touch with significant developments in national and state politics, he often helped formulate strategies to advance the interests of the large corporate entities with which he was associated.”

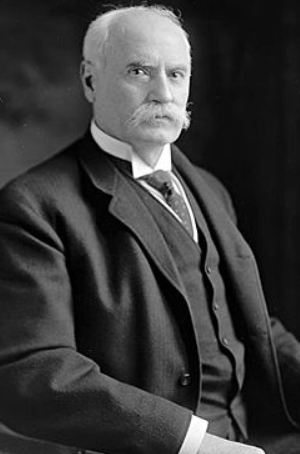

Winthrop Murray Crane

Winthrop Crane born at Dalton, Massachusetts, on April 23, 1853, was the grandfather of Crane 3rd. He was lieutenant governor of Massachusetts, 1897-1899, and governor, 1900-1902, and served as a Senator from that state, 1902-1913. He was a member of the Republican National Committee, 1892-1900 and 1904-1916 and a Harvard graduate (Who’s Who, 1914, page 545). He voted for the Federal Reserve Act.

According to “American National Biography” (Oxford University Press, 1999), page 681

“He secured the business of the Winchester Arms Company in 1875 by designing and producing “Bullet Patch,” a special cartridge paper needed for the breech loading rifles the gun merchant sold abroad and in the American West. Crane’s second major sales coup came in 1879, when he captured an exclusive contract with the federal government for currency and bond paper. His shrewd investing expanded the already considerable Crane fortune and involved him in the affairs of booming late nineteenth century enterprises such as the American Telephone & Telegraph Company, the Boston & Albany Railroad, the Otis Elevator Company, and Western Union.

Vertical and Horizontal "chains of influence"

The article below articulates how the Senate no longer represented the interest of America but the interest of the wealthiest 1%. Passage of the Federal Reserve Act (because of family alliances and networks) led to the creation of an institution representing private bankers and their 1% families.

The Senate 1906 - 2011

The Purpose of the Senate: They are the final arbiter of the distribution of the enormous prosperity annually created by the American people.

Who pays the big election expenses of your congressman, of the men you send to the legislature to elect senators? Do you imagine those who foot those huge bills are fools? Don't you know that they make sure of getting their money back, with interest, compound upon compound? Your candidates get most of the money for their campaigns from the party committees; and the central party committee is the national committee with which congressional and state and local committees are affiliated. The bulk of the money for the "political trust" comes from "the interests." "The interests" will give only to the "political trust.'

An orchestrated financial "panic" led the way for a banker controlled central bank.

1908-1912: The Stage is Set for a Decentralized Central Bank

The Aldrich-Vreeland Act of 1908, passed as an immediate response to the panic of 1907, provided for emergency currency issues during crises. It also established the National Monetary Commission to search for a long-term solution to the nation's banking and financial problems. Under the leadership of Sen. Nelson Aldrich, the commission developed a banker-controlled plan.

Senator Nelson Aldrich (Pilgrims) was the primary Capitol Hill force behind the Federal Reserve Act.

His son, Winthrop Williams Aldrich, became president of Equitable Trust Company in 1929, under Pilgrims member Alvin W. Krech (born 1858), director of 37 corporations. Equitable Trust merged into Chase National Bank, and from 1930-1934 Winthrop Aldrich, uncle of Pilgrims members Nelson and David Rockefeller, was president. He then became chairman until 1953 of the notoriously anti-precious metals bank. In 1953 Winthrop Aldrich became Ambassador to Britain, through 1957 and became a member of the Order of the British Empire and a leading member of The Pilgrims--- these are the political allies on Capitol Hill Crane & Company has relied on over the years to protect their monopolistic interests. According to “American National Biography” (Oxford University Press, 1999), pages 255 and 256, Aldrich married Harriet Alexander, granddaughter of Charles Crocker, banking and railroad kingpin behind the Southern Pacific Railroad and many other interests, including banking, timber and mining; Pilgrims member William H. Morton later appeared on the board of Crocker Bank.

We read (page 255)---“Aldrich’s life and career were closely intertwined with the Rockefeller family. His sister, Abby Aldrich, married John D. Rockefeller Jr., and Aldrich devoted his career to serving the Rockefeller family’s financial and political interests. In the 1920s John D. Rockefeller Jr. acquired the Equitable Trust Company. Aldrich served as his legal counsel and confidential advisor. The Equitable Trust Company remained at the center of the Rockefeller financial empire, and Aldrich was at the center of Equitable Trust. In 1930 he maneuvered the merger of Equitable Trust and Chase National Bank, creating the world’s largest bank.”

Continuing on page 256--- “As president of Chase, Aldrich supervised Rockefeller financial interests worldwide and established banking affiliates throughout Europe and Latin America. With the onset of World War II he became a forceful advocate for British interests within American business and political circles. He urged amendment of the Neutrality Act to provide active assistance to Britain. In 1946 he consulted on the creation of the World Bank.”

this country is theirs, not ours

The more you see the family and secret society networks and connect the dots, the more obvious it becomes that this country is theirs and not ours.

Robert Winthrop (born 1904, leaked Pilgrims list 1969) was a director of First National City Bank of New York (now Citigroup); National Reinsurance Corporation; Seamen’s Bank for Savings; and International Banking Corporation. Currently we find John Winthrop in the Secret Society, and Robert Lee Sterling, another member, managing Winthrop Asset Management.

Robert Lee Sterling in turn is a Livingston family relation, tracing to Crown collaborators centuries ago who got huge land grants in Colonial times. The Livingston lines appear in many Pilgrims Society members over the years. Let’s look at some ancestry. Massachusetts Senator John Kerry, who ran for President in the last election, is of course, along with the winner of that race, a member of the Skull & Bones Society of Yale, a British influence front dating to the old Chinese opium trade.

John Kerry is 4th cousin, twice removed, of Franklin Roosevelt (Pilgrims Society). John Winthrop Jr. (born 1606) was Governor of Connecticut Colony, 1657-1676 is Kerry’s 7th great-great grandfather. Governor Winthrop’s father was John Winthrop (1587-1649), first Governor of Massachusetts Bay Colony in 1629. Kerry has surprising hereditary ancestry to assorted medieval royalty.

John Winthrop also founded Boston in 1630. There was another Winthrop in this line of descent, Robert, who was Speaker of the United States House of Representatives, 1847-1849. Kerry married into the Heinz food processing fortune (Pilgrims), which is an offshoot of the far larger Mellon interests (Pilgrims). James Bowdoin (1726-1790) was great-great grandfather of Robert Charles Winthrop. Bowdoin was 5th great-great grandfather of John Forbes Kerry; Bowdoin was Governor of Massachusetts, 1785-1787, and Bowdoin College is named for him. Barry Mills, president of the college, was with the Pilgrims law firm of Debevoise & Plimpton.

John Leverett was Governor of Massachusetts Bay Colony starting in 1673. Sir Richard Saltonstall, Crown loyalist, was with the Massachusetts Bay Company.

Leverett Saltonstall (1892-1979) was Governor of Massachusetts, 1939-1945, when he became a U.S. Senator, until 1967. He was a reliable friend to the infamous Silver Users Association, who seems to feel that all the world’s silver should be theirs. He was great-great grandson of Leverett Saltonstall (1783-1845), a Senator from Massachusetts who supported the second Bank of the United States. The modern Senator Saltonstall was an active enemy of the “Congressional Silver Bloc”

The Commercial & Financial Chronicle, June 13, 1946, page 3249) reveals-- “Senator Leverett Saltonstall of Massachusetts, another silverware and jewelry state, informed this correspondent of his hope that “the silver problem can be settled as soon as possible. Our industrial firms need silver to keep people at work.” Senator Abe Murdock (D. Utah) said “Silver cannot be produced profitably at 71.11 cents per ounce.”

Saltonstall fought fiercely for every Federal price cap on silver. One of Saltonstall’s law partners in Boston was Arthur A. Ballantine, who became a Pilgrims member who was undersecretary of the Treasury in 1932-33 under Pilgrims member Ogden Livingston Mills, who inherited $40 million from railroads, banking and silver mining ventures by way of his grandfather, Darius Mills. Ballantine was a director of New York Life; New York Trust; General American Investors and was a trustee of several universities and of the Carnegie Endowment for International Peace, a British front. Curiously, one of Ballantine’s children had Winthrop for his middle name and his older brother’s middle name was Winthrop, suggesting more genealogical relationships. Preceding Saltonstall in the Senate seat from Massachusetts was Sinclair Weeks, whose father John Wingate Weeks was a founder in 1888 of Hornblower & Weeks, investment bankers whose partners in later years would include such Pilgrims members as Ralph Hornblower Jr.; Henry Hornblower II and Clifford Hemphill, with interests in casinos, hotels, sugar, oysters, land, textiles, fire insurance and electric utilities. The elder Weeks was a Senator from Massachusetts, 1913-1919 and was Secretary of War, 1921-1925. That was ironic since his son Sinclair, who was Commerce Secretary, 1953-1958, later led the Silver Users Association that would eventually deplete our national military strategic silver reserve and headed Reed & Barton, silversmiths---

2013 Louis and son Mark Oliari --The Family That Sells Gold to the Government U.S. Mint.

Coins 'n Things Inc (508) 697-9600

350 Bedford St # 2, Bridgewater, MA 02324

In early 2010 the Oliaris won approval to sell gold to the Mint. wholesale metals market

Coins ’N Things is the largest seller of raw gold to the federal government. In the fiscal year that just ended, the U.S. Mint, which has bars made into coins for collectors and investors, bought $1.86 billion worth of the metal from the Bridgewater (Mass.) company, doing three or four million dollars a day.

Every weekday, Coins ’N Things faxes the Mint with the amount of gold it can furnish and the price it wants. The Oliaris compete against four other government-approved sellers, and the Mint orders from the one with enough stock on hand at the lowest price. The family says its extensive network of suppliers often means they win the day. Coins ’N Things gets roughly 40 percent of its gold from a refinery owned by the Canadian government. “You have to know everybody, everywhere,” Mark says.

Annual revenue is now about $6.5 billion, 65 percent of which comes from gold. Mark won’t reveal profits but says the company pockets about a quarter of a percent of its precious metal sales—less for the gold it sells to the government. With 50 employees, including Mark’s two daughters and a son, Coins ‘N Things is still a family affair, selling $1.86 billion worth to the U.S. Mint in 2011.

Coins 'n Things Inc. <GOLD> http://ow.ly/jk9rK Top 100 Recipients of Federal Awards for 2012 $1,169,424,854 http://ow.ly/jk9tC

the families that defy democracy

1937 America's 60 Families, Ferdinand Lundberg's 1937 expose on the super-rich.

Lundberg used tax records to uncover the often impenetrable financial and political machinations of the 60 Families, effectively publishing a directory of names and occupations of family scions as well as estimates of their fortunes. "The United States is owned and dominated today by a hierarchy of its sixty richest families, buttressed by no more than ninety families of lesser wealth...

These families are the living center of the modern industrial oligarchy which dominates the United States, functioning discreetly under a de jure democratic form of government behind which a de facto government, absolutist and plutocratic in its lineaments, has gradually taken form since the Civil War. This de facto government is actually the government of the United States -- informal, invisible, shadowy. It is the government of money in a dollar democracy."

Americas 60 Families by Ferdinand Lundberg (1937), page 159

“After astounding his fellow townsmen by capturing the mayoralty of Northampton, Massachusetts from two abler candidates, he was elected to the Massachusetts Senate as the protégé of the wealthy Senator W. Murray Crane, director of the American Telephone & Telegraph Company and other J.P. Morgan enterprises.”

| 1 | Rockefeller Family |

| 2 | Morgan Family |

| 3 | Ford Family |

| 4 | Harkness Family |

| 5 | Mellon Family |

| 6 | Vanderbilt Family |

| 7 | Whitney Family |

| 8 | Standard Oil Families |

| 9 | Du Pont Family |

| 10 | McCormick Family |

| 11 | Baker Family |

| 12 | Fisher Family |

| 13 | Guggenheim Family |

| 14 | Field Family |

| 15 | Curtis-Boks Family |

| 16 | Duke Family |

| 17 | Berwind Family |

| 18 | Lehman Family |

| 19 | Widener Family |

| 20 | Reynolds Family |

| 21 | Astor Family |

| 22 | Winthrop Family |

| 23 | Stillman Family |

| 24 | Timken Family |

| 25 | Pitcairn Family |

| 26 | Warburg Family |

| 27 | Metcalf Family |

| 28 | Clark Family |

| 29 | Phipps Family |

| 30 | Kahn Family |

| 31 | Green Family |

| 32 | Patterson Family |

| 33 | Taft Family |

| 34 | Deering Family |

| 35 | De Forest Family |

| 36 | Gould Family |

| 37 | Hills Family |

| 38 | Drexel Family |

| 39 | Ryan Family |

| 40 | Foster Family |

| 41 | Johnson Family |

| 42 | James Family |

| 43 | Nash Family |

| 44 | Schiff Family |

| 45 | Patten Family |

| 46 | Hayden Family |

| 47 | Weber Family |

| 48 | Blumenthal Family |

| 49 | Mills Family |

| 50 | Friedsam Family |

| 51 | McLean Family |

| 52 | Higgins Family |

| 53 | Cochran Family |

| 54 | Kirkwood Family |

| 55 | Tyson Family |

| 56 | Huntington Family |

| 57 | Storrow Family |

| 58 | Rosenwald Family |

| 59 | Baruch Family |

| 60 | Kresge Family |

1% philanthropy

is a sham

In 1906 Crane’s second marriage was to Josephine Boardman, twenty years younger than him, and they had three children—a daughter and two sons, one named Bruce, who eventually became president of Crane & Company, fiat currency paper suppliers to the United States. The Boardmans of Massachusetts fielded a member of The Pilgrims, Arthur Goddard Boardman Jr. (Who’s Who, 1971, page 210), of Irving Trust Company at 1 Wall Street. The New York Times obituary on Josephine Crane appeared on July 9, 1972, page 51---

“Her daughter, Louise Crane, recalled that along with Mrs. John D. Rockefeller 2nd, Mrs. Crane founded the Museum of Modern Art in 1929. Her mother was a founding trustee of the Metropolitan Museum of Art, the Morgan Library and the Dalton School of New York. In 1935 Mrs. Crane was named to the original executive committee of the newly organized American National Theatre and Academy, the first organization of its kind to receive a Federal charter.”

The big rich have long been interested in art as an investment and as a tax dodge or write-off. It’s neat to buy a painting for $50,000, donate it to a museum, and then claim a $650,000 deduction. Ferdinand Lundberg commented in “America’s 60 Families” (1937), page 367---

“The collection is repatriated, tariff free, and in due course, the millionaire sells it for $4,000,000. Here he has a capital loss of $1,000,000, which he may deduct from his income tax return. As his hidden purchase price was $100,000 and his resale price was $4,000,000, he has actually made a profit of $3,900,000, subject only to cost of handling, and fees or commissions to the agents, and he has escaped taxes on $1,000,000 of income for which deduction has been claimed.”

His son, Winthrop Murray Crane Jr., (1881-1968), graduated from Yale in 1904 and was a member of Skull & Bones Society. Was the middle Crane a Pilgrims member, as his son, Crane the 3rd would become? This is another case of unavailable data and an organization that will not go public. Crane Jr. headed Crane & Company, Federal Reserve paper note suppliers, for many years. He was also a director of Otis Elevator; American Brake Shoe & Foundry Company; U.S. Industrial Alcohol Company; Agricultural National Bank; and Springfield Fire & Marine Insurance Company (Who’s Who, 1935, page 627) Perhaps he bought shares with paper notes shipped to him from the Fed?

how collusion really works

Salmon writes thoughtful article about how elite power networks and families naturally consolidate power for themselves behind the veil of democracy. They and their 1% ancestors built a system that continues to reward them.

12/2011 Lincoln Stoller ~ Felix Salmon writes about what really went on in Hank Paulson's treasury in 2008, and it's taken 3 years to become public knowledge in spite of there being no institutionally orchestrated wall of silence to keep it from the public eye. This is what government conspiracy really is, and it's not "conspiracy" per se, it's collusion on various scales carried out in an ununified manner. Nevertheless, it looks the same and comes to the same end as a "real" conspiracy. Please read "Hank Paulson's inside jobs"

Here Salmon says:

"What on earth did Hank Paulson think his job was in the summer of 2008? As far as most of us were concerned, he was secretary of the US Treasury, answerable to the US people and to the president. But at the same time, in secret meetings, Paulson was hanging out with his old Goldman Sachs buddies, giving them invaluable information about what he was thinking in his new job.

"The first news of this behavior came in October 2009, when Andrew Ross Sorkin revealed that Paulson had met with the entire board of Goldman Sachs in a Moscow hotel suite for an hour at the end of June 2008. He told them his views of the US and global economies, he previewed a market-moving speech he was about to give, and he even talked about the possibility that Lehman Brothers might blow up. Maybe it's not so surprising that Goldman Sachs turned out to be so well positioned when Lehman did indeed do just that a few months later."

My point is that what outsiders view as conspiracy is, in most cases, simply profitable information being passed between collaborators for the purposes of private gain, tighter cooperation, and more monopolistic organization. These events don't need to be done with a master plan in mind, they simply leverage jointly valued opportunity that generates a narrower, more focused collusive network.

This is how the network grows. At some point in the future these networks might be taken over by a singular power with an over arching plan, but even without that kind of top-level heirarchy they still operate to the common advantage of the participants who share a de facto common goal. They don't need a "master plan for world domination" because the system in which they operate already offers them ever increasing power by operating within the existing "winner takes all" model of international corporatism and weakly regulated government collaboration.

Orchestrating a coordinated operation that involves careful timing and invented stories, such as the World Trade Center attack, does involve a conspiracy of the more conventional sort, although in the context of certain institutions, such as rogue states, the Pentagon and the Executive Branch, close coordination of that sort is already in place.

What people need to understand is that for a collection of interests to develop unified operations outside of public view does not require any singular authority or master plan. These segregated networks develop organically and will conduct exclusive operations consistent with the internal organization on which they're built. Our system rewards them for doing so.