Contents

- Introduction

- Preface

- Overview

- Relief Valve

- LECTURE 1: Why We Are In The Dark About Money

- LECTURE 2: The Con

- LECTURE 3: The Vatican-Central to the Origins of Money & Power

- LECTURE 4: London The Corporation Origins of Opium Drug Smuggling

- LECTURE 5: U.S. Pirates, Boston Brahmins Opium Drug Smugglers

- LECTURE 6: The Shady Origins Of The Federal Reserve

-

LECTURE 7: How The Rich Protect Their Money

- What Do You Know About getting Rich?

- Wall Street: How they Make Money

- The Royal Colonies

- Offshore Banking - Panama Papers

- Tax Havens

- Collectibles and Taxes

- Royal Jewels measured in Centuries not Carats

- We Buy Gold

- Free Trade Is Not American

- The Filibuster and Freebooting

- America's Total Debt Report

- Enron: Ultimate agent of the American empire

- What is a Cash Cow?

- Lecture 7 Objectives and Discussion Questions

- LECTURE 8: How To Protect Your Money From The 1% Predators

- LECTURE 9: Final Thoughts

Banks are Pirates in Suits

21 INSTITUTIONAL INVESTORS IN RMBS ISSUED BY JPMORGAN, BEAR STEARNS AND CHASE

ANNOUNCE BINDING OFFER BY JPMORGAN TO SEVEN RMBS TRUSTEES TO SETTLE

MORTGAGE REPURCHASE AND SERVICING CLAIMS FOR 330 RMBS TRUSTS

1999 BILL CLINTON REPEALED THE GLASS-STEAGALL ACT.

Under the Glass-Steagall Act of 1933, banks holding insured deposits were not allowed to be affiliated with Wall Street investment banks and brokerage firms — which have a storied history of stock frauds, abusing their customers, and blowing up. That protection was removed when President Bill Clinton signed into law the Gramm-Leach-Bliley Act on November 12, 1999, the legislation that repealed the Glass-Steagall Act. After protecting the nation for 66 years, it took just 9 years after its repeal for Wall Street to implode, taking the U.S. economy with it.

Bill Clinton and his Treasury Secretary, Robert Rubin, ushered in the era of the financial supermarket that has trapped America in a time warp of 1920s-style abuses on Wall Street and the income and wealth inequality that it has spawned. Rubin had the audacity to head straight for Citigroup’s Board after stepping down as U.S. Treasury Secretary, collecting $126 million in compensation over the next decade.

The Consumer Financial Protection Bureau (an agency of the United States government) has launched a database of consumer complaints against US banks.

The Consumer Financial Protection Bureau (CFPB) has set up an online database of financial horror stories that shows what happens when an average American interacts with one of the financial supermarkets (a/k/a universal banks) that grew out of the repeal of the investor protection legislation known as the Glass-Steagall Act. The complaints are concentrated against the biggest Wall Street banks. Just go to the complaint archive, and place the name of any bank you want to examine in the upper right-hand search box. Searching under the name Citibank (part of the Wall Street behemoth Citigroup) will bring up 29,000 rows of complaints. A search under Chase, part of the mega Wall Street bank, JPMorgan Chase, brings up 37,000 rows of complaints. After years of being charged by Federal regulators for abusing their customers and the public trust, both U.S. banks became felons on May 20 of last year when they admitted to felony charges related to rigging foreign currency markets.

FINRA, the primary regulator of U.S. brokerages, requires brokers to disclose incidents in their past that might give investors concern. Concentrated risk FINRA, the primary regulator of U.S. brokerages, requires brokers to disclose incidents in their past that might give investors concern. Reuters analyzed the most serious of those incidents to identify firms with high concentrations of brokers with such FINRA flags, which include regulatory sanctions, civil judgments, personal bankruptcies and broker terminations after allegations of misconduct. At least 30 percent of brokers at the 48 firms listed below have a history of such FINRA-mandated disclosures.

http://webcache.googleusercontent.com/search?q=cache:4_NEY6P3gEcJ:fingfx.thomsonreuters.com/gfx/rngs/FINRA-BROKERS/010041FY34W/index.html+&cd=1&hl=en&ct=clnk&gl=us

The carried-interest tax loophole, allows wealthy hedge fund managers pay lower tax rates on much of their income.

State tax codes should not allow hedge fund managers and private equity executives to classify the “carried interest” earnings they make off of clients' investments as capital gains, which are taxed at lower rates. They say those earnings should instead be taxed as regular income.

Politicians are Paid Off financial interests have flooded state politician campaign coffers with $158 million since 2010, including more than $24 million to the current governors of those states. That gubernatorial cash haul includes nearly $14 million from 10 of the highest-earning hedge fund managers. Trump/Clinton use Corporation Trust Centre 1209 North Orange St. DE 'loophole' addy w 285,000 firms loose $9bn tax

#NYFedHearing Here is a "Revolving Door" case in point: Federal Reserve employee -> Goldman Sachs Center for Responsive Politics.

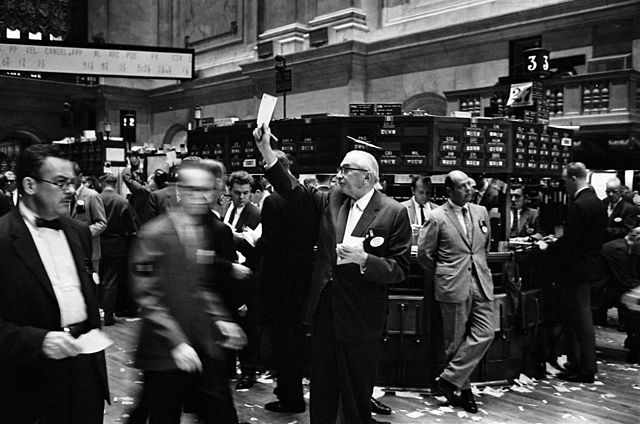

The New York Stock Exchange (NYSE), sometimes known as the "Big Board", is a stock exchange located at 11 Wall Street, Lower Manhattan, New York City, New York, United States. It is by far the world's largest stock exchange by market capitalization of its listed companies at US$16.613 trillion as of May 2013. Average daily trading value was approximately US$169 billion in 2013. Hubs and Spokes

One-Percent Jokes and Plutocrats in Drag: What I Saw When I Crashed a Wall Street Secret Society

Secret Thuggee Wall Street fraternity called Kappa Beta Phi.

Venture capitalists are comparing the persecution of the rich to the plight of Jews at Kristallnacht, Wall Street titans are saying that they’re sick of being beaten up, and this week, a billionaire investor, Wilbur Ross, proclaimed that “the 1 percent is being picked on for political reasons.” “Good evening, Exalted High Council, former Grand Swipes, Grand Swipes-in-waiting, fellow Wall Street Kappas, Kappas from the Spring Street and Montgomery Street chapters, and worthless neophytes!” see the full Kappa Beta Phi member list

The secret to how Silicon Valley calculates the value of its hottest companies

Here's the secret to how Silicon Valley calculates the value of its hottest companies: The numbers are sort of made-up.

The Fuzzy, Insane Math That's Creating So Many Billion-Dollar Tech Companies

http://www.bloomberg.com/news/articles/2015-03-17/the-fuzzy-insane-math-that-s-creating-so-many-billion-dollar-tech-companies

Here's the secret to how Silicon Valley calculates the value of its hottest companies: The numbers are sort of made-up.

"These big numbers almost don't matter," says Randy Komisar, a partner at venture firm Kleiner Perkins Caufield & Byers. "Those numbers are just a middling shot at a valuation, and then it's adjusted later" through various legal techniques, if an earlier valuation was too high, he says.

For the most mature startups, investors agree to grant higher valuations, which help the companies with recruitment and building credibility, in exchange for guarantees that they'll get their money back first if the company goes public or sells. They can also negotiate to receive additional free shares if a subsequent round's valuation is less favorable. Interviews with more than a dozen founders, venture capitalists, and the attorneys who draw up investment contracts reveal the most common financial provisions used in private-market technology deals today. The backroom agreements are becoming more common as tech companies stay private longer, according to the interviews and financial documents obtained by Bloomberg Business. The practice obfuscates the meaning of a valuation, which can become dangerous down the road because private investors aren't taking the same risks a public-market shareholder would. By the time a company does go public, the valuation it got from VCs may not align with its balance sheet. Just ask Box.

Downside protection Here's where things start to get tricky: Buried in their corporate filings, startups tuck away all sorts of provisions that reward investors for accepting these mega-valuations. The practice is more regular and egregious in financing rounds for mature companies. Their capital requirements tend to be much larger, so they must turn to more sophisticated investment firms that demand these kinds of terms. Startups that are generous with these guarantees can garner much higher valuations. Each provision covers different ways to make sure new investors get paid back, even if disaster strikes, if an initial public offering gives the company a market cap far less than its private number, or, more commonly, if the startup has to raise money again at a lower valuation. One stipulation, called senior liquidation preference, ensures that a certain group gets its money back before anyone else, including employees. Another class, called downside protection or ratchets, automatically grants additional shares in the event of a declining valuation, removing a great deal of risk that the stake will ever lose value. "When we're talking about these decacorn-type valuations, generally, the way these deals are structured is: They could be worth that much; it's not a fake number, but it's not the same as buying the stock in the public market," says Jason Lemkin, managing director at Storm Ventures. "There's always some kind of warrant, some kind of ratchet, some kind of downside protection."

2016 How the Elizabeth Holmes story came crashing down

The Game In Silicon Valley, every company has an origin story—a fable, often slightly embellished, that humanizes its mission for the purpose of winning over investors, the press, and, if it ever gets to that point, customers, too. These origin stories can provide a unique, and uniquely powerful, lubricant in the Valley. After all, while Silicon Valley is responsible for some truly astounding companies, its business dealings can also replicate one big confidence game in which entrepreneurs, venture capitalists, and the tech media pretend to vet one another while, in reality, functioning as cogs in a machine that is designed to not question anything—and buoy one another all along the way.

It generally works like this: the venture capitalists (who are mostly white men) don’t really know what they’re doing with any certainty—it’s impossible, after all, to truly predict the next big thing—so they bet a little bit on every company that they can with the hope that one of them hits it big. The entrepreneurs (also mostly white men) often work on a lot of meaningless stuff, like using code to deliver frozen yogurt more expeditiously or apps that let you say “Yo!” (and only “Yo!”) to your friends. The entrepreneurs generally glorify their efforts by saying that their innovation could change the world, which tends to appease the venture capitalists, because they can also pretend they’re not there only to make money. And this also helps seduce the tech press (also largely comprised of white men), which is often ready to play a game of access in exchange for a few more page views of their story about the company that is trying to change the world by getting frozen yogurt to customers more expeditiously. The financial rewards speak for themselves. Silicon Valley, which is 50 square miles, has created more wealth than any place in human history. In the end, it isn’t in anyone’s interest to call bullshit.

phony-baloney financial reports

2016 Fantasy Math Is Helping Companies Spin Losses Into Profits

Companies, if granted the leeway, will surely present their financial results in the best possible light. And of course they will try to persuade investors that the calculations they prefer, in which certain costs are excluded, best represent the reality in their operations. Call it accentuating the positive, accounting-style. What’s surprising, though, is how willing regulators have been to allow the proliferation of phony-baloney financial reports and how keenly investors have embraced them. As a result, major public companies reporting results that are not based on generally accepted accounting principles, or GAAP, has grown from a modest problem into a mammoth one. According to a recent study in The Analyst’s Accounting Observer, 90 percent of companies in the Standard & Poor’s 500-stock index reported non-GAAP results last year, up from 72 percent in 2009. Regulations still require corporations to report their financial results under accounting rules. But companies often steer investors instead to massaged calculations that produce a better outcome.

corporate inversions

Medtronic Is a Case Study in How Corporations Gain Ways to Dodge Taxes by "Moving" Offshore http://

2016 ... since the company inverted last year, the U.S. share of pretax income has fallen precipitously: the company’s last pre-inversion disclosure showed the U.S. representing 54 percent of sales and 46 percent of income, but the company’s newest annual report, covering 2015, shows that while the company derives 58 percent of its revenues from U.S. sales, those revenues only translated into 8 percent of the company’s worldwide income Earnings stripping is the likely culprit.

This scheme typically takes the form of intra-company borrowing: a U.S. subsidiary borrows cash from its foreign parent, and pays interest on the loan to the parent. The interest payments reduce the company’s U.S. taxable income, and the interest income boosts the company’s foreign income — even though the entire transaction amounts to nothing but shifting profits from one corporate pocket to another.

7/7/15 The Treasury Department’s latest plan to curb tax-motivated overseas mergers takes aim at inter-company loans.

The Treasury’s proposal, specifically aims at the practice of American companies borrowing from their foreign parents in a lower tax region, leaving interest payments to be deducted when calculating their annual tab to Uncle Sam. The practice is called earnings stripping because it essentially ships the profit overseas. Often, an American company does not even actually borrow the money. It just makes interest payments to its corporate overlord. Sometimes subsidiaries are created exclusively for this purpose. The Treasury Department is long overdue in focusing on such schemes. as written, the new rule also might capture legitimate cash-management activities. Companies often take a surplus from one division to finance activities at another carrying a deficit. This might be prohibited under the proposal, forcing companies to borrow more from banks.

TAXES

2016 U.S. corporations have a 35% statutory tax rate, which they frequently lament as the largest in the industrialized world. (Of course, after the sea of deductions they take, the Government Accountability Office puts the effective corporate tax rate at just 12.6 percent, which is lower than most competitors). But there’s a catch: Corporate profits earned in other countries only get taxed when they are “repatriated” into the United States. If they stay overseas, the government cannot collect. Corporations have hoarded $2.5 trillion overseas since 2004. Nearly two-thirds of the money is held by pharmaceutical and tech firms, who are adept at making it look like most of their profits are earned abroad. So expect a permanent tax cut to get passed by Hillary Clinton and the money brought back to be taxed.

Commerce without Conscience

HOW DO FORTUNE 500 COMPANIES AVOID TAXES

EVEN GOOGLE KNOW EXECUTIVE STOCK OPTIONS ENABLE CORPORATE TAX DODGING

Fortune 500 Corporations Used Stock Option Loophole to Avoid $64.6 Billion in Taxes Over the Past Five Years

6/10/16 Google dodged $1.9 billion in taxes thanks to the executive stock option loophole

4/24/14 Tech giants settle no-poaching court case

No One Goes To Jail. Four of the biggest technology firms - Apple, Google, Intel and Adobe - have settled a class action case alleging they conspired to hold down salaries. The case alleged that the firms agreed not to poach staff from each other, which it claimed prevented workers from getting better job offers. The firms did not disclose the details of the settlement. The US lawsuit had claimed $3bn in damages on behalf of more than 64,000 workers at the four firms. If the companies had lost the case and damages were awarded, they could have tripled to $9bn under US antitrust laws.

Movie Park Avenue: Money Power and the American Dream

INTERNATIONAL BANKERS

299 Park Avenue

17th Floor New York, NY 10171

Tel: (212) 421-1611 Fax: (212) 421-1119 Email: iib@iib.org

740 Park Avenue NY Where the Masters of the Universe live.

740 Park Ave, New York City, is home to some of the wealthiest Americans. Across the Harlem River, 10 minutes to the north, is the other Park Avenue in South Bronx, where more than half the population needs food stamps and children are 20 times more likely to be killed. In the last 30 years, inequality has rocketed in the US -- the American Dream only applies to those with money to lobby politicians for friendly bills on Capitol Hill. How much inequality is too much? To find out more and get teaching resources linked to the film, go to www.whypoverty.net

Meet The House That Inequality Built

Optimal collusion with private information

Author: Athey, Susan; Bagwell, Kyle download http://dspace.mit.edu/handle/1721.1/63939

More than anything else, this speaks to the insatiable appetite of the world’s greatly expanded billionaire class. Middle Eastern oil magnates, Chinese billionaires, Russian oligarchs, and the Latin American aristocracy all have one thing in common: More money than they know what to do with and a desperation to get as much of it out of their home countries as possible.

Notably, while Macklowe Properties had kept 432 Park Avenue’s units off of popular broker databases like StreetEasy and the Residential Listing Service (RLS), the firm was going full-throttle in its attempt to court the Russian oligarchy. A kind of traveling sales office was set up at the Ritz-Carlton Hotel on Moscow’s Tverskaya Street, where dozens of billionaires pass through the lobby each day. It is the fact that, in a building so tall and imposing, with over 400,000 square feet of usable interior space, there are only 104 units for people to live in. 432 Park Avenue is, in short, a monument to the epic rise of the global super-wealthy. It is the house that historic inequality built.

With over 400,000 square feet of usable interior space, there are only 104 units for people to live in. 432 Park Avenue is a monument to the epic rise of the global super-wealthy. “There are only two markets, ultraluxury and subsidized housing.” —Rafael Viñoly, architect of 432 Park Avenue. Along a stretch of New York City’s Park Avenue, between 56th and 57th Street, soars a tower so jaw-droppingly altitudinous that King Kong himself would likely think twice before scaling it. At 96 stories (1,396 feet), it has no company in the space it occupies atop Manhattan’s skyline. The Empire State Building tops out some 150 feet below that. Absent its spire, the newly built World Financial Center—itself a giant—is 28 feet shorter than this new cathedral to uber-wealth. 432 Park Avenue can be seen from all five boroughs of New York City, from inbound Metro-North trains coming in along the Harlem River, from the Meadowlands in New Jersey, and from several vantage points on Long Island. Its lone silhouette dominates the skyline from every angle. It demands your attention in a way that no residential building ever has.

- Learn How To Make Money and Get Rich

- Wealthy Americans avoid state income taxes

- The Financial Secrecy Index ranks jurisdictions according to their secrecy and the scale of their activities. A politically neutral ranking, it is a tool for understanding global financial secrecy, tax havens or secrecy jurisdictions, and illicit financial flows

- A Taxpayer Receipt - - How to make money picture

- A one Picture summary if what JP Morgan meant when he said everything else is credit.

- Explained very simply: READ EVERYTHING ABOUT THE 2008 WALL STREET CRASH

- Rich countries failing to address money laundering and tax evasion, says OECD Illicit cash flows cost poor countries billions as wealthy nations fail to honor pledges to halt activity, claims damning new report

- Kaupthing Icelandic Banking: This document contains a list of 28167 claims, totally 40 billion euro, lodged against the failed Icelandic bank Kaupthing Bank hf. The document is important because it reveals billions in cash, bonds and other property held with Kaupthing by wealthy investors and asset hiders from around the world, including Goldman Sachs, Deutsche Bank, Credit Suisse, Morgan Stanly, Exista, Barclays, Commerzbank AG and a vast number of others.

There’s A Secret Craigslist Just For Rich People Called POSH any Bloomberg Terminal user can list an item for sale.

The classifieds section of the Bloomberg terminal, which costs more than $20,000 a year, is called POSH. The Bloomberg terminal is an expensive Wall Street trading and research machine with lots of financial data. It has its own version of Craigslist, called POSH. Prices tend to be higher than what you’d find in typical classifieds sections, with goods such as vast estates, boats, Rolexes, diamond rings, and expensive cars. They’re mostly listed by bankers, hedge fund managers, private-equity types, and their friends. There’s even a filter for just airplanes and boats!

ALERT: all markets today are subject to manipulation for private gain.

"ON A LONG ENOUGH TIMELINE, THE SURVIVAL RATE FOR EVERYONE DROPS TO ZERO"

1) Allen Greenspan conveniently and simply admitted that he "failed to come to grips with the power of popular culture and greed in the delusions of crowds as part of the "economic" model".

1a) Just to put the US trade deficit with the People's Republic of China in perspective. America's Growing Trade Deficit Is Selling The Nation Out From Under Us.

Here's A Way To Fix The Problem--And We Need To Do It Now. (FORTUNE Magazine) By Warren E. Buffett Carol J. Loomis November 10, 2003

The trade deficit with the PRC was about $227 billion in 2009, and Microsoft's market cap is about $225 billion. So every year, the USA is doing the equivalent of packing Microsoft into shipping containers—every rack of servers, every line of code, every partner contract, every patent—and loading the containers onto a ship bound for the PRC.

High Frequency Trading

Money and Speed: Inside the Box Documentary

2013 Million Dollar Microsecond

2013 Fast Cash Dash Flash Crash Clash

We are talking billions and billions of transactions here. Many of these trades are made in a handful of thousandths of a second. When something like the Flash Crash happens, Nanex can look back at all their data and give us a millisecond-by-millisecond, slow-motion playback of the whole thing.

HFT: Even the NY Stock Exchange itself is acknowledging the HFT media campaign

A Dysfunctional Role of High Frequency Trading in Electronic Markets Robert A. Jarrow

Cornell University - Samuel Curtis Johnson Graduate School of Management

Johnson School Research Paper Series No. 08-2011

Number of Pages in PDF File: 14 Working Paper Series Date posted: March 09, 2011

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1781124

Abstract: This paper shows that high frequency trading may play a dysfunctional role in financial markets. Contrary to arbitrageurs who make financial markets more efficient by taking advantage of and thereby eliminating mispricings, high frequency traders can create a mispricing that they unknowingly exploit to the disadvantage of ordinary investors. This mispricing is generated by the collective and independent actions of high frequency traders, coordinated via the observation of a common signal.

2012 High-Frequency Traders Flat-Out Buying Data Ahead of You

Questions of integrity, while the lines defining what is or is not early release are becoming increasingly blurred. In July, the ISM a national nonprofit organization signed a contract with Thomson Reuters to offer a streamlined version, called "low-latency,” of its closely watched business-activity report. It will release the full report to Business Wire, a press release service, at exactly the same time.

When the Institute for Supply Management releases its index of manufacturing activity next week, the headlines from the report will flash to traders at what their eyes tell them is 10:00 am. But unless they are subscribers to a new low-latency feed provided by Thomson Reuters, they’ll actually be getting it late—and depending on how they’re positioned, it could be too late. The ISM is just one of the private data providers that are increasingly splitting their dissemination policies.

http://blogs.wsj.com/

Gorden Geeko:

I don't throw darts

at a board.

I bet on sure things.

Read

Sun-tzu,

The Art of War.

Every battle is won before it is ever fought.

Goldman Sachs Dominated Fraud:

computerized front running using high-frequency trading programs. Wall Street commentator Max Keiser who invented and patented the program calls it rigged market capitalism: all markets today are subject to manipulation for private gain. High Frequency Trading (HFT) or black box trading, automated program trading uses high-speed computers governed by complex algorithms (instructions to the computer) to analyze data and transact orders in massive quantities at very high speeds.

Saturday, July 25, 2009 HFT And Goldman Sachs Boiling Point: NYT And Max Keiser

I want to know. Where are the Nightly News Network Reporters? 3000 people work at CNBC. Why aren't they reporting this information to us! This is why we use the net, which is the dominant paradigm for real information.

Gordon Gekko: If you're not inside, you're *outside*!

Gordon Gekko: You're walking around blind without a cane, pal. A fool and his money are lucky enough to get together in the first place.

If you are reading this on the Educational CyberPlayGround - You are not a player!

Is Wall Street Picking our Pockets?

Gordon Gekko

"The richest one percent of this country owns half our country's wealth, five trillion dollars. One third of that comes from hard work, two thirds comes from inheritance, interest on interest accumulating to widows and idiot sons and what I do, stock and real estate speculation. It's bullshit. You got ninety percent of the American public out there with little or no net worth. I create nothing. I own. We make the rules, pal. The news, war, peace, famine, upheaval, the price per paper clip. We pick that rabbit out of the hat while everybody sits out there wondering how the hell we did it. Now you're not naive enough to think we're living in a democracy, are you buddy? It's the free market. And you're a part of it. You've got that killer instinct. Stick around pal, I've still got a lot to teach you."

BANKING SECRETS

Tax havens

1600 East India Company granted a charter by the Queen of England.

The Opium Trade

"If the trade is ever legalized, it will cease to be profitable from that time. The more difficulties that attend it, the better for you and us." -- Directors of Jardine-Matheson

"Once you become part of senior management," he says, "and gain international experience, as I did, then you are part of the inner circle – and things become much clearer. You are part of the plot. You know what the real products and service are, and why they are so expensive.

It should be no surprise that the main product is secrecy … Crimes are committed and lies spread in order to protect this secrecy.

"My understanding is that my client's attempts to get the banks to act over various complaints he made came to nothing internally," says Elmer's lawyer, Jack Blum, one of America's leading experts in tracking offshore money. "Neither would the Swiss courts act on his complaints. That's why he went to WikiLeaks."

Swiss whistleblower Rudolf Elmer plans to hand over offshore banking secrets of the rich and famous to WikiLeaks. "Well-known pillars of society will hold investment portfolios and may include houses, trading companies, artwork, yachts, jewelery, horses, and so on." Blow the whistle on what they see as unprofessional, immoral and even potentially criminal activity by powerful international financial institutions.

Along with the City of London and Wall Street, Switzerland is a fortress of banking and financial services, but famously secretive and expert in the concealment of wealth from all over the world for tax evasion and other extra-legal purposes. The list includes "high net worth individuals", multinational conglomerates and financial institutions – hedge funds". They are said to be "using secrecy as a screen to hide behind in order to avoid paying tax". They come from the US, Britain, Germany, Austria and Asia – "from all over".

Clients include "business people, politicians, people who have made their living in the arts and multinational conglomerates – from both sides of the Atlantic". "What I am objecting to is not one particular bank, but a system of structures," he told the Observer. "I have worked for major banks other than Julius Baer, and the one thing on which I am absolutely clear is that the banks know, and the big boys know, that money is being secreted away for tax-evasion purposes, and other things such as money-laundering – although these cases involve tax evasion." Elmer says his documents include all the back-up data held on Julius Baer's computer server in the Caymans at the time he was sacked, including accounts, correspondence, memos and resolutions dealing with 114 trusts, 80 companies, 60 funds and 1,330 individuals.

The data was later seen by the Guardian, which found "details of numerous trusts in which wealthy people have placed capital. This allows them lawfully to avoid paying tax on profits, because legally it belongs to the trust"; the data also "[appeared] to include several cases where wealthy individuals sought to use trust money as though it were their own".

The documents include details of numerous trusts in which wealthy people have placed capital. This allows them lawfully to avoid paying tax on profits, because legally it belongs to the trust. In the same way, the capital can pass to heirs free of inheritance tax. The trust itself pays no tax, as a Caymans resident. The trustees can distribute money to the trust's beneficiaries but it is essential the trustees exercise their own control over the trust's assets. If not, the assets become once more the property of the person who sets up the trust- and may be taxed.

"A gang armed with guns can easily steal thousands. A gang armed with pens can just as easily steal millions - and the prison terms are shorter.”

Lawyers and accountants make up a tenth of the 52,000 population of the Cayman Islands, [see Ken Dart] which are English-speaking, politically stable, in the US time zone, and with zero taxes. This British Overseas Territory with palm trees and luxury hotels, measuring less than 100 square miles, is the fifth largest financial centre on the planet. Tax Justice Network campaigners estimate that tax havens collectively hold more than $11.5 trillion. Some comes from tax avoidance. Each year the US may lose a total of about $100bn in potential taxes, France about $50bn, Germany $30bn, the UK between $20bn and $80bn - and the developing world loses up to $800bn in stolen capital. But in the Caymans, a prison sentence awaits anyone who discloses bank information.

Tax Havens / Shell Companies

Kaupthing Icelandic Banking: This document contains a list of 28167 claims, totally 40 billion euro, lodged against the failed Icelandic bank Kaupthing Bank hf. The document is important because it reveals billions in cash, bonds and other property held with Kaupthing by wealthy investors and asset hiders from around the world, including Goldman Sachs, Deutsche Bank, Credit Suisse, Morgan Stanley, Exista, Barclays, Commerzbank AG and a vast number of others.

2008 Tax haven banks in Liechtenstein and Switzerland. Swiss bank UBS and its alleged efforts to help wealthy Americans hide their money from the IRS through shell companies in Liechtenstein. Liechtenstein's veil of secrecy was pierced five years ago when the disgruntled technician, Kieber, downloaded the names of foreign citizens connected to the secret accounts. Arrests of several prominent CEO's on charges that had evaded millions of dollars in taxes. Kieber's Washington lawyer, Jack Blum, says Kieber should be considered a whistleblower and a hero, not a thief, for revealing how the super rich hid billions of dollars using the Liechtenstein bank. A former UBS private banker, Bradley Birkenfeld, has agreed to a plea deal and is reported to be cooperating with US authorities in bring charges against American citizens on tax evasion charges. The Liechtenstein bank, LGT, is owned by the tiny country's ruling family led by Prince Hans-Adam II. http://abcnews.go.com/Blotter/story?id=5378080&page=1

1/19/2011 JPMorgan Chase and Morgan Stanley won approval from Chinese regulators to form joint ventures in the country, potentially giving them a bigger role in China's booming securities business. The two firms are the latest global banks to win the right to team up with local players to underwrite stock and bond offerings in China. Eventually, the joint ventures will be able to sell stocks to Chinese citizens and institutions.

WHISTLEBLOWERS

http://xrl.in/71jz This is the Cover Story for this January/February 2011 issue of the magazine, which goes out in hard copy to roughly 90,000 Chartered Financial Analysts across the globe.

The stories of whistleblowers rarely have a happy ending, primarily because the companies they report on do not implode but continue with their poor behavior and often prosper. Elmer’s advice to anyone considering blowing the whistle is to plan ahead. "You have to have a very strategic approach,” he says. "You should not think about the moment of the whistleblowing but what happens to your family and friends and know that your lifestyle will change dramatically.” Moreover, he adds, "Financially, you have to be certain you can survive. In the United States, the False Claims Act, which was strengthened in 1986, covers cases in which bogus or inflated claims are filed for the payment of federal/government money (e.g., under a federal contract or federally funded program). The False Claims Act contains whistleblower provisions called "qui tam,” which allow citizens with evidence of such fraud to sue and recover the stolen money. As a reward for blowing the whistle, whistleblowers can recoup between 15 percent and 25 percent of monies recovered. But the False Claims Act doesn’t cover tax fraud. A separate U.S. Internal Revenue Service whistleblower rule allows for those who expose tax evaders to be awarded a similar 15–25 percent of the amount recovered.

But there’s a catch for would-be whistleblowers. Under the False Claims Act, although files are sealed in U.S. federal court for seven years, the whistleblower’s identity eventually will be made public. Currently, the outcome for Dodd–Frank provisions remains to be determined. It’s unclear whether the SEC will have any mechanism for disclosing the name(s) of whistleblowers or might be forced to provide such disclosures.IRS Rewards UBS Whistleblower with $104M Payout 9/11, 2012

http://www.theblaze.com/stories/irs-rewards-ubs-whistleblower-with-104m-payout/The Internal Revenue Service has awarded an ex-banker $104 million for providing information about overseas tax cheats — the largest amount ever awarded by the agency, lawyers for the whistleblower. Birkenfeld has become something of a cause célèbre among whistleblowers because of the magnitude of his case and the fact that he was jailed after cooperating with authorities. In 2006, Congress strengthened whistleblower rewards. The 2006 law targets high-income tax dodgers, guaranteeing rewards for qualified whistleblowers if the company in question owes a least $2 million in unpaid taxes, interest and penalties.2011 Banker Rudolf Elmer and whistle blower former employee of Swiss bank Julius Bär. "As a banker, I have the right to stand up if something is wrong [...] I am against the system. I know how the system works and I know the day-to-day business. I wanted to let society know how this system works because it's damaging society". He added that he had tried to approach universities with his data but that they had not responded. Likewise, attempts to attract the attention of the Swiss media had failed, with Elmer being dismissed as "a paranoid person, a mentally ill person". Elmer began to lose hope, "but then a friend of mine told me: 'There's WikiLeaks.' I looked at it and thought: 'That's the only hope I have to [let] society know what's going on.'"

Commerce WithOUT

Conscience

Ethics vs. Institutional Corruption

After 11 hours of accusations by members of the Senate Subcommittee on Permanent Investigations, people close to the bank said Goldman is mulling closing the SEC fraud-case chapter on the belief the firm's reputation, already damaged, might not endure a street fight with the Wall Street watchdog. The SEC on April 16 announced that it had sued the Wall Street giant on charges it misled investors about the details of a mortgage-securities deal in which billionaire hedge fund king John Paulson influenced some of the collateral used in the transaction and then bet against its performance. The SEC also sued Goldman mortgage trader FabriceTourre, who's been accused of concealing Paulson's involvement when marketing the deal to investors. The SEC filed its charges after months of discussions with the bank over the claims. However, sources said the agency pulled the trigger on suing the bank out of frustration for what it saw as Goldman dragging its feet toward a resolution.

HARVARD GRADUATES: CARL LEVIN VS BLANKFEIN

2/28/10 Carl Levin, chairman of the Senate’s Permanent Subcommittee on Investigations, pummeled Blankfein, chairman and chief executive officer of Goldman Sachs Group Inc., Both are Harvard Law School Graduates.

Levin worked as an assistant attorney general in Michigan and general counsel for the Michigan Civil Rights Commission before being elected to the Detroit City Council and then winning a seat in the Senate in 1978. He is chairman of the Armed Services Committee as well as the investigations subcommittee and has led probes into unfair credit card practices, money laundering and the collapse of Enron Corp. Last year he made $174,000.

Carl Levin said. "You shouldn’t be selling crap. You shouldn’t be betting against your own customers.” "Your people think it’s a piece of crap and go out and sell it,” said Levin, his reading glasses pushed to the tip of his nose, referring to Goldman Sachs e-mails in which traders spoke of selling securities to customers. "We’re talking about betting against the very thing that you’re selling, without disclosing that to your client.” "What do you think about your own people selling securities they think are crap?” the senator asked.

Calculated Risk - they just pay their fines and keep going

THERE IS NO REAL PUNISHMENT SO THERE IS NO REAL RISK

ALERT Goldman "Risk Factors."

The mere materiality of undisclosed information doesn't create liability for its omission; as opposed to a misrepresentation, the culpability of an omission depends first on a duty to disclose.

However: Section 11 of the 33 Act has been held to require that the issuer disclose information that might tend to deter an investor from purchasing. As I understand it, an issuer who doesn't comply with that obligation is liable, even if it admits that it hasn't complied. In other words, you can't just warn prospective purchasers that you've failed to disclose material information - you have to disclose. And, again IMO, it seems hard to argue that purchasers would not have wanted to know that the guy who secretly assembled the portfolio was shorting it.

Deal settles lawsuit brought by Federal Housing Finance Agency – but has still to agree on bond sales fine

-

JP Morgan agrees to $5.1bn fine with mortgage regulator

-

JPMORGAN, ANNOUNCE BINDING OFFER TO SETTLE MORTGAGE REPURCHASE AND SERVICING CLAIMS FOR 330 RMBS TRUSTS.

http://www.gibbsbruns.com/jpm-rmbstrusteesettlement/JPMorgan Chase & Co. has reached a $4.5 billion agreement with 21 major institutional investors, represented by Gibbs & Bruns LLP

EVERYTHING ABOUT THE 2008 WALL STREET CRASH

which is the result of the The Commodities Future Modernization Act that allowed Toxic Assets aka "Credit Default Swaps", BIG OIL and BANKS and ENTIRE EXCHANGES to be removed from Government Purview. Plus Lax oversight by Gov't agencies and deregulation which produced the disaster on wall street. Contributions to Congress Campaigns pays them off. They are paid not to look! That is how this happens. Congress wasn't protecting the public they were helping the tax payer get ripped off.

So we are looking at a distortion of the process. The goldrush mentality of Society's Parasites (The Speculators. Why Banks and S&Ls went Bankrupt along with the Hedge Funds, the Trilateral Commission Bankers, the Big 4 Credit Rating Agencies Standard & Poor’s, Moody’s Corporation, and Fitch Ratings auditing firms are complicit in the malaise now sickening the global financial services sector. Topped off by another Trilateral Commission member and Federal Reserve Chairman Greenspan who admitted he didn't figure into his model that people who weren't supervised would steal! Greenspan conveniently and simply admits that he failed to come to grips with the power of popular culture and greed in the delusions of crowds as part of the "economic" model.

Gordon Gekko:

Greed is good

Lloyd Blankfein Goldman CEO Goldman Sachs was sued on April 16, 2010, by the U.S. Securities and Exchange Commissionand is accused of fraudulently selling collateralized debt obligations tied to subprime mortgages. With Blankfein at the helm Goldman has also been criticized "by lawmakers and pundits for issues from its pay practices to its role in helping Greece mask the size of its debts."[8] Blankfein testified before Congress in April of 2010 at a hearing of the Senate Permanent Subcommittee on Investigations.

Movie Wall Street Lou Mannheim: "Man looks in the abyss, there's nothing staring back at him. At that moment, man finds his character. And that is what keeps him out of the abyss."

Basic conclusions about Entrepreneurs: Panel Study of Entrepreneurial Dynamics [source]

- seem to worry equally about financial autonomy and/or a feeling of being motivated in their jobs.

- are worse at coming up with reasons they might fail

- don't care what other people think about them.

If baseball owners and players had only played the win:win game, but the integrity of the sport itself was tarnished

- ... that would have been a win : win : lose

- ... And without the Third Win, society will be, at some level, damaged.

PERILS OF THE "BOTTOM LINE" MODEL

- "Bottom Line" model where the ONLY thing that appears to matter is the money at the end of the day. Do you think MONEY is all that matters and HOW you make it is irrelevant?

- Successful businesses do not care about being "better people they want to be a RICHER people. Does Money Equal Happiness?

- Mr. Schachter wrote a research note, which suggests that he still doesn't quite get the concept of serving customers first, and worrying about revenues later"

-

You say you want a revolution

Well, you know

We all want to change the world

You tell me that it's evolution

Well, you know

We all want to change the world

Positive psychology is a relatively new discipline that which focuses on what makes people happy, rather than just their pathologies. Tal Ben-Shahar is an author and lecturer at Harvard University. He currently teaches the largest course at Harvard on "Positive Psychology" and the third largest on "The Psychology of Leadership".

and

Can a public company satisfy shortsighted Wall Street investors looking for the next quarterly return and still build a company directed by long-term strategies? Some see the conflict in stark terms. You can build a company that serves customers or build a company that serves shareholders, but you can't easily serve both constituencies well.

2004 - In seeking venture capital investment, however, a company is hungry not just for cash but also for the venture firm’s "reputation and access to a network of relationships – with customers, suppliers, investments bankers and other important constituents in the universe that the entrepreneur cares about,” Professor Hsu says. This may not be a startling insight to technology entrepreneurs who are familiar with venture capitalists. What Hsu’s paper does, however, is provide "a scientific measurement” of the magnitude of this phenomenon. He found that offers from more reputable venture capitalists are three times more likely to be accepted by entrepreneurial companies and that, on average, these favored investors acquire start-up equity in the companies at a 10-14% discount. What Hsu discovered is that "a lot of money is left on the table” by the companies, both in absolute terms and as a percentage of the pre-money valuation accepted by the companies. Less than half of the firms surveyed accepted their best financial offer. High-reputation VCs primarily syndicate with other high-reputation VCs." Affiliating with the right venture capital partner can certify the merits of a company to other parties, such as other investors.” These investors typically invest between $50,000 and $50,000,000 in new ventures. Review each site to determine what each firm likes to invest in. Source registration required.

- The Five Most Common Lies in Business

- Top 10 lies of Engineers

- Top 10 lies of Marketers

- The Top 10 lies of Venture Capitalists

- The Top 10 lies of Entrepreneurs

Startup Company Valuation Calculator

This is an educational and humorous multiple-choice quiz for estimating the value of an early-stage company.

Brand Value: A brand’s value is simply about the extent to which it can sell its goods and services at a premium price. Many marketers mistakenly attribute product quality, styling, service and reliability to a brand name’s value, when all brand value ultimately comes down to is pricing power. Brand name value is the "most sustainable competitive advantage known to business.” The value of brand names, is a mix of some advertising, a lot of luck, and being in the right place at the right time.”Branding is an illusion an emotion the intangible emotional connections people feel they have with the brand. Nurtyre your brand’s image, "the illusion” as, the image can be more valuable than the product itself. ~ Damodaran

Old-Boy Network's Power Exposed

KarmaBank.com

Activists Attack Companies With Revenue Depleting Boycotts - Hedge Funds Attack These Companies With Stock Crushing Short-Sales

Washington Post: "The Internet allows people to swarm and hit a company where it hurts most -- in their stock price."

Soon it could take more than a secret handshake to swing boards' decisions.

Cliques of well-connected businessmen can easily corrupt or distort corporate board decisions, but now a team of scientists say they can assess how much power old-boy networks have over boardroom meetings. "A well-connected lobby of a minority of directors can drive the decision of the board," say Stefano Battiston of the Ecole Normale Supérieure in Paris and co-workers. But they think that it is possible to predict the chances that a board will agree with the opinion of such a lobby. If this is so, the power of the lobby can be assessed and the changes needed to break its dominance identified. It all depends, say the researchers, on how many members of a board also sit together on other boards. It's a common situation. Almost 100 years ago Louis Brandeis, a judge in the US Supreme Court, spoke of a "financial oligarchy controlling the business of the country". Not much has changed. Directors and board members of large companies form a kind of social network in which many individuals sit with at least one other person on more than one corporate board.

"They Rule"

THEY RULE are the board members of Fortune 100 companies, and you can use this site to see the relationships between these companies. Click on "Add Company" and select a favorite, then click on the board table's "plus" sign and select "Expand" to see the names of that company's board of directors. Next, click on a board member's briefcase -- let's try Sam Nunn -- and select "Expand" again to view other companies on whose board that person sits. (Nunn also sits on the boards of General Electric, Texaco, and Dell Computers.) You can also click on "Load Map" to see the connections that others have suggested. Did you know that there are 72 guys named "John" on the boards of Fortune 100 companies? Or how few steps there are between Microsoft and Hewlett-Packard? Open Secrets

U.S. Sage Attacks Executive Greed

WARREN BUFFETT, the US investor whose folksy style masks one of the shrewdest minds in corporate America, used the annual gathering of his Berkshire Hathaway vehicle to launch a fierce attack on US executive greed and President Bush¹s planned tax cuts.

The shareholder meeting in Mr Buffett¹s home town of Omaha, Nebraska, which attracts some 14,000 "Buffeteers", is dubbed the "Woodstock for Capitalists" and is a fixture in the investment calendar. But this year¹s gathering at times seemed more like an antiglobalisation rally.

The second richest man in the world, Mr Buffett, known as the "Sage of Omaha", criticized plans for tax cuts that he said were designed to fleece the poor and reward the rich.

"I am not for the Bush plan. It screams of injustice. The main beneficiaries will be people like me and Charlie," he said, referring to the Berkshire Hathaway vice-chairman Charlie Munger. Mr Buffett said the tax plan was equivalent to "us giving a lesser percentage of our incomes to Washington than the people working in our shoe factories".

He called on investors to rise up and revolt over colossal executive pay packages, saying in the past 20 years there had been "an enormous disparity in the rates of compensation between people at the top and people at the bottom, and a disconnect between people at the top and the shareowners who give them the money.

"Arise shareholders," he concluded, raising both palms skyward. Famed for his integrity and modest lifestyle, Mr Buffett paid himself $100,000 (£62,000) in salary and a further $300,000 in bonuses last year. He still lives in the grey stucco house he bought in 1956 for $31,500.

Berkshire Hathaway, the insurance-to-candy conglomerate that he chairs, would report record operating profits of $1.7 billion in the first quarter, benefiting from the strength of the insurance sector, he said. This was double the $818 million reported for the first three months of 2001.

Mr Buffett reported a "soft" performance of Berkshire¹s consumer businesses, citing weak consumer spending power, which he claimed was not fairly reflected in the figures for US gross domestic product.

Mr Buffett said Berkshire had accumulated investable cash or "float" of $42.5 billion, up from about $37 billion a year ago. The conglomerate owns a diverse range of companies including Geico, the sixth largest auto insurer in the US, and General Re, a leading reinsurer.

Last Friday the company announced plans to buy McLane, a wholesale grocery distributor owned by Wal-Mart, for $1.5 billion.

When asked about the increase in dubious litigation in the US, Mr Buffett acknowledged the problem but seemed more concerned about the growing number of plaintiffs with a genuine grievance against a US corporation.

AUDITORS

CLASS ACTION SUITS AGAINST THE BIG 4 AUDITORS 2013

For the Big Four - PwC, Ernst & Young, KPMG and Deloitte - the offshore expansion of class actions presents a big risk. More than 20 countries now have legal rules allowing class actions. That is up from just three - the US, Canada and Australia - in the late 1990s, according to a 2011 report by Stanford Law School Professor Deborah Hensler. Countries and regions that now permit class actions include Brazil, South Africa, Taiwan, Portugal and Chile. Mexico began allowing class actions last year. India is considering doing the same as it undertakes reforms following a 2009 accounting scandal at Satyam Computer Services.

The Big Four audit all but two of the companies in the US S&P 500 index, according to research firm Audit Analytics. In Britain, the four audit more than 90 percent of the FTSE 350 index, covering the biggest companies on the London Stock Exchange. Once known as the Big Eight, the top-tier auditing industry shrank to five firms by 1998 through mergers; then to four with Arthur Andersen's implosion in the 2002 Enron scandal. Class actions are not the only growing international legal threat to the firms. Regulators and liquidators for bankrupt companies have also been bringing lawsuits on behalf of investors, resulting in big settlements. Potential losses are so large that commercial insurers no longer provide affordable liability insurance to the Big Four. They are now self-insured through "captives," or insurance firms owned by the global audit networks and funded with premiums paid by member firms. Yet the captives have limited capital and cannot cover the full risks faced by audit firms, according to a 2006 study by London Economics. "Class action litigation can drive up costs to the breaking point fairly quickly," said Ed Nusbaum, head of 6th-largest audit firm, Grant Thornton International.

Class actions against the world's largest corporate auditing firms are spreading as governments bolster investor protection laws in countries where the Big Four have not faced substantial legal risks previously.The firms - which had collective auditing revenues of nearly US$50 billion in 2012, according to the International Accounting Bulletin - have worked hard over the years in the courts and through lobbying to shield themselves from legal liability, with considerable success in the US. But they have also followed their multinational clients into new, developing markets where legal, accounting and regulatory systems are often weak, if not corrupt. Auditing problems and perils have followed. The Big Four are structured as networks of legally separate affiliates, typically one in each country, so that when one national practice is sued, the others in the network and the parent in the US are protected. This business model allows the firms to market themselves as global organizations, but insulates individual components of their networks.

Even as class action lawsuits dwindle in the United States due to court rulings and legislation, the number of countries allowing these kinds of suits has grown to more than 20, including recent additions Italy, Poland and Mexico. The biggest class action settlement in Australia came last year in a US$203 million case that named audit firm PricewaterhouseCoopers as one of the defendants. It paid about a third of the sum. Ernst & Young last year paid about US$118 million in Canada's largest class action settlement against an auditor. These firms check the books of most of the world's largest corporations. When accounting scandals erupt, shareholders with losses on their investments typically seek legal recourse. Those able to sue as a class frequently target deep-pocketed audit firms. "The average investor or common man truly does not have access to a means by which they can sue a Big Four auditor," said Andrea Kim, a partner at Houston law firm Diamond McCarthy. "Class actions give you a bigger chance of affordable representation against a behemoth like a Big Four," she said. The spread of class actions worldwide reflects efforts by some governments to shore up consumer and investor rights. Such laws help hold auditors accountable, said a lawyer at the Council of Institutional Investors, a nonprofit US group that supports good corporate governance. "External auditors should be subject to robust oversight and genuine accountability," said Jeff Mahoney, the group's general counsel, calling securities class actions "an important supplement to regulatory activity."

In the past, the firms have said that class action damages can be catastrophic if the firms are held liable for investor losses that dwarf the fees earned by auditors. The potential size of damages often forces auditors to settle lawsuits out of court, even if they have strong defenses. For example, PwC's US affiliate in 2004 won dismissal of a lawsuit against it in US District Court in Manhattan alleging negligence in audits performed by affiliates in Peru for the troubled bank Nuevo Mundo. The bank ended up being liquidated. Still, a massive settlement could be a fatal blow to a national unit, according to academics and market specialists. In Britain, for example, consulting firm London Economics concluded in 2006 that the biggest legal hit that could be absorbed by a Big Four UK firm was US$685 million, depending on the firm. The Big Four over the years have asked for liability relief, saying they lack the capital or insurance coverage to withstand the largest claims, forcing them to settle out of court.

The two big class action cases that put the auditors on notice last year were in Canada and Australia. In Canada, Ernst & Young last year agreed to pay about US$118 million to settle claims of substandard audits at Chinese forestry company Sino-Forest, which collapsed amid fraud allegations. It was by far the largest settlement by an auditor in Canada. Ernst & Young said it was "hopeful the settlement in Sino-Forest will be approved" but declined further comment because a final court ruling is pending. The Sino-Forest case was part of a wave of class-action lawsuits alleging misleading accounting at China-based companies that were listed on US exchanges. Investors, mostly in the US, have suffered big losses since 2010 from accounting scandals at China-based companies, many of which were audited by the Big Four. While US courts let plaintiffs sue Chinese companies, pursuing such cases can be tricky due to language barriers and difficulty in getting evidence out of China.

The US is the largest market for the major accounting and audit firms and it was long home to the largest legal claims against them, as well. That has changed, despite shareholder advocates' warnings that the threat of potential legal action makes audit firms do a better job. Court rulings have made it harder to sue a company's outside auditors for misleading accounting. Top audit firms were named as defendants in just two of the US federal securities class actions filed last year, or about 1 percent of cases, according to NERA Economic Consulting. In contrast, auditors were defendants in nearly 7 percent of cases between 2005 and 2009. Big Four auditors were hit with a spate of US lawsuits over their failure to flag risks at troubled banks ahead of the 2008-2009 financial crisis, but most of these cases were dismissed or settled for small amounts.

shanghaidaily.com/article/?id=526783

The whistleblower who exposed Bernie Madoff thinks the insurance industry is riddled with fraud 2016

Madoff Showed How Easy it is to Fool the Big Four Auditors The fact that Madoff feeder funds were getting clean audit opinions from the Big Four accountants, when Bernie was stealing every dime from day one, shows how easy it was for Madoff to fool the accountants, Markopolos said, adding that in the history of accounting it’s impossible to name even one multibillion fraud that the Big Four uncovered. “Now, if I asked you, to name all the big, multibillion-dollar accounting frauds that the Big Four aided and abetted, we could be here all afternoon,” he said. “The incentives are totally screwed up in the accounting industry. There is no way the company should be paying the audit fees. It should be the shareholders. It should be a fee. Every time you buy a share, a certain number of basis points should be allocated to audit fees. Because the audit fees are currently way too low. Management brags about how low they've gotten the audit fees.

https://archive.is/sG0mt

resources

If you qualify for public assistance – and you play fair – should we, as taxpayers, be allowed to tell you how you can spend your money and where you’re allowed to make withdrawals? And who decides what’s allowable? It’s fair to assume that welfare recipients are always going to make the wrong choices.

Do Store owners take the Food Stamps and Welfare Cards anyway, yes of course they do and who watches them?

Supplemental Needs Assistance Program (SNAP) Under current rules, you can’t use food stamps to buy beer, wine, liquor, cigarettes or tobacco, pet food, household supplies (including soap and paper products), vitamins, medicines, hot foods or prepared foods (eat in). Other federal dollars are used to fund Women Infants and Children (WIC) programs for new mothers who meet certain income guidelines. That program is also restricted by type of grocery item. You’re not allowed, for example, to buy imported cheese, fruit drinks (that aren’t 100% juice) or soda. Also on the "banned” list for fruits and vegetables if using cash-value vouchers: white potatoes, catsup or other condiments, olives and peanuts. Another federal program, Temporary Assistance for Needy Families (TANF), is designed to help move recipients into work and turn welfare into a program of temporary assistance; this is the program that most people think of when they think of "welfare” since the program provides cash assistance directly to families. States set their own eligibility requirements for the program though the funding and the overall management comes from Washington. In February, President Obama signed into law a provision that would bar welfare recipients from using cash assistance cards (in the form of debit-like cards) in strip clubs, liquor stores and casinos. Also See www.forbes.com/sites/kellyphillipserb/2012/02/17/payroll-tax-cuts-unemployment-benefits-extended-finally/

In Colorado and Indiana, rules are in place that bar the purchase of alcohol and guns using welfare cards. For the record, all legal if you pay cash.

Not for Profit isn't Against Profit,

but exactly the opposite is true.

"If you choose to work in the nonprofit sector, you're not taking a vow of poverty, but you are saying you're motivated by something besides how do I make the most possible money," said John Vogel, a professor of nonprofit management at Dartmouth College's Tuck School of Business. "The chief executive officer's salary does send a signal. It does say what kind of organization you are, what you value, what you care about."

How to Recruit Smart People

Lifestyle proclivities represent a profound new force in the economy and life of America. How to keep members of the creative class: a fast-growing, highly educated, and well-paid segment of the workforce on whose efforts corporate profits and economic growth increasingly depend. Members of the creative class do a wide variety of work in a wide variety of industries---from technology to entertainment, journalism to finance, high-end manufacturing to the arts. They do not consciously think of themselves as a class. Yet they share a common ethos that values creativity, individuality, difference, and merit. Find Large Cities Creativity Rankings.

Definition of Crowd Sourcing

The act of taking a job traditionally performed by an employee and outsourcing it to an undefined group of people on a project-by-project basis, in the form of an open call. Firms wishing to follow this model could encourage employees to set up a company with 10 or more colleagues, and buy back their services as and when needed.

Do the right thing.

It will gratify some people

and astonish the rest

~ Samuel Clemens

How to Make Money on the Net by Chris Brogan

- Grow bigger ears (listening) – the best way I’ve found to help people make money via the web is to "listen at the point of need.” The idea is that people are offering up their interests and requests and desires via the social web every day. If you have what they need, there are opportunities to get into the selling cycle on the spot, instead of waiting.

- Be protective of your community – this is how Oprah succeeded. She grew a community around content that was helpful to the people consuming it, and then she attracted sponsors who wanted access to those people. She then stayed fiercely in between the two groups, making sure her community was always protected, and that sponsors had access on her terms only. Own the relationship, own the money.

- Add more value than promotion – selling is often heavy-handed and based on wanting to close. The real winners are relationship-minded people who make not only the first sale, but all the subsequent sales thereafter. By giving your community much more value (more content, more things they can use) than just promoting your stuff, you win longer term sales relationships.

- Promote and recognize others – in selling and marketing, we talk too much about ourselves. People want to be seen and recognized. Use your platform to point out the good stuff that would appeal to the rest of your community. Mention them. Talk about your customers more than you talk about yourselves.

- Be clear on your ask – when you finally have a hard ask, a request for a sale, then be very clear about it. Don’t ever sidle up to the sale. Never let there be a confusion between your goodwill efforts and your direct need for a sale. Never flinch about it, and never make it a mushy mix of community warmth and indirect sales requests. Just like relationships, short and clear is better than long and convoluted.