Contents

- Introduction

- Preface

- Overview

- Relief Valve

- LECTURE 1: Why We Are In The Dark About Money

- LECTURE 2: The Con

- LECTURE 3: The Vatican-Central to the Origins of Money & Power

- LECTURE 4: London The Corporation Origins of Opium Drug Smuggling

-

LECTURE 5: U.S. Pirates, Boston Brahmins Opium Drug Smugglers

- THE BOSTON BRAHMINS

- Pirates Profiteers Banksters Traders Transfers

- Pirates

- White Slavers, Cargo, Property, Auctions, Amazing Grace

- $ Colonial Labor: Indentured Servants

- England to Philadelphia Slave Trade and Opium

- Extract from Charter of Freedoms and Exemptions to Patroons 1629

- The Definitive Treaty of Peace

- Pennsylvania Charter of Privileges 28 October 1701

- Opium Trade -- American Drug Smuggling Pirates

- Opium In America

- 1% Power Elite Networks

- 1% Elite Networks Bush & The CIA

- BEFORE Skull & Bones

-

SKULL AND BONES

- Academia, Fraternity, Feeder Schools

- Yale and China

- Order of Skull and Bones Chains of Influence

- Tracing the History of Skull and Bones

- Russell Trust

- White Shoe Law Firms

- Kleiner Perkins Caufield & Byers

- Ruth Avery Hyde Paine

- Skull and Bones Secrets

- $uper Rich

- Prescott Bush - Trading With The Enemy Act

- George Bush, Skull & Bones and the New World Order

- Dulles Family and Harvard's Pig Club

- Du Pont Loves Monoplies, Nazis and Trust Funds

- Skull & Bones and the American National Red Cross

- Caribbean Pirates in the American South

- Who Were the Tories

- The Golden Age of Imperialism Opium Act 1908

- Global Dominance Groups

- The New World Order

- Characteristics of Fascism

- War on drugs

- Lecture 5 Objectives and Discussion Questions

- LECTURE 6: The Shady Origins Of The Federal Reserve

- LECTURE 7: How The Rich Protect Their Money

- LECTURE 8: How To Protect Your Money From The 1% Predators

- LECTURE 9: Final Thoughts

With few exceptions, private equity in the first half of the 20th century was the domain of the Boston Brahmins 1%

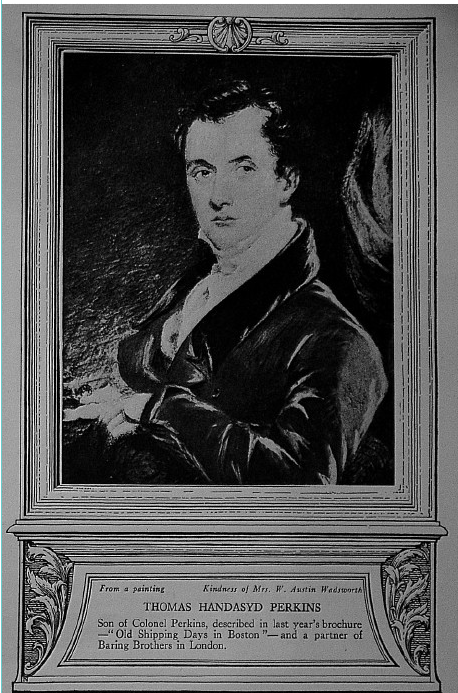

BOSTON BRAHMIN - THOMAS HANDASYD PERKINS - OPIUM DRUG SMUGGLING PIRATE

| Thomas Handasyd Perkins | Colonel Perkins | Frances Perkins | Clark Perkins |

|

|

|

|

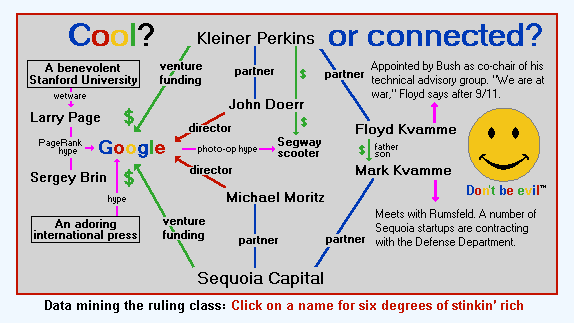

Kleiner Perkins Caufield & Byers

Tom Perkins, a direct descendant of the first American drug smuggling cartel, now grows his drug money as partner in one of the most powerful private equity firms in the U.S. This is one of the many ways in which America's 1% drug families continue to grow their money and their influence.

In 1999 Kleiner Perkins and Sequoia Capital paid $25 million for 20% of Google - today Google's market capitalization is over $149 billion (January 2007). Michael Moritz, chairman of Sequoia Capital, was knighted in 2013. Want to know why your college education has become so expensive? It isn't about education it's about commoditys. Tom Perkions scours university research labs looking for novel technologies that could be commercialized. Beginnings of venture capital firm Kleiner Perkins Caufield & Byers.

Three high-profile sexual harassment lawsuits were filed in 2014 against Tinder, the virtual town square of hookup culture, and two of the biggest venture capital firms—Kleiner Perkins Caufield & Byers and CMEA Capital. The complaints include a senior CMEA partner harassing a series of executive assistants like a character in Mad Men, replete with sexual nicknames, trapping them in his office and frequently referring to porn and pubic hair. At Kleiner Perkins, former partner Ellen Pao says partners countenanced harassment and retaliation from a fellow partner, and excluded women from client dinner parties because they “kill the buzz.” At Tinder, a male co-founder (and ex-boyfriend) sent abusive texts and yanked co-founder Whitney Wolfe’s title because, she alleged, he told her having a woman on a board “makes the company seem like a joke.” Tinder and CMEA settled under confidential terms within months. That CMEA partner is no longer with the firm, and Tinder temporarily suspended the executive involved. The suit filed by Ellen Pao—who is now at Reddit—is headed to trial this spring. Kleiner Perkins has denied the allegations and stated that Pao “twisted facts and events in an attempt to create legal claims where none exist.”

Silicon Valley culture echoes the Wolf of Wall Street culture in the ’80s and ’90s. But while Wall Street today seems tamer—thanks to lawsuits and diversity consultants in every corner—in Silicon Valley the misogyny continues unabated.

More: Overview | The Perkins Family | THE 1% - The Power of Networks | Should You Go To College | Vatican Bank | White Shoe Law Firms | Education Market

In the 1960s the common form of private equity fund, still in use today, emerged. Private equity firms organized limited partnerships to hold investments in which the investment professionals served as general partner and the investors, who were passive limited partners, put up the capital. The compensation structure, still in use today, also emerged with limited partners paying an annual management fee of 1-2% and a carried interest typically representing up to 20% of the profits of the partnership. The growth of the venture capital industry was fueled by the emergence of the independent investment firms on Sand Hill Road, (Silicon Valley) beginning with Kleiner, Perkins, Caufield & Byers and Sequoia Capital in 1972. Located, in Menlo Park, CA, Kleiner Perkins, Sequoia and later venture capital firms would have access to the burgeoning technology industries in the area. The firm was named after its four founding partners: Eugene Kleiner (emeritus), Tom J.Perkins (emeritus), Frank J. Caufield (emeritus), and Brook Byers. KPCB was formed in 1972.

Private Equity

9/22/14 Why aren't the American and British middle-classes staging a revolution?

9/22/14 Why aren't the American and British middle-classes staging a revolution?

Why aren't the middle-classes more angry and what will it take to tip us over the edge, ~ Alex Proud

Why aren’t we seeing scenes reminiscent of Paris in 1968? Moscow in 1917? Boston in 1773?

Phones4U was bought by the private equity house, BC Partners, in 2011 for £200m. BC then borrowed £205m and, having saddled the company with vast amounts of debt, paid themselves a dividend of £223m. Crippled by debt, the company has now collapsed into administration. The people who crippled it have walked away with nearly £20m million, while 5,600 people face losing their jobs. The taxman may also be stiffed on £90m in unpaid VAT and PAYE. It’s like a version of 1987’s Wall Street on steroids, the difference being that Gordon Gecko wins at the end and everyone shrugs and says, “Well, it’s not ideal, but really we need guys like him.”

I’m not financially sophisticated enough to understand the labyrinthine ins and outs of private equity deals. But I don’t think I need to be. Here, my relative ignorance is actually a plus. You took a viable company, ran up ridiculous levels of debt, paid yourselves millions and then walked away, leaving unemployment and unpaid tax bills in your wake. What’s to understand? We should be calling for your heads on a plate.

All these guys care about is money. They don’t care about society. They certainly don’t care about jobs and they don’t care about you. OK, you might say, but this has always been going on. But it hasn’t. This sort of utterly amoral screw-everyone capitalism has become much more prevalent in the last 15 years. Our financial elite is now totally out of control. They learned nothing from the crisis, except that the rest of us were stupid enough to give them a second chance. And, now, having plucked all the “low hanging fruit,” they’re destroying the middle classes for profit. Our current problems have their roots in the early 80s. While much of what Reagan and Thatcher did was necessary, the trouble is that they set a deregulatory train in motion which, over the last couple of decades has dismantled so much of the legal framework that protected us from greedy scuzzballs.

powerful alliances grow money& influence

THE CONNECTION BETWEEN PRIVATE EQUITY, DRUG MONEY, AND THE VATICAN

It is stunning how each member of the private equity giant, Kleiner Perkins Caufield & Byers is tied to each of the most powerful elite networks in the world. It is incomprehensible the kind of influence members of this firm have individually and collectively.

Vatican Assassins III by Eric Jon Phelps

CFR Director Frank Caufield co-founded Kleiner Perkins Caufield & Byers along with Brooks Byers, a member of the Vatican controlled Bohemian Club. He is on the board of Caremark, which is run by Thomas M. Ryan, who is a director of the Bank of America, which was founded by a Knight of Malta and is 51% owned by the Jesuits, as reported by Der Spiegel in 1958.

Bohemia - Crown province of the Austro-Hungarian Monarchy, which until 1526 was an independent kingdom

Bohemian Brethren - 'Bohemian Brethren' and 'Moravian Brethren' are the current popular designation of the Unitas Fratrum founded in Bohemia in 1457, renewed by Count Zinzendorf in 1722

Bohemians of the United States - Religious dissensions at the beginning of the seventeenth century induced many to leave their native country and cross the ocean

Blackwater who got total immunity from illegal activity. - Mr. Prince advances the Christian God and refers to the Order of Malta. Bush helped to advance Prince's position on the War on Terrorism which is a Vatican Crusade.

Knighthood - Considered from three points of view: the military, the social, and the religious

Knights of Christ, Order of the - A military order which sprang out of the famous Order of the Temple

Knights of Columbus - Brief explanation and history of the organization

Knights of the Cross - A religious order famous in the history of Bohemia, and accustomed from the beginning to the use of arms, a custom which was confirmed in 1292 by an ambassador of Pope Nicholas IV

Knights of Malta - The most important of all the military orders, both for the extent of its area and for its duration

Knights Templars, The - The earliest founders of the military orders

THE PERKINS FAMILY

Waze announced another $30 million in funding, bringing its total to nearly $60 million. It also said that one of its new investors is Asia's richest man, Hong Kong's conglomerate magnate Li Ka Shing, who will help the company as it navigates the challenging and difficult Chinese market. The other investor in this round is Kleiner Perkins Caufield & Byers.

searchengineland.com/waze-craze-brings-30-million-for-growth-china-expansion-97404